Forex Options XIV – The Butterfly Spread

The Call Butterfly spread requires buying a Call at one strike price, selling two Calls at a higher strike, and buying one additional Call at an even higher strike level. The Put Butterfly spread consists of buying a Put at a strike price, selling two more Puts at a lower strike, and buying an extra call at a strike below the written Puts. The Butterfly ratios are always 1:2:1 or a multiple of it. The purpose of a Butterfly spread is to profit from the high volatility of assets in a trading range by collecting option premiums. Butterfly Spreads are a specialized, statistically-based strategy. To improve the chanced of success, traders must consider the following.

Guidelines when selecting a Butterfly spread trade

The underlying asset should be in a trading range, with no potential news that would disrupt the ranging state. The asset should have produced visible support and resistance zones on a daily or weekly chart. That means that assets that are trending are poor candidates.

The implied volatility of the asset is high. The higher, the better, also considering the first guideline, of course. High volatility is required as the money comes from the two sold options, as the time premium increases with volatility. Thus, the more time premium the written options have, the better the profit.

No more than 60 days till expiration, to help accelerate the time decay. Options with 30 days to expiration are ideal.

The written options should be at-the-money or only slightly out-of-the-money. That will improve the chances of the asset to expire near at-the-money, where the premium maximizes.

Make sure to trade it as a unity, avoiding market orders to sell and buy its components. A Butterfly created at optimal prices will increment the odds of making profits. The use of limit orders to guarantee you get the trade as you’ve planned is essential.

Look to commissions also. A low-commission broker is desirable, as this trade involves trading four options.

Position management

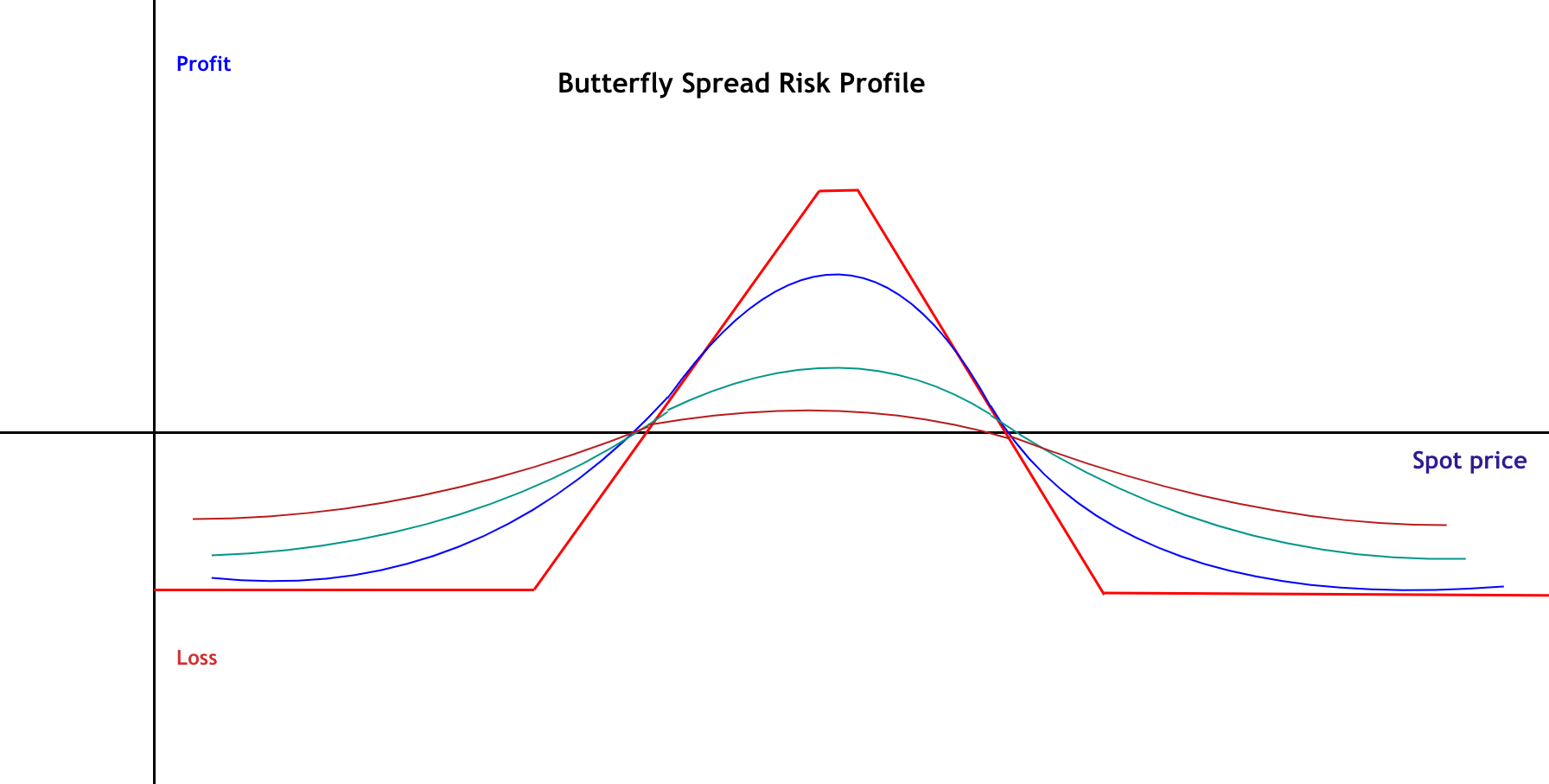

The risk profile graph shows that the maximum profit available grows with the approach to the expiration, but also, the range of prices in which the spread is profitable gets narrower. The maximum profit is produced when the underlying’s price is at the strike price at the expiration date.

The best plan for exits is to close the spread before expiration; therefore, we have to make another four option trades. This is why Butterflies are complicated to trade. A complete trade requires eight trades in which spreads and commissions might eat all the available profit. Therefore, the trader must be alert to the best opportunity to close the position and create appropriate orders to minimize trade costs.

By good opportunity, we mean occasions where the combination of decreasing volatility and the price in the vicinity of the maximum level allows the closing of the spread at an acceptable profit.

Stop-loss

We should plan a stop-loss level in which our loss does not go beyond our projected profit to try to make sure our overall reward-to-risk ratio is at least 1:1.