Forex Options IX – Buying Naked Options

Buying naked options means the purchase of just calls or puts of the same strike and expiration date, with no ownership of the underlying asset, nor other simultaneous purchases of a different call ( or put).

Buying a naked option is a market-timing strategy. The options trader considers that, at the current price, the asset is overvalued or undervalued, and, also, there are signs of a market reversal.

The main factors to consider are:

There are technical reasons to believe in a large movement soon! Actual low implied volatility! Good Delta and time remaining to expiration so time decay will be minimal.

The main errors novice options traders do when buying naked options are:

Only consider market timing to make a trade.

Buying out of the money options because they are cheap. Buying options with no regard to the current implied volatility. And if they are expensive, switching to an even more out of the money strike. Buying options with short expiries because they are cheaper.

The threats

Poor timing is the main threat. Buying a call followed by a drop in price will swiftly devalue the option. Therefore, to buy options, it is imperative to have a fairly precise timing signal.

Also, time decay will hurt the value of the option if the underlying security fails to make the expected movement, which will cause a drop in volatility and a decrease in the premium. This effect increases if the time to expiration is short.

The following rules will maximize the odds in our favor:

Buy naked options only if your timing method has proven accurate

Buy calls with Delta over 50 or puts with Delta below -50 to improve the chances.

Buy calls near support, buy puts near resistance, especially on non-trend or mean-reverting markets. Lower volatility is a plus, although not too critical if the action is short-term

At least 30 days to expiration to minimize time decay.

The key elements to make a profit are two:

- A reliable indicator or pattern that consistently predicts a large movement

- Avoiding being hurt by time decay and drops in volatility.

A possible use of this strategy is to catch tops and bottoms. Options will limit the risk at the premium paid by the option. With enough time to expiration, the timing required to succeed does not need to be as accurate as with the underlying instrument. The risk is limited without the need for stop-loss orders, which on many occasions, get taken, and then the market reverses.

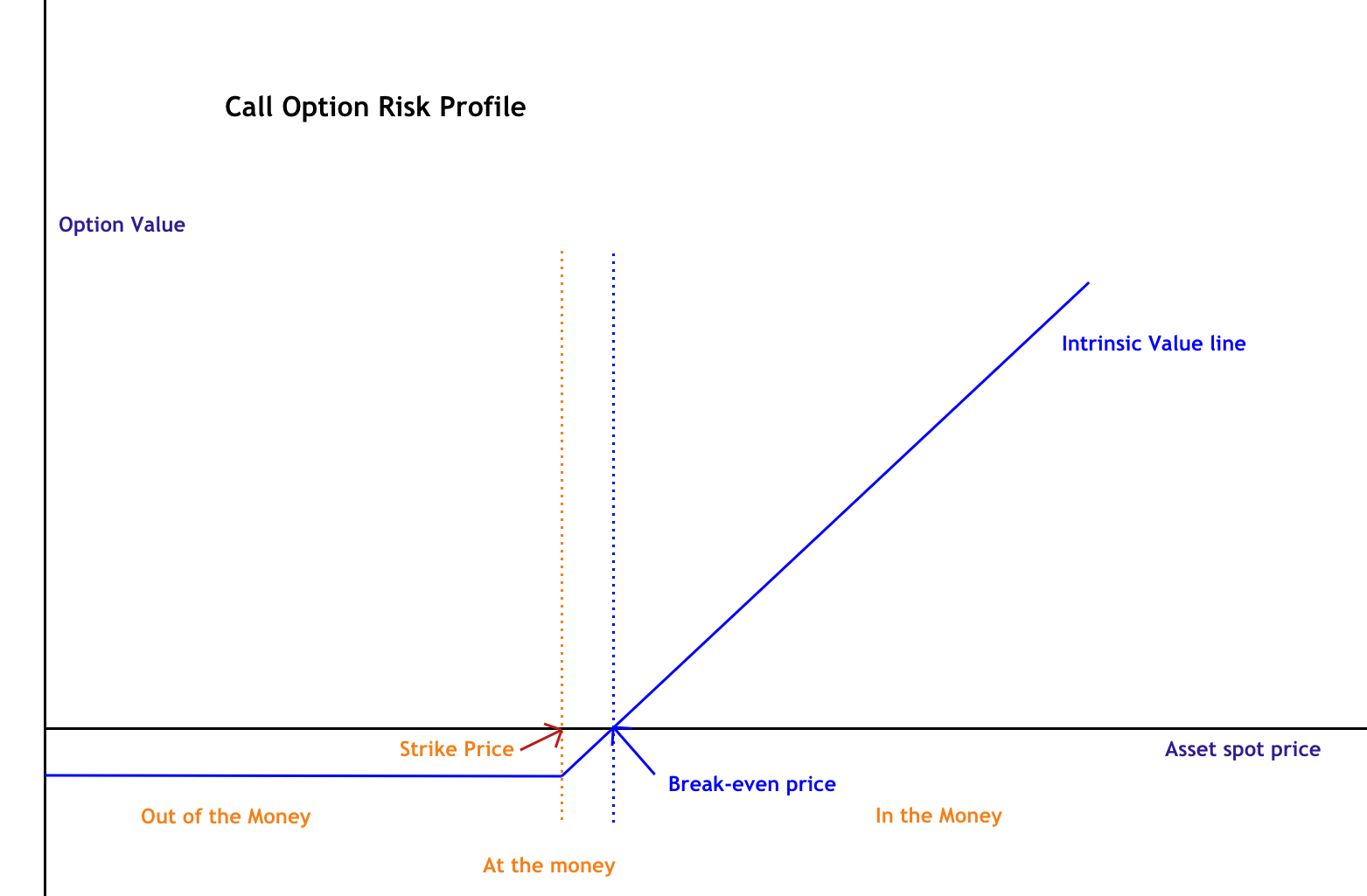

The risk/reward profile of a Call

The risk-reward profile of a naked call has already been shown, and it shows the characteristic stick profile with limited risk and unlimited reward. The intrinsic value line shows the values at expiration, but, since the before expiry, the option has a time value. The real market value at a set date before expiration draws a curve similar to the red line shown in the image. The shorter the time to expiry, the closer this line will be to its intrinsic value, since time value decay, as we already know.

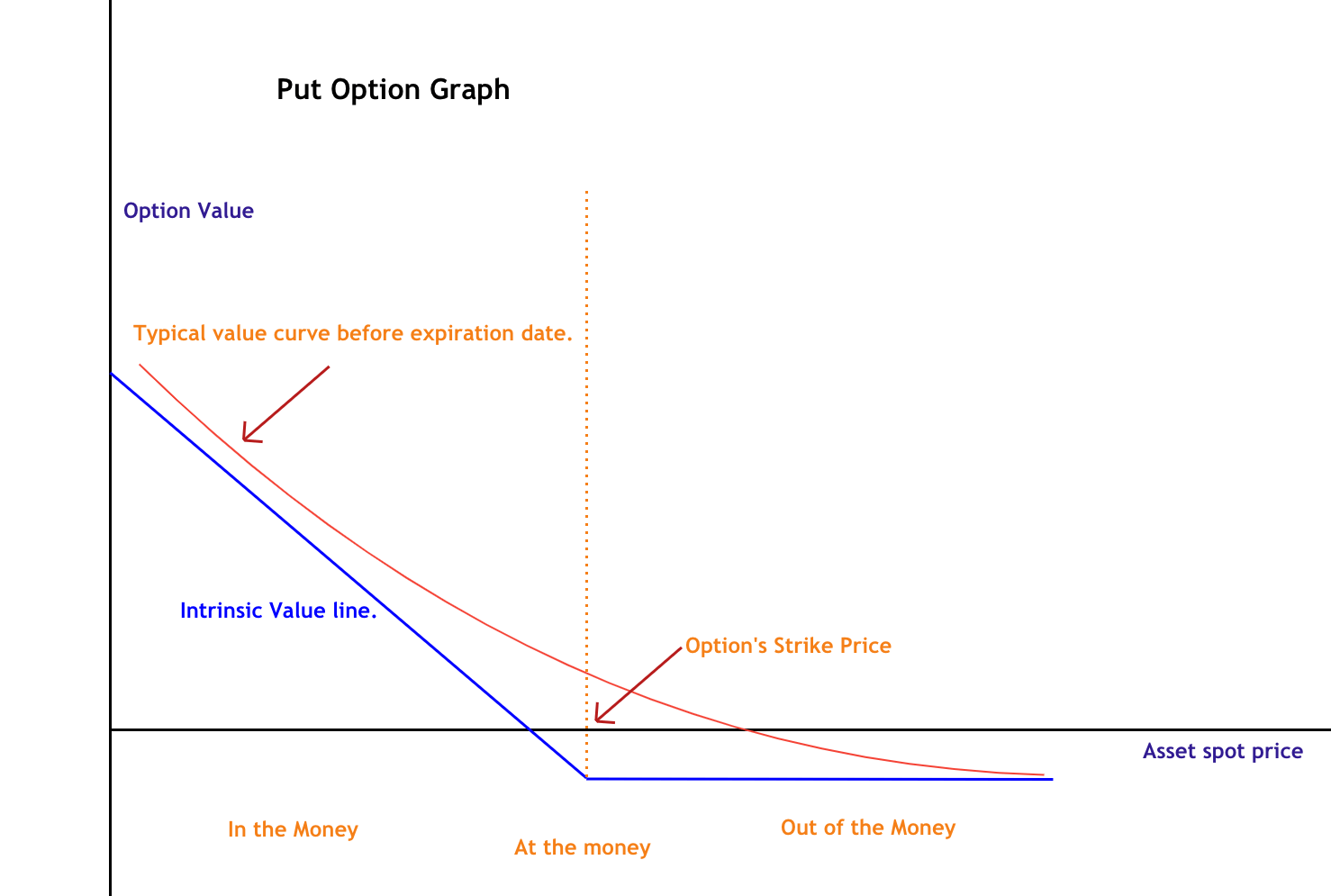

Similarly, the risk/reward profile of a Put shows a stick-like pattern; only this time, the rewards come from prices under the strike price. As it happens in Calls, the red line in the image shows a likely value line of a Put before expiry, that would get closer and closer to the intrinsic line as the time approaches the expiry date.