Swiss International is a Kuwait based foreign exchange broker that is regulated by the Kuwait Chamber of Commerce and licensed from the Ministry of Commerce and Industry of Kuwait. “To offer world-class quality in all the services we provide, we have worked hard to put together a highly qualified team of professionals. From the most junior marketing executive to the senior management.” That is what they say about themselves, so now it is our turn to look at what is on offer and so you can decide if they are the right broker for you.

Account Types

There isn’t an account comparison page available on the site so the exact details of the account are not known to us initially, as we go through the review we will be looking at different aspects of the broker including the conditions of the accounts, so any differences in potential accounts we will outline in each section of the review individually.

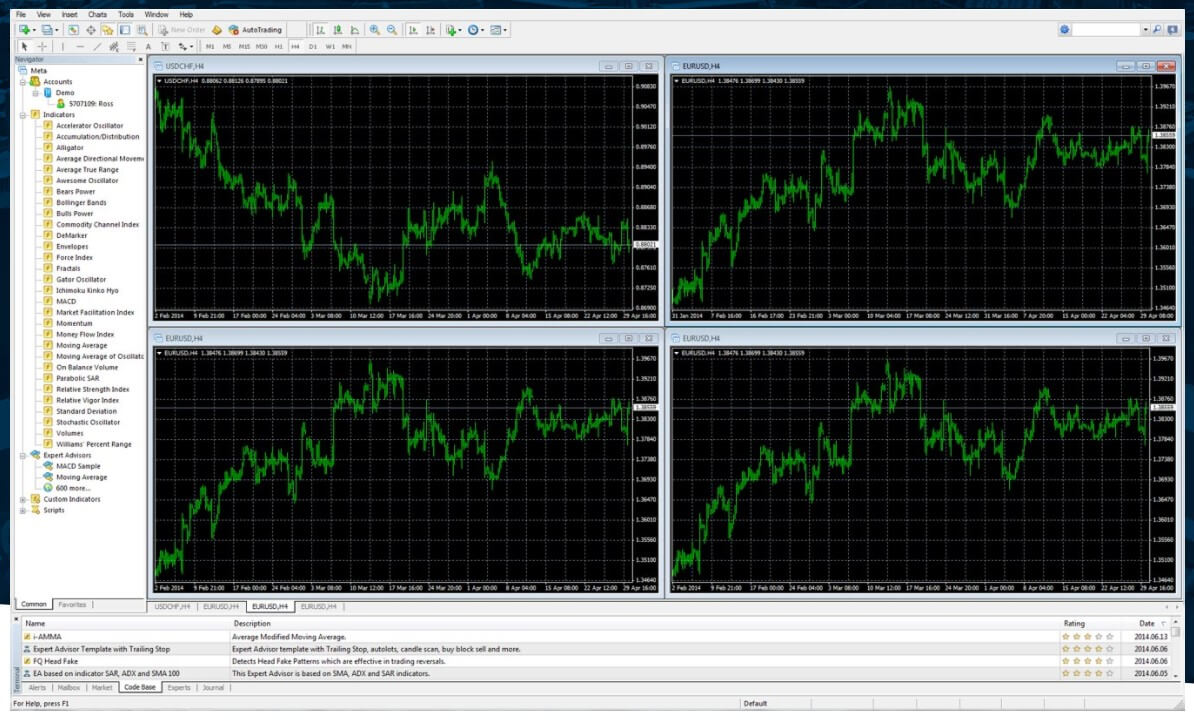

Platforms

There are two different platforms available, we will outline their main features for you below.

MetaTrader 4 (MT4)

MetaTrader 4 is capable of handling trade operations with a large number of financial assets, providing Forex traders with the ability to carry out technical analysis with chart functions using automated strategies and various indicators. Offering over 50 built-in indicators and analytical tools. MetaTrader 4 can assist with the automation of the trading, analyses of price trends, and to locate the ideal entry and exit points. MT4 is available in over 30 languages.

UniTrader

UniTrader delivers essential trading in seventeen major languages. The user-friendly interface is simple to navigate for beginner traders as well as those with experience. UniTrader allows for the maximum customization of system settings in order to fulfill even the most demanding FX trading needs. Users can trade on a variety of assets all from a single trade window. UniTrader offers a Trailing Stop on the server side, which means that risk and stop orders are fully controlled by the server. This ensures that risk limits are in place and always active.

Leverage

The maximum leverage available to use is 1:400 when trading forex if you trade indices then the maximum leverage is 1:33 and for commodities, it is either 1:33 or 1:100 depending on the instrument. The leverage for the account can be selected when opening up an account and can be changed by sending a change request to the customer service team.

Trade Sizes

The lot sizes on Swiss FS are 10,000 so they are slightly smaller than most brokers. The minimum trade size for forex trading is 0.1 lots (1,000 units and the same as 0.01 lots on most brokers). The trade sizes go up in increments of 0.10 lots, we are not sure what the maximum trade size is. When trading indices the minimum trade size is 1 lot and when trading commodities the minimum trade size is also 1 lot. We do not know how many open trades you can have at any one time.

Trading Costs

There is no transaction fee on the product specification page so that indicates to use that there is no added commission on the trading. There are however swap charges which are a fee for holding trades overnight; this can be viewed in the trading platform you are using. There are Islamic swap-free accounts should your beliefs not allow you to pay or receive interest.

Assets

The assets have been broken down into three categories, we have outlined them for you below.

Forex: EURUSD, USDCHF, USDJPY, USDCAD, EURJPY, EURCAD, CHFJPY, CADJPY, GBPUSD, EURGBP, GBPJPY, NZDUSD, GBPCHF, AUDUSD, AUDJPY, EURAUD, NZDJPY, GBPCAD, GBPAUD, AUDNZD, AUDCHF, EURCHF, AUDCAD.

Indices: Europe 50, SP 500, DJ 30, France 40, DAX 30, Nasdaq, UK 100, Japan 225, and USD Index.

Commodities: US Crude Oil, Silver, and Gold.

Spreads

Sadly the spreads are not actually indicated to us on the site, the product specification does not mention them, the only bit of information that we do know is that they are variable and so are influenced by the markets, they can move up and down depending on the available liquidity or volatility in the markets.

Minimum Deposit

Unfortunately, we do not know what the minimum deposit is due to the fact that we are not able to open an account (restricted country).

Deposit Methods & Costs

There are five different methods available to deposit, these are Bank Wire Transfer, Skrill, Credit/Debit Card, CashU, and Neteller. We do not know of any potential fees as they are not stated, but it is also not stated that there aren’t any, at any rate, we would encourage you to check with your own bank or processor to see if they add any outgoing transfer fees of their own.

Withdrawal Methods & Costs

The same methods are available to withdraw with, for clarification they are Bank Wire Transfer, Skrill, Credit/Debit Card, CashU, and Neteller. Any deposits that were made with a Credit/Debit card cannot be withdrawn for 30 days, once again there is no mention of the possible fees but you should check with your bank or processor to see if they add any processing fees of their own.

Withdrawal Processing & Wait Time

Unfortunately, this information is not present on the site, or at least we could not locate it. We would expect any withdrawal requests to be fully processed within 3 to 7 working days based o the processing times from Swiss International and your own bank or card issuer.

Bonuses & Promotions

The bonus on the site has actually expired, but we will outline it anyway so you can get an understanding of the sorts of promotions that take place at Swiss International.

20% April Deposit Bonus: You can receive a 20% deposit bonus of up to $10,000. In order to convert the funds into real funds, you will need to reach a certain level of turnover in lots. For instance, if you receive $100 as a bonus, you will need to turn over 20 lots,m if you receive $200 then you will need to turn over 40 lots, for every $100 increment you will need to trade an additional 20 lots. This continues until you reach a $10,000 bonus with a trading volume requirement of 2,000 lots.

Educational & Trading Tools

There is a tutorial section on the site, the first page simply tells you what Forex is, there is another page simply detailing different aspects of the markets, good for complete beginners but if you have traded before then you would have seen all of this before. The next page tells you how to calculate your profit and loss with some examples of it, the final page simply explains what technical analysis is. Ok for a complete beginner but nothing that will help make you a trading expert.

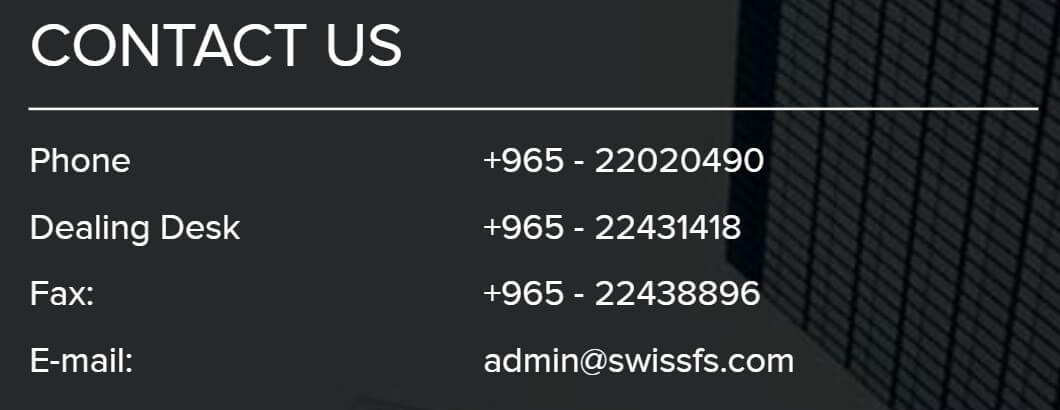

Customer Service

There is an online submission form that you can use to send your query to Swiss International, you should then get a reply via email. You can also use the postal addresses that are provided for the various offices or the phone number and email address, you can use whichever method you prefer.

Address: KUWAIT (MAIN OFFICE), CITY TOWER (AL MADINA TOWER) FLOOR 16, KHALID IBN AL WALEED STREET SHARQ KUWAIT P.O.BOX 26635, SAFAT 13127

Email: [email protected]

Phone: +965-22020490

Demo Account

Demo accounts are available and allow you to test out the markets and also new strategies completely risk-free. We tried to open up an account but the little loading icon just kept going and nothing happened, we are not sure if it was a temporary thing or something wrong with our computer. There isn’t actually much information relating to the demo accounts such as the trading conditions or possibility of expiration time. You can also open one from within the MT4 platform if you have downloaded it already.

Countries Accepted

While this is not stated on the site, if you try to open up an account from a country that is not accepted you will be presented with a message saying that you cannot sign up, if you are still not sure then you can always contact the customer service team to find out.

Conclusion

We do not fully know the account details due to not being eligible for an account, the main information that we do not have is the spreads, this is the main factor that will show how expensive the trading is, so not knowing them means we do not know the costs of trading. There are enough assets to trade and they can be traded up to 1:400 which is reasonable leverage to have. When it comes to funding there are a few options available but the fees for them are not known to us. It also didn’t help that the demo account was not working and we could not sign up for one. With the cost of trading and the cost of funding not known, we would have to recommend looking elsewhere as the last thing you want is to deposit with a fee and find that the spreads are very high.