Forex Options XV – Delta Neutral Strategies

The Delta

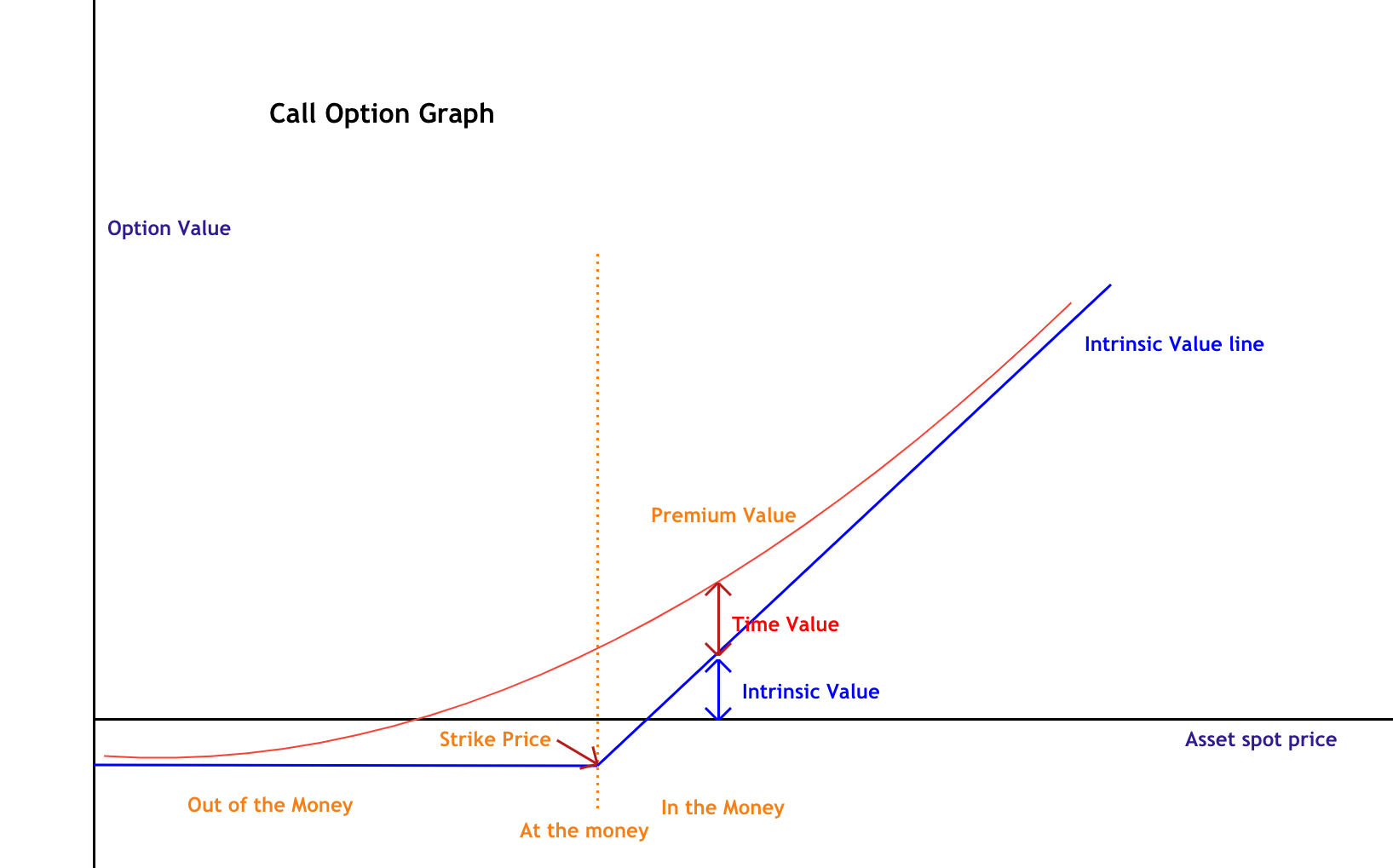

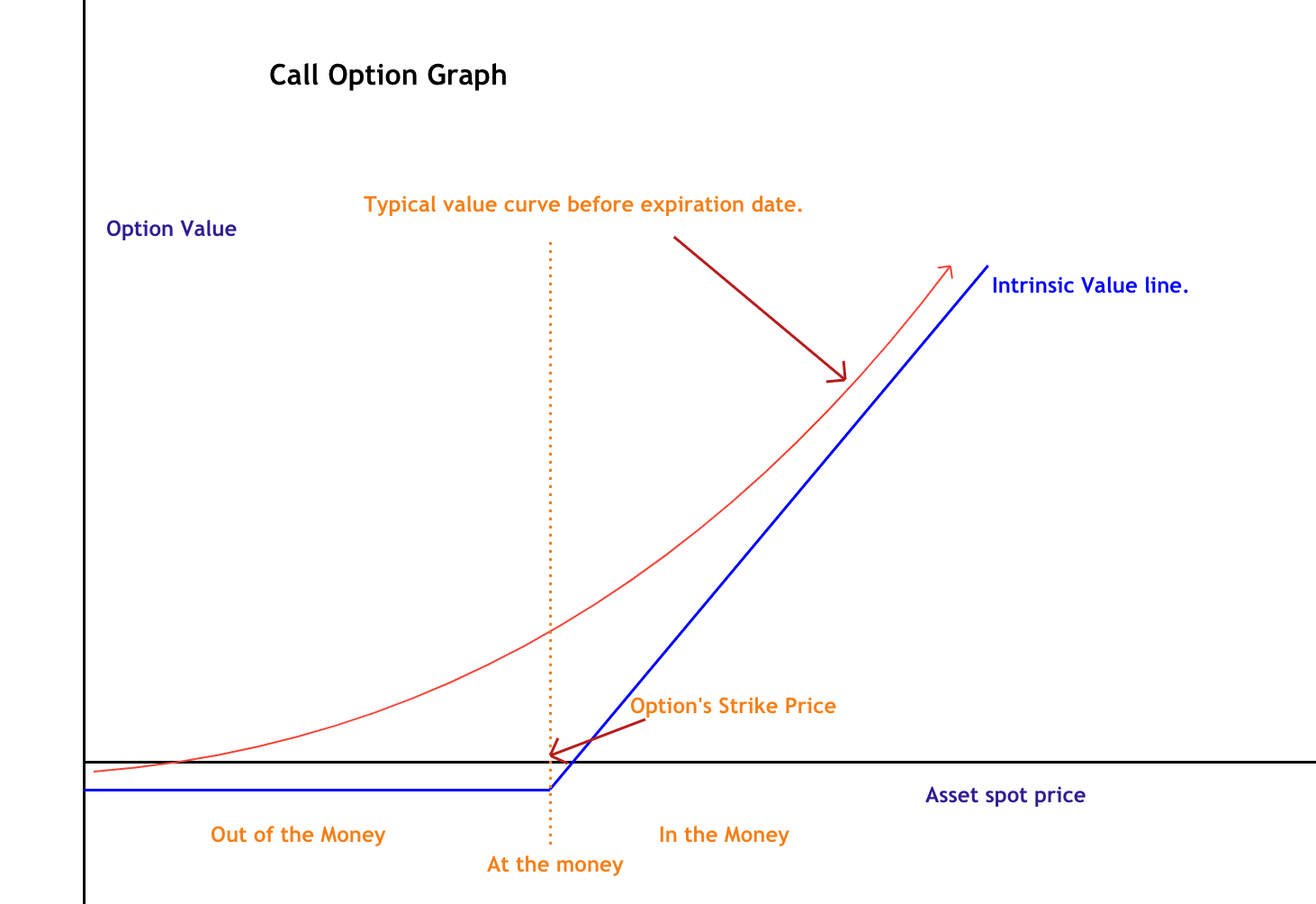

To be proficient with Delta-neutral strategies, one obviously needs to understand Delta. The option Delta can be considered the ratio of change in the option premium relative to the underlying spot price movement.

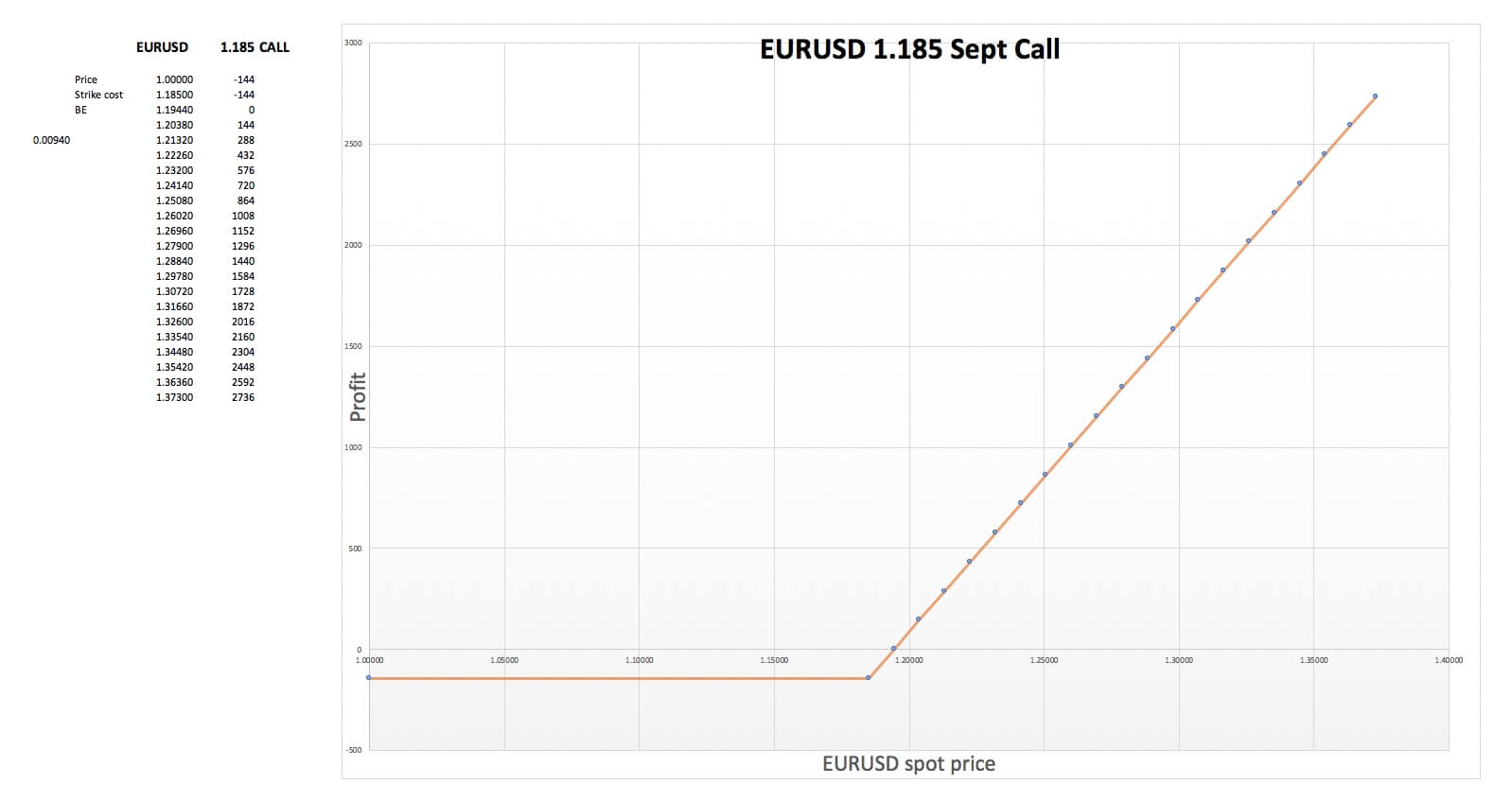

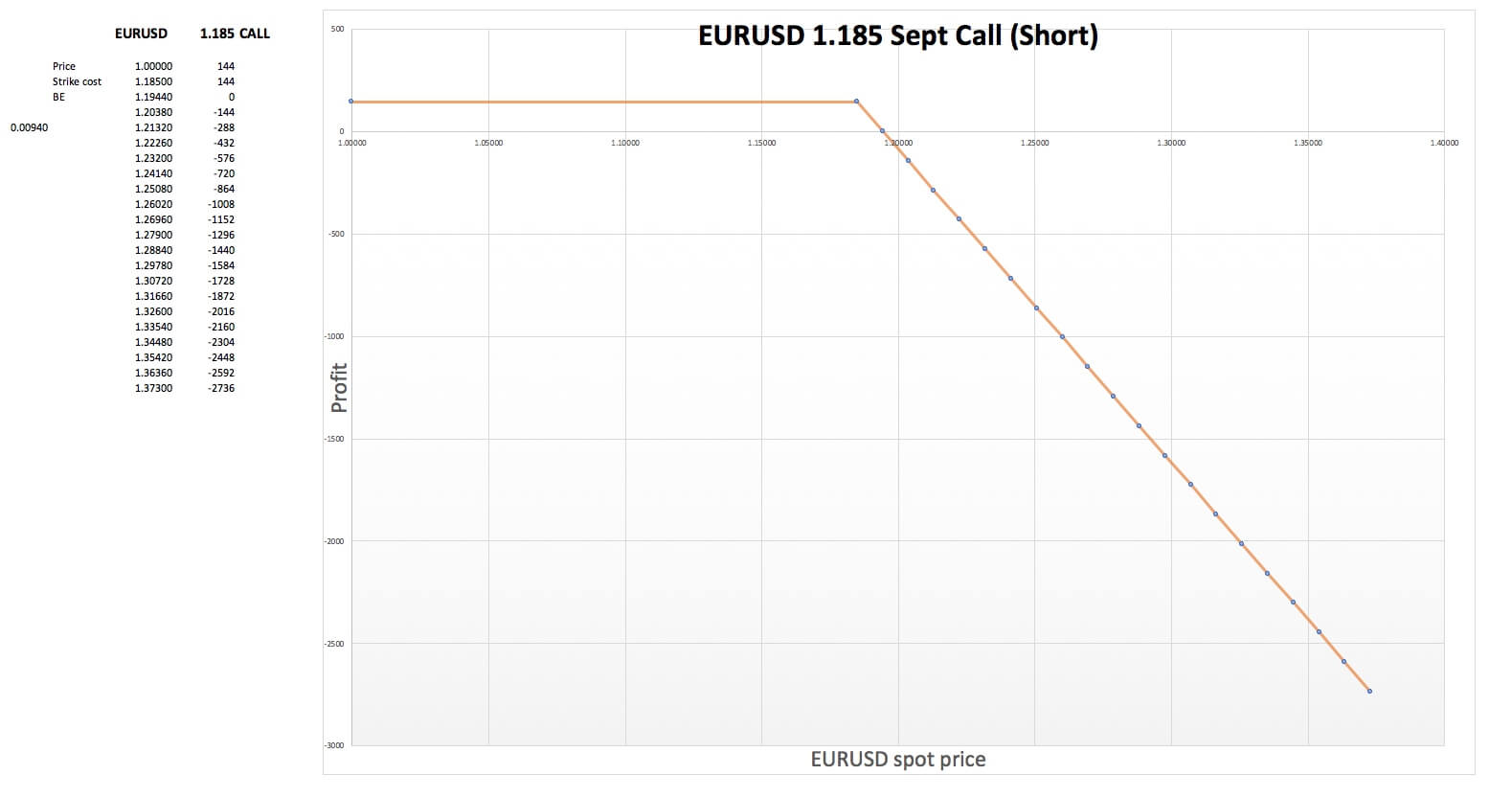

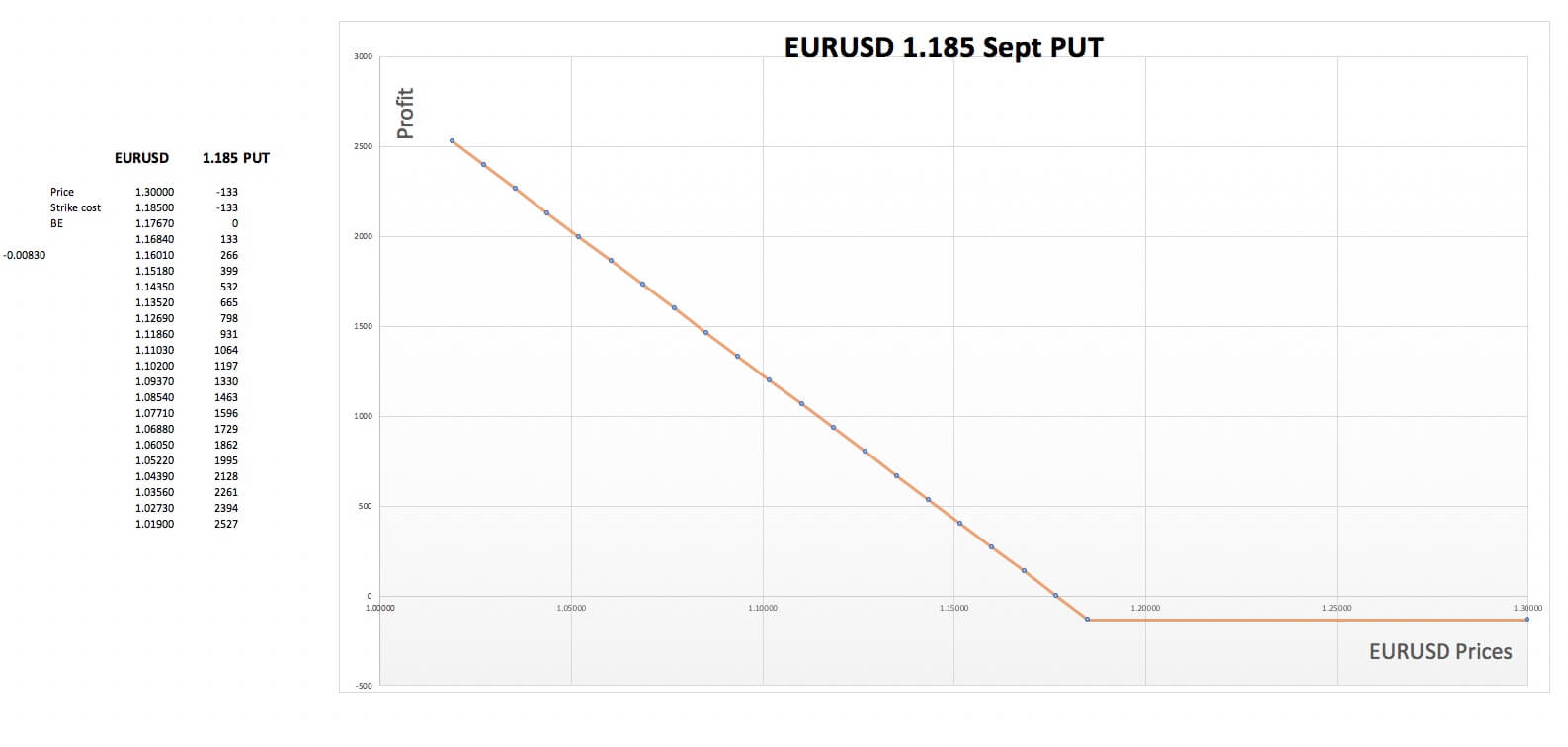

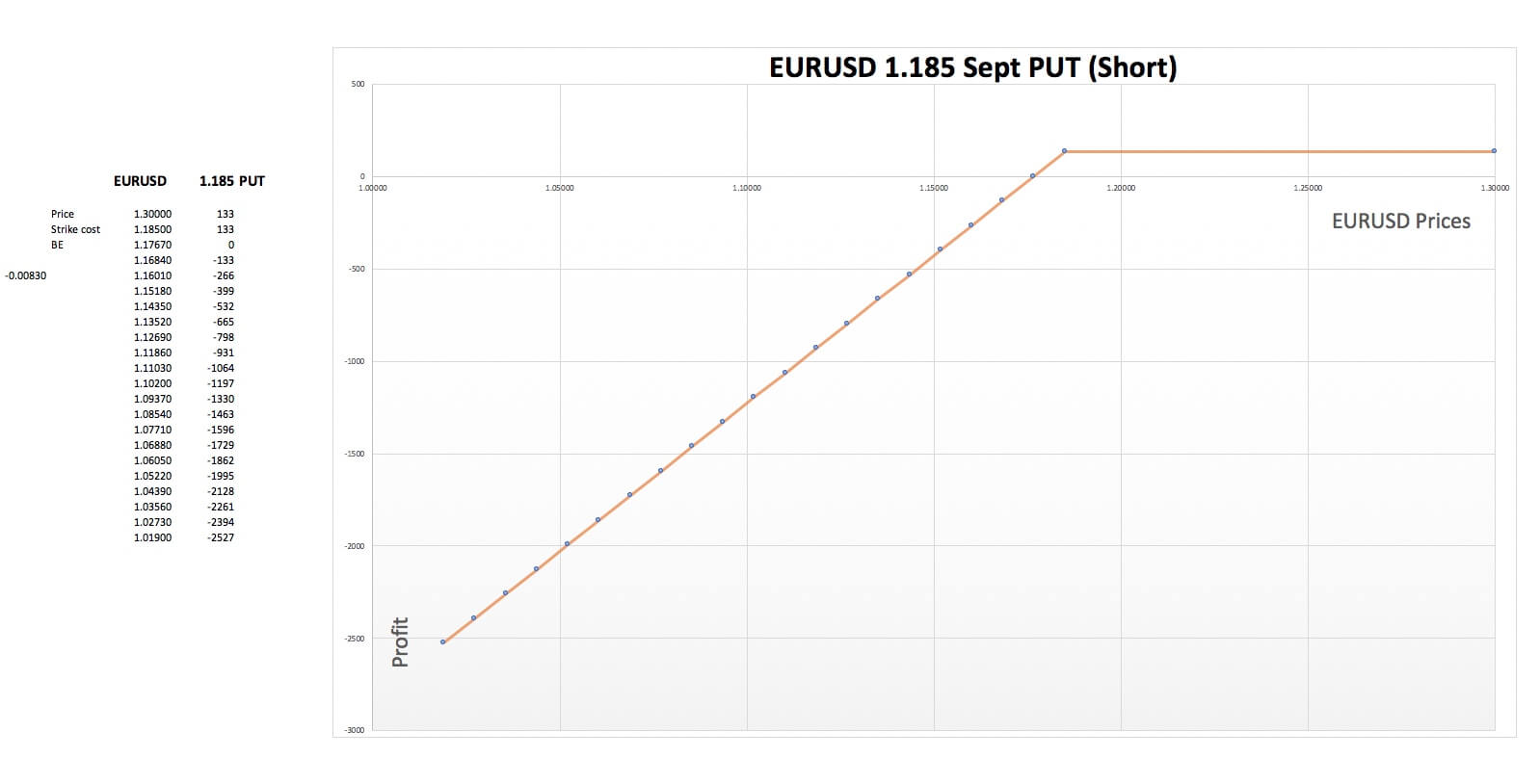

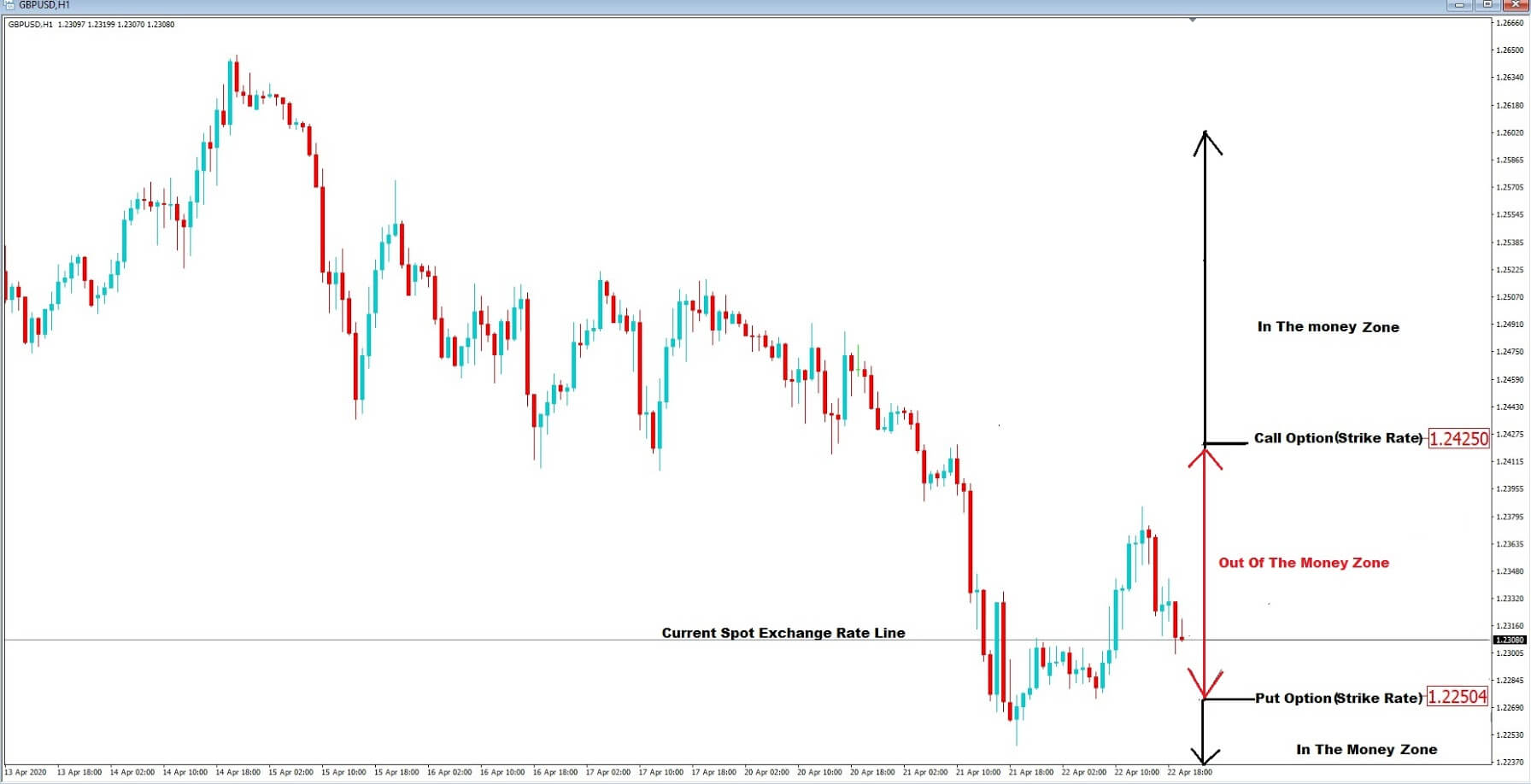

Delta’s range is 0 to100 for Calls and -100 to 0 for Puts. Thus, on a combination of options, it may range from -100 to 100. Bullish strategies will show positive Deltas, whereas bearish positions will present negative Deltas. Bullish strategies include long the underlying, long calls, and short puts. Also, short the underlying, short calls and long puts are bearish strategies.

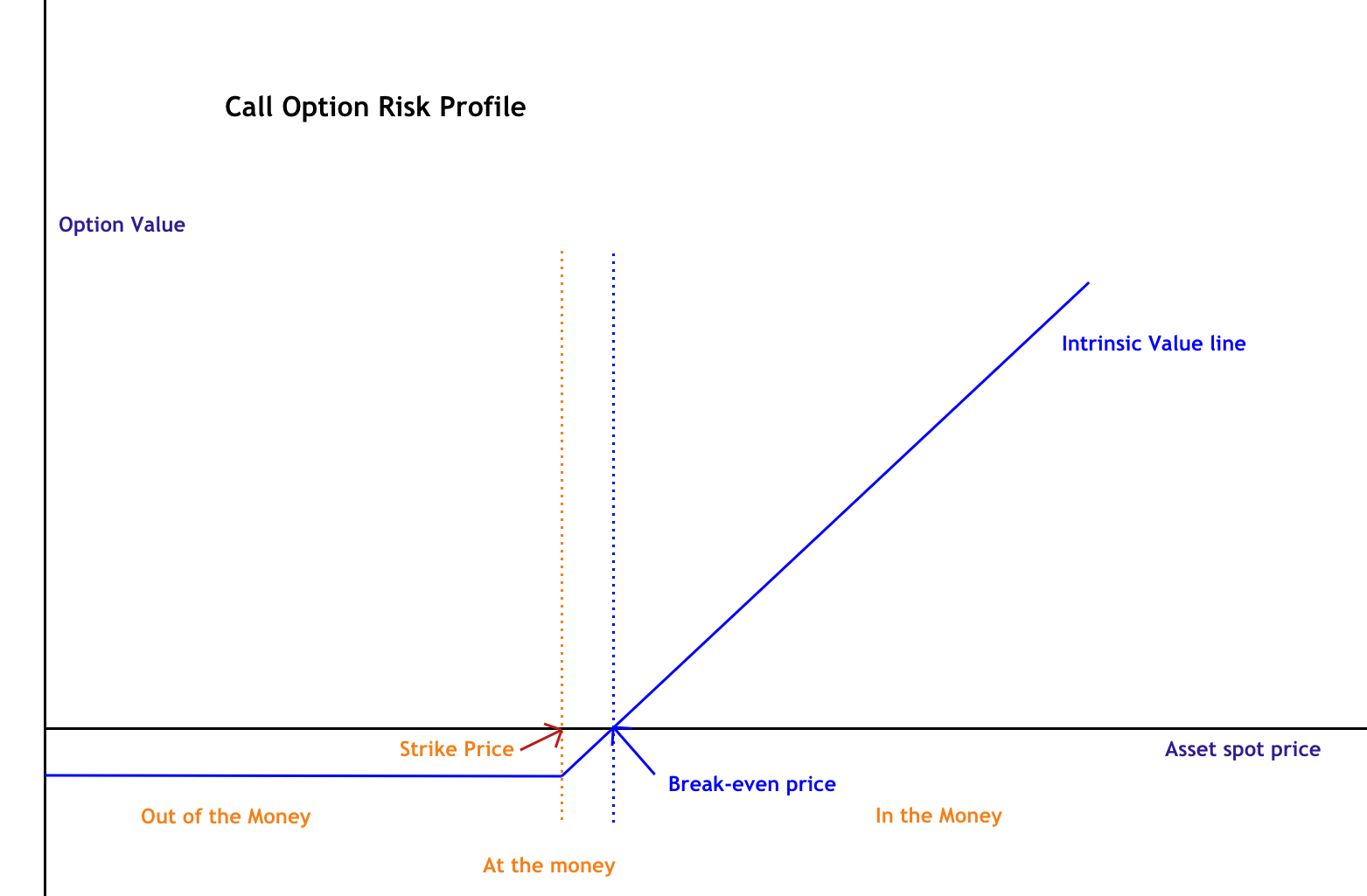

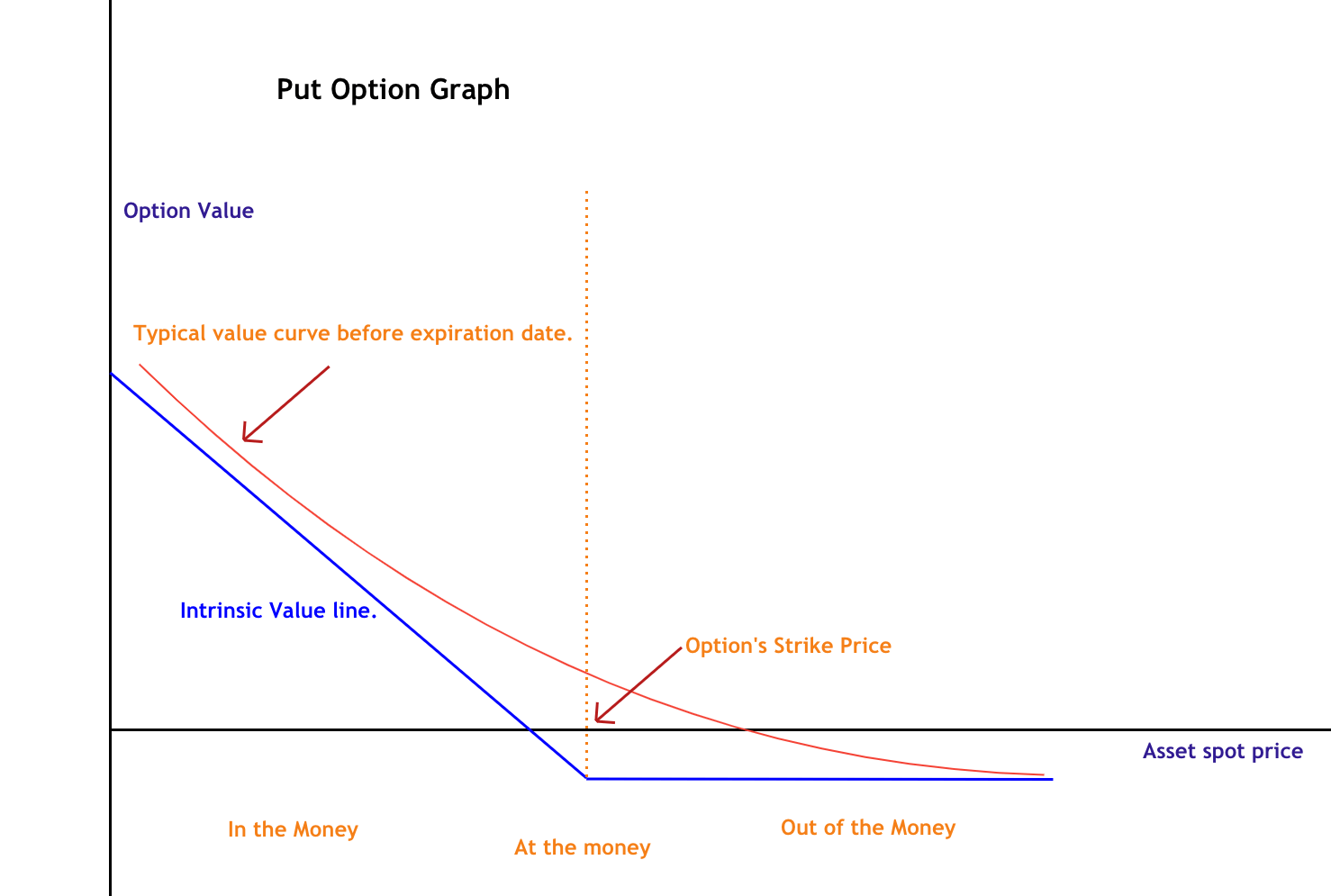

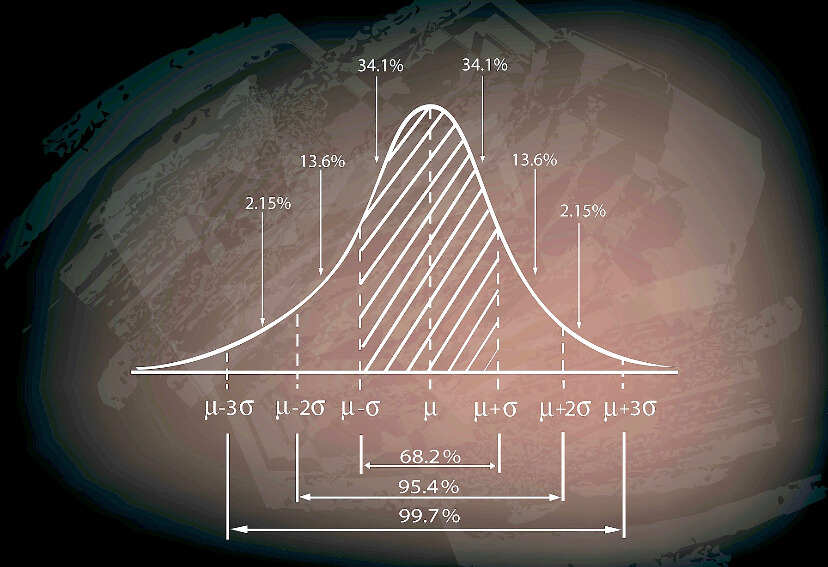

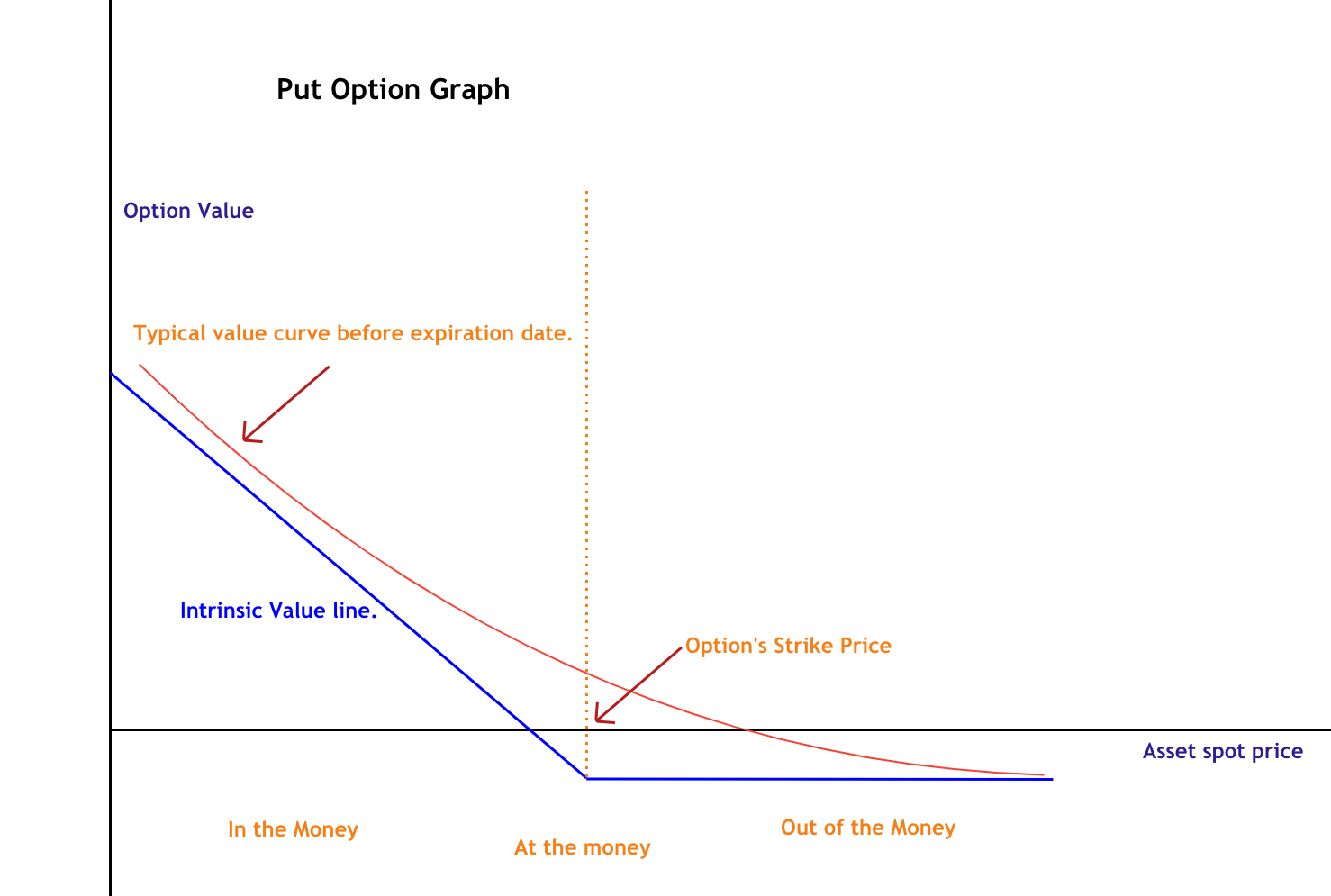

The deeper in-the-money a strategy is, the higher its Delta (regardless of the sign). Out-of- the-money options present Delta values below 50. The farther out, the less its Delta will be. As already explained, the Delta is a proxy to the probability of an option to end in the money at expiration. An option with Delta of 10 has a 10 percent probability of being in-the-money at expiration. An option very deep in-the-money acts very similarly to its underlying. Its time value shrinks while its intrinsic value increases.

On the other hand, out-of-the-money options are almost unaffected even by a significant movement in the underlying. For example, if you were holding that option with a delta of 10, it would catch only 10 percent of the underlying movement. Therefore, a 10-Delta option is cheap, but it captures a tiny portion of market action.

Delta Features

Are estimates of the option’s price change against the underlying changes in price

Defines the probability of it expiring with profits

Delimits the number of options needed to equal the movement of the asset

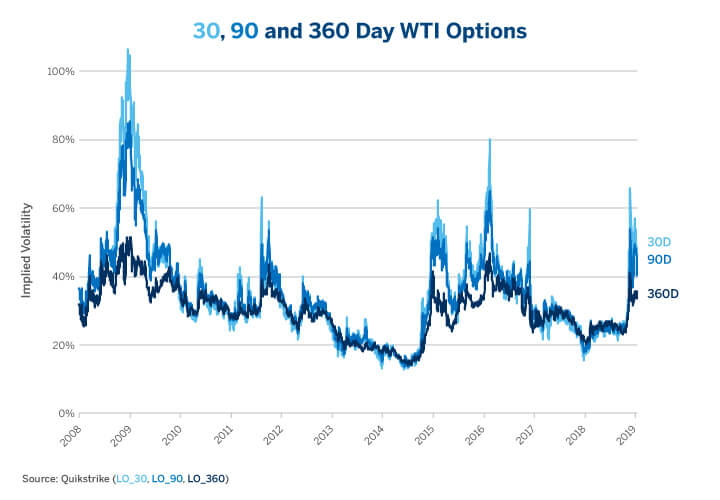

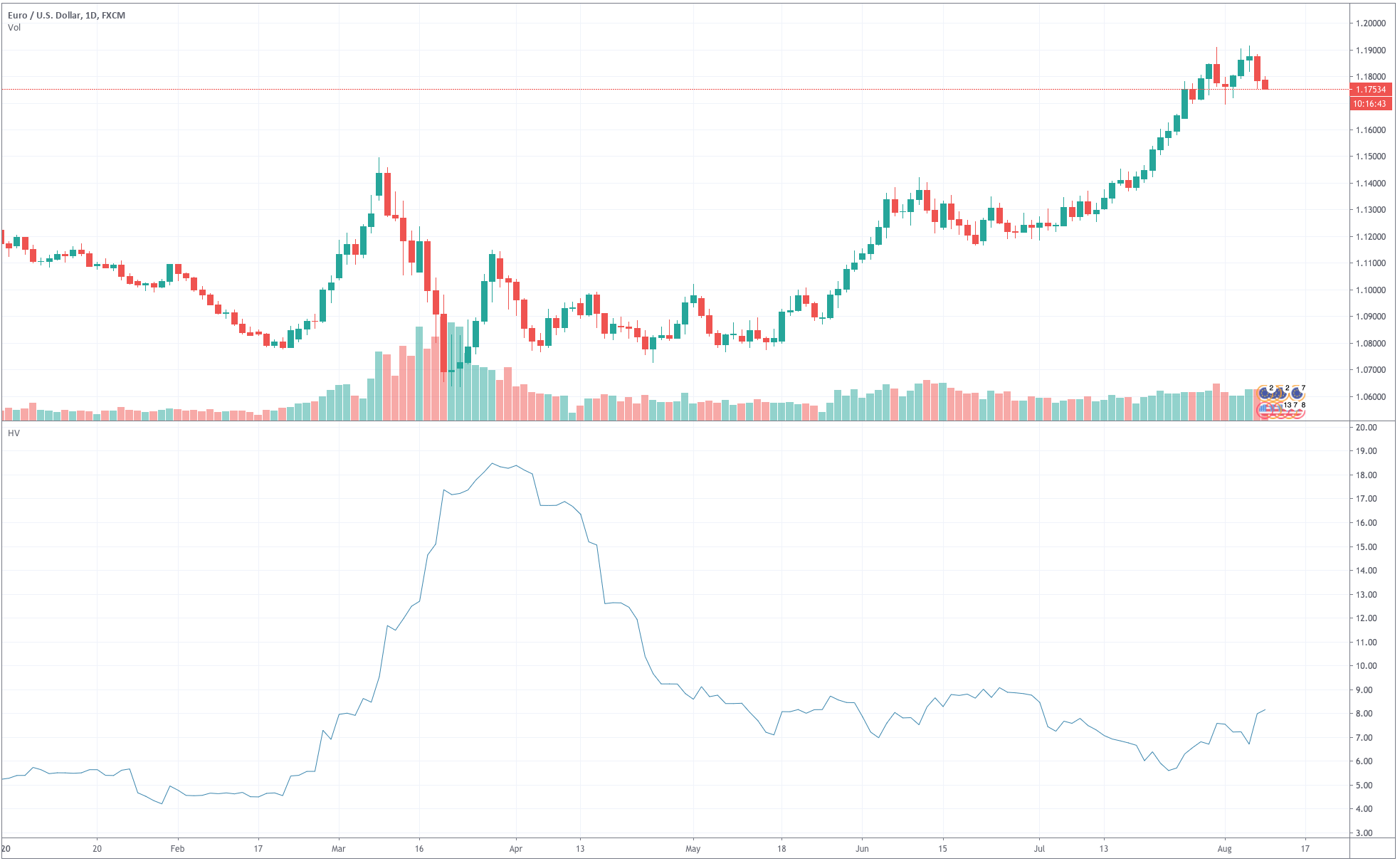

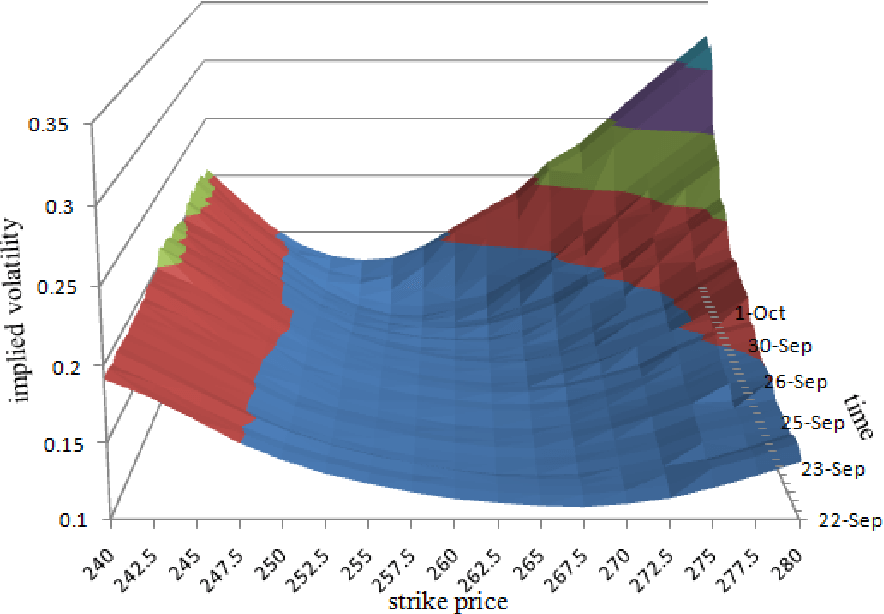

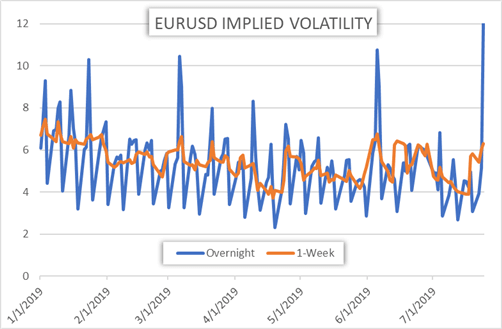

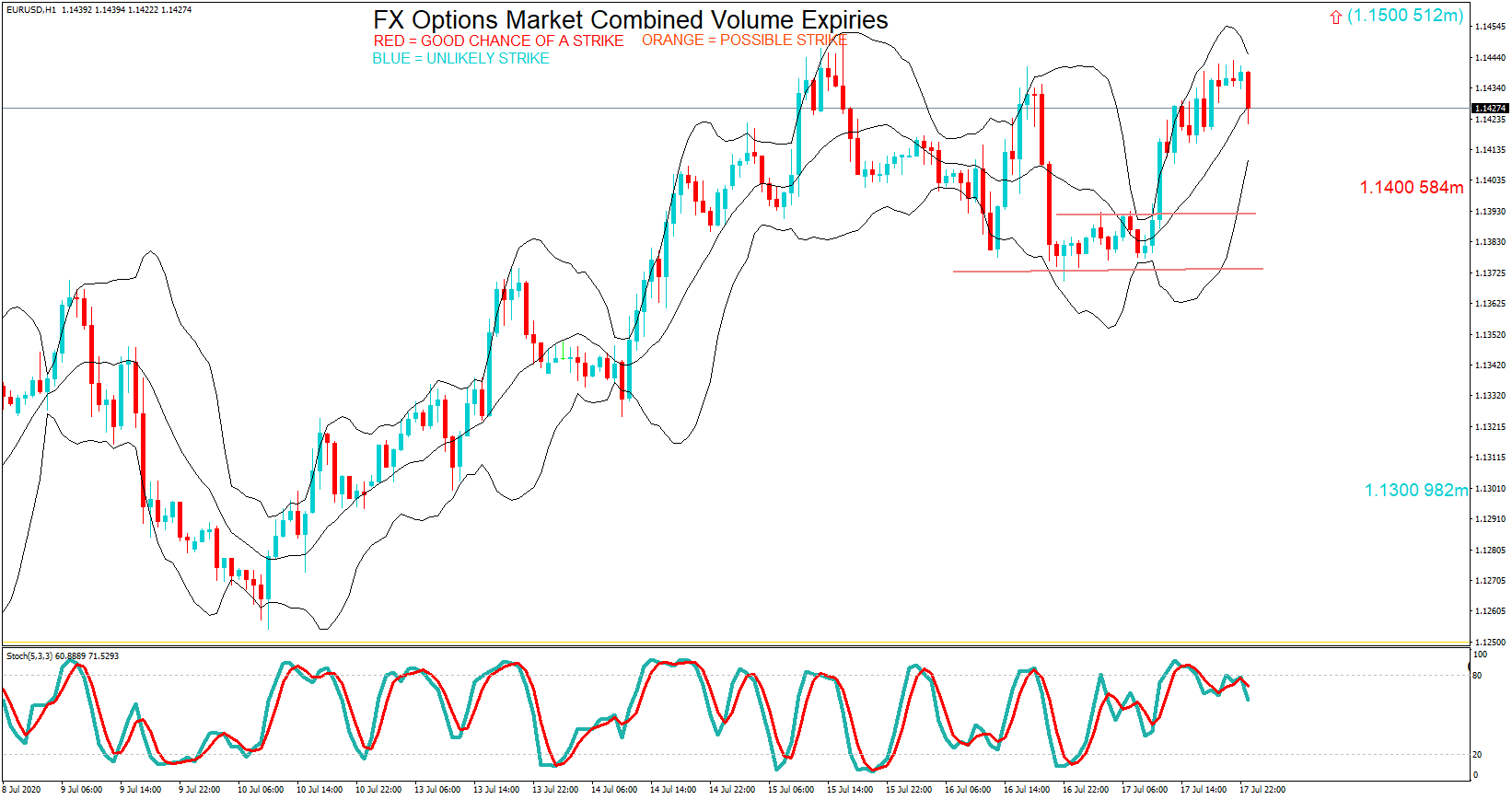

Relationship between Volatility and Deltas

As we have already understood, Volatility is a measure of the uncertainty of the markets and the degree to which the prices of an asset are expected to move over time. Also, Delta can be considered as the sensitivity of an option to its underlying price movement. An increase in Volatility causes all option deltas to move toward 50. For in-the-money options, Deltas will decrease, and for out-of-the-money options, Deltas will increase. Since Deltas are related to the probability of expiring in-the-money, when Volatility grows, probabilities move towards 50-50.

Volatility is a crucial element for Delta-neutral strategies, and knowing how Deltas behave due to Volatility changes and price movements in the underlying is critical.

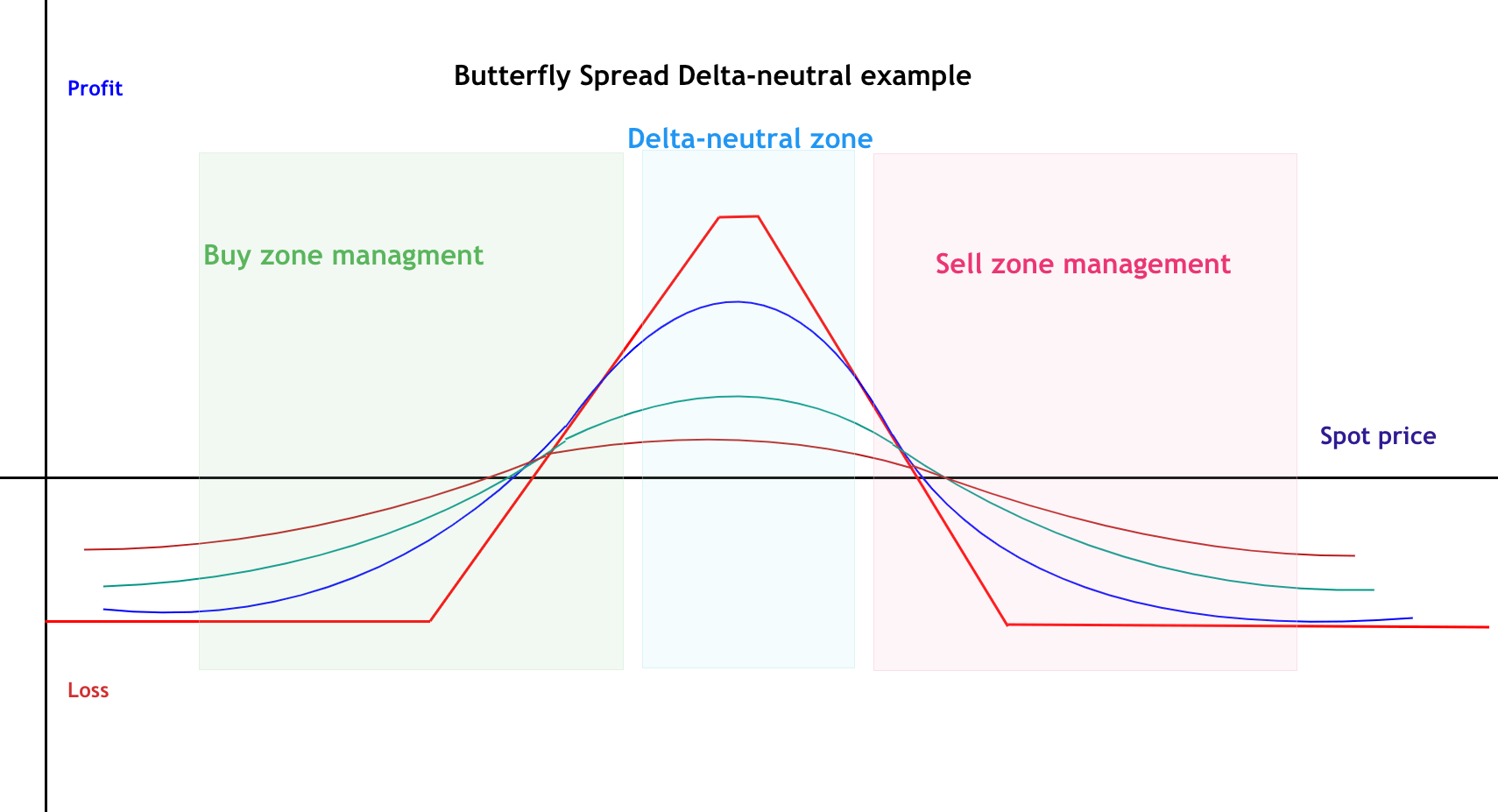

The Delta Neutral Strategy

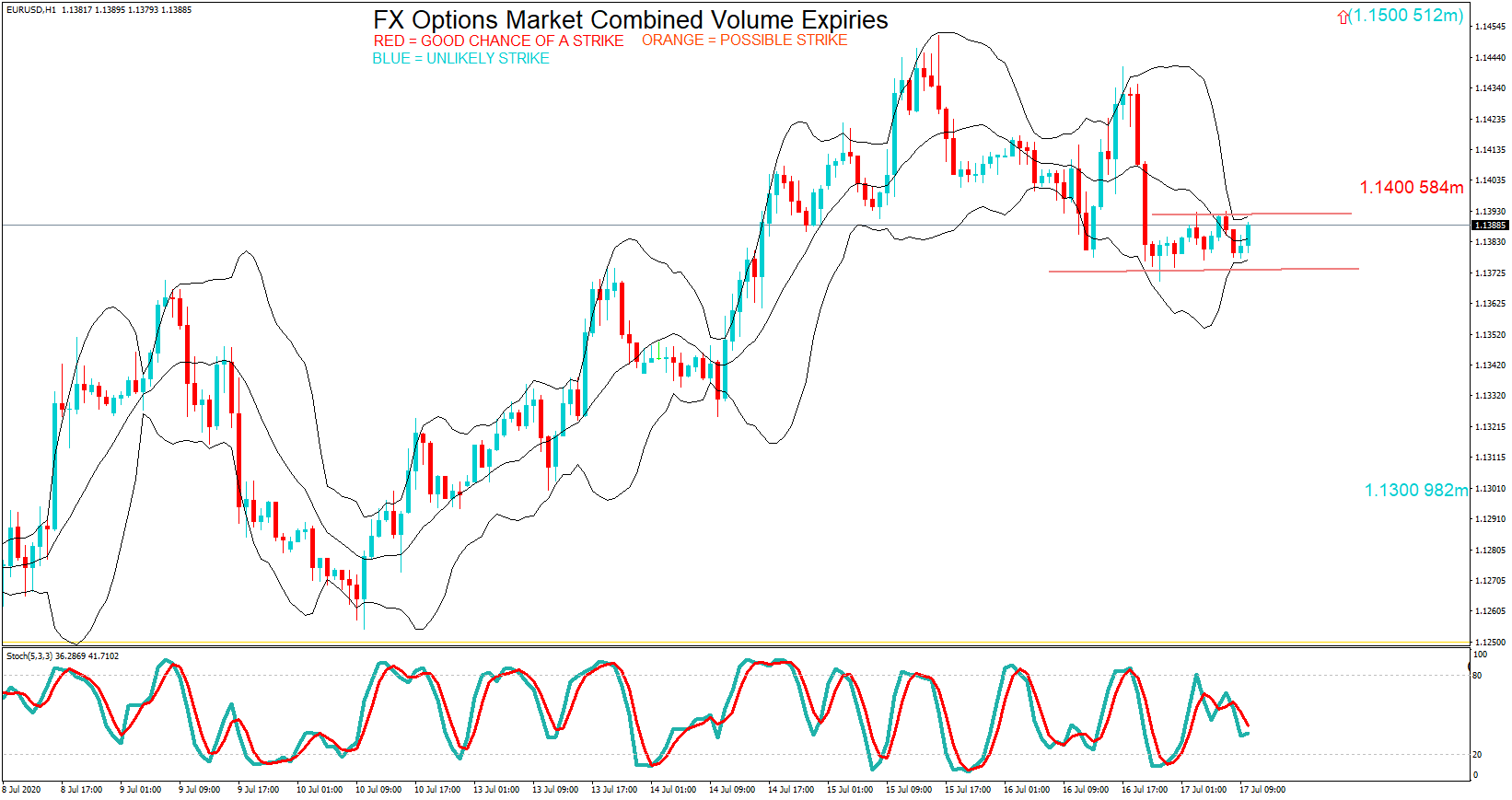

A Delta Neutral Strategy is a combination of securities to create a position with a total Delta of zero. It can be a combination of asset plus options or only options whose total delta summation is close to zero. The key idea is to profit from the Volatility changes while covering the position from the movement of the underlying.

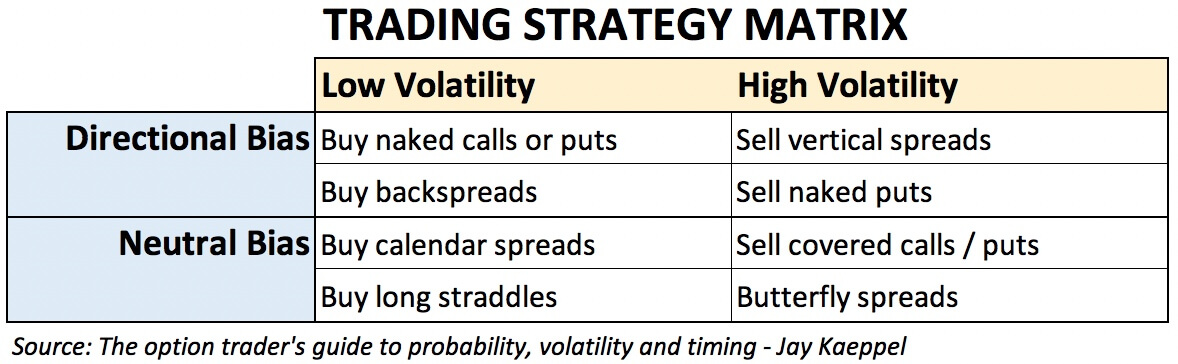

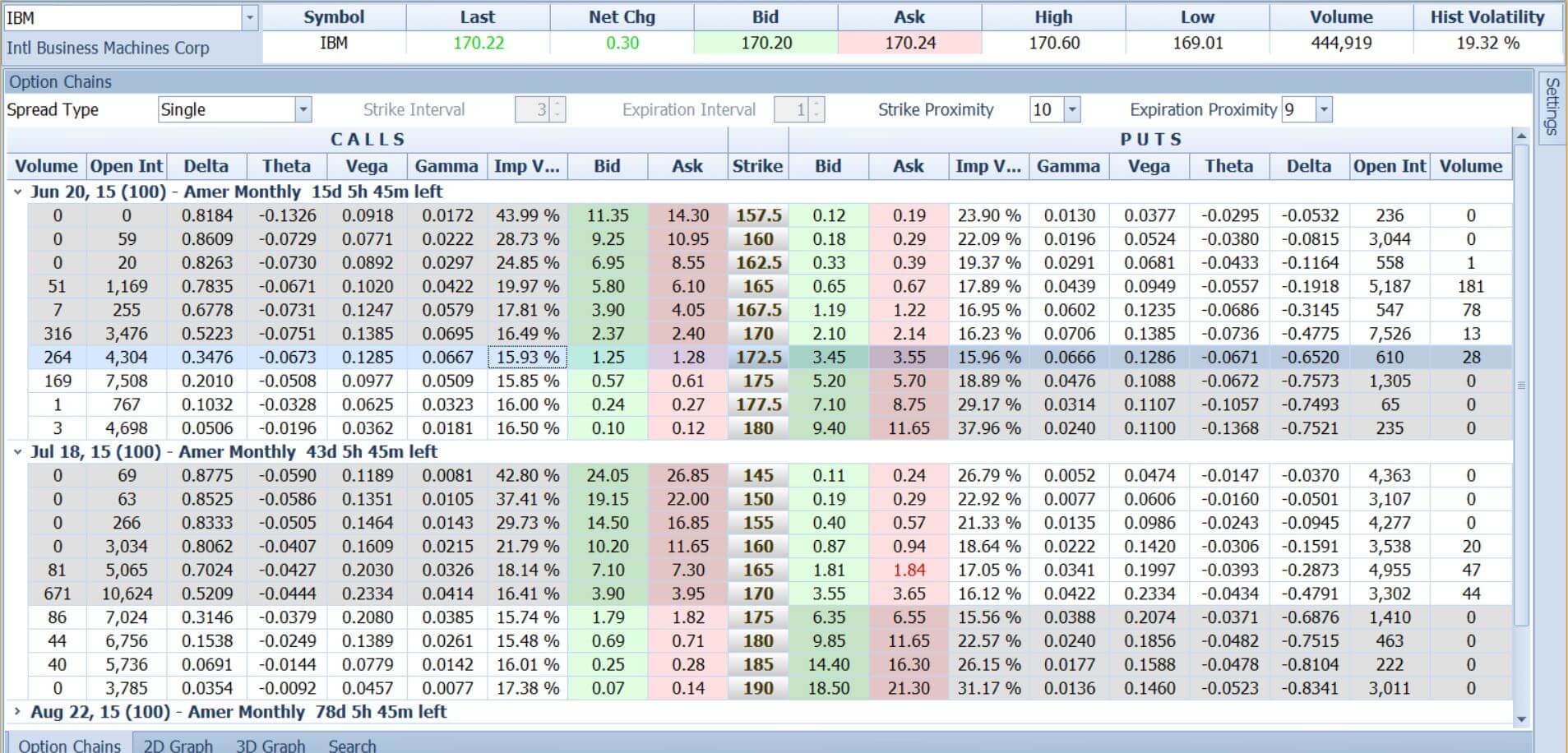

Professional traders think in terms of option spreads, and they hedge their trades to stay neutral on the market direction. To them, the direction of the asset is less critical than the Implied Volatility. Implied Volatility will define when to buy or when to sell options, as it will determine if the option’s price is cheap or expensive.

The second key element is to manage the trade when needed. If the position becomes too bullish or too bearish, the trader should act without hesitation and adjust it back to neutral. The beauty of this concept is that it naturally makes you do the right thing: buy cheap and sell expensive.

Think about it. You start your options trade delta neutral. If your position goes to the bullish side after some time, it means your options betting to the bullish side gained value, whereas your bearish side lost it. What should you do under these circumstances? To move back to neutral, you should sell. Thus, you’re selling high. Imagine then that the price turns and go bearish. Then you must buy some assets to balance the position back to neutral, and you’ll do that when the price is relatively low. We can see that buying and selling come naturally from the need to balance the position, not by market timing considerations, but this happens to be the right strategy.

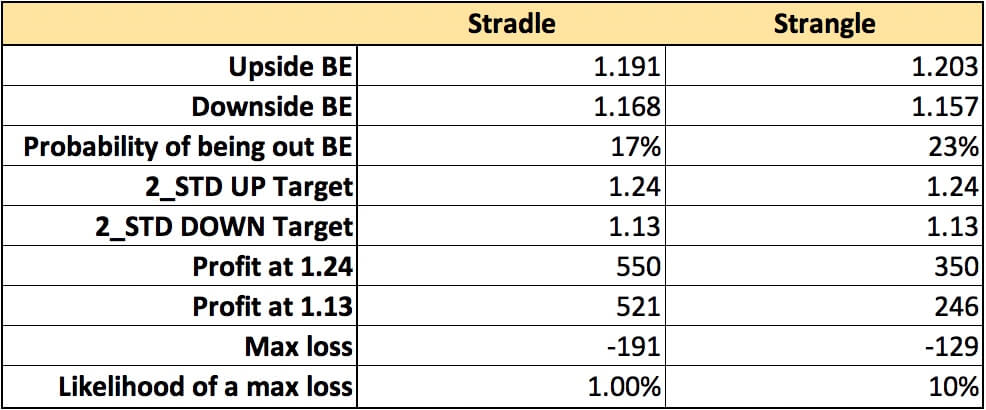

As with other strategies, the upside and downside break-evens must be computed to identify the profit range. The maximum profit and loss potential should be understood by a trader to see if the trade is viable, modified, or discarded. You’re not timing the market, but on mean- reverting markets such as in Forex, this strategy is quite profitable.

Usual Delta Neutral Strategies

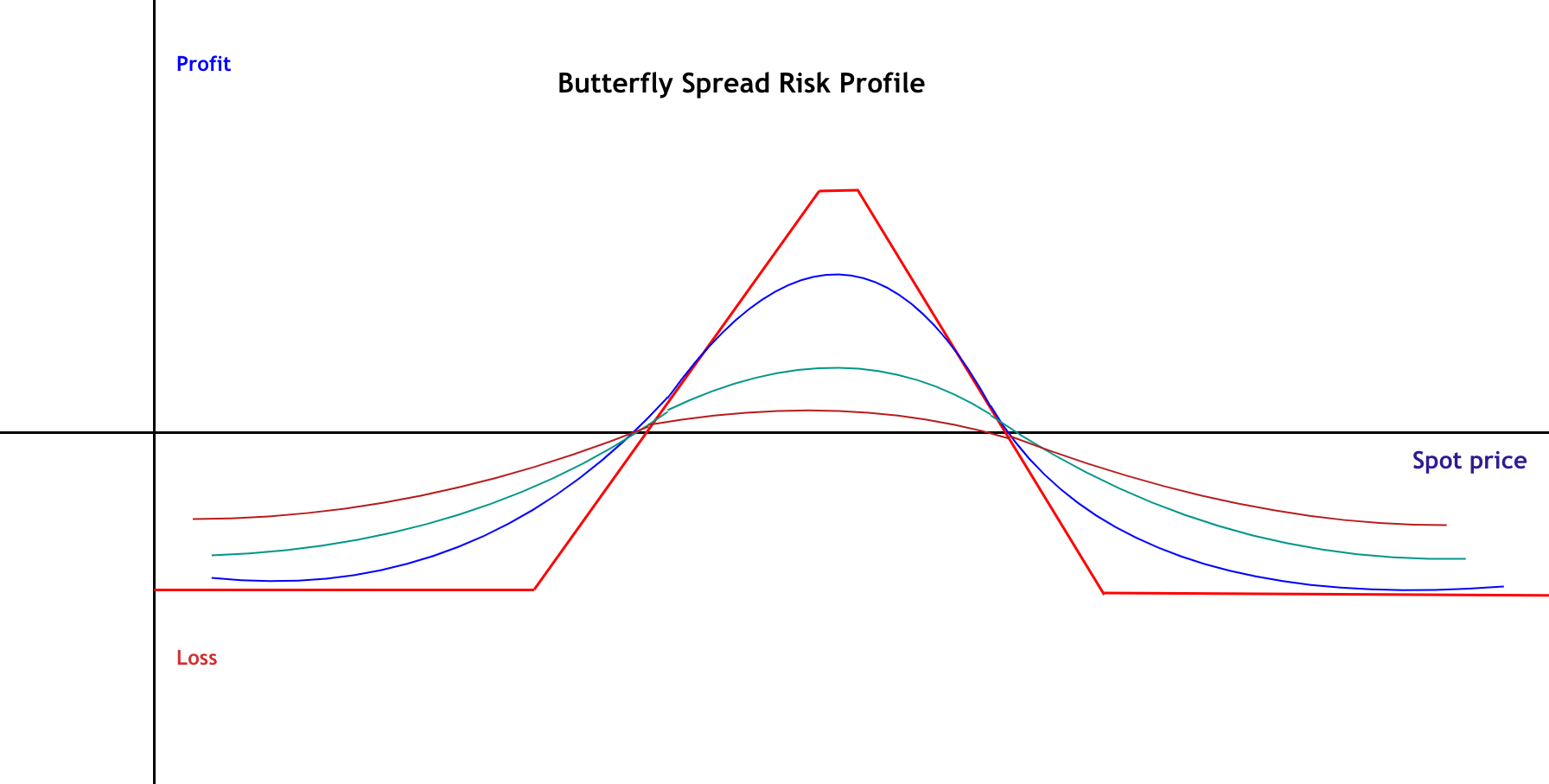

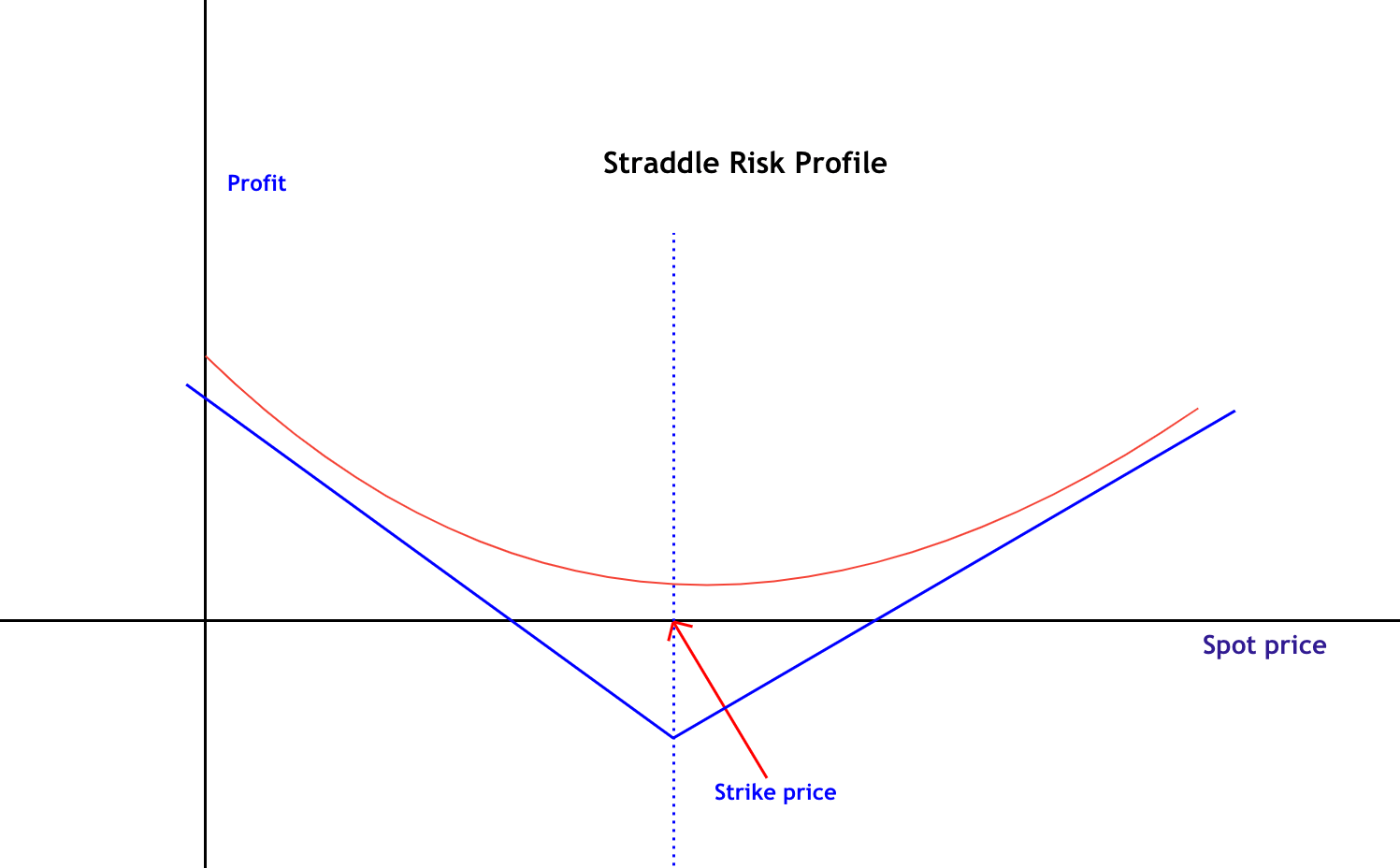

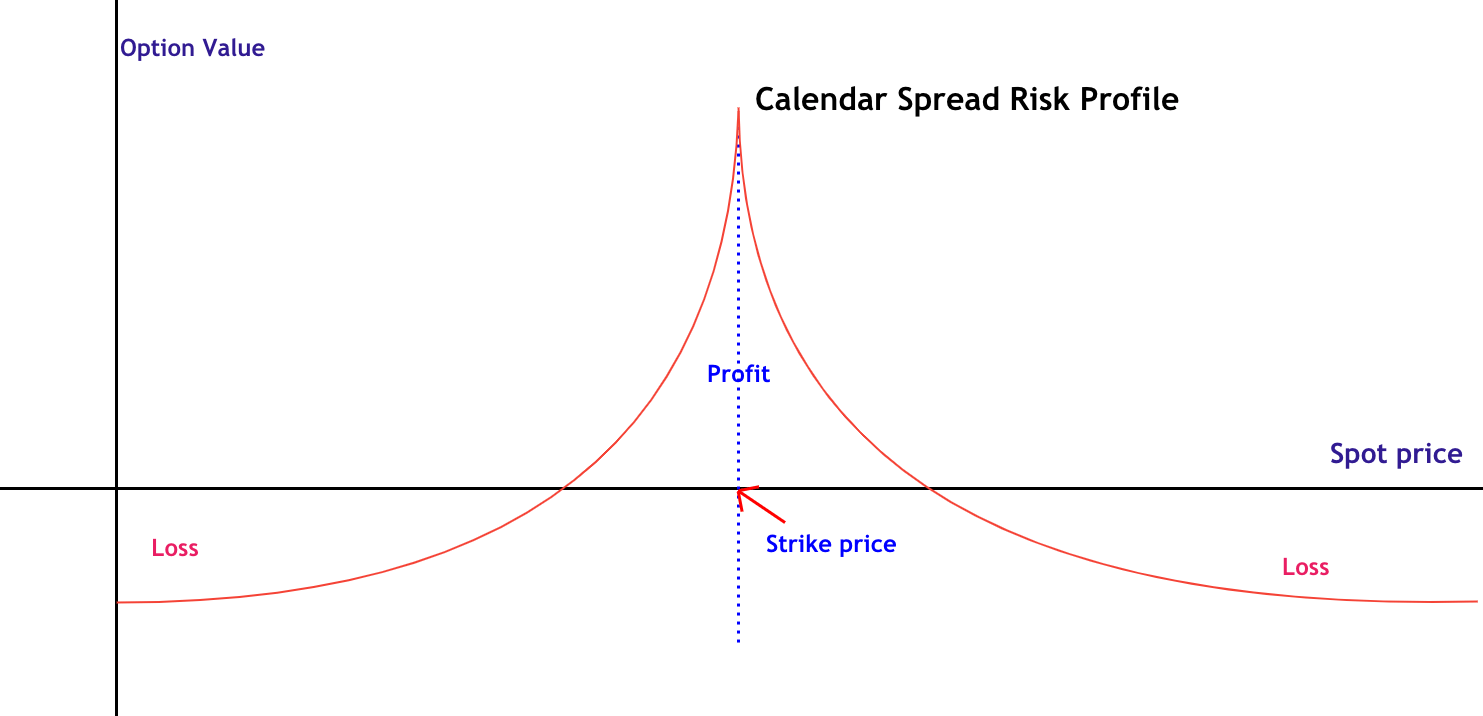

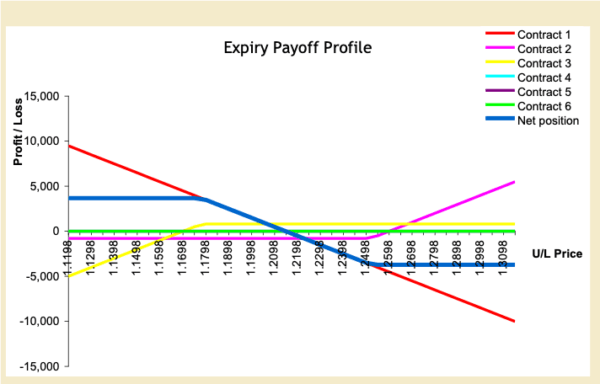

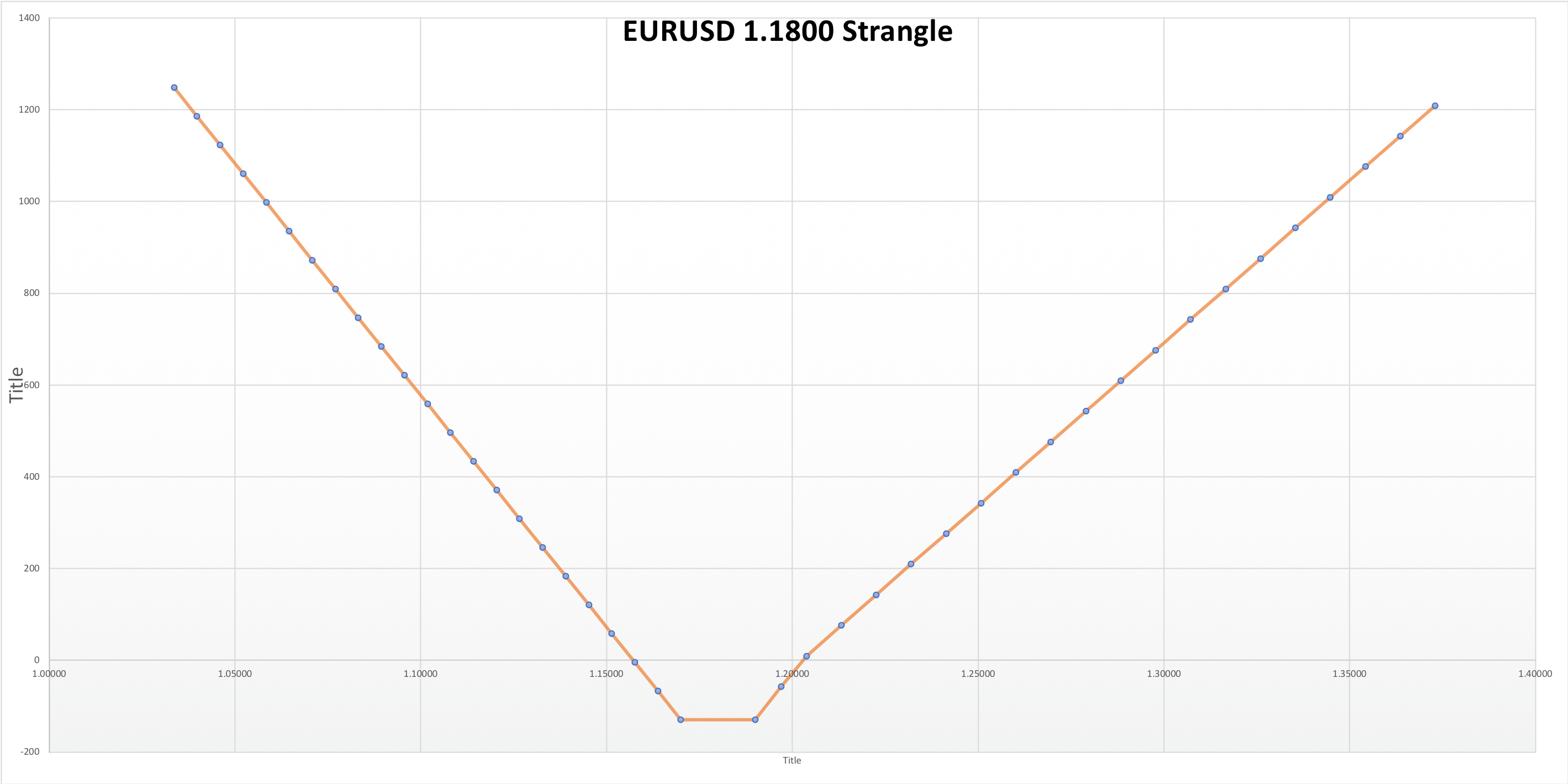

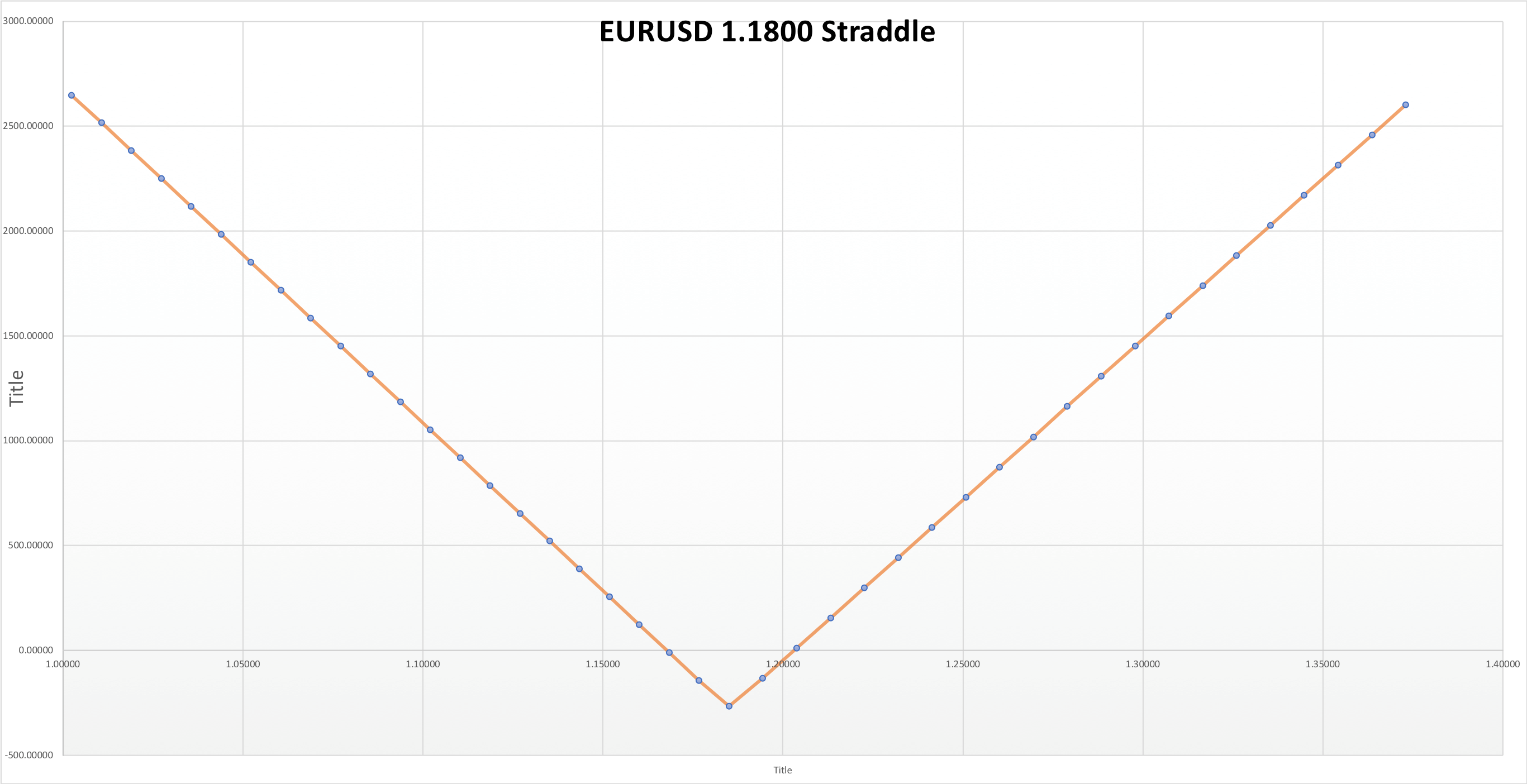

Strategies with zero Delta include buying or selling straddles and strangles, as well as Butterflies. It can also be created by a combination of underlying and options, such as buying one lot of a forex pair and sell two at-the-money calls of the same asset.

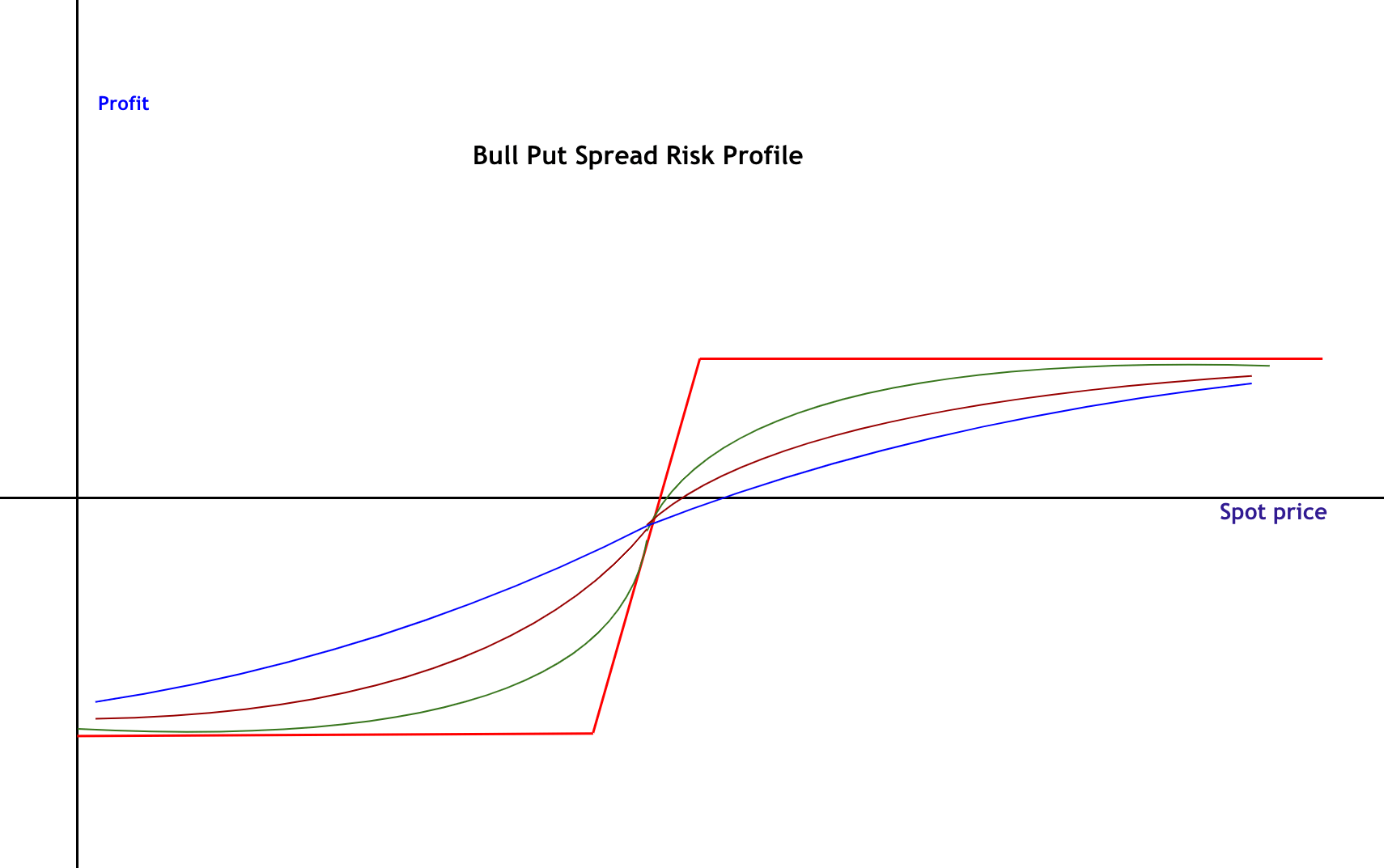

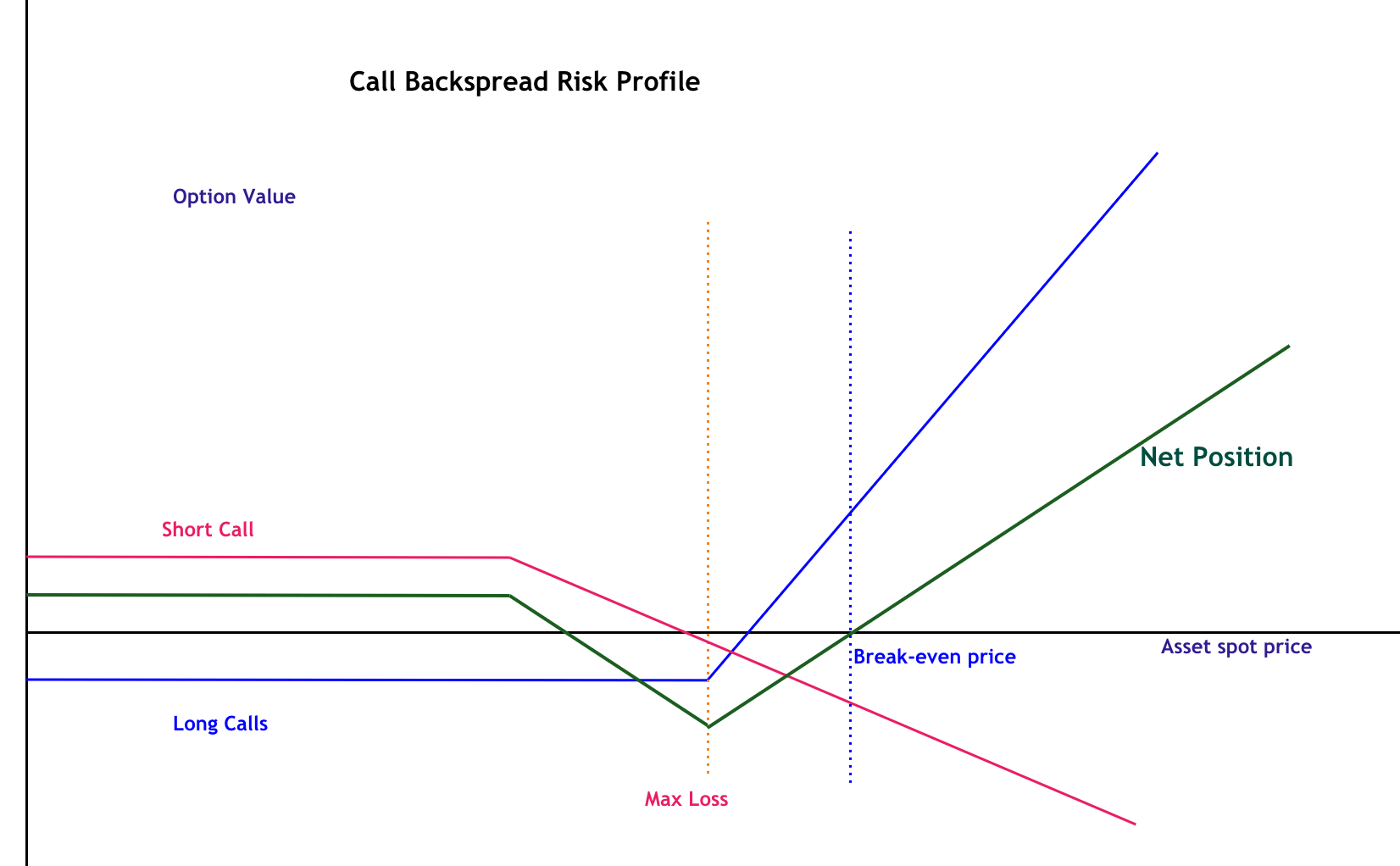

One of the most used delta-neutral position is a Ratio Spread. A Ratio Spread involves the uneven number of options are purchased and sold. Spreads can also be combined with the underlying asset. The particular spread to use should be based on the market conditions, as we already have understood in previous videos.

Ratio spreads are attractive strategies that present a broad profit region; nevertheless, they also show an unlimited risk; therefore, the position should be observed and managed.

Our videos are an introduction to Forex options; consequently, an in-depth explanation of a particular delta-neutral strategy is left for the reader.