Forex Options XIII – Selling a Vertical Spread

A vertical spread is a combination of options in which the trader buys a Call or Put and sells another Call or Put of the same underlying at a different strike.

Buying a Vertical Spread

We are long ( buying the vertical spread) when we buy the at-the-money or in-the-money option and sell an out-of-the-money option. A vertical spread is a strategy similar to a naked option. The selling of the out of the money call simply lowers its cost, as the trader is aware that the price is unlikely to move above the sold option’s strike level.

Traders buy vertical spreads when they are sure about the market direction, have a target for the move, and seek to optimize the cost of the trade.

Selling a Vertical Spread

We sell a vertical spread when we sell the at-the-money or in-the-money option and buy an out-of-the-money option. This is not a market-timing strategy, but a statistically-based move. The purpose of this is to profit from the decay and volatility drop, avoiding the unlimited risk of a naked option.

It is well known that the sellers make the majority of the money on options trading. That is because options will lose all its premium at expiration. Over 60% of all options that are out of the money expire worthless. This fact gives option sellers an advantage. The downside is that naked options involve the assumption of unlimited risk. The selling of an out-of-the-money option and the simultaneous purchase of a further out-of-the-money option solves this issue. This strategy allows traders to profit from high volatility and market-timing situations such as market tops and bottoms.

Key factors to maximize the trade potential of a vertical spread

- The implied volatility is in the upper range, historically, the higher, the better to maximize the amount of premium received.

- Identify support and resistance levels on the underlying’s price action, and sell the option whose strike price is at or beyond that level ( so that the chance to cross it is minimized).

Sell the call with a delta of 40 or a put with a delta of -40. That way, the chance of the option to expire in the money is below 50%, while the premium is still acceptable. - Choose options with less than one month to expiration to make the time decay more pronounced

- Look for the situation where the volatility of the sold option is higher than the one you intend to buy.

Market timing

Option writing can be used in place of option buying to take advantage of a market-timing strategy when volatility is very high. Inexperienced traders usually make the mistake of buying naked options to profit from the market movements without caring for volatility, losing money, long-term, because the more expensive the cost is, the larger the movement of the underlying to compensate for the costs of the trade. Furthermore, a posterior drop in volatility will further reduce the options’ value, hurting the naked position.

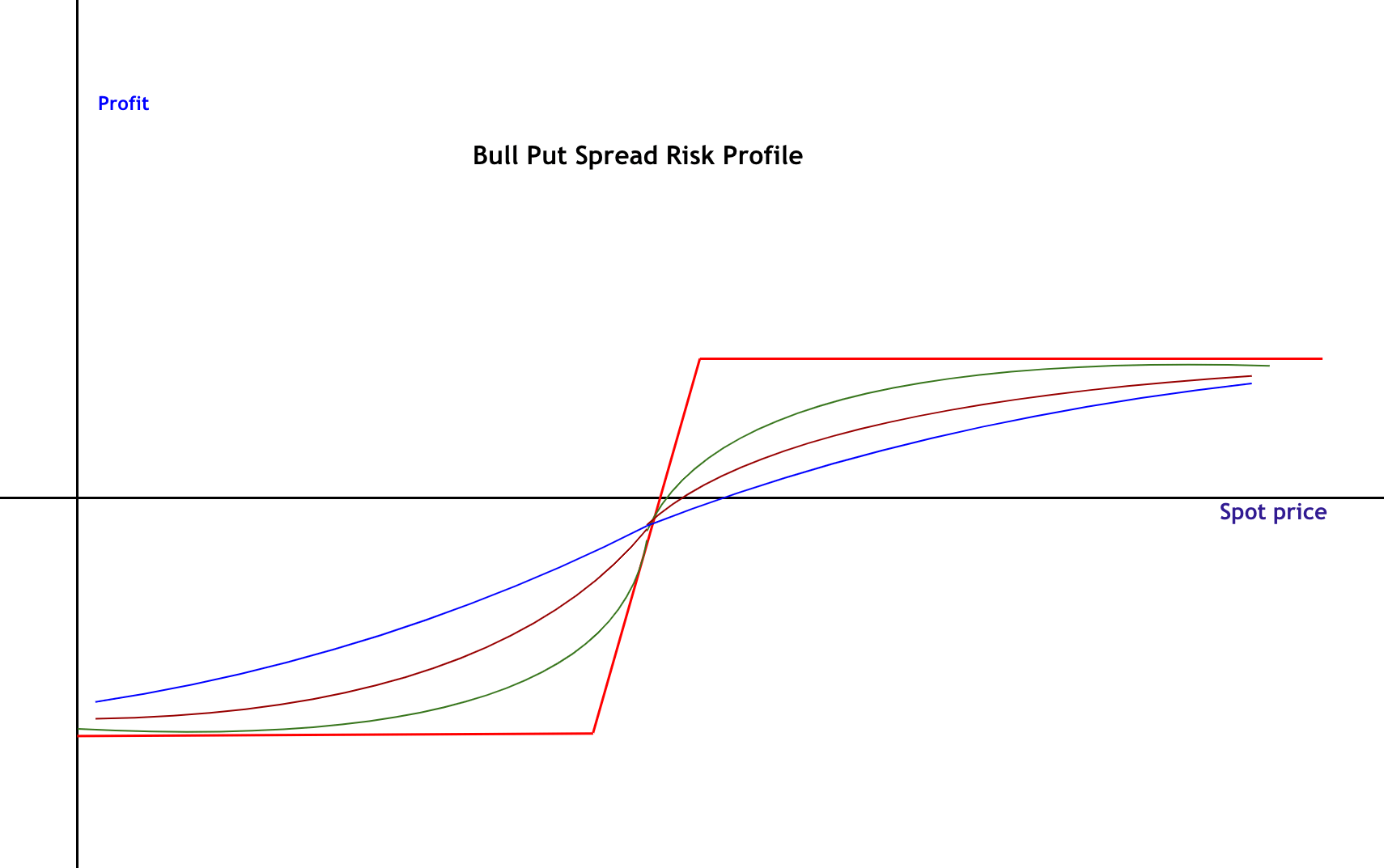

The best alternative to option buying when you believe the underlying is going to move in a determined direction and volatility is high, is selling a vertical spread. When you have reasons to believe that the market is going to rally or remain flat, you may sell a vertical put spread, usually called “Bull Put Spread.” Conversely, if you consider the market is going to fall, flat, or with limited movement, you may decide to sell a vertical call spread, called “Bear Call Spread.”

Position management

To optimize the profits, you should look at your strategy’s risk-profile curve at expiration to determine your maximum potential profit.

Also, check the risk curves before expiration to determine how far against your position should move the market to create a loss equal to your maximum profit, and determine the level at which to cut losses. The main idea is we don’t want reward-to-risk trades below 1.

Stop-loss

- Close the trade if the loss surpasses the max-profit value.

- If you consider that some significant support or

- resistance was broken and the scenario you considered for the trade is no longer valid.

Taking profits

Close the trade if your profit reaches 80% of the maximum profit potential.

The idea behind this is that holding the trade trying to get the last 20% of the profits is wrong from the risk-reward point of view, as the R/R is

RR =0.25.