Forex Options II – INTRINSIC VALUE AND TIME VALUE

As we have seen in our previous video, Options have value, called the premium. The premium is the cost of buying the option and varies depending on its strike price distance to the spot price.

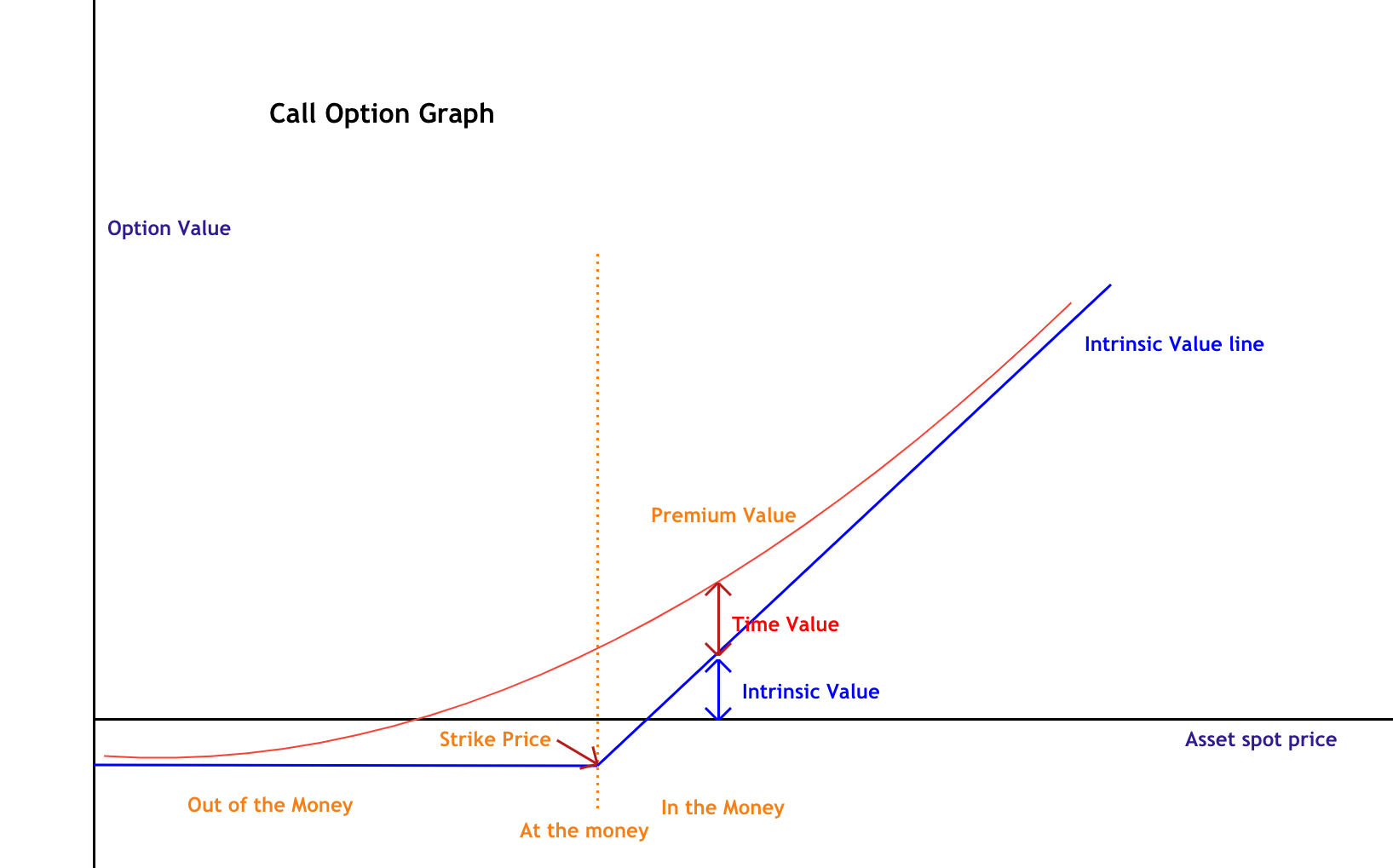

As we can see on the graph 1, depending on whether the spot price is above, equal or below the strike price, it is said s call option is “in-the-money,” “at-the-money,” or “out-of-the- money” (Conversely, “out-of-the-money,” at-the-money” and “in-the-money” for a put option.)

The value of the option (premium) in a determined moment is composed of its intrinsic value and time value.

Premium = Intrinsic Value + Time Value

Intrinsic value

The intrinsic value of an option is the amount by which it is in-the-money. The intrinsic value part of the premium is not reduced or lost by the passage of time. On a Call option, it is the difference between the spot price and the strike price of the underlying asset. On a Put option, the intrinsic value is equal to the subtraction of the strike price and the asset’s spot price. If the option is at the money or out of the money, its intrinsic value is zero.

We can see that the intrinsic value is not dependent on how much time is left until its expiration. It only tells how much of the value of the asset is included in the price. If the intrinsic value is zero, then the premium has only time value, which decreases over time.

Time Value

The time value (Theta) can be thought of as the amount by which the premium exceeds its intrinsic value. Also called Extrinsic value, the time value has a direct relation to time, but also to changes in volatility. The time value of an option expiring in three weeks has less time value than a similar option expiring in six weeks. That is logical, as the buyer can profit more time from the movement of the option.

Since American options can be exercised any time before expiration, an option premium cannot go below its intrinsic value. This means that the cheaper the option, the less real value is included in the price. The price of out of the money options are lower as the strike price moves further out of the money. That is because the odds of being profitable at expiration decrease with distance from strike to spot price.

The time value has a kind of snowball behavior. It decreases slowly when far away from expiration, but it accelerates and depreciates faster and faster. On the expiration date, the option’s value is only its intrinsic value, which means the option has to be in the money.

As the option is deeper in the money, it has less time value and more intrinsic value. This also means the option behaves more and more as its underlying asset. This is related to the Delta getting closer to 100 ( or -100 in the case of puts). The higher the Delta, the option captures a higher percentage of the movement of its underlying asset.

That’s all for today. In the next videos will explain the basic strategies using options.

Recommended reading:

THE OPTION TRADER’S GUIDE TO PROBABILITY, VOLATILITY, AND TIMING , by Jay Kaeppel