Forex Options VI – Assessing options

Probabilities

If you’ve been following our Options video series, you’ve understood that options trading is a game of chance. Thus, if you hope to succeed at trading options, you must strive to consistently place the odds in your favor as much as you can on every trade you intend to make.

Options traders must realize that options are not the same as trading the underlying asset. Options have a time premium that vanishes with time, and that makes their probability of profit to be less than 50%.

Pros and Cons

Although forex traders are used to having an opinion on whether a pair is going to move up or down, the options’ trader should not theorize about it, but comparing the risk and reward characteristics of several possible trades to decide which is the most desirable. Dreaming about unlimited profits while buying low-probability options or selling far out of the money options with high-probability of profits without minimizing the risk is a recipe for disaster.

The Delta as a proxy of probability

An option’s Delta can be determined for each option, using an option-pricing model, which usually is made available by the broker to its customers. Sites such as Investing.com display the Delta of the most usual FX options.

Delta values range from 0 to 100 on Calls and from -100 to 0 on Puts. Delta can be viewed as

1.- An estimate of the odds that the option will be in the money at its expiry. For instance, if the EURUSD 1.1650 Sept Call has a delta of 0.33, it has about a 33% probability of expiring in the money.

2.- A delta of 0.33 implies that the option moves 0.33 pips for every pip of movement on the underlying. A delta of 100 means the option position is equivalent to buying the underlying asset; thus, a delta of -50 is equal to being short the underlying with half of the original position size.

Please note, though, that the Delta of an option changes with time and price movements.

Delta Neutral

Delta neutral is a way to place the overall trade position so that the Delta nears to zero. This can be achieved by having a combination of options with positive and negative deltas so that their summation is near zero. Delta neutral traders don’t bother with market movements, because they don’t not affect them. Their task is to keep their position neutral, rebalancing it when the position moves away from neutral by opening new positions and/or closing open ones. According to advocates of this methodology, Delta Neutral strategies naturally make a trader buy low and sell high, creating a consistently profitable game.

Probability and risk Analysis

Options traders usually have several ways to fill an options trade for a determined strategy. Thus, evaluating the probability and the risk of the possible trade combinations will determine which is the most profitable and best candidate.

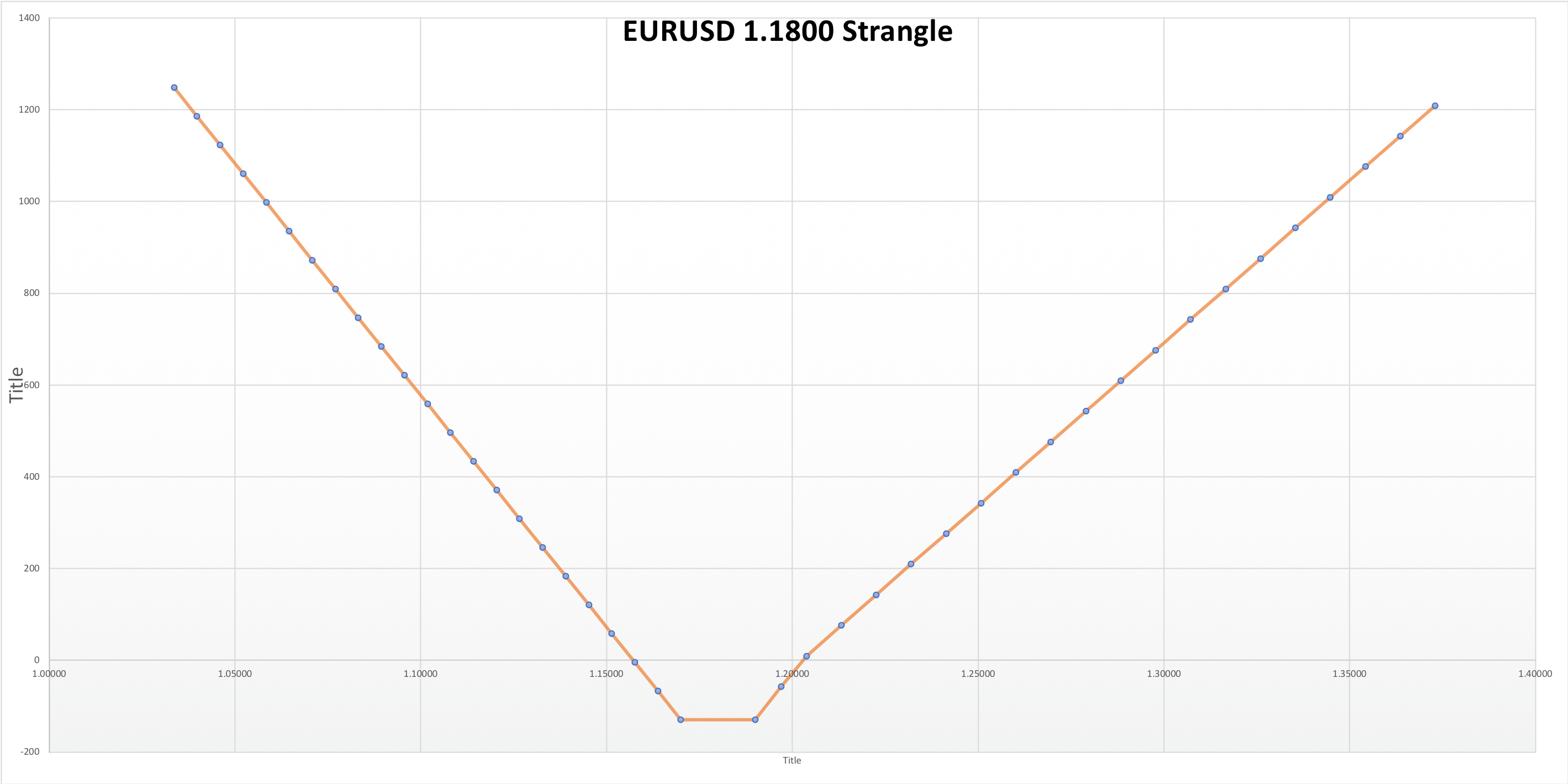

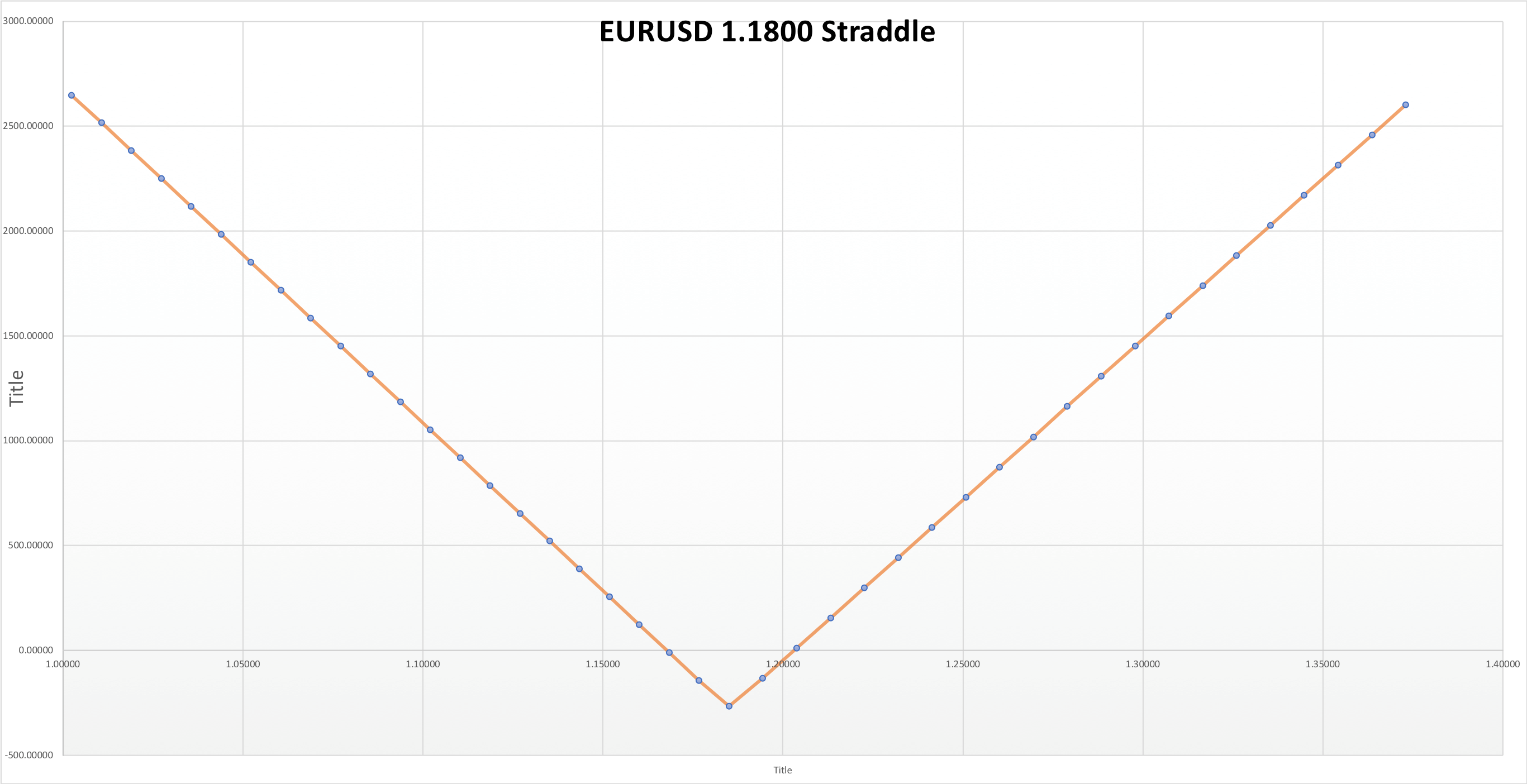

For example, a trader may be decided to buy a put and a call on the EURUSD pair before a potential disrupting event. That way, he will profit from the volatility raise without caring about direction. But he may be in doubt about whether to buy them at the same strike price (Straddle) or a different price (Strangle).

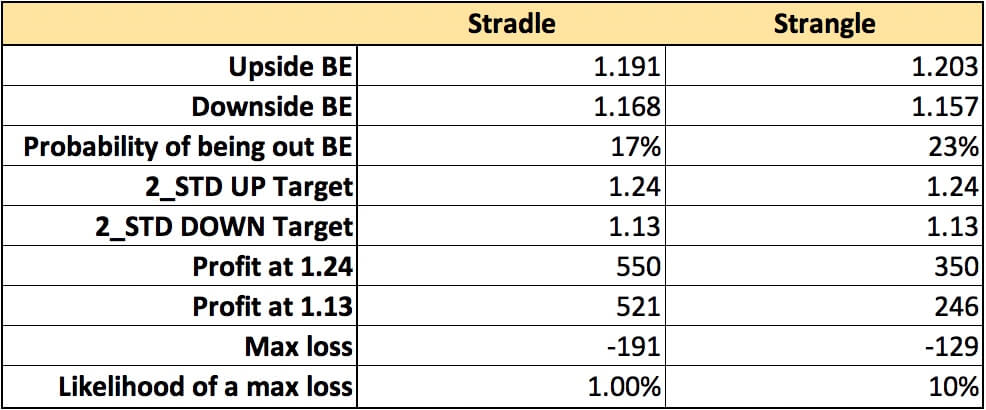

The trader must consider the following for every candidate combination:

- Upside and downside break-even points

- Probability of being outside of BE at Expiration

- Profit at expiration for the upward and downward targets

- The maximum loss of the option combination

- Likelihood of experiencing the maximum loss.

A table made with these parameters will show the best alternative, which in this case, is the Straddle, as it shows the best settings and also the highest rewards for its risk.

Keys to Success in Option Trading

The essential trading guidelines to succeed in options trading are:

- Identifying the strategies available

- Understanding when to use a given plan to maximize the benefit

- Accurately evaluating the level of the current volatility

- Identifying whether it is time is to buy premium or sell premium

- Buying undervalued options and selling overvalued options

- Recognizing when there are disparities in the implied volatilities of different options and take advantage of the fact

- Properly take a profit and cut a loss

Stay tuned for more on Option Strategies!

Recommended reading:

THE OPTION TRADER’S GUIDE TO PROBABILITY, VOLATILITY, AND TIMING , by Jay Kaeppel