Introduction

The abbreviation of AUD/HRK is Australian Dollar, paired with the Croatian Kuna. Here AUD is the official currency of Australia and is also the fifth most traded currency in the Foreign Exchange market. In contrast, HRK stands for the Kuna, and it is the official currency of Croatia. The Croatian National Bank issues this currency.

Understanding AUD/HRK

In the Forex market, to determine the relative value of one currency, we need another currency to compare. Here, when we buy a currency, which is known as the base currency and simultaneously sell the quote currency. The market value of AUD/HRK helps us to understand the strength of HRK against the AUD. So if the exchange rate for the pair AUD/HRK is 4.5571, it means to buy 1 AUD, we need 4.5571 HRK.

Spread

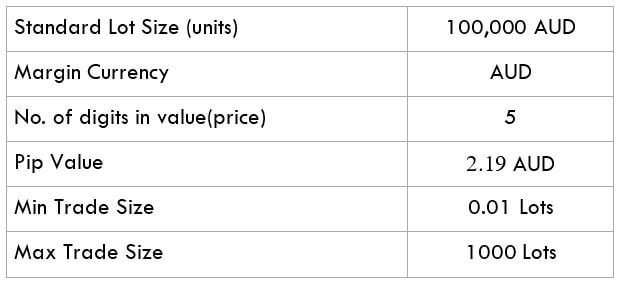

A spread is defined as the difference between the purchasing & selling price of a Forex pair. In simple words, it is the difference between the bid price and the ask price of an asset. Below is the spread charges for ECN and STP brokers for AUD/HRK pair.

ECN: 40 pips | STP: 43 pips

Fees

A Fee is the charges that we traders pay to the broker for executing a trade. Fees to a much depend on the type of broker(STP/ECN) we use.

Slippage

When we want to execute a trade at a particular market rate, but instead, the trade gets executed at a different rate, and that is because of the slippage. Slippage occurs when we counter a volatile market, and when we execute a large order at the same time.

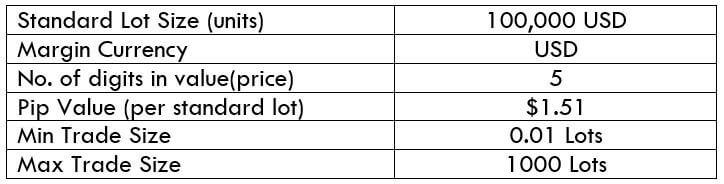

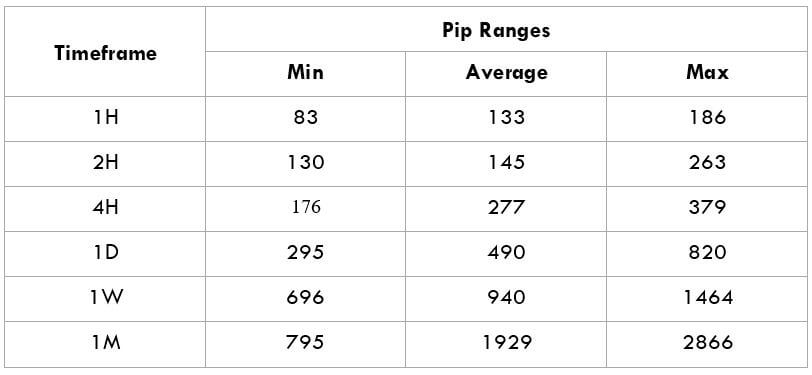

Trading Range in AUD/HRK

The trading range here will determine the amount of money we will win or lose in a given amount of time. In the below table, we have the representation of the minimum, average, and maximum pip movement in a currency pair. Here we will use the ATR indicator that indicates the price movement in a currency pair. We will evaluate it merely by using it with 200-period SMA.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a significant period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

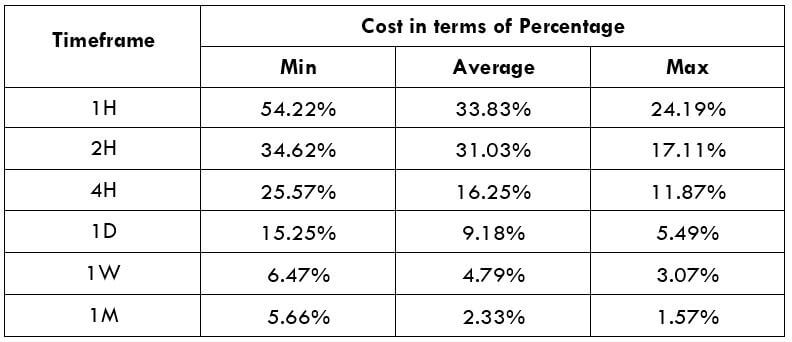

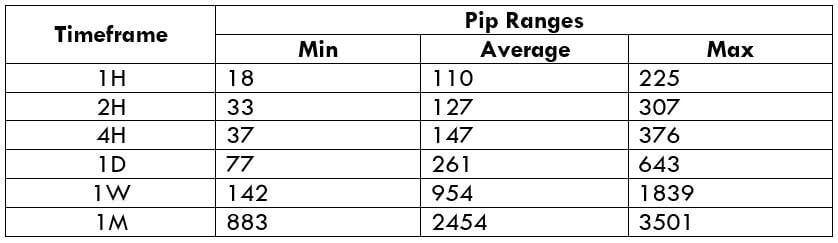

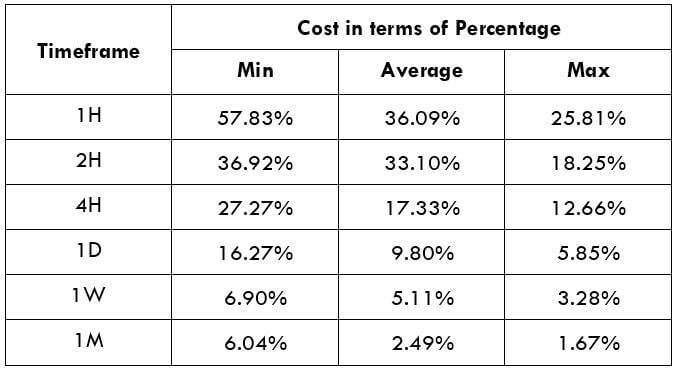

AUD/HRK Cost as a Percent of the Trading Range

The cost of trade depends on the broker type and varies based on the volatility of the market. The overall cost of trade includes spread, fees, and sometimes slippage if the volatility is more. To decrease the cost of the trade, we can use limit orders instead of market execution.

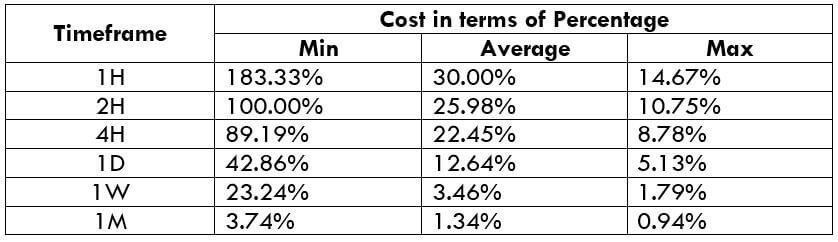

ECN Model Account

Spread = 40 | Slippage = 3 |Trading fee = 5

Total cost = Slippage + Spread + Trading Fee = 3 + 40 + 5 = 48

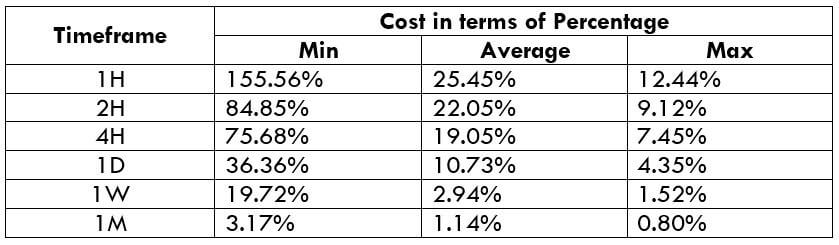

STP Model Account

Spread = 43| Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 43 + 0 = 46

Trading the AUD/HRK

AUD/HRK is an exotic currency pair. As we can see, the average pip movement in 1hr is 133, which implies higher volatility. The higher the volatility, the higher is the risk and lower is the cost of the trade and vice versa. Taking an example, we can see from the trading range that when the pip movement is lower, the charge is high, and when the pip movement is high, the charge is low.

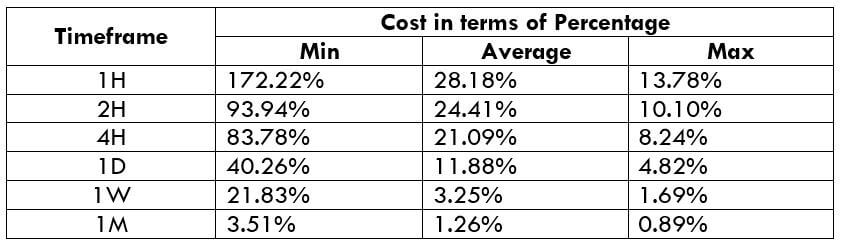

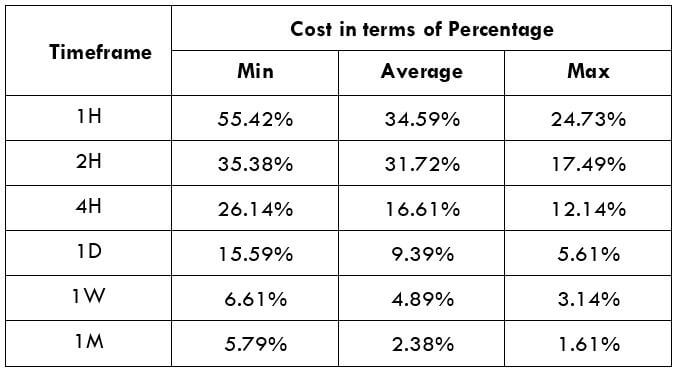

To reduce our costs of trade, we may place trades using limit orders instead of market orders. In the below table, we will see the representation of the cost percentages when limit orders are used. As we can see, the cost of slippage is zero. In doing so, the slippage will not be included in the calculation of the total costs. And this will help us in reducing the trading cost by a considerable margin. An example of the same is given below.

ECN Model Account (Using Limit Orders)

Spread = 40 | Slippage = 0 |Trading fee = 5

Total cost = Slippage + Spread + Trading Fee = 0 + 40 + 5 = 45