How do forex option expiries affect price action in the spot FX market

In this video presentation, we are going to be looking at how Forex option expiries affect price action in the spot FX market.

We will be exploring how forex options work, although we will not be concentrating too much on the technicalities of how they are traded because we are more interested in how FX options expiries can be of great benefit to traders in the spot FX arena.

So what are FX Options, and what is the significance of their expiries?

FX options is essentially another way of trading forex. In effect, they are different branches of the same entity. One is traded on the spot FX, thus known as the Spot FX market, which most of you will be familiar with, and the one we are discussing today is the Future’s FX Options market, where trades are made based upon the price of a currency exchange rate at some point in the future.

So what are FX options?

Options traders purchase what is called a premium, which is a contract and which gives them the right, but not an obligation to buy or sell an FX currency exchange rate at a specified price. This exchange rate is called a strike.

Typically these contracts will be purchased for a future date, typically days, weeks, or even months in advance and where the contract is purchased from a market maker, which is usually an institution that offers futures contracts trading, unlike banks and brokers which offer spreads in spot forex. Contracts expire on the date that the trader chose and always at 10:00 a.m. in New York, USA. This is known as the New York Cut.

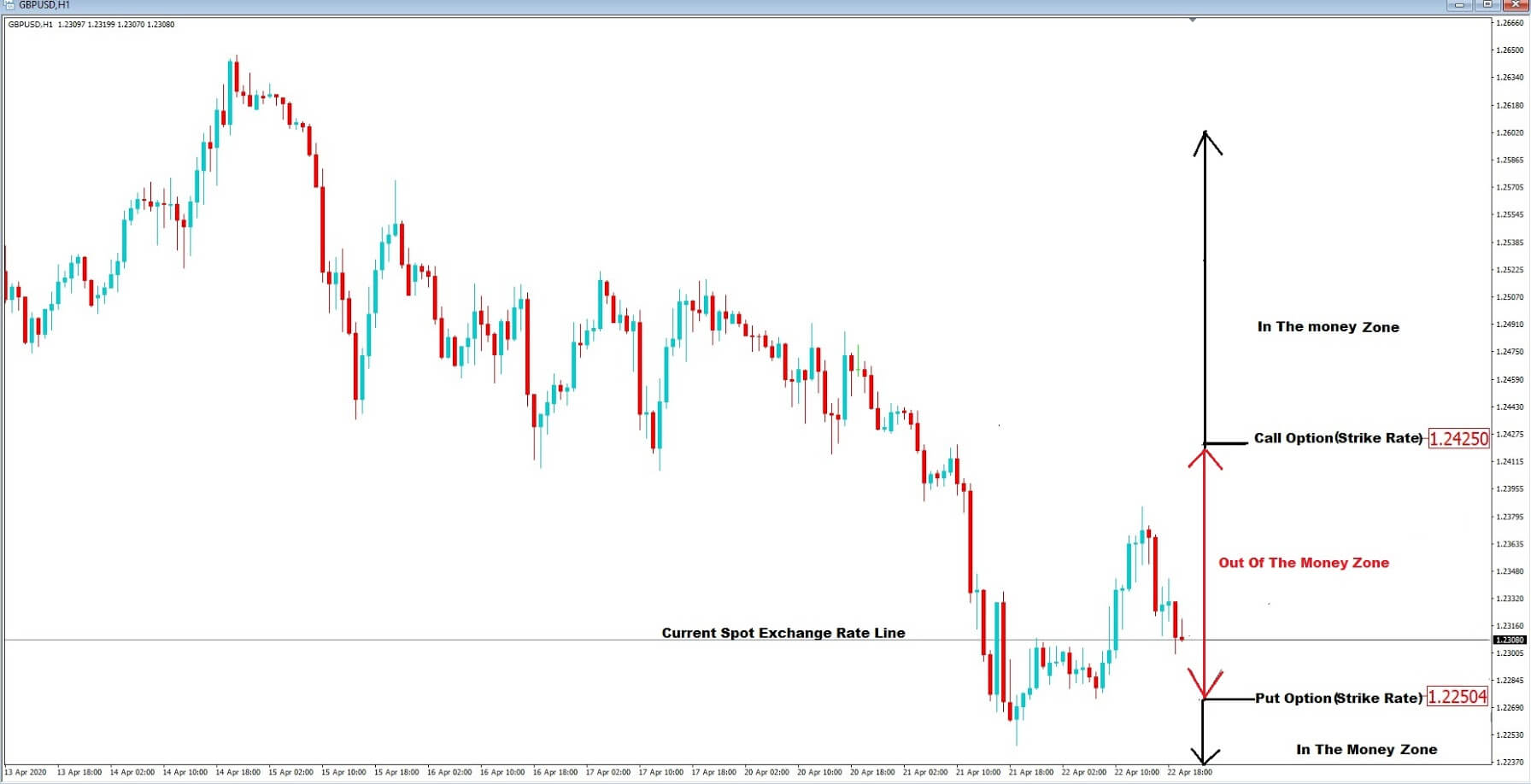

If a trader wishes to purchase a premium, for a future date, for an FX Option, where he or she believes that a chosen currency pair’s exchange rate will be above that at the time of the purchase, he or she buys a Call Option. This is an option to buy. Alternatively, if the trader wishes to purchase a premium for an option where he or she believes that the future currency pair’s exchange rate would be below that at the time of the purchase, he or she buys a put option. This is an option to sell.

So how much does the premium contract cost a trader?

This will vary depending on the size of the contract and also so how far the future currency exchange rate is from the current one and the length of the future expiry date. However, futures traders often prefer this type of exposure in the FX market because they take a long term view of where exchange rates will be. And rather than swing trade to these levels in the spot FX market, they prefer to pay the price or premium for the contract upfront, and this then becomes their risk and exposure, unlike spot FX traders whose level of risk fluctuates with price action.

How do options traders make money?

If on the day of the maturity of the FX options contract at 10 a.m. for the New york cut the strike rate, or currency exchange rate, Is it at or above the exchange rate for a call option, or at or below the exchange rate for a put option, then the trader is known as being in the money. If a currency exchange rate is not hit, they are out of the money. If they are out of the money, the option expires, and the contract is worthless to the buyer, and he loses the premium.

If, however they are in the money, the buyer will get to exercise the option and create a position in the market. And the seller of the contract will be the counterparty in the ongoing trade. The seller of the contract also gets to keep the premium.

So who trades FX currency options?

Anybody can trade FX options, but typically we will find institutions, high net worth individuals, forex traders looking to hedge positions, forward forex traders, speculators, exporters, banks, institutions, companies with exposure in the foreign exchange market generally.

Insert G: So, how does FX currency options affect the spot FX market? Interestingly, when FX options expiries accumulate into large amounts, typically $100 million +, we often find that these accumulated amounts at a set currency exchange rate have somewhat of a magnetic effect to spot FX Trader in the run up to the 10 a.m. new york cut.

Although these huge amounts of options expiring at a particular level occur on an almost daily basis, it does not definitely mean that price action pertaining to a particular pair will hit the strike rate. However, some of the traders who are involved in FX options will also use the Spot FX market to hedge some of their own positions, thus using the Spot market to try and move price to where they need it to be.

Also, these currency options expiry levels with the accumulated amounts are available via certain brokers and commentators before the expiries. Thus this publicly available information is used by Spot FX traders to keep an eye out in the market in the period leading up to the expiry. Remember, the larger the amount of the expiring contracts, the more it would seem that there is a gravitational pull towards these exchange rates.

Forex.Academy will be making these levels available to you, free of charge, and they can be accessed on the options drop-down menu of our home page. For your convenience, as and when option expiries become available almost each day, we will also plot them onto a chart, as per this slide, and you will be able to view them there for your convenience.