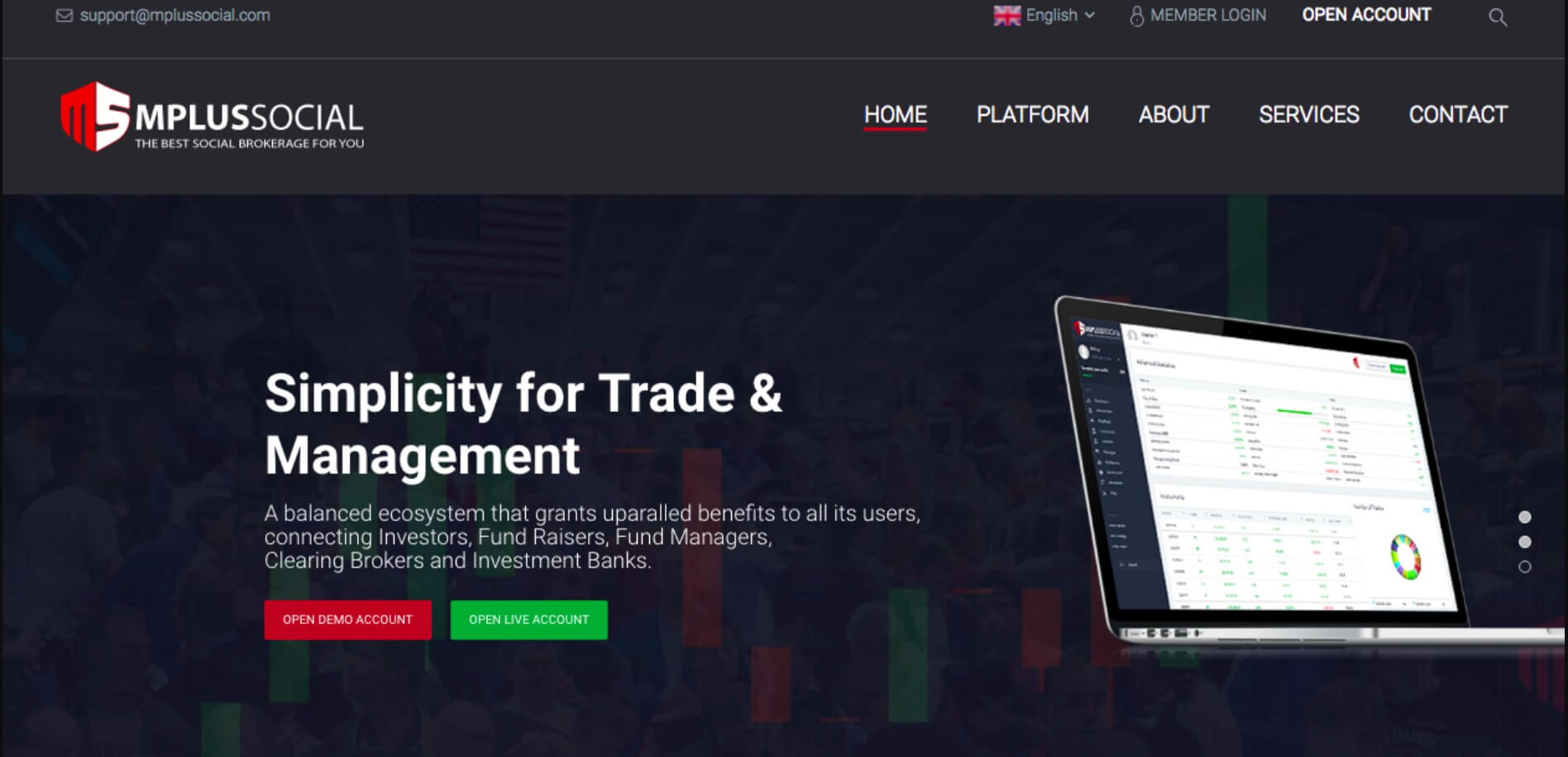

Mplus Social is a Thailand based foreign exchange broker that focuses on both individual trading and as a social trading platform. Their main philosophy is to provide an honest and innovative trading platform through technology and transparency, looking to build a relationship with their clients. As we go through this review we will be looking into the service on offer to see what really is on offer and how Mplus Social stands up next to the competition.

Account Types

It appears that there is just the one account type available which is usable across the site, so we would be outlining any potential differences in this section. Throughout this review, we will be looking at different sections of the broker and so any information provided will be relevant to this one available account.

Platforms

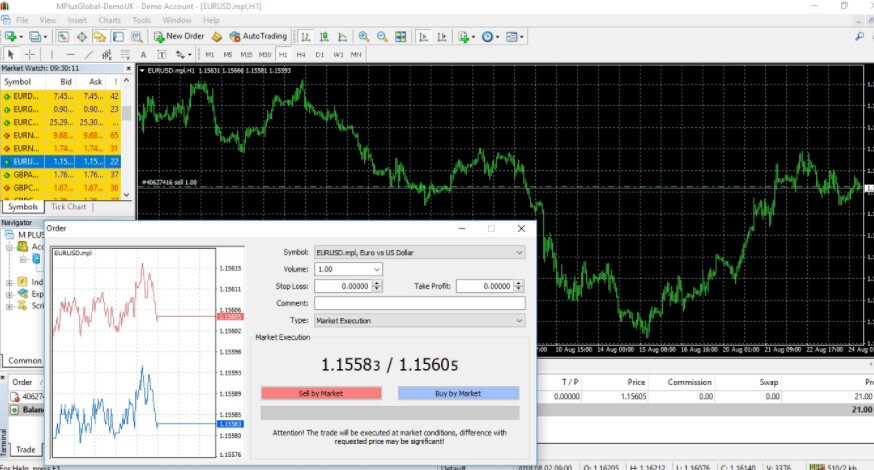

There are two different platforms available to use, we have outlined some of their main features below.

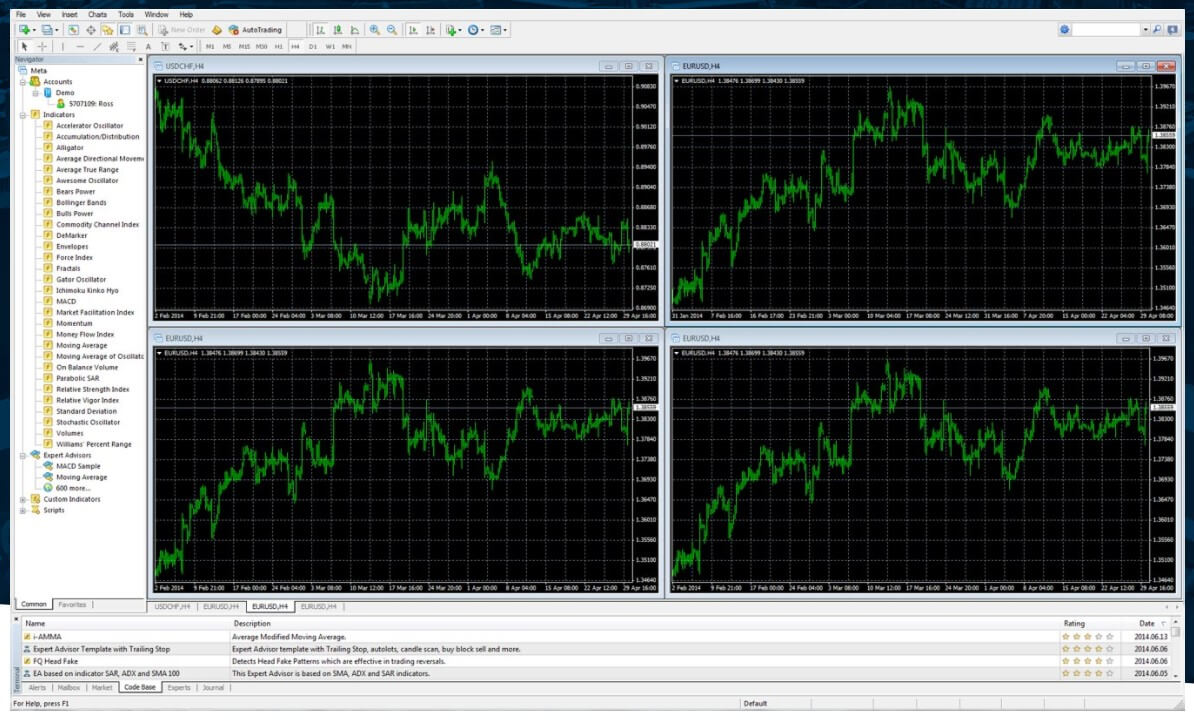

MetaTrader 4 (MT4): MetaTrader 4 is usable as a desktop download, mobile application, or WebTrader, which makes it highly accessible and it is one of the most used trading platforms, hosting the trades of over a million traders. MT4 is highly customizable allowing you to alter its appearance to suit you, has multiple timeframes and charts, and is compatible with thousands of indicators for analysis and expert advisors for your automated trading needs.

Social Platform: The social trading links head over to a site called Dion Social, so we believe that Mplus Social is using their platform for their social trading needs. There isn’t much information available about Dion Social as you need to login to view their site, so at the moment we are not able to talk about the functions that are available.

Leverage

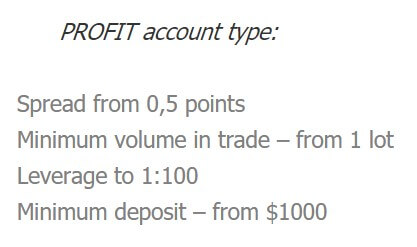

The maximum leverage available is 1:100 which can be selected when opening up a new account. We do not know if it can be changed once an account is open, but you should contact the customer service team should you wish to change it.

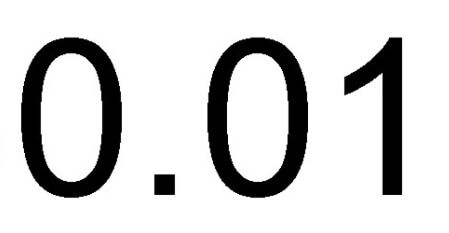

Trade Sizes

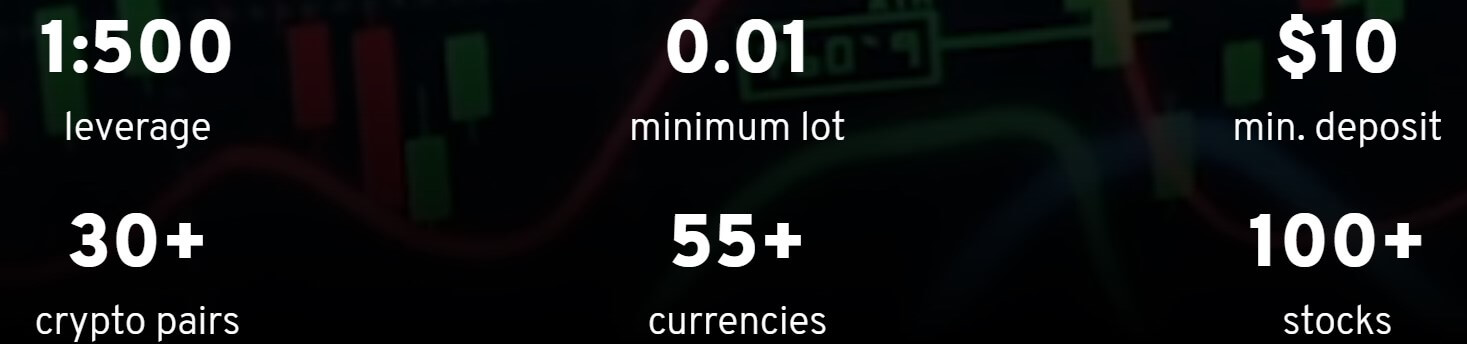

Trade sizes start from 0.01 lots which are known as a micro lot and the trades then go up in increments of 0.01 lots. We do not know what the maximum trade size is or how many trades you can have open at any one time, we would not recommend trading more than 50 lots in a single trade due to liquidity and slippage issues.

Trading Costs

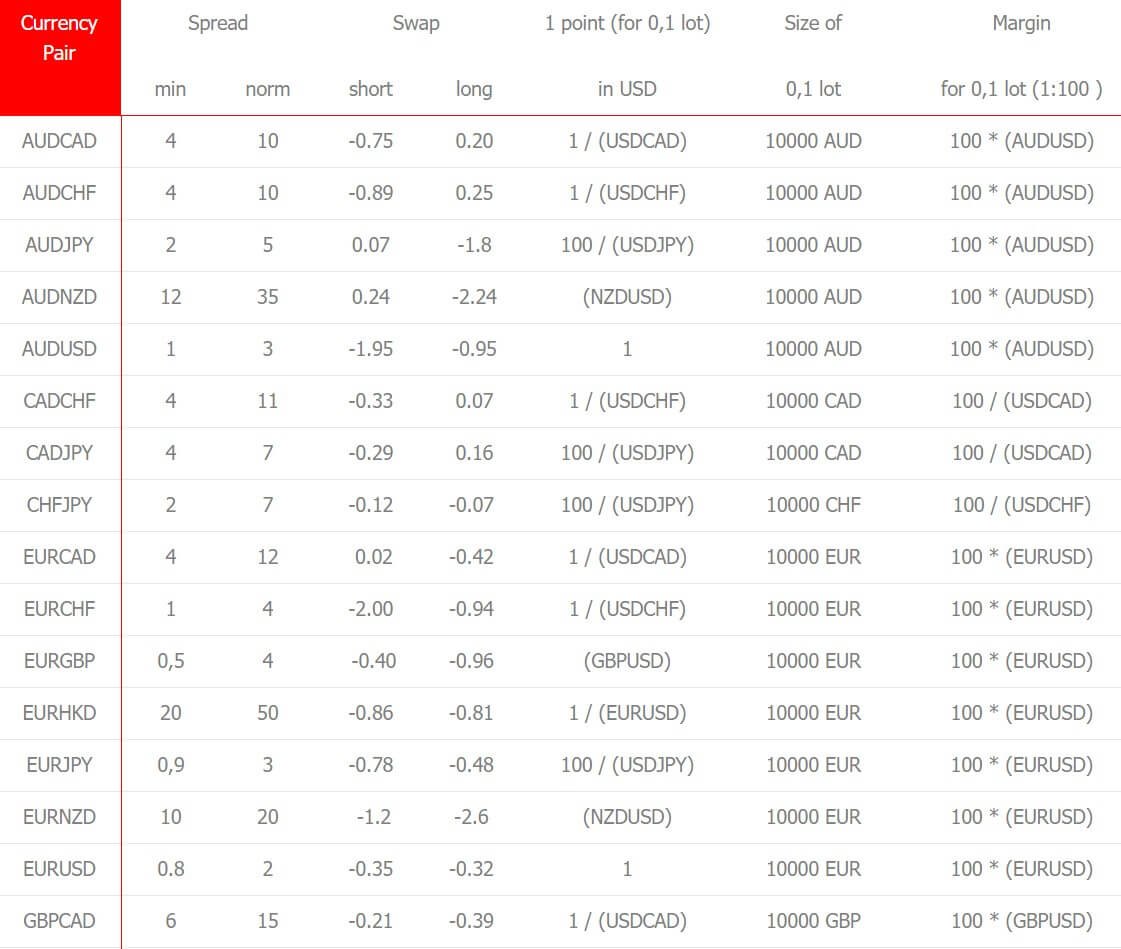

We do not know if there are any added commissions when trading but due to the spreads being quite high we do not think that there are any added. There are however swap fees, these are charges that you get when holding trades overnight, they can be both positive or negative and can be viewed within the trading platform that you are using.

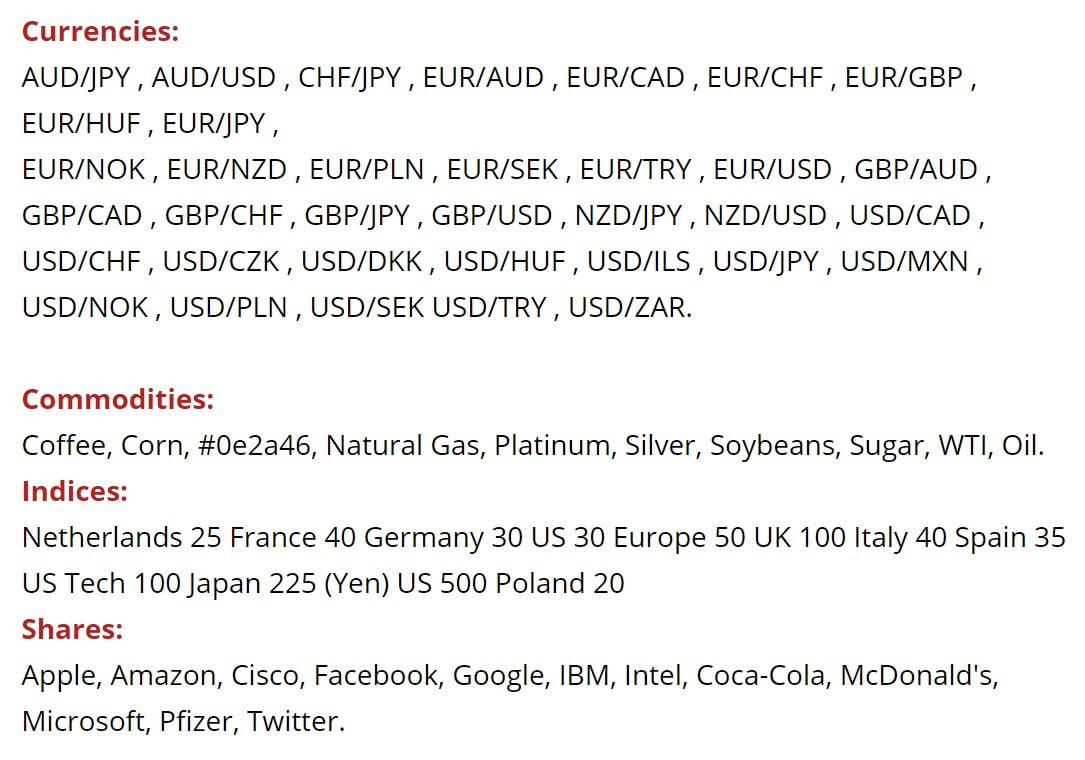

Assets

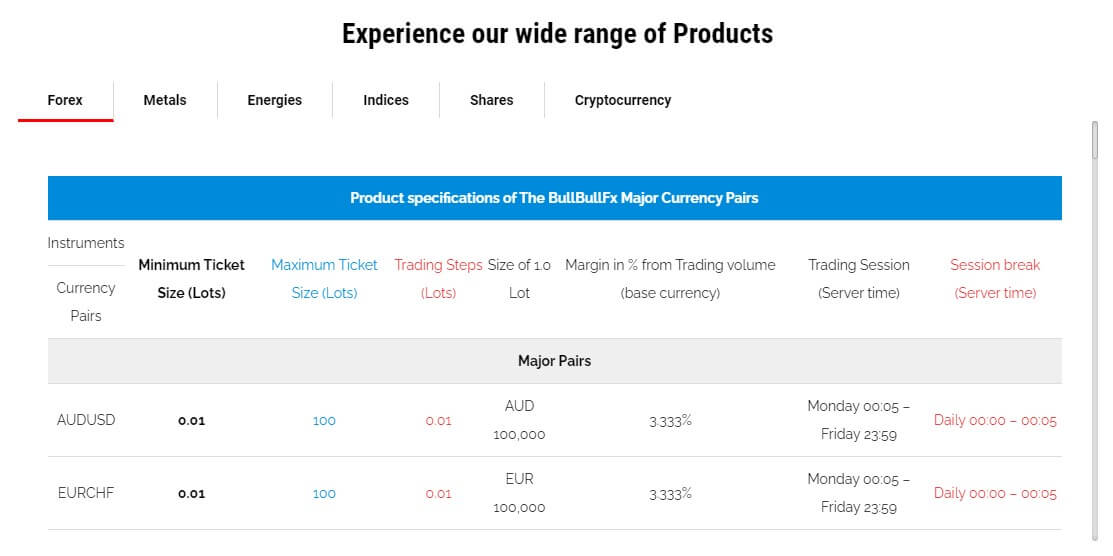

There isn’t a full breakdown or product specification available, the site does state that the spreads shown on that page are calculated throughout the day, but there isn’t actually a list available. What we do know is that there are over 40 different asset pairs available however there is little information about any other asset types.

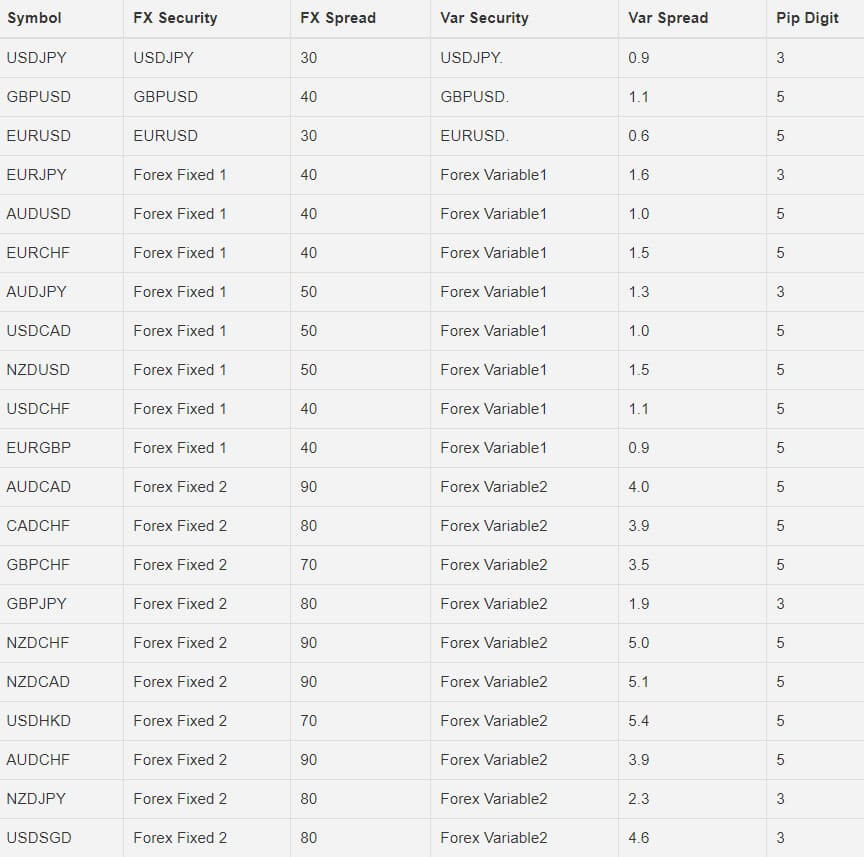

Spreads

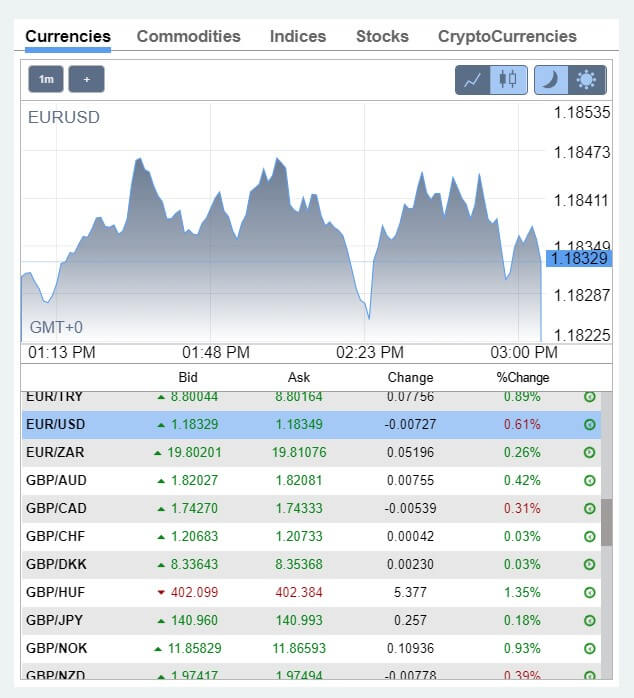

While we do not have a lot of information available, the website states that the spreads start as low as 0.1 pips however, we do know that the spreads seem to start from around 2.2 pips, they are also variable which means they will be influenced by the markets, the higher that volatility or lower the liquidity the higher the spreads will grow, different instruments will also have different starting spreads, so while EURUSD may start at 2.2 pips, other instruments will start higher.

Minimum Deposit

The minimum amount required to open up an account is $1,000. We do not know if this minimum deposit amount reduces once an account is open.

Deposit Methods & Costs

Sadly the deposit methods are not shown on the site so we do not know what methods you can use to deposit into the account, this is a shame as many clients will want to use their preferred method, we also do not know if there are any added fees or commissions when depositing.

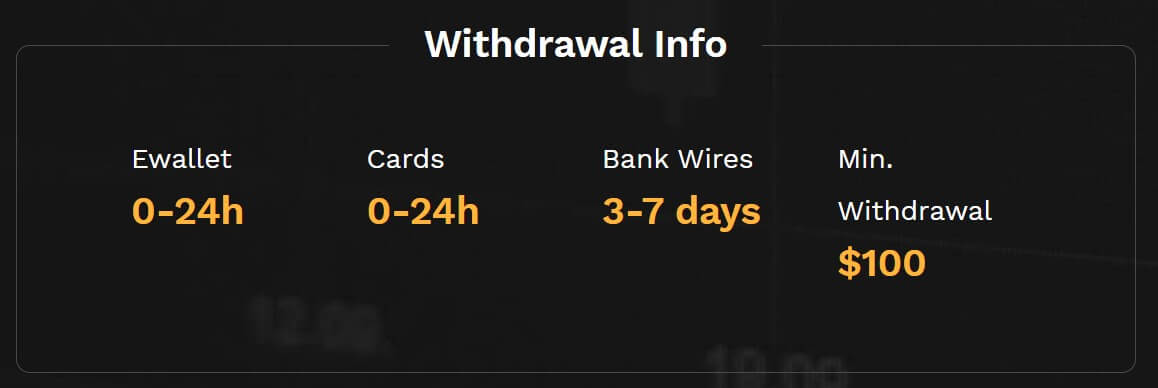

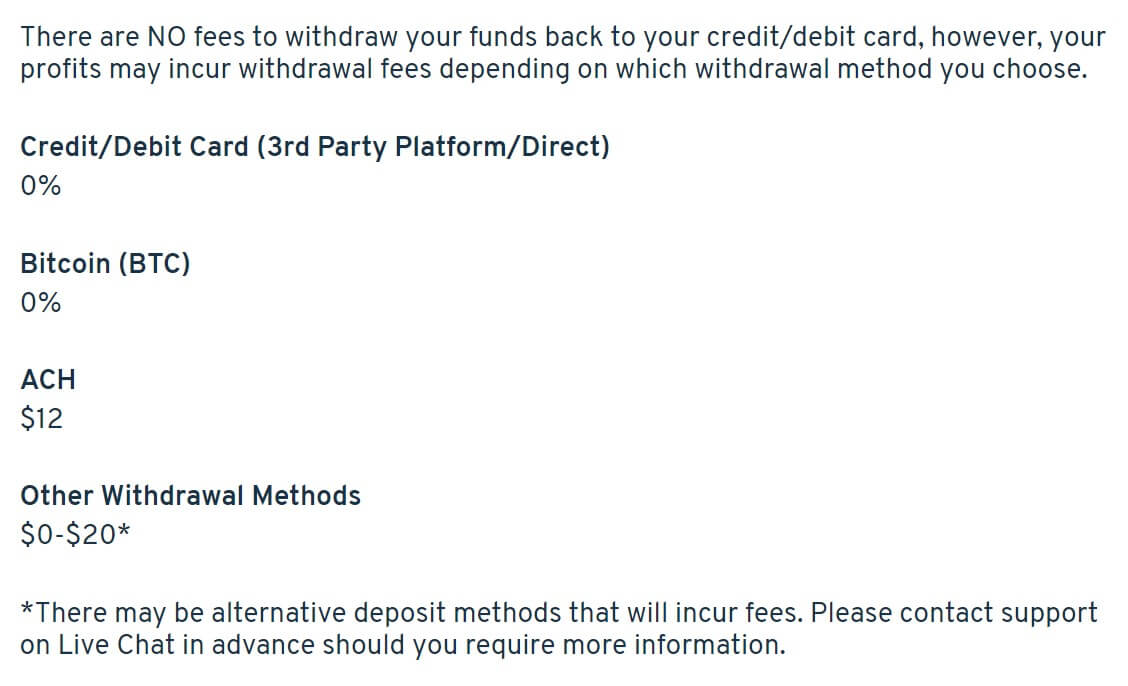

Withdrawal Methods & Costs

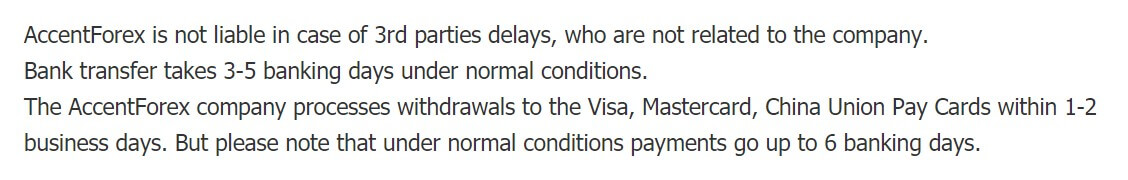

As there is no information on depositing there is also none on withdrawing, this again is vital information for potential clients to know, and not knowing could cause a number of them to look for different brokers. We also do not know if there are any added fees when withdrawing from Mplus Social.

Withdrawal Processing & Wait Time

As we do not know what methods are available to withdraw with, it also means that we do not know how long the possible withdrawal times are. We would expect that any withdrawal requests are fully processed within 7 days of the request being made however we cannot say for sure.

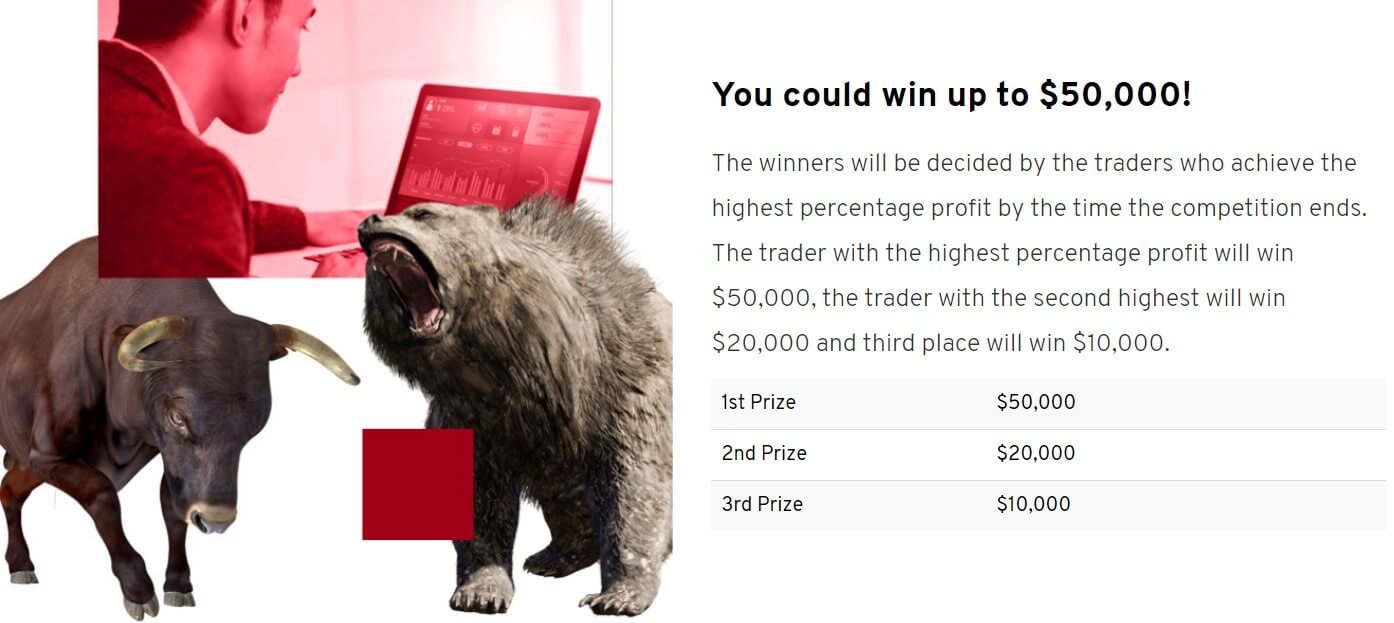

Bonuses & Promotions

There are no bonuses or promotions mentioned on the site so at the time of writing this review it does not look like there are any available. You could always contact the customer service team to see if there is anything available coming up that you could take part in.

Educational & Trading Tools

There does not appear to be any educational material on the site which is a shame as many brokers are now trying to help their clients improve on their trading, so it would have been nice to see Mplus Social do something similar for their clients.

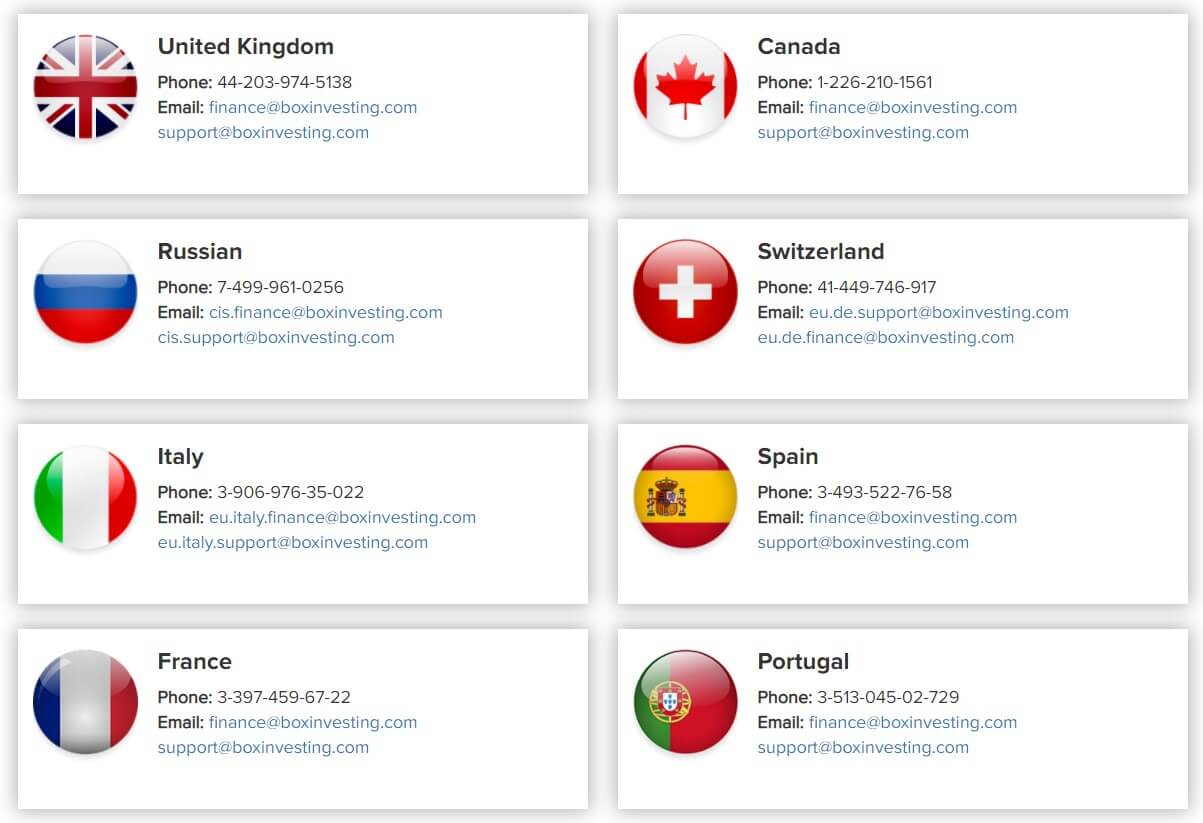

Customer Service

The contact us page only has a contact form available, you can fill it in, and then you should get a reply via email At the bottom of the screen there is also a phone number, email address, and skype username available to use.

Telephone: +35725030440

Email: [email protected]

Skype: @supportmplussocial

Demo Account

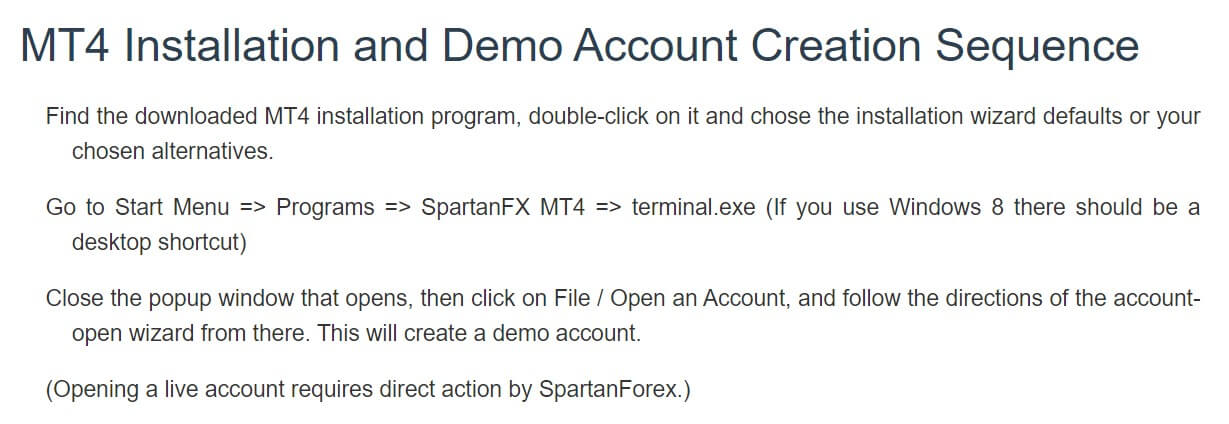

There is a demo account when using the MetaTrader 4 platform, we don’t actually know what the trading conditions are but we would expect them to mimic the trading conditions found on the live account and mentioned throughout this review.

Countries Accepted

The following statement is present on the site: “MPlus Global Ltd does not provide services for citizens of certain regions, such as The United States of America.” This doesn’t give the full list so if you are thinking of joining we would recommend contacting the customer service team to ensure that you are eligible for an account prior to opening one up.

Conclusion

The name Mplus Social gives a low emphasis on the social site, however, the website doesn’t give much information about it at all. There appears to only be the one account type and on paper, however, the actual conditions are quite a bit higher, we do not know what the commissions are, but with spreads, at around 2.2 pips we would hope that there aren’t any and even with no commissions the trading costs are a little expensive. We also do not have a list of available assets or any information on deposits or withdrawals. Knowing how you can get your money in and out of the broker is incredibly important, as you need to know that the method you use is available and also if it will cost you to do it. Without this vital information, we find it hard to recommend Mplus Social as a broker to sue at this point in time.

Just the one platform available, but thankfully it is a good one. Metatrader 4 (MT4) is the world’s preferred

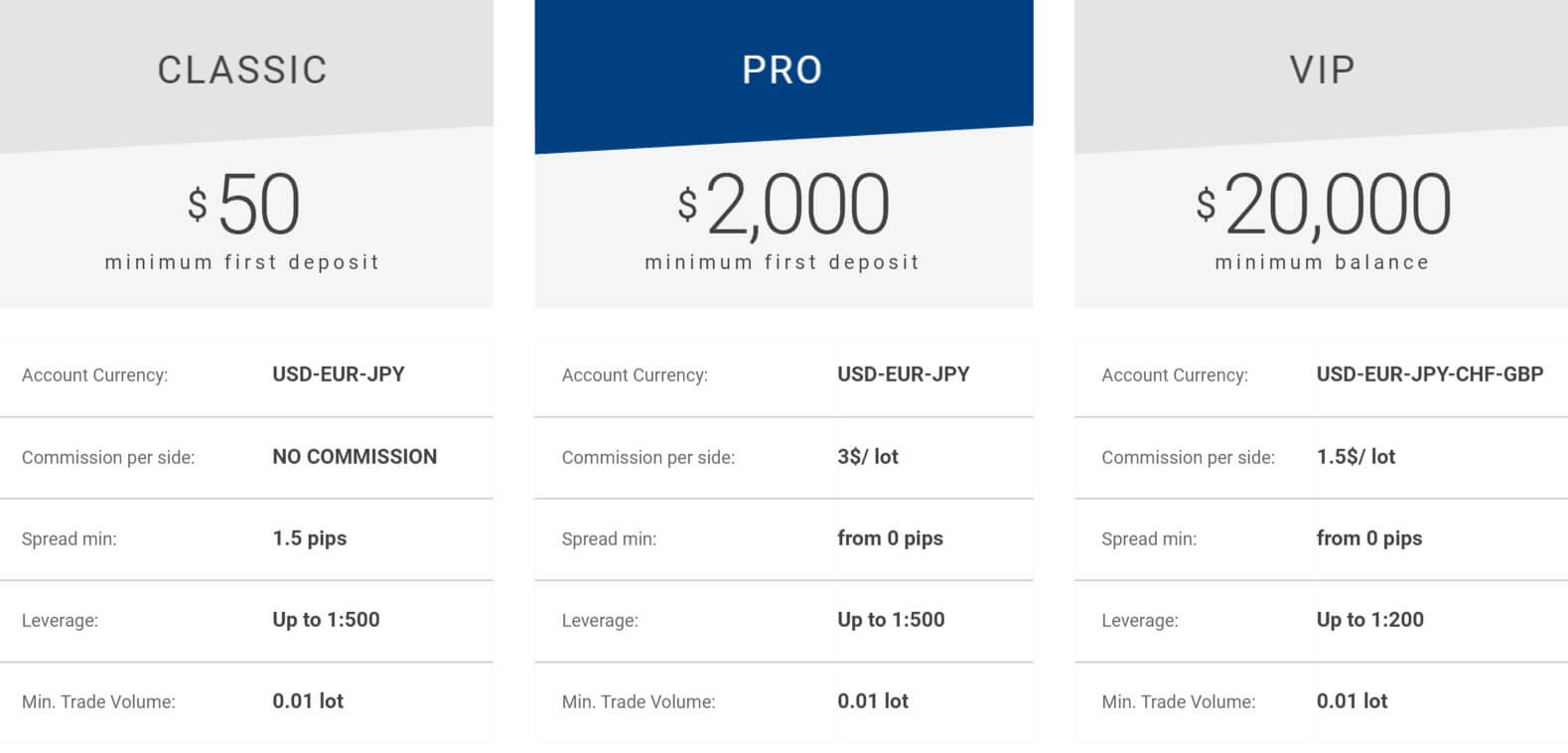

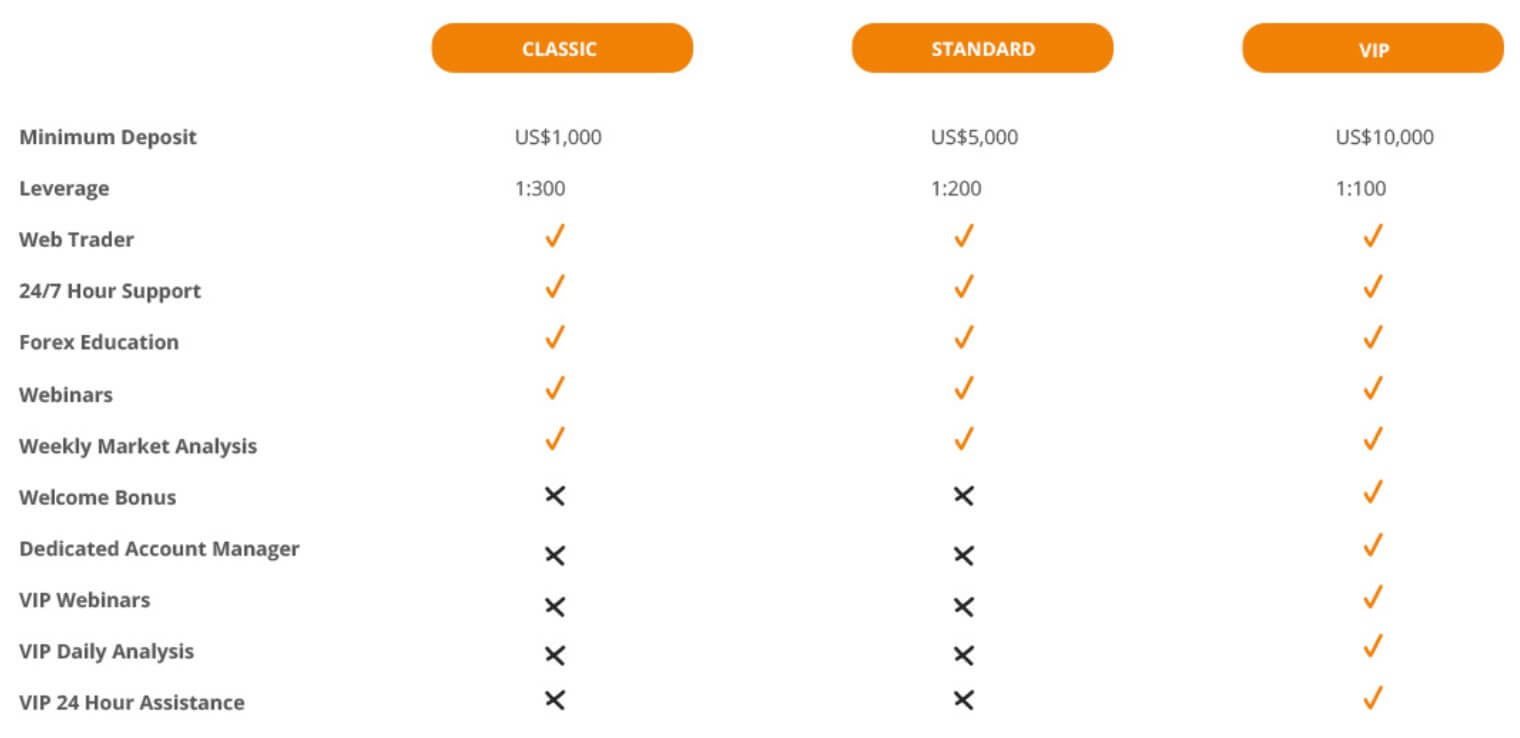

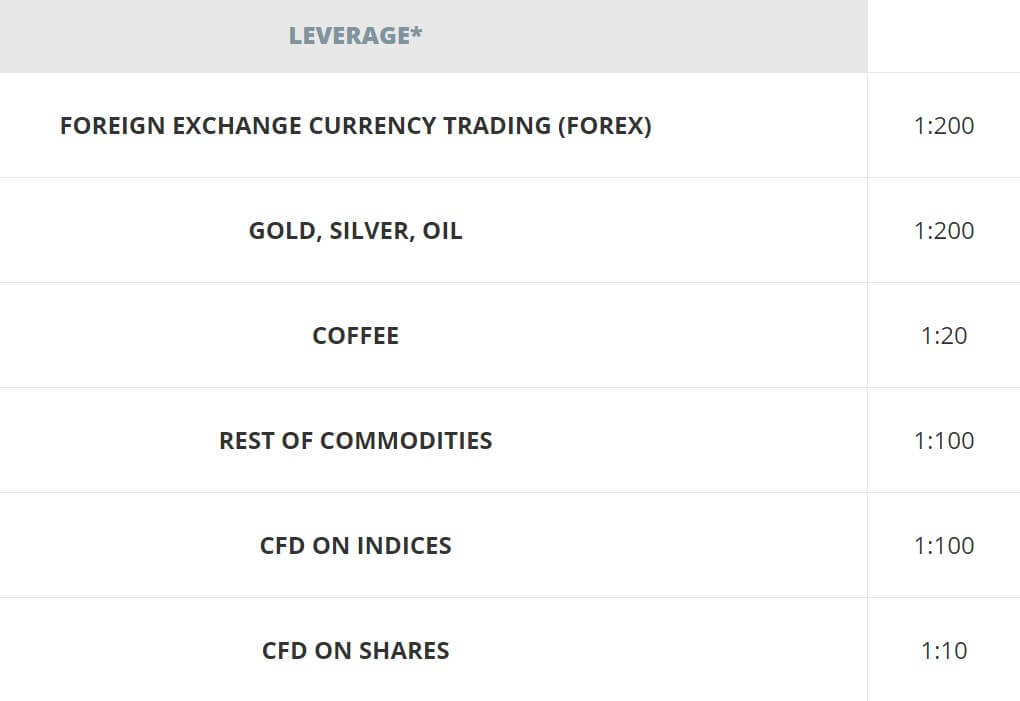

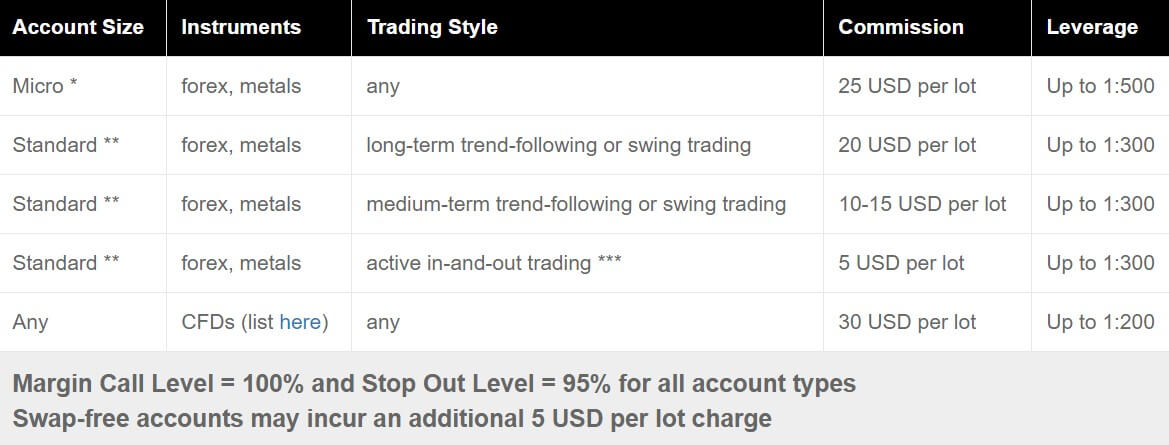

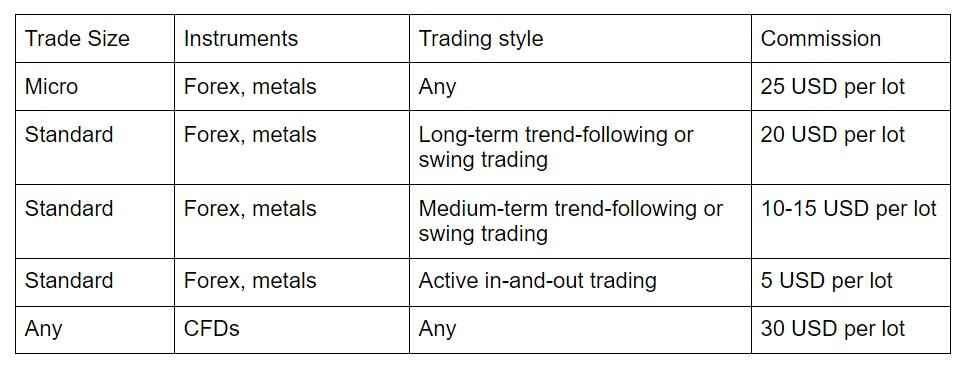

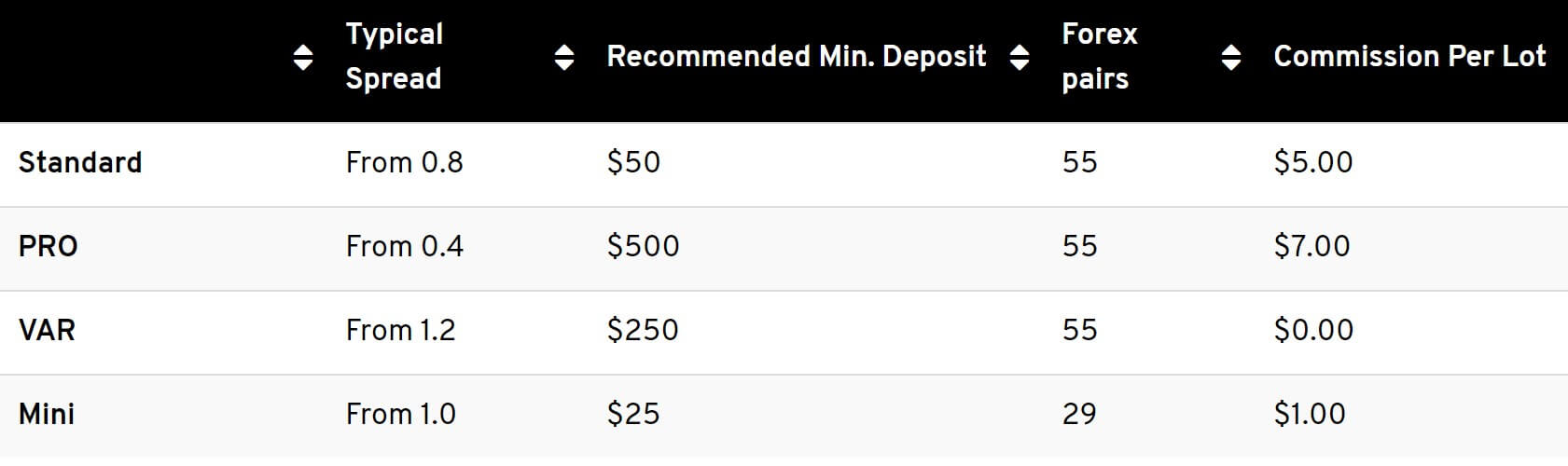

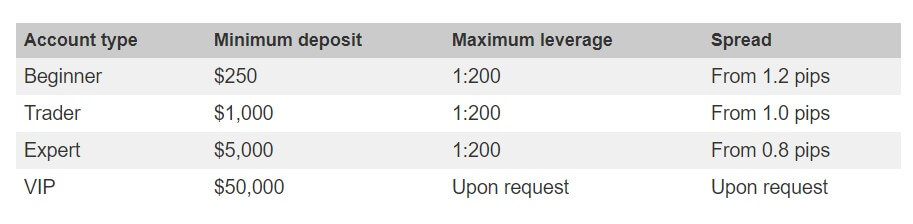

Just the one platform available, but thankfully it is a good one. Metatrader 4 (MT4) is the world’s preferred  The classic and Pro account c can be leveraged up to 1:500 while the VIP account can be leveraged up to 1:200. The leverage can be selected when first opening up an account and can be changed by sending a request to the customer service department.

The classic and Pro account c can be leveraged up to 1:500 while the VIP account can be leveraged up to 1:200. The leverage can be selected when first opening up an account and can be changed by sending a request to the customer service department.

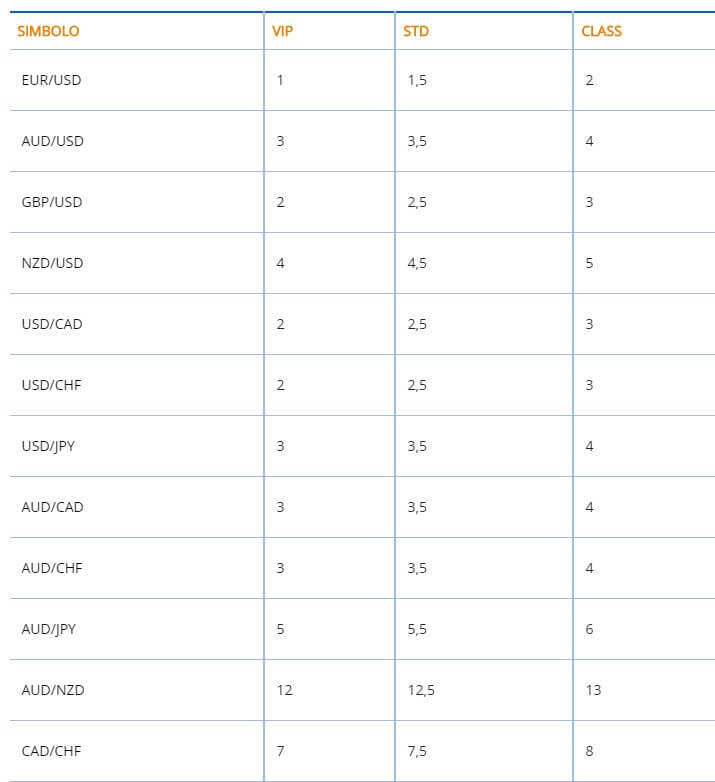

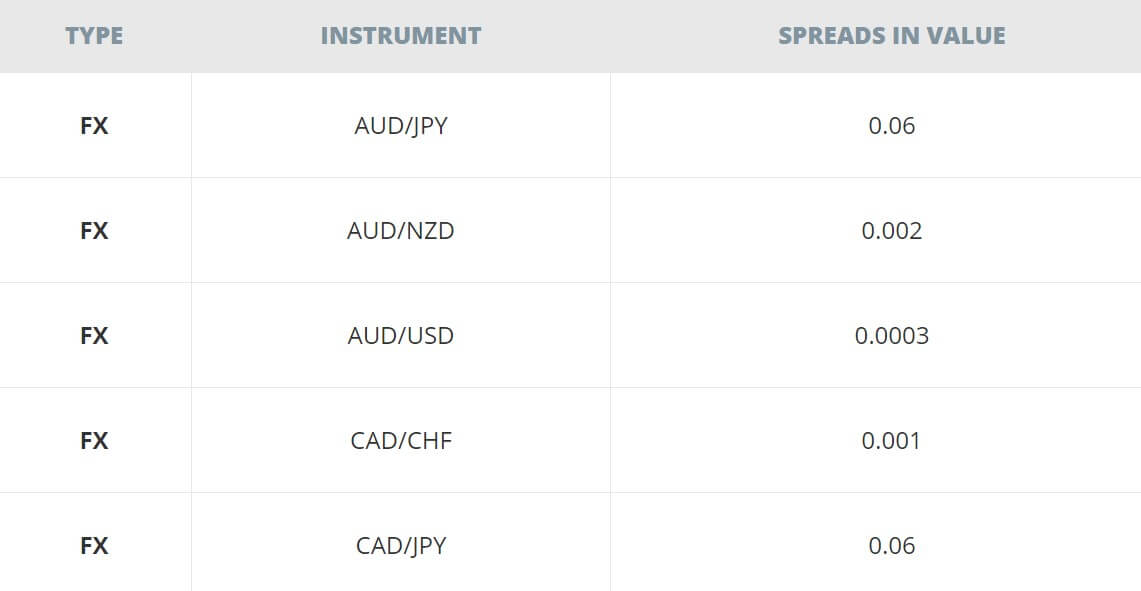

The spreads depend on the account you are using along with a few other factors. The Classic account has spreads starting from 1,.5 pips while the Pro and

The spreads depend on the account you are using along with a few other factors. The Classic account has spreads starting from 1,.5 pips while the Pro and

There isn’t too much when it comes to education, there are some pages explaining what each currency is and how it works and also some Webinars which seem to run each week, we do not know how good they are or if they are worth attending though.

There isn’t too much when it comes to education, there are some pages explaining what each currency is and how it works and also some Webinars which seem to run each week, we do not know how good they are or if they are worth attending though.

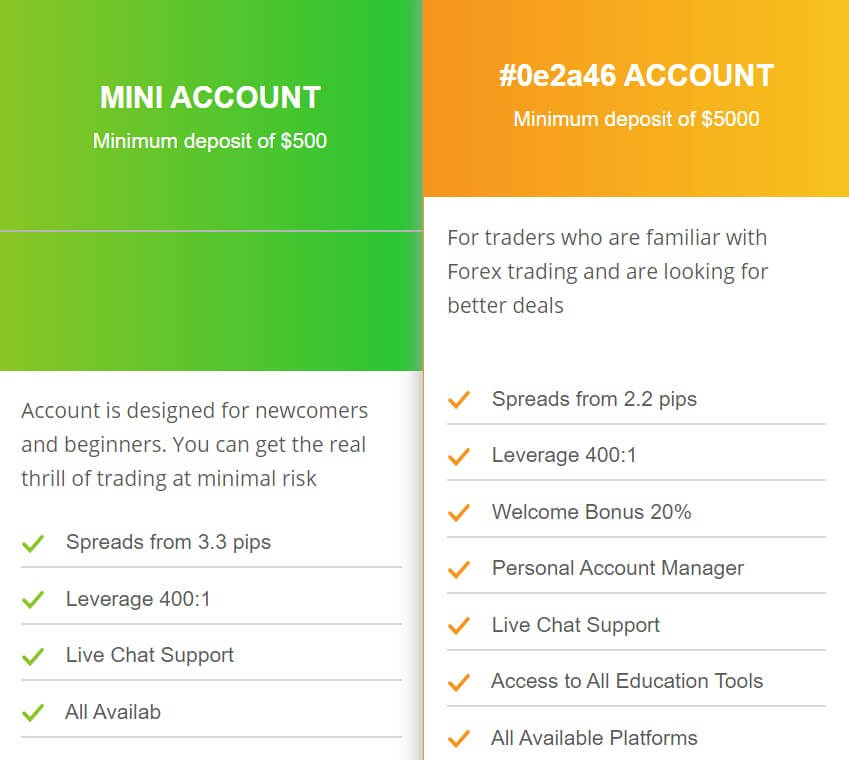

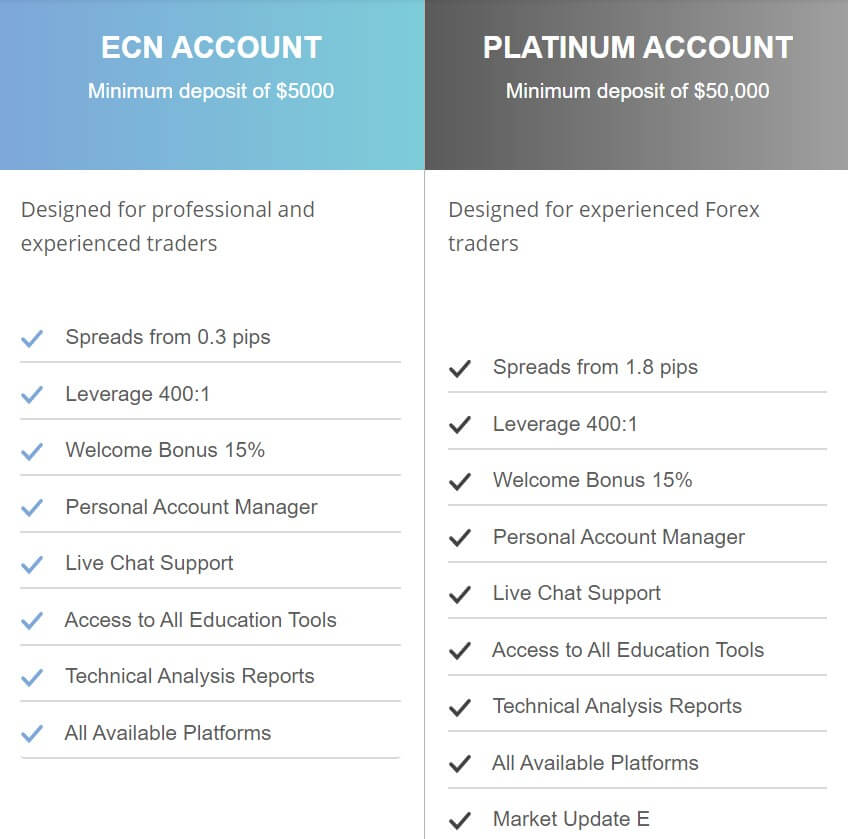

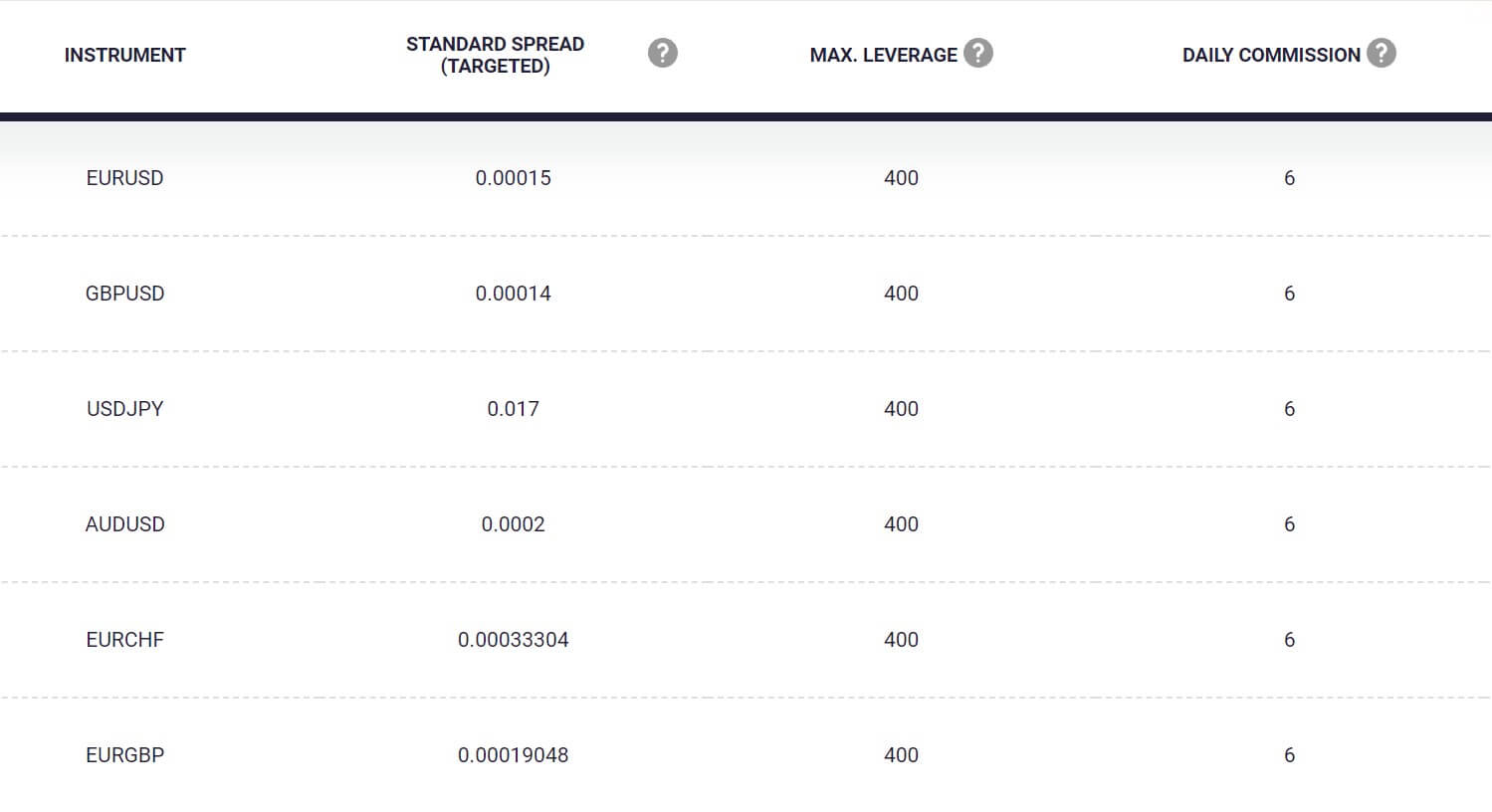

There isn’t any solid information when it comes to leverage, in fact, the only information available at all is in the terms and conditions, but it has nothing to do with what the maximum leverage is, there is a short sentence regarding the bonus funds, it mentions having a leverage of 1:400, so we would assume that this amount is available on the accounts, however, we can not say for sure. Why this information is not available is unknown to us, as it is quite important for potential clients to know.

There isn’t any solid information when it comes to leverage, in fact, the only information available at all is in the terms and conditions, but it has nothing to do with what the maximum leverage is, there is a short sentence regarding the bonus funds, it mentions having a leverage of 1:400, so we would assume that this amount is available on the accounts, however, we can not say for sure. Why this information is not available is unknown to us, as it is quite important for potential clients to know. Trading Costs

Trading Costs Deposit Methods & Costs

Deposit Methods & Costs

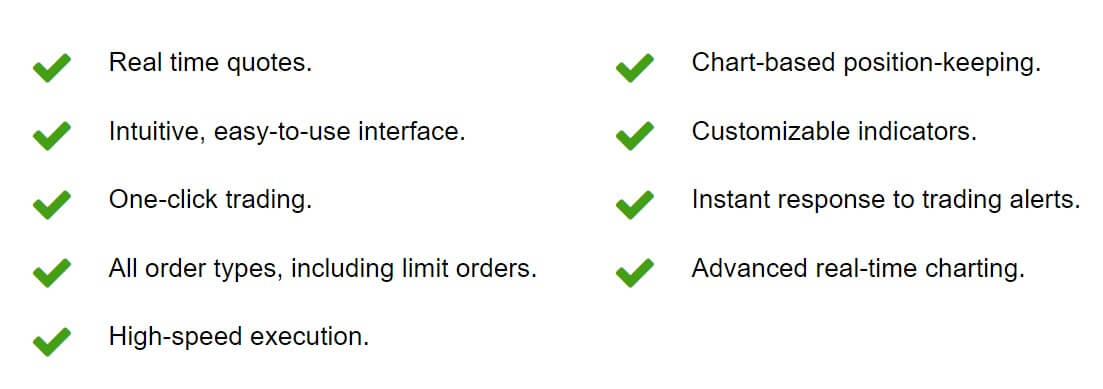

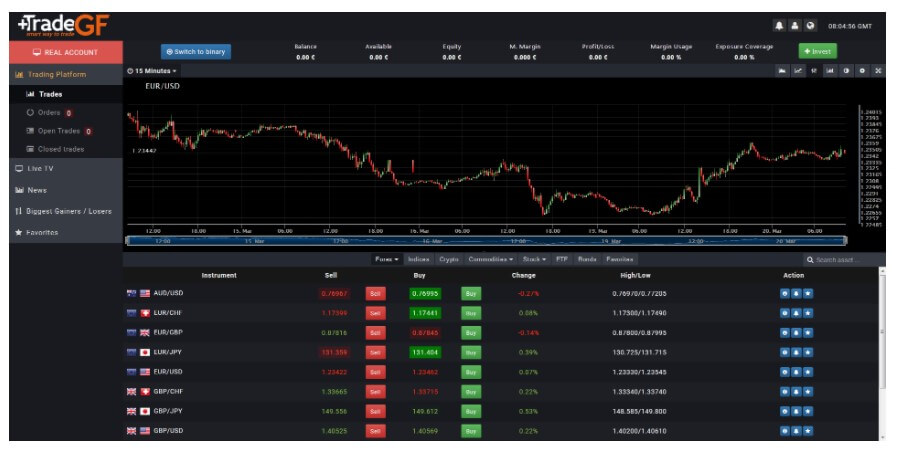

Your Trade Choice, like most brokers, offers its clients the MT4 trading platform. Remember that MT4 is one of the traders’ favorite tools for the following reasons, it is stable, it is reliable, has many functionalities and complements that have been perfected over the 10 years in the financial market.

Your Trade Choice, like most brokers, offers its clients the MT4 trading platform. Remember that MT4 is one of the traders’ favorite tools for the following reasons, it is stable, it is reliable, has many functionalities and complements that have been perfected over the 10 years in the financial market.

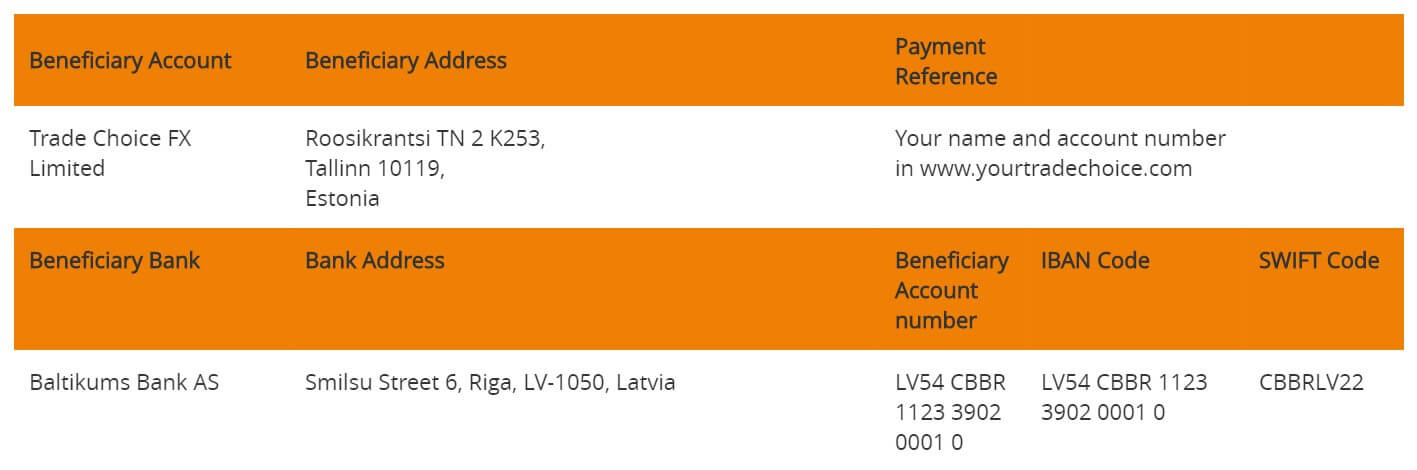

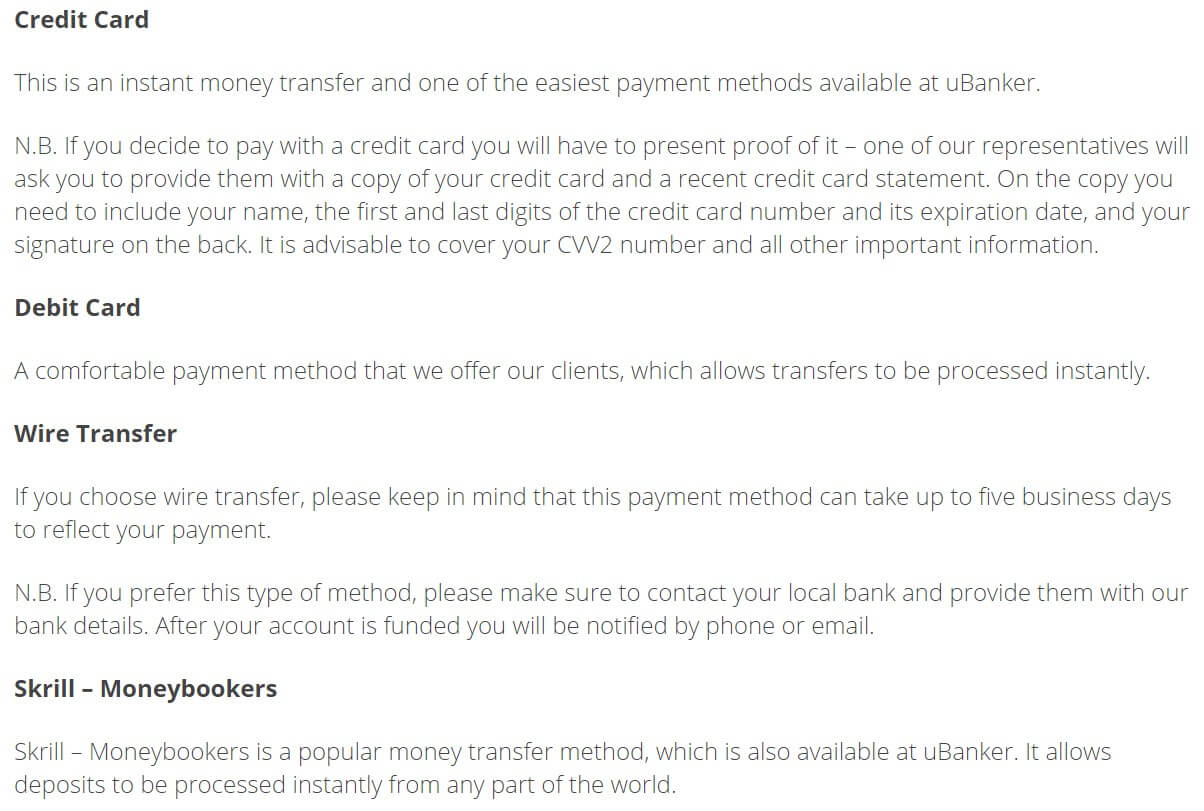

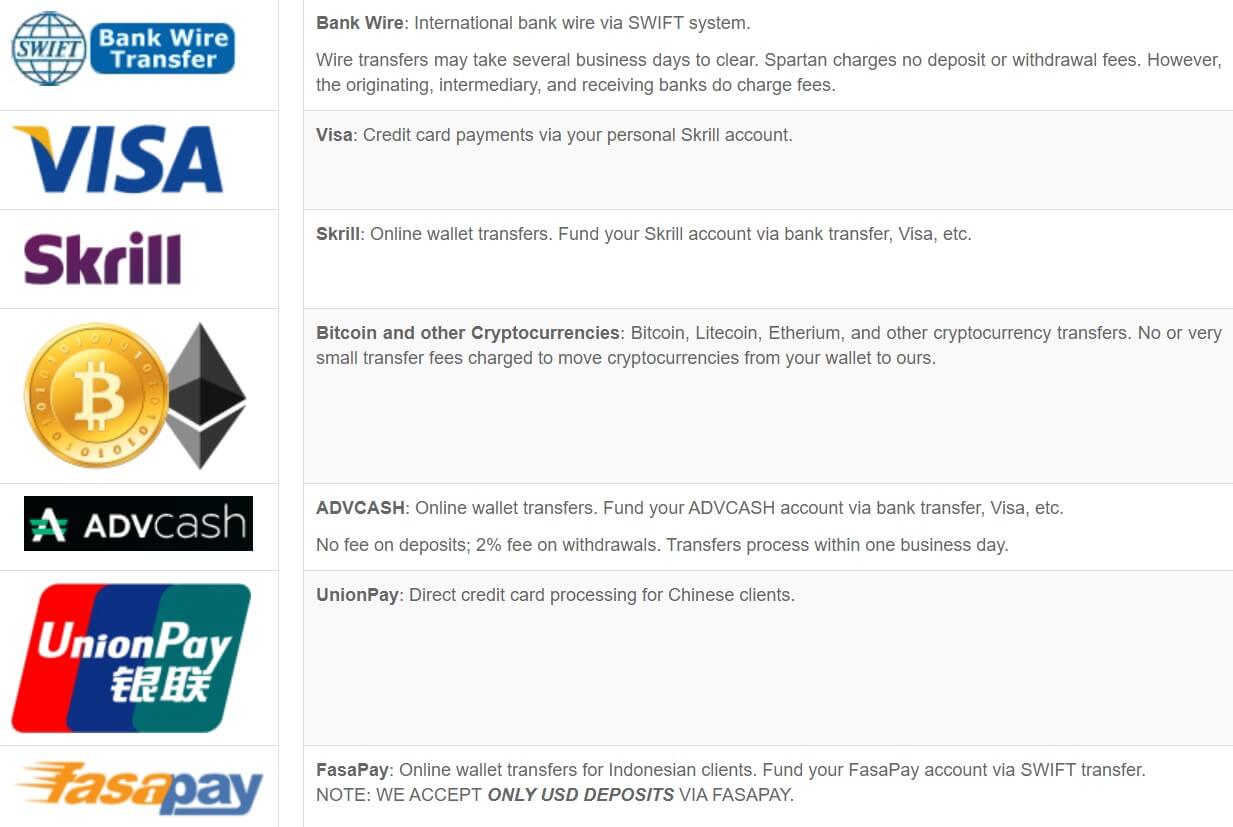

In the FAQ it states that Bank Wire Transfer, Credit / Debit Cards, Moneybookers (Skrill), and transfers from other existing broker accounts are available as deposit methods. However at the bottom of the site, there is also an image of UnionPay and AliPay, but we are not sure if they are actually usable or not.

In the FAQ it states that Bank Wire Transfer, Credit / Debit Cards, Moneybookers (Skrill), and transfers from other existing broker accounts are available as deposit methods. However at the bottom of the site, there is also an image of UnionPay and AliPay, but we are not sure if they are actually usable or not.

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by

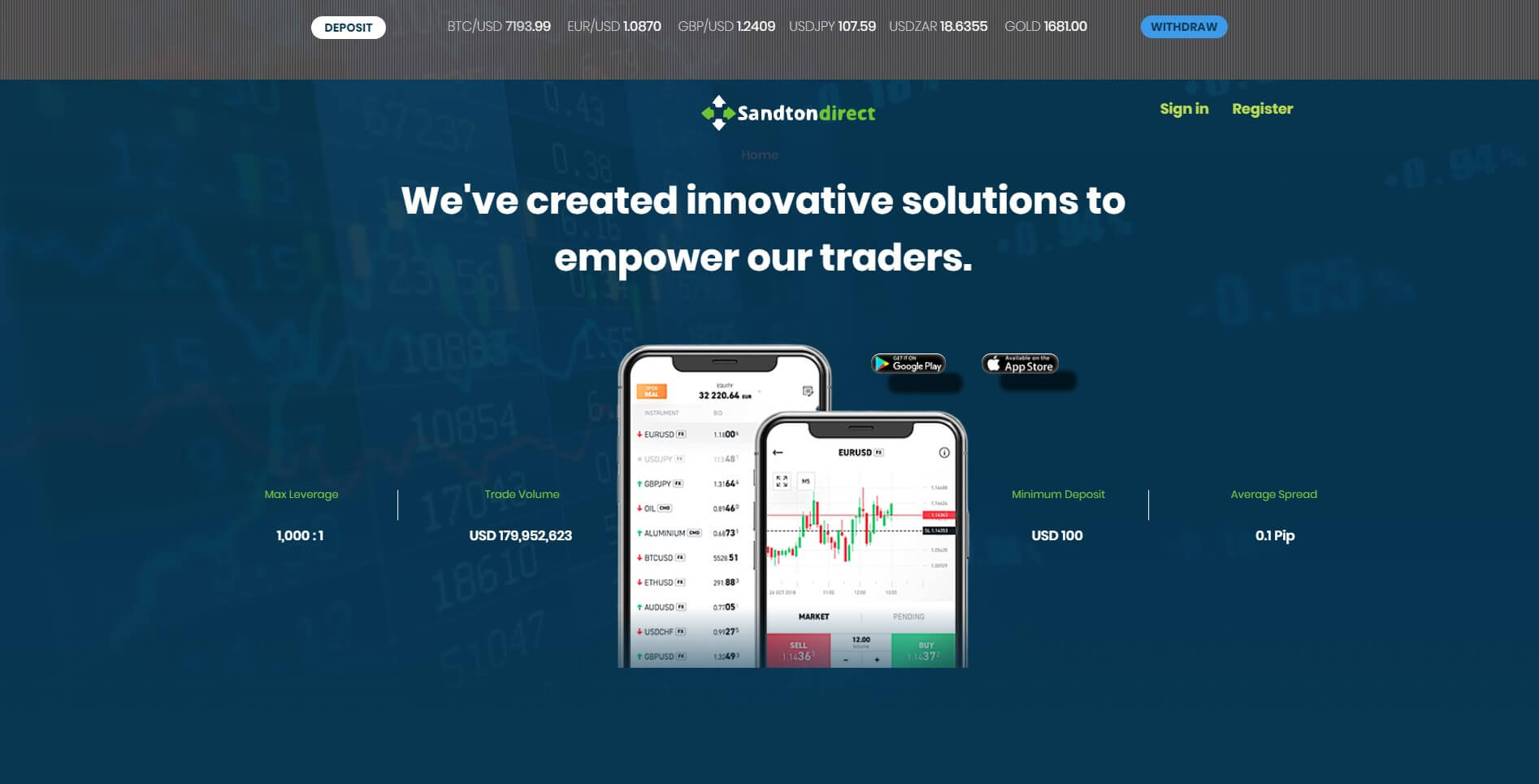

When opening up an account you are able to select leverage between 1:33 and 1:1000. We would suggest not trading over 1:500 as the risk grows exponentially the higher you go and 1:500 is a good balance of risk and reward. Should you wish to change the leverage on an account you have already opened, you should send a request to the customer service team to help you do this.

When opening up an account you are able to select leverage between 1:33 and 1:1000. We would suggest not trading over 1:500 as the risk grows exponentially the higher you go and 1:500 is a good balance of risk and reward. Should you wish to change the leverage on an account you have already opened, you should send a request to the customer service team to help you do this. According to the front page of the site, the average spread starts from 0.1 pips which, if true, is very low and quite impressive. We don’t actually have any examples of the available spreads but we do know that they are variable spreads, this means that they are affected by the markets and can move up and down according to liquidity and volatility.

According to the front page of the site, the average spread starts from 0.1 pips which, if true, is very low and quite impressive. We don’t actually have any examples of the available spreads but we do know that they are variable spreads, this means that they are affected by the markets and can move up and down according to liquidity and volatility.

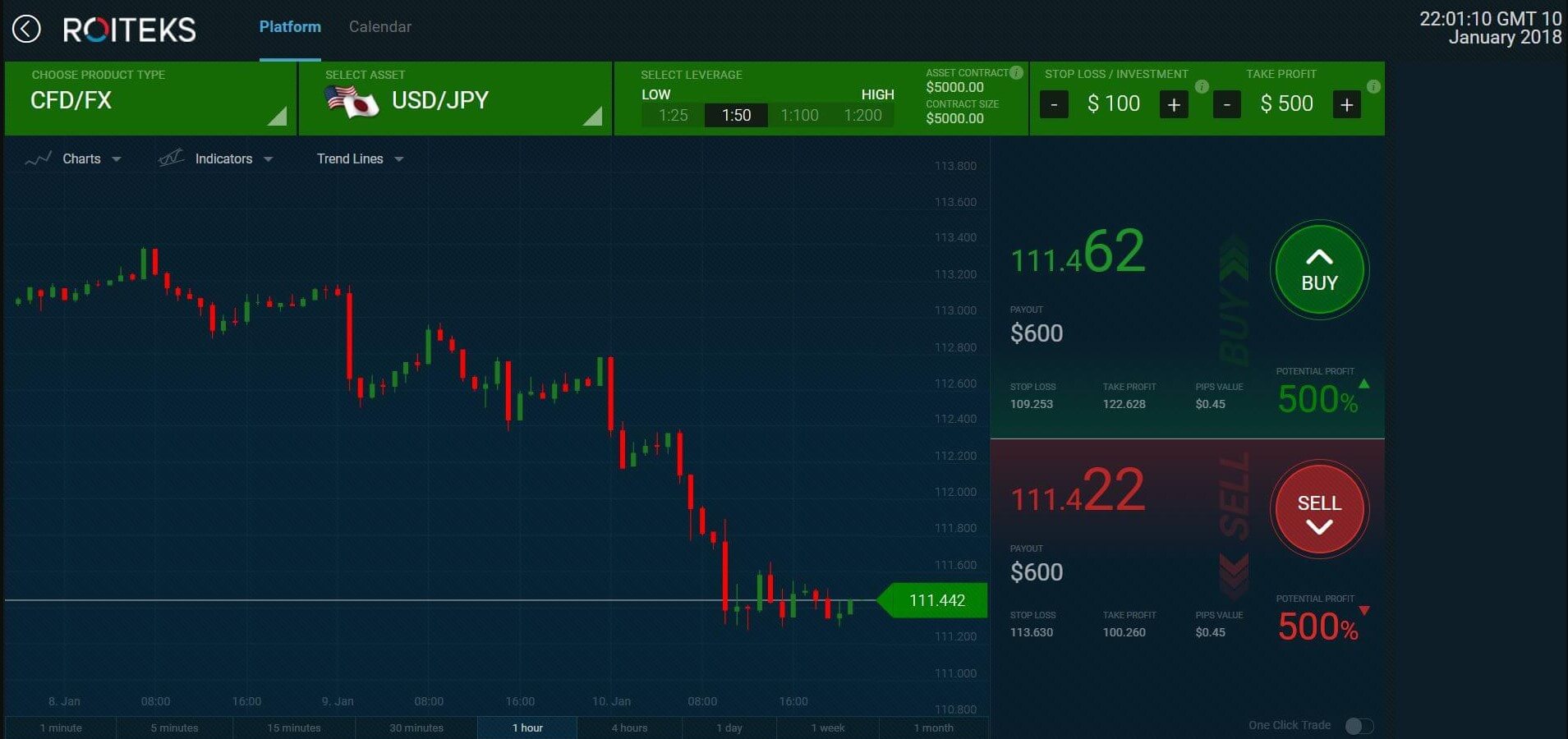

When placing a trade you are able to choose a leverage of 1:20, 1:50, 1:100, or 1:300. This is a slightly different way of doing things as it is not based on the account but the individual trade. 1:300 isn’t as high as we often like to see as many brokers are now looking towards offering 1:500, but 1:100 is still an acceptable level to use.

When placing a trade you are able to choose a leverage of 1:20, 1:50, 1:100, or 1:300. This is a slightly different way of doing things as it is not based on the account but the individual trade. 1:300 isn’t as high as we often like to see as many brokers are now looking towards offering 1:500, but 1:100 is still an acceptable level to use. There are no additional commissions added to the trades, this is stated in the terms and conditions. There are however

There are no additional commissions added to the trades, this is stated in the terms and conditions. There are however

The minimum deposit requirement with Roiteks is 250 EUR, USD or GBP. We do not know if this amount reduces once an account has already been opened, and advise that you speak with customer service to be clear on what fees are associated with funding a trading account with Roiteks.

The minimum deposit requirement with Roiteks is 250 EUR, USD or GBP. We do not know if this amount reduces once an account has already been opened, and advise that you speak with customer service to be clear on what fees are associated with funding a trading account with Roiteks.

Forex: GBPUSD, USDJPY, EURUSD, USDTRY, USDCHF, AUDUSD, USDCAD, GBPJPY, EURGBP, USDRUB, EURJPY, GBPCHF, NZDUSD, EURCHF, USDZAR, EURTRY, AUDCAD, USDMXN, EURAUD, EURAUD, AUDJPY, GBPAUD, EURZAR, CHFJPY, GBPNZD, EURCAD, CADJPY, AUDNZD, GBPCAD, AUDCHF, CADCHF, NZDCHF, NZDCAD, EURNZD, EURRUB, USDNOK, GBPRUB, USDSEK, USDDKK, USDPLN, USDHKD, EURSEK, USDSHD, EURNOK, EURPLN, USDCZK, EURDKK.

Forex: GBPUSD, USDJPY, EURUSD, USDTRY, USDCHF, AUDUSD, USDCAD, GBPJPY, EURGBP, USDRUB, EURJPY, GBPCHF, NZDUSD, EURCHF, USDZAR, EURTRY, AUDCAD, USDMXN, EURAUD, EURAUD, AUDJPY, GBPAUD, EURZAR, CHFJPY, GBPNZD, EURCAD, CADJPY, AUDNZD, GBPCAD, AUDCHF, CADCHF, NZDCHF, NZDCAD, EURNZD, EURRUB, USDNOK, GBPRUB, USDSEK, USDDKK, USDPLN, USDHKD, EURSEK, USDSHD, EURNOK, EURPLN, USDCZK, EURDKK.

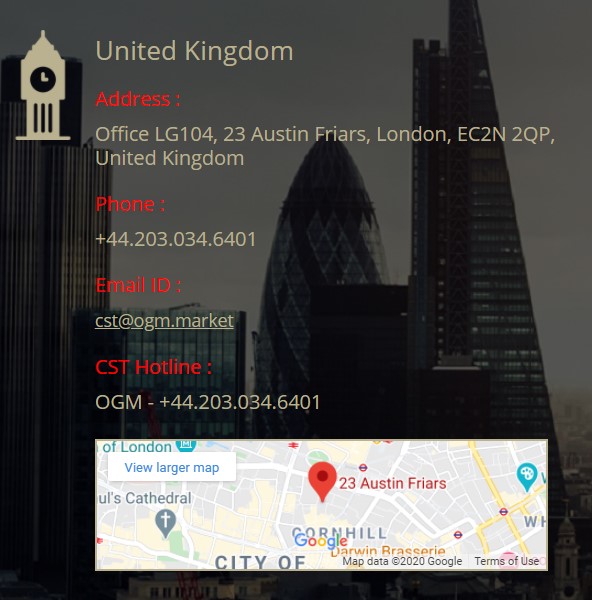

Address:

Address:

As they state on their website their objective is to create a safe and transparent environment where their clients can trade their available products. They specialize in CFDs and Forex trading whilst making use of sophisticated online trading systems such as the MT4.

As they state on their website their objective is to create a safe and transparent environment where their clients can trade their available products. They specialize in CFDs and Forex trading whilst making use of sophisticated online trading systems such as the MT4.

Customers who have an open account with this broker can trade a number of assets including – Forex pairs, Precious Metals, Energies, and Cash Indices. The broker does not have a full list of available assets on their website, so we assume customers are given this information once an open account is created.

Customers who have an open account with this broker can trade a number of assets including – Forex pairs, Precious Metals, Energies, and Cash Indices. The broker does not have a full list of available assets on their website, so we assume customers are given this information once an open account is created.

OGM has a firm set of obligations and standards set out for themselves which are; transparent executions, security and stability through their platform and strict regulators, connectivity infrastructure, a very strong liquidity offering, the ability for customers to educate themselves through their experience garnered over 29 years of experience within the industry and finally satisfaction through their service.

OGM has a firm set of obligations and standards set out for themselves which are; transparent executions, security and stability through their platform and strict regulators, connectivity infrastructure, a very strong liquidity offering, the ability for customers to educate themselves through their experience garnered over 29 years of experience within the industry and finally satisfaction through their service.

BS Trading is an online foreign exchange broker that offers investment options in FX pairs and CFDs, including a few cryptocurrencies. The company is based in Vanuatu under the regulatory oversight of the Vanuatu Financial Services Commission (VFSC). BS Trading manages to bring traders tight spreads and high leverage options, all for a low $1 deposit, but there are a few things missing from the overall experience. When it comes to describing themselves, the company only sticks to the basic facts. If you’re in the market for a broker, our detailed review should help to decide whether BS Trading is a worthy candidate.

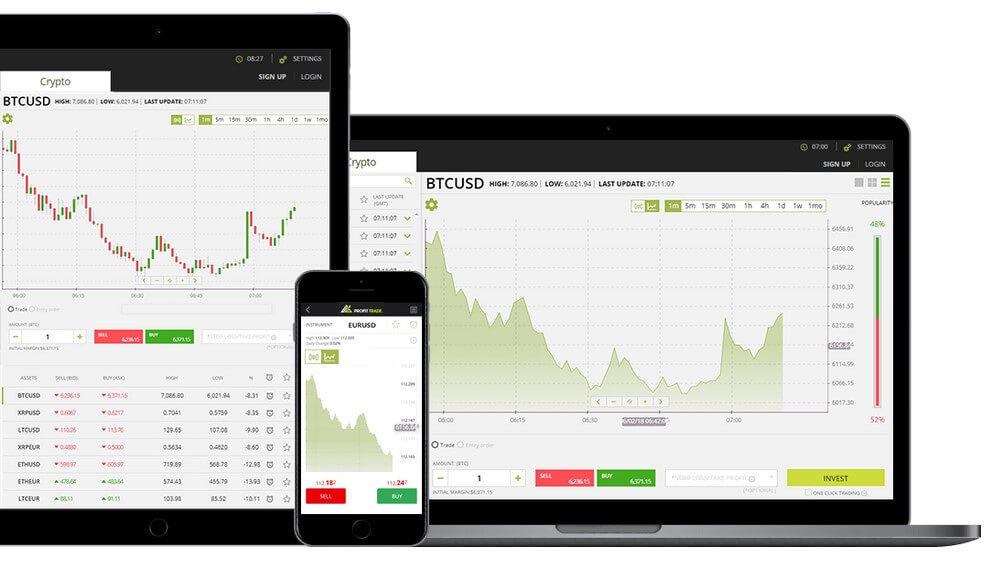

BS Trading is an online foreign exchange broker that offers investment options in FX pairs and CFDs, including a few cryptocurrencies. The company is based in Vanuatu under the regulatory oversight of the Vanuatu Financial Services Commission (VFSC). BS Trading manages to bring traders tight spreads and high leverage options, all for a low $1 deposit, but there are a few things missing from the overall experience. When it comes to describing themselves, the company only sticks to the basic facts. If you’re in the market for a broker, our detailed review should help to decide whether BS Trading is a worthy candidate. Along with the majority of other forex brokers, BS Trading offers the award-winning MetaTrader 4 platform for download on PC and mobile devices, or through the web-browser. MT4 features one-click trading, EAs (Expert Advisors), multiple languages, and VPS functionality. The platform also comes with technical analysis tools, nearly 50 indicators, 3 chart types, charting tools, and the list goes on. Compared to other options, MetaTrader 4 will always remain one of the most preferred trading platforms on the market for the sheer fact that it offers all of these features and more from a navigable, powerful, and customizable interface. If you’re looking for a convenient all-in-one option, MT4 will be more than sufficient.

Along with the majority of other forex brokers, BS Trading offers the award-winning MetaTrader 4 platform for download on PC and mobile devices, or through the web-browser. MT4 features one-click trading, EAs (Expert Advisors), multiple languages, and VPS functionality. The platform also comes with technical analysis tools, nearly 50 indicators, 3 chart types, charting tools, and the list goes on. Compared to other options, MetaTrader 4 will always remain one of the most preferred trading platforms on the market for the sheer fact that it offers all of these features and more from a navigable, powerful, and customizable interface. If you’re looking for a convenient all-in-one option, MT4 will be more than sufficient.

BS Trading advertises 100+ instruments as being available. Among those options, traders will find 54

BS Trading advertises 100+ instruments as being available. Among those options, traders will find 54

The Mobile trader enables customers to stay up to date with the most recent market rates. Some key features of this platform are, the ability to trade over 200 stocks, indices, currency pairs and commodities, the ability to constantly monitor positions, complete access to balance sheets, equity and margin details, and customizable layout for easy usage.

The Mobile trader enables customers to stay up to date with the most recent market rates. Some key features of this platform are, the ability to trade over 200 stocks, indices, currency pairs and commodities, the ability to constantly monitor positions, complete access to balance sheets, equity and margin details, and customizable layout for easy usage.

Educational & Trading Tools

Educational & Trading Tools

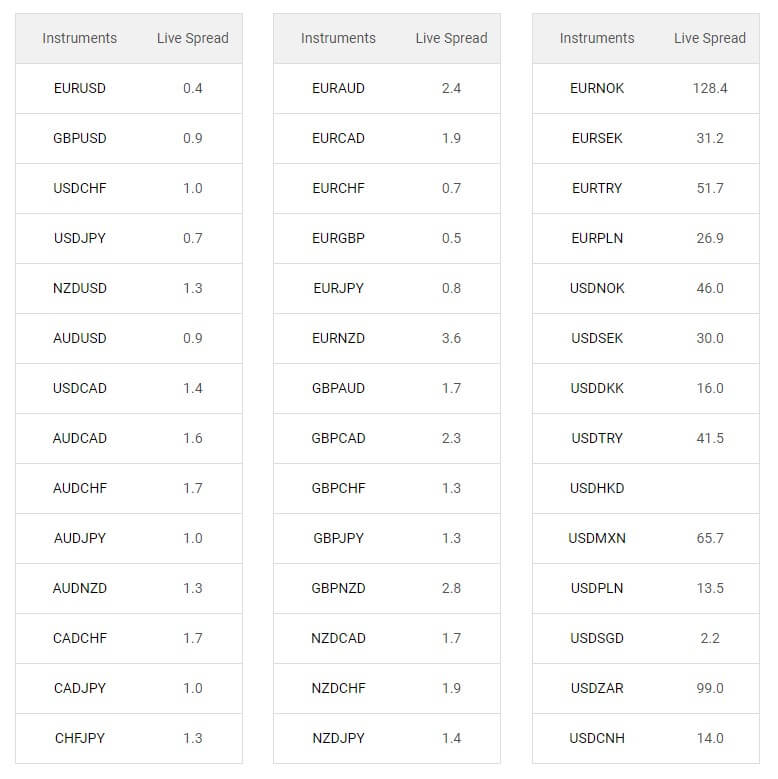

-45 currency pairs; majors, minors, and several exotics, including the Mexican Peso, Turkish Lira, South African Rand, Swedish Krona, Danish Krone, Hong Kong Dollar, and Singapore Dollar.

-45 currency pairs; majors, minors, and several exotics, including the Mexican Peso, Turkish Lira, South African Rand, Swedish Krona, Danish Krone, Hong Kong Dollar, and Singapore Dollar.