Forex Options X – Buying a Backspread

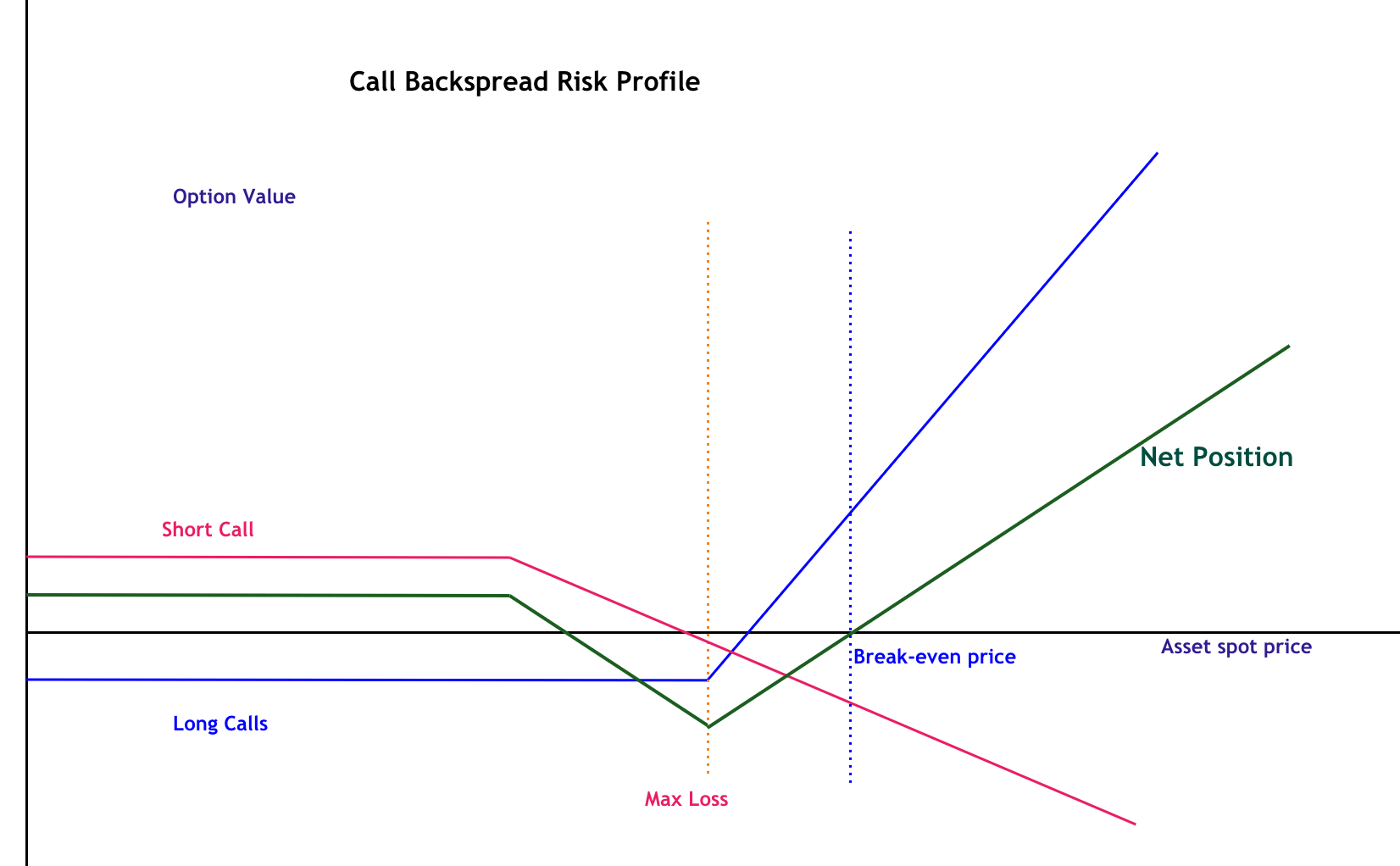

A Backspread is a combination of option positions. A Call Backspread involves selling an at-the-money or in-the-money call and buying a higher number of out of the money calls. The ratio of options sold to options bought usually are 1:2, 2:3, 5:3, or any combination. The main idea is to buy more options than sold. The ideal situation happens when it is entered at a credit, meaning you earn more from the sold option than you pay for the purchase of options, which is ideal, as it offers total protection in the case you’re wrong with the direction of the trade.

Call Backspreads is a better alternative to buying naked calls because it offers better protection when wrong about the direction of the market.

A Put Backspread is identical to a call, but, as we may guess, it is the right choice if we think the market will move downwards.

Main Factors

We are expecting a market movement, but we would like to be covered if we are wrong.

Implied volatility is low, and we hope it will rise after our entry.

A total transaction entered at a credit is ideal.

A Falling Knife

The use of Backspreads is ideal for catching market bottoms and tops, as it limits, or, even, avoids the risk of being wrong. One situation is to capture a falling-knife market. In this scenario, the market experienced a sharp and significant drop, but we think it has to reverse. Buying naked calls in this scenario can be too risky, as the timing of an upward move is far from accurate, and we may end up with a losing position if the market keeps falling. The use of a Backspread is excellent because we can still profit if wrong in the case of a credit Backspread.

Overextensions

Another ideal situation occurs if the market makes an overextended rally, but you suspect it is a bull trap. That often happens when trading Bitcoin, for instance, with the Bart Simpson pattern. The Bart Simpson pattern shows a sharp upward movement followed by a similar downward action after several hours of sideways action.

Under this scenario, a Put Backspread position is ideal because, if wrong, we could still be protected but still having unlimited profit potential.

Uncertain timing

A third situation arises when we expect a substantial upward rally but are not sure about the timing. A properly constructed call Backspread can give unlimited profit for a minimal dollar risk.

Time to expiration

In all situations, it is better to use longer to expire options when constructing the Backspread, as this offers a broader timeframe for the play to develop. What’s more, Longer-dated options are more sensitive to changes in volatility, so that if we enter a Backspread on reduced volatility, the profits multiply when volatility increases due to the market move.

The risk

The main downside of this strategy happens when the underlying asset remains near the strike price of the sold call/put at expiration, or the implied volatility declines further, which usually occurs when the asset does not move much. This is why it is best not to hold Backspreads until expiration, as they can generate its largest loss with the lack of movement of the underlying security.

To summarize

A Backspread strategy can give the trader

- The stamina to trade tops or bottoms on strongly trending assets

- Time to allow the timing to work out with a limited risk

- Profiting from an increase in volatility