CIX Markets, a new project by CCC (City Credit Capital) is an FCA regulated company that offers 24/5 customer service with multiple platform options available for its customers. Customers of CIX can be assured that their funds are held in top-tier rated banks, separate from the company’s own funds. This broker has a broad range of products available which they offer using the latest technology. Join us as we delve into CIX Market’s website and determine whether they’re a good choice for you to invest your money with.

Accounts

CIX Markets have two types of accounts available which are the Live account and the Corporate account. One can open up a live account with this broker in 5 simple steps. Keep in mind that all customers must provide proof of identity and proof of address in order to do so.

Although this broker does not implement a strict minimum deposit requirement, we were informed via e-mail that clients should deposit around $500 when opening up their live account

To open a CIX Corporate account customers must complete the Corporate account form and they will then be contacted directly by one of CIX’s representatives. On CIX’s website, customers are given prime access to a research portal when opening a live trading account.

Platform

CIX MARKETS use their own trading platform, the CIX trader which has a loyal following among a multitude of traders. The sophisticated trading platform is fast, secure, and flexible allowing clients 24/5 access to a broad range of financial instruments including FX, Equity, Indices, Precious metals and, commodities. This platform is catered towards more advanced traders and this platform can be downloaded from CIX’s website. For those who want to trade on the go, the platform is also available on IOS and Android tablets and phones. Clients can make use of technical analysis and charting packages, position monitoring, live prices, and constantly updated market news which will help them make a good decision when trading.

Apart from their own proprietary trading platform, this broker also offers the most popular platform around, the MT4. This multilingual platform enjoys popularity all over the globe because of its advanced technical and analytical indicators.

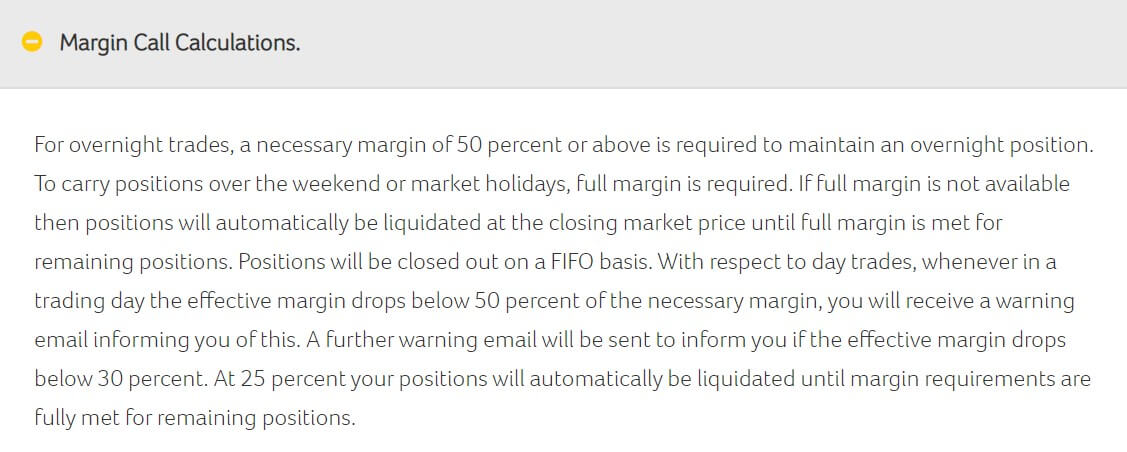

Leverage

Although there is mention of leverage ratios on CIX’s terms and conditions page, they do not go into detail about the specific leverage that they offer.

Trade sizes

This broker sets minimum and maximum trade sizes for all their available assets. Customers can find this information on their proprietary trading platform via the Order Entry Screen. The broker warns that these sizes may vary from time to time depending on the specific market conditions. For those clients who would like to execute a trade size which is larger than the maximum size usually allowed by the broker, they can request it specifically and they will be quoted a different price. On their Market Information Sheet, we did find that for Forex pairs, Indices and Commodities the minimum trade size is 0.1Lots.

Trading costs

Apart from the spread and swap fees, this broker does not charge any additional fees for customers’ trading.

Assets

CIXMarkets offer quite a large variety of assets available for trading, including the most popular currency pairs, including some Exotic pairs as well, Indices including AUS200c, GER30C, and US500c just to mention a few, Commodities including Gold, Silver, and Copper including others as well as some Interest rates & Bonds including EURIBOR, EUROSWISS, and SHORT STG. You can find the full list of available assets on this Broker’s main page under the title FXMARKETINFO.

Spreads

This broker offers fixed, variable, and also target spreads, but this is dependent on the instruments chosen and the underlying liquidity. On their Market information sheets, one can find detailed tables comparing the difference in spreads for both the Fixed and Variable options, for example, the popular EUR/USD pair has a fixed spread of 1 and the AUD/CAD pair has a variable spread of 1.60. The majority of FX and Metal products are quoted using a fixed spread, which means the spread will remain unchanged no matter what the market situation is.

Minimum Deposit

Although there are no details regarding minimum deposit requirements on the broker’s website, we were informed via email that while there is no set minimum to open an account, the deposit should cover the initial margin for a trade. The company suggests that clients should deposit at least a minimum of 500Euro.

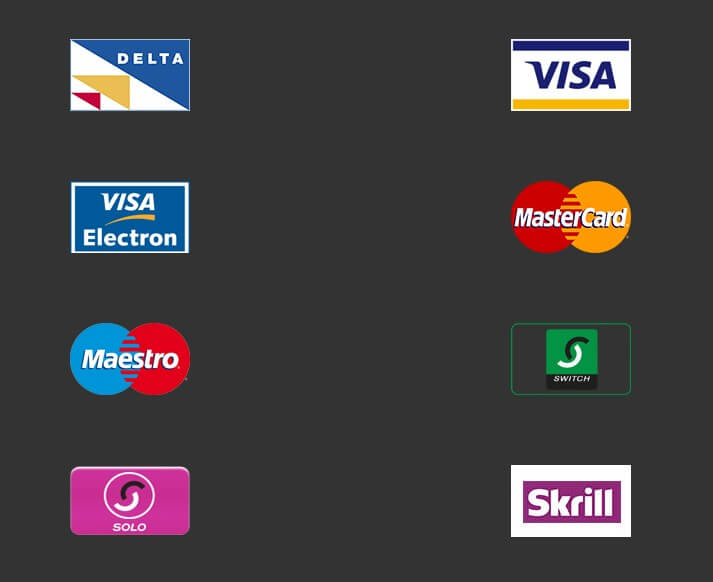

Deposit Methods & Costs

You can deposit your funds via Visa credit, Visa debit, MasterCard, Maestro, Solo, Switch cards, Bank Wire, Neteller and, Skrill. Deposits can be made using a number of different currencies including; USD, GBP, EUR, or any other currency that the broker will agree on with you. Wire transfers, cheques, bank drafts, and some electronic wallets are also accepted. For those funding their account via cheque should allow a maximum of 3 weeks for their funds to be cleared and sent to their trading account.

Withdrawal Methods and Costs

Customers can withdraw their funds using the same methods they used to initially deposit funds into their accounts. There is no information regarding any withdrawal fees one might encounter when withdrawing funds with this broker, however, one should keep in mind that some banks may impose their own fees.

Withdrawal Processing & Wait Time

Once a withdrawal request is sent, customers must wait approximately seven business days for their requests to be completed.

Bonuses & Promotions

At the time of this review, we couldn’t find any bonuses and promotions being offered by this broker.

Education and Trading Tools

On their website, CIXMARKETS has a page dedicated to News and Education. On this page one can find a few articles which cover the basics of trading, including some historical information, which can be interesting to those just starting out in the trading world. Their News segment is frequently updated, with multiple articles updated daily. This will surely keep CIX’s clients up to date with the latest market news.

This broker has also partnered up with Trading Central, an independent research provider, in order to provide its clients with first-class trading signals and technical analysis to help them with their daily trading decisions. Clients can access this information via the Daily Market Brief which is found on their account page.

Customer Service

Clients can contact CIXMarkets either by email, telephone, or via an online message found on the main page of the website.

Here is their contact information:

Email – [email protected]

Tel: +44(0)20 7614 4688

+44(0)20 76144668

Address; 110, Bishopgate

EC2N 4AY

London

United Kingdom

Unfortunately, this broker does not offer a live chat option, however, we did test out their Message window and we were pleased to receive an answer just a few minutes after we submitted our query. Their customer support is fast and informative and we encourage potential clients to get in touch with the broker directly for more information.

Demo Account

Customers can test out trading with CIXMARKETS by opening a Demo account. This account can be opened in a few easy steps and customers will have $50,000 funds available to test their skills. Demo accounts expire after 4 weeks.

Countries Accepted

This broker does not seem to have any restricted countries apart from the USA at the moment.

Conclusion

CIX Markets is a trading company based in the UK that is authorized and regulated by the FCA. Although they do not have much variety when it comes to account types, they do have a vast array of assets available for all their customers. These assets can be traded on either the most popular platform around, the MT4, or on the broker’s proprietary trading platform, the CIX Trader. We did find that certain information, such as minimum deposits, spreads, and leverages are not easily found on their site, however, after speaking to their customer support we were given all the necessary information.

A major advantage of this broker is that they are fully authorized and regulated by one of the strictest regulators, the FCA. Customers can feel at ease when investing their funds with CIX Markets as their funds are held separately from the company’s own which is always a good point to note. If you are intrigued by what you’ve heard so far, head on to their website to get more information about this broker and what they have to offer.