Forex Options: Introduction

This article begins a series that will explain the basic concepts of options. We will focus on the basic or vanilla options because we think they are the most used in all markets, and base of all variants, including the infamous binary options.

Options as Insurance

An option was thought of as insurance, where the buyer acquires the right to be compensated if something happens to his main assets. That way, fund managers could hedge the risks of their portfolios. Thus, an option is a derivative from the main asset, which gives the buyer the right, but not the obligation, to buy or sell at a determined price at the expiration date.

Therefore, contrary to the underlying asset, an option purchase offers unlimited gains for a limited loss. In a sense is like a position with built-in stop loss, only that the stop loss does not get executed until the expiration date of that option. This, and its relatively low cost compared with the cost of the underlying asset, has made options a game extremely popular.

The contract

Options are structured contracts between two parties, a buyer and a seller in which the seller takes the obligation to sell a specified asset at a determined price, called Strike Price, at a future expiration date. The buyer also acquires the right, but not the obligation to buy the asset at the strike price.

Option basic classes

There are two basic option classes: Calls and Puts.

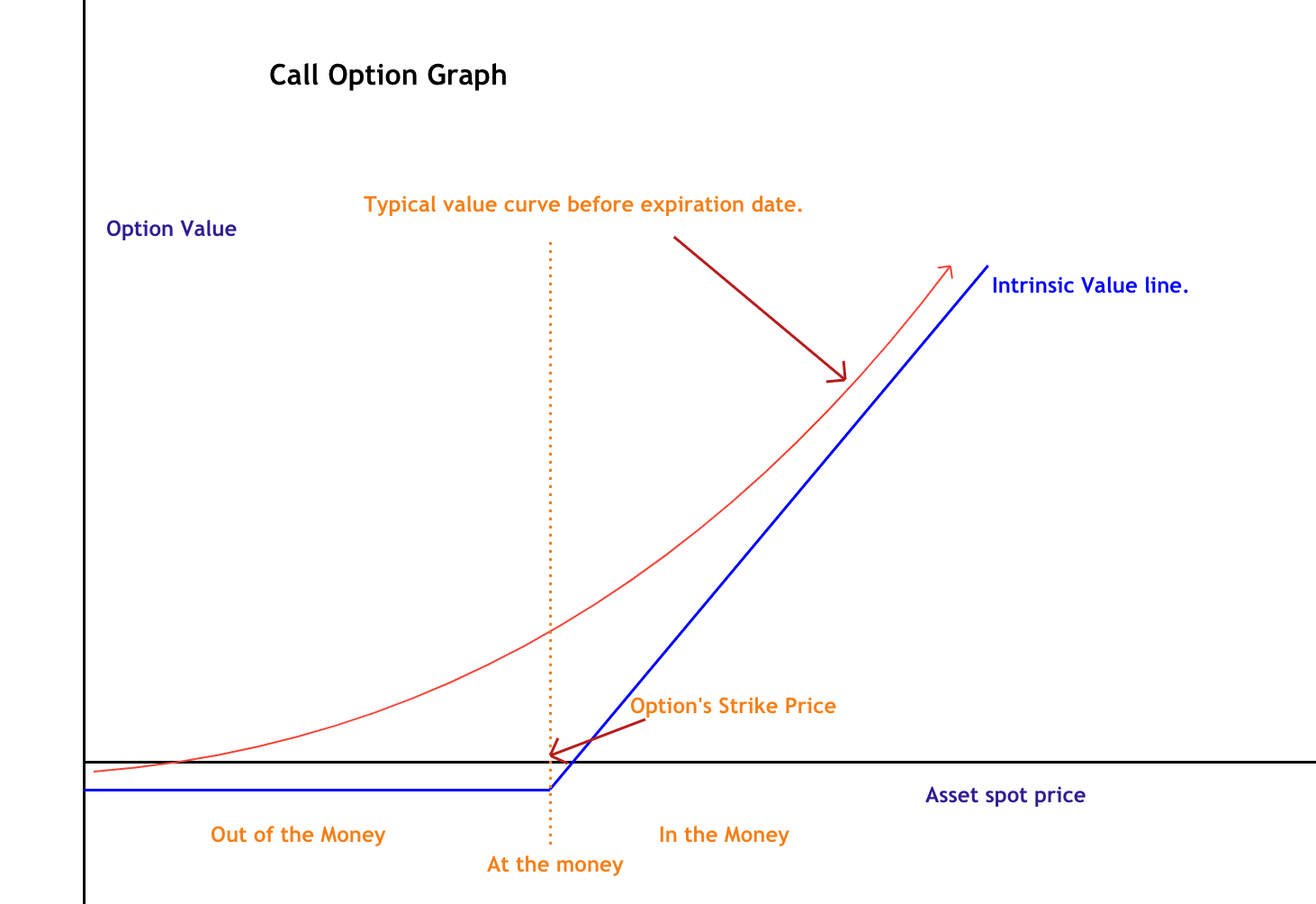

Fig 1 – The valuation curve of a Call

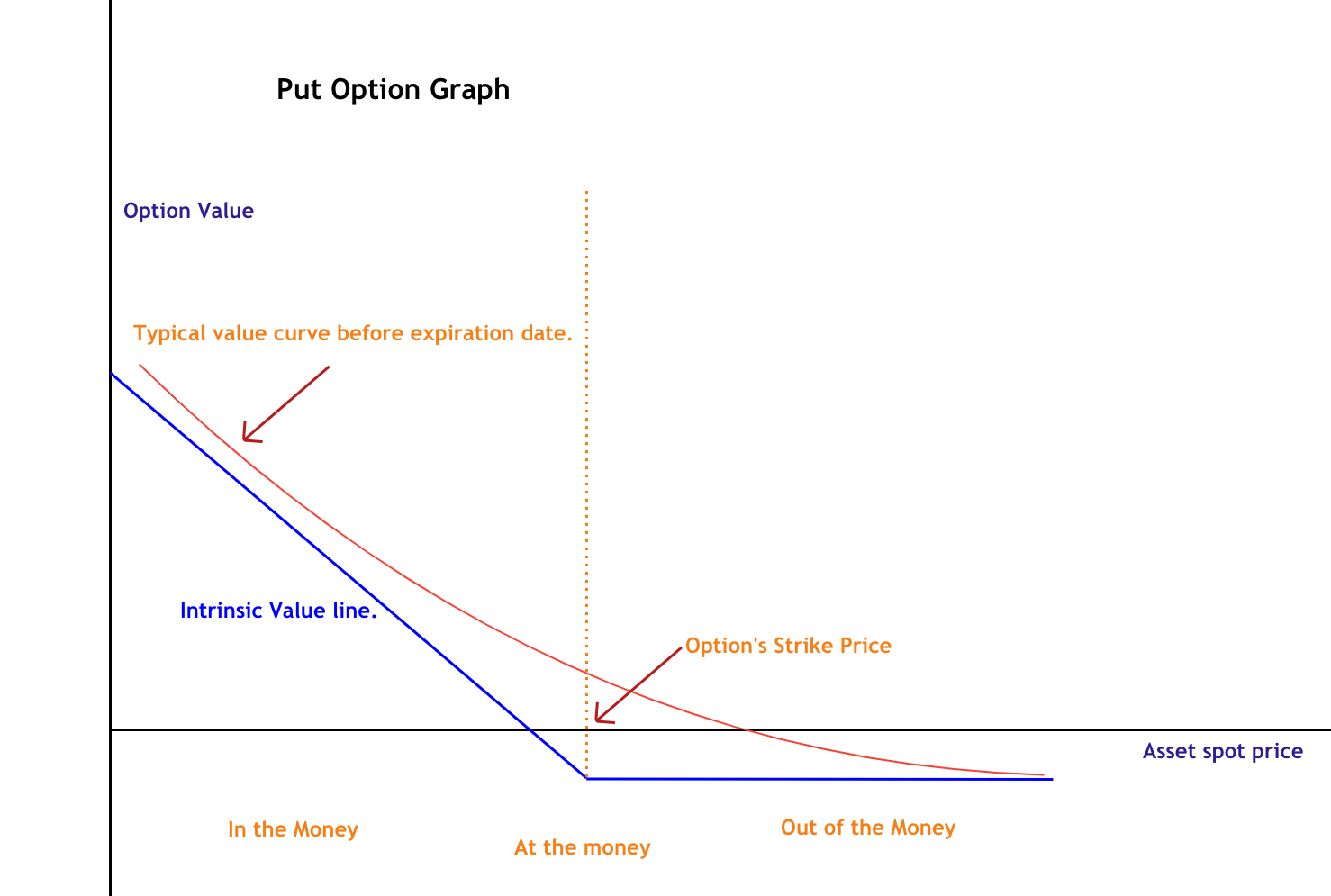

Fig 2 – The valuation curve of a Put

A Call offers the buyer the right to buy the underlying asset at the strike price, and a put provides the buyer the right to sell it at the specified strike price, both at a set expiration date. There are two options styles, European and American options. Both are similar. The only difference is that American options allow the buyer to exercise the option at any time before expiration, while the European style may be exercised only on the Expiration date. The difference is subtle but unimportant, as any trader can sell the purchased option instead of exercising it and use the money to purchase the asset.

Option contract detail terminology

The terminology of an option stipulates the asset, expiration date, type, and strike price of the contract. Example:

“EUR-USD December 01 1.20 Call”

This contract states that the underlying asset is the EUR/USD pair, that the expiration date is December 01, the strike price is 1.20, and is a Call.

Expiration dates are usually the third Saturday of the month for monthly options, but there are also weekly options that may expire at a determined day and time.

We can see that for a predetermined asset there can be a lot of different contracts involving different expiries, strike prices, and class (put or call). These contracts are called option chains.

Recommended reading:

THE OPTION TRADER’S GUIDE TO PROBABILITY, VOLATILITY, AND TIMING , by Jay Kaeppel