Introduction

The abbreviation of AUD/RON is Australian Dollar paired with Romanian Leu. Here AUD is the official currency of Australia and is also to be the fifth most traded currency in the Forex market. While RON stands for The Romanian leu, and it is the currency of Romania.

Understanding AUD/RON

In AUD/RON currency pairs, the first currency (AUD) is the base currency, and the second currency (RON) is the quote currency. In the Foreign Exchange market, we always buy the base currency and simultaneously sell the quote currency and vice versa. Here, the market value of AUD/RON helps us to understand the strength of RON against the AUD. So if the exchange rate of the pair AUD/RON is 2.9141, it means to buy1 AUD we need 2.9141 RON.

Spread

Forex brokers charge some commission on the trade we open, and that depends on the ask and the bid price by the broker. Spread is the difference between this Ask and Bid price. Every broker has different ask and bid prices. Below is the spread charges for ECN and STP brokers for AUD/RON pair.

ECN: 33 pips | STP: 35 pips

Fees

A Fee is the charges that we traders pay to the broker for opening a trade. This fee depends on the type of broker we use (STP/ECN).

Slippage

When we want to execute a trade at a particular market rate, but instead, the trade gets executed at a different rate. This is because of slippage. Slippage can take place at any time, but mostly we can counter a volatile market, and when we execute a large order at the same time.

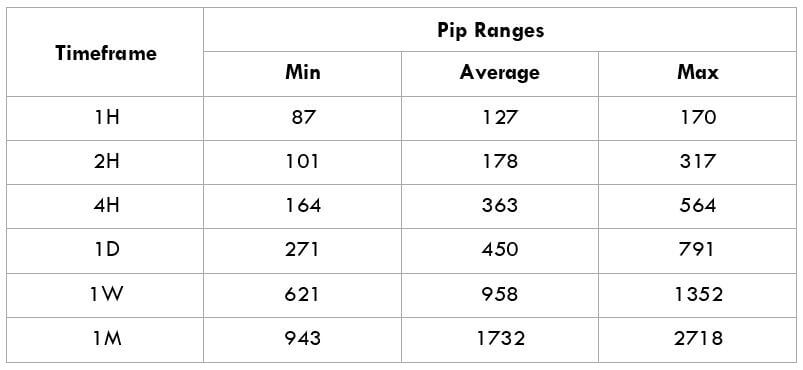

Trading Range in AUD/RON

As a trader, our main motive should be to know the market volatility and avoid losses. The trading range here will determine the amount of money we will win or lose in a given amount of time. ATR is a technical indicator that indicates the price movement in a currency pair. In the below table, we have the representation of the minimum, average, and maximum pip movement in a currency pair. We will evaluate it merely by using the ATR indicator combined with 200-period SMA.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can determine a significant period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

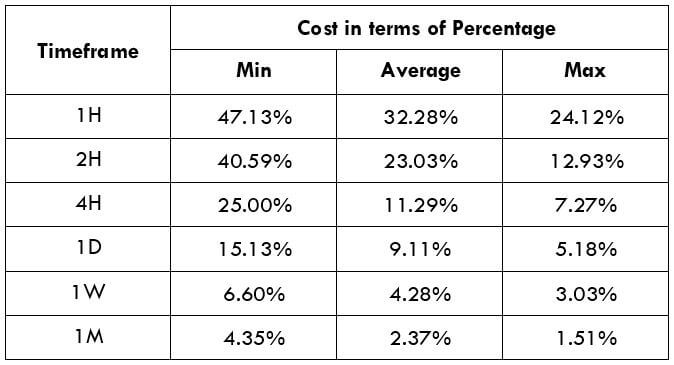

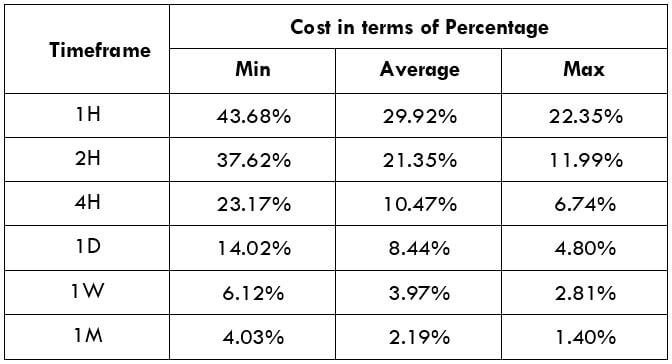

AUD/RON Cost as a Percent of the Trading Range

The cost of trade depends on the broker type and varies based on the volatility of the market. The overall cost of trade includes spread, fees, and sometimes slippage if the volatility is more. To decrease the cost of the trade, we can use limit orders instead of market execution.

ECN Model Account

Spread = 33 | Slippage = 3 |Trading fee = 5

Total cost = Slippage + Spread + Trading Fee = 3 + 33 + 5 = 41

STP Model Account

Spread = 35| Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 35 + 0 = 38

Trading the AUD/RON

AUD/RON is an exotic currency pair. As we can see, the average pip movement in 1hr is 127, which shows the volatility is very high. Note, the higher the volatility, the higher is the risk and lower is the cost of the trade and vice versa.

Taking an example, we can see from the trading range that when the pip movement is lower, the charge is high, and when the pip movement is high, the charge is low. AUD/RON must be traded with proper risk management because of its volatile nature. If we have our strategy with adequate risk management, we can trade in a volatile market too.