Forex Options XI – Buying a Calendar Spread

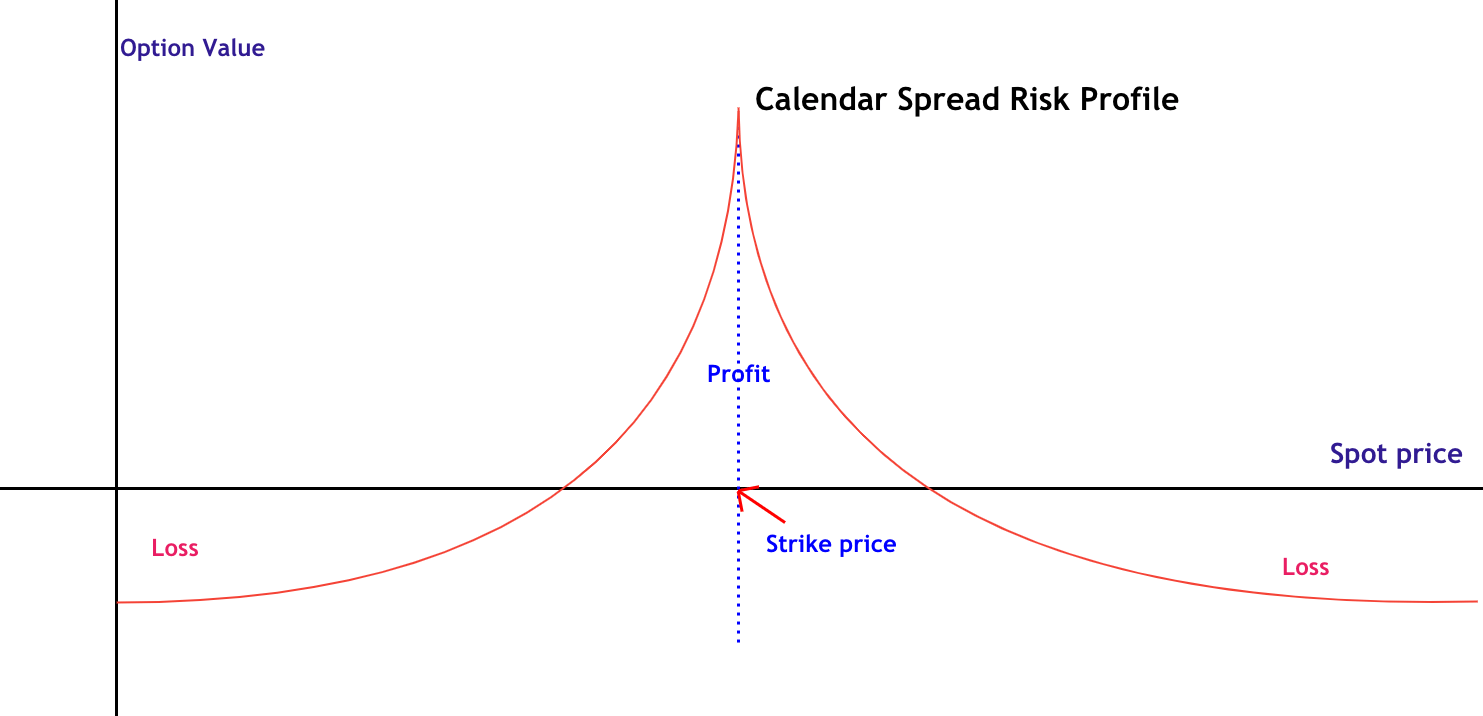

The Calendar Spread is a strategy only available on options. As we already know, Options on assets come with different expiration dates, and each one offers different implied volatility levels. What’s more, at times, they show strikingly different values. Traders can use this situation to take advantage of the disparity by selling the option that trades at a significantly high price and buying the cheaper one.

The main factors for using calendar spreads are:

The written option should trade at least at 15% higher implied volatility than the option bought.

If the overall volatility is high, it is wrong to use it. It works best when the bought option shows low implied volatility.

The sold option expiry is within the next 45 days.

There are reasons to think that the underlying market will remain in a range.

A calendar spread is a neutral position that is entered by buying one option of a determined strike price and expiration month, and selling at the same time another option of the same type and strike price, but with less time until expiration than the option bought. The right time to enter a calendar spread is when the short-term implied volatility is over 15% higher than the long-term one. The higher the implied volatility of the option sold relative to the option bought, the higher the likelihood of profit.

The dangers

A significant advance or decline in the underlying makes the trade very unprofitable.

A sharp decline in implied volatility degrades the odds of a profit.

Therefore, the less time to expiration for the option sold, the better, provided it allows enough premium to have profits.

Factors to profitability

According to Jay Kaeppel, to maximize profits, we must consider the following:

Only trade a calendar spread when the volatility gap between sold and bought option is higher than 15%

Rank the volatility from 0 to 10 land trade calendar spreads only when below 6, ideally in the 1-2 range. If volatility increases on a trade entered at these volatility levels, it would return extraordinary profits, because the bought long-term option will increase much more than the short-term option that was sold.

Don’t sell options with more than 45 days to expiration.

The options traded must show deltas within 30 to 65 on calls and -30 to -65 on puts. As a rule of thumb, avoid trading options with more than one strike price from the current asset price.

Ideal markets for a calendar spread are assets moving in a trading range, where supports and resistances are clearly identified.

A decline in volatility

A decrease in volatility is the worst that can happen on a calendar spread trade. To understand why we have to remember that we sell the short-term option and buy the longer-term option. The longer the time to expiration, the higher the sensitivity of the option to volatility changes. That means a rise in volatility would result in increased profits because the option bought will increase more than the option sold. Conversely, a volatility drop would drive the trade to the losing side as the price of option bought sinks relative to the option sold.

References: “The option’s trader guide to probability, volatility and timing” by Jay Kaeppel