Grinta Invest is a broker that was founded and has been active since 2015. This broker has several assets, including about 30 currency pairs, precious metals, and a variety of CFDs. The platform used by Grinta Invest is the popular Metatrader 4. Also, from the broker’s website, it is claimed that brokerage is STP / ECN, this means that the broker acts as an intermediary between buyers and sellers in the markets, not as a counterparty.

Grinta – Invest Limited is the company that owns the trademark and website of Grinta Invest. Grinta – Invest Limited is registered in the Marshall Islands, and UK-based Grinta Holdings Limited provides payment services.

Brokers based in the Marshall Islands have no regulation. If a customer trades with an unregulated broker, he must know that the company lacks protection in the event of insolvency. For this reason, we always advise traders to choose well-regulated brokers, for example, through the FCA, Cysec, or ASIC.

However, an unregulated broker need not be a bad broker. For example, the customer reviews of Grinta Invest on various Forex websites and forums are generally quite positive. Their business offer is reasonably good. So if you want an offshore broker for some reason, Grinta Invest may be the right choice for you.

Grinta Invest’s website is available in 4 languages, English, Spanish, Russian, and Arabic.

ACCOUNT TYPES

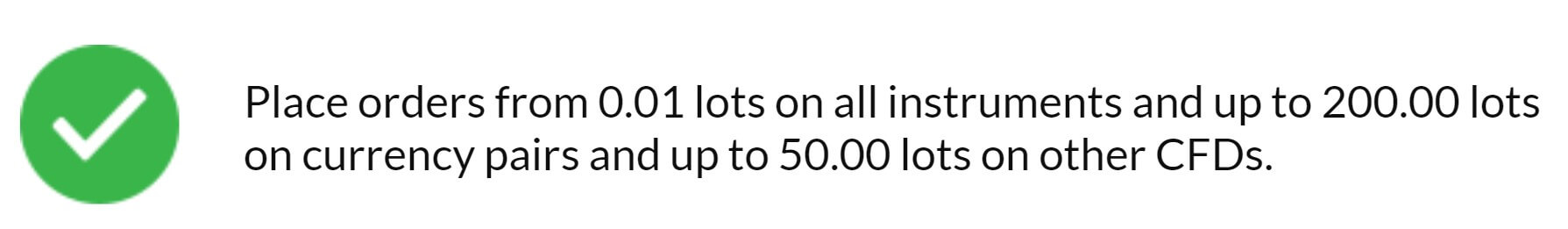

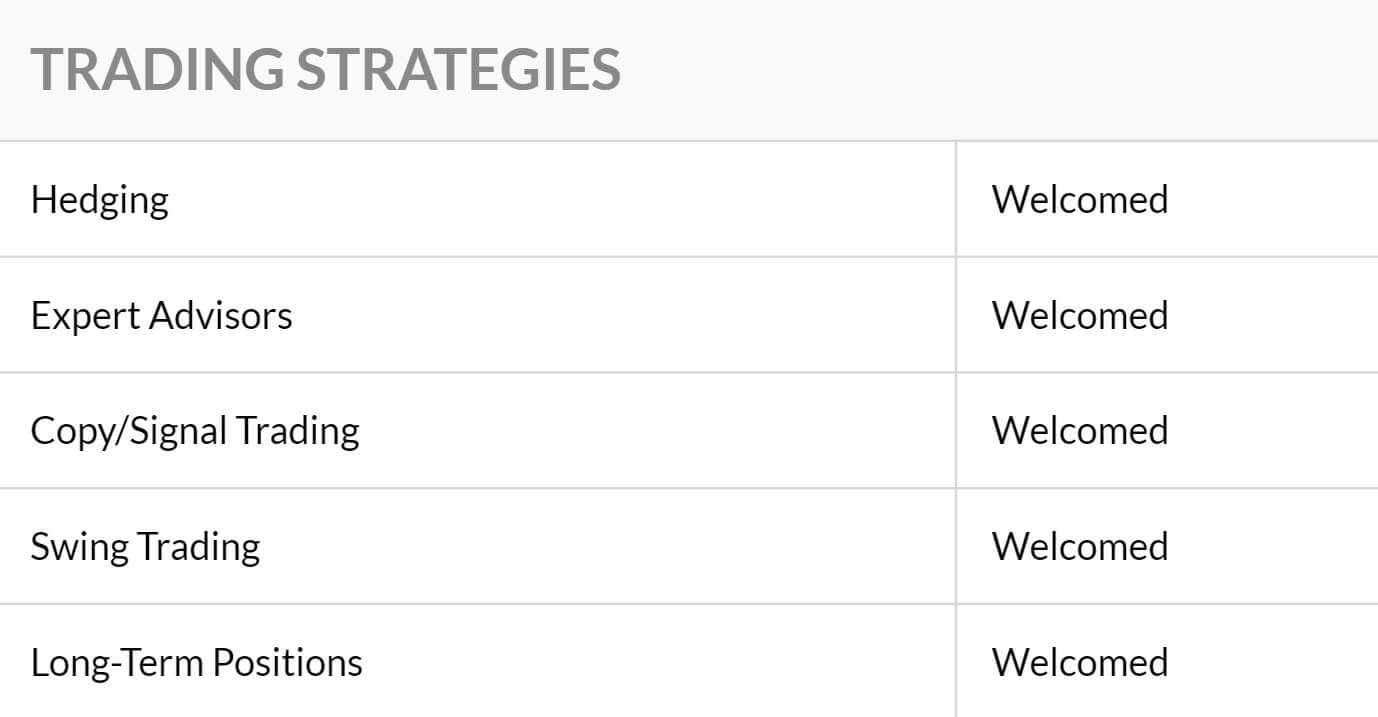

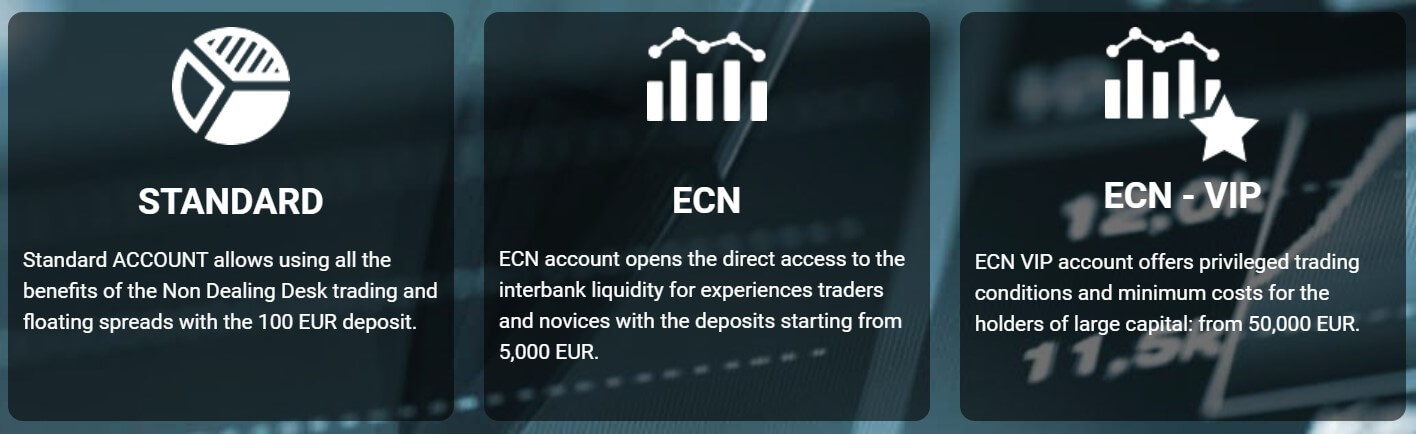

Grinta Invest customers have two different types of accounts. The accounts have no operating fee, and the spreads they offer are variable. The execution of orders is to market (STP / ECN). As for leverage, we can have a leverage of up to 1:500. The commercial sizes we can use start at 0.01lots (micro lot), and the trading platform offered by this broker is the popular MetaTrader 4 (MT4).

PLATFORMS

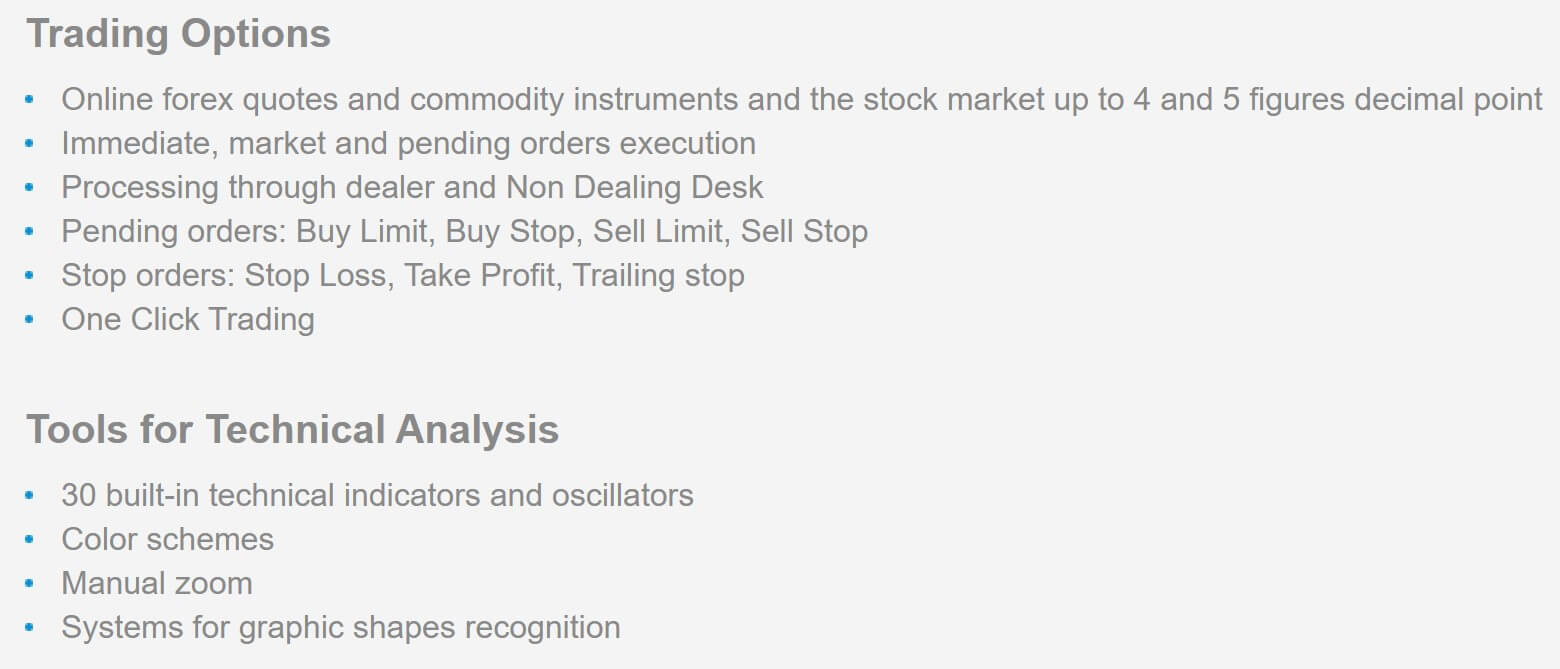

Grinta Invest provides us with the Metatrader 4 platform, a top-rated platform among traders. This platform is available both in the desktop version and in a mobile application for use on smartphones and tablets.

Grinta Invest provides us with the Metatrader 4 platform, a top-rated platform among traders. This platform is available both in the desktop version and in a mobile application for use on smartphones and tablets.

This professional software with all its functions offers traders everything you may need from a platform. Simplicity in its use, quick execution of orders, a good variety of technical indicators, a package of advanced graphics, back-up options testing of our strategies, and the possibility of developing and then using Expert Advisors (EA), among other functionalities.

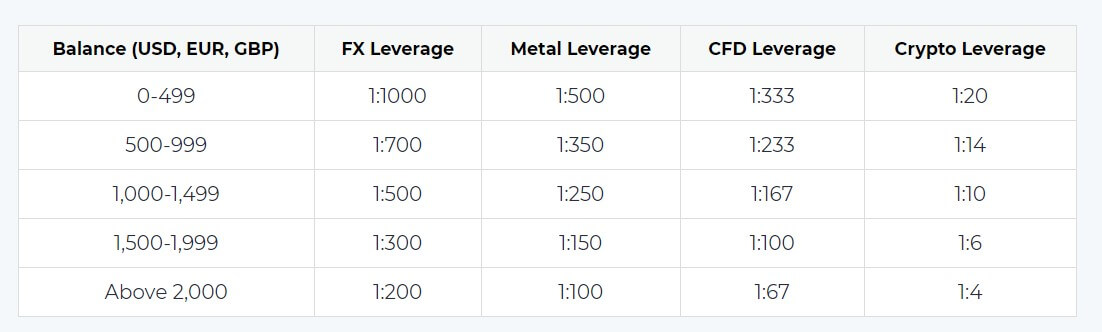

LEVERAGE

Grinta Invest allows us to have a leverage of up to 1:500. This does not mean that we have to use such high leverage; we can contact the broker’s customer service and modify the leverage to 1:100 or 1:200, for example.

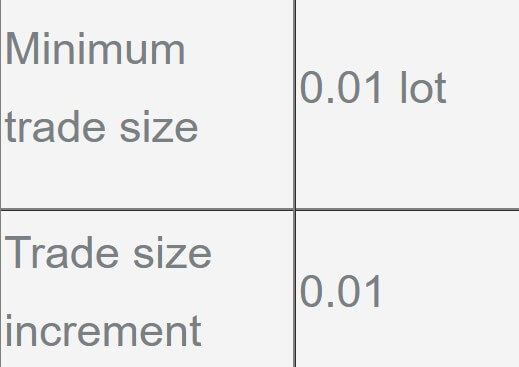

TRADE SIZES

The trade sizes from which we can trade are 0.01 lots (micro lot).

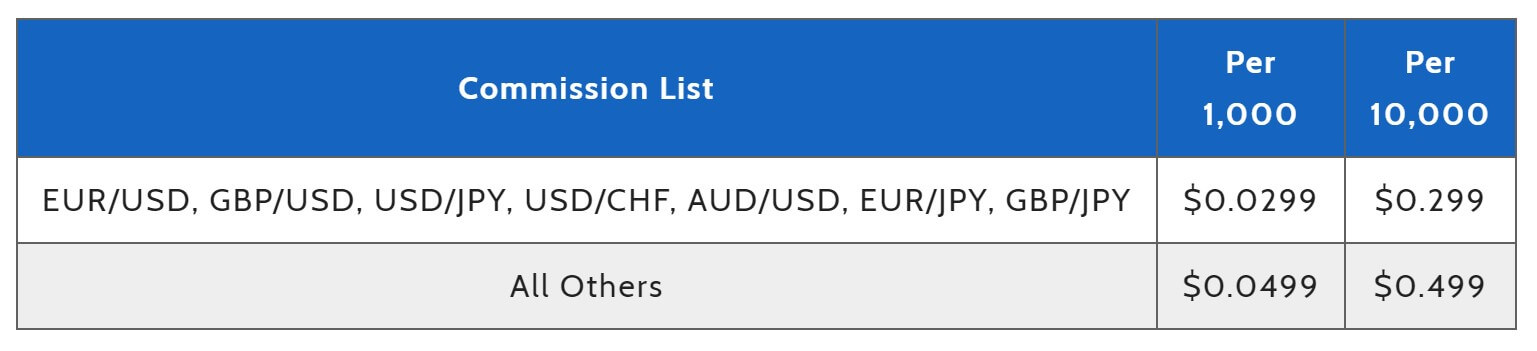

TRADING COSTS

The accounts offered by Grinta Invest have no operating fee. Therefore, the only cost we will take into account is the Swaps: any position held overnight, which will incur a maintenance cost (interest). This amount can be negative or positive depending on the instrument and the direction of the position, and its amount is fixed by the central banks of the base currency of the open position.

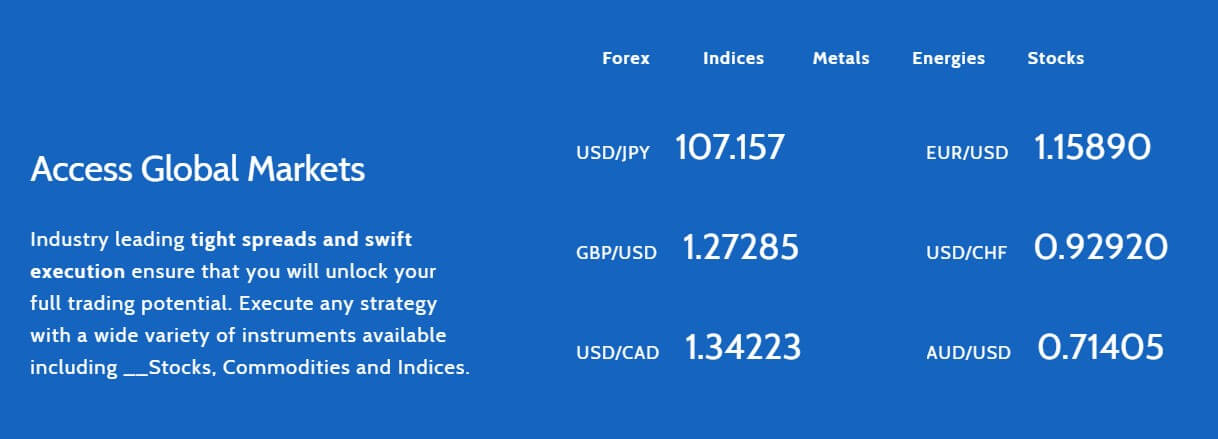

ASSETS

In this broker, we have a good variety of assets to trade: 30 currency pairs, precious metals, and a range of CFDs in indexes and commodities.

SPREADS

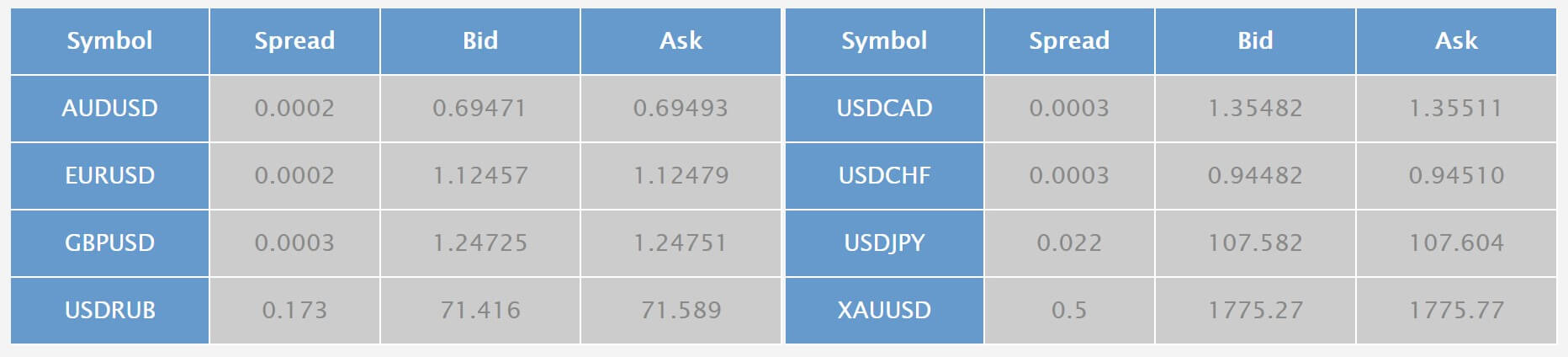

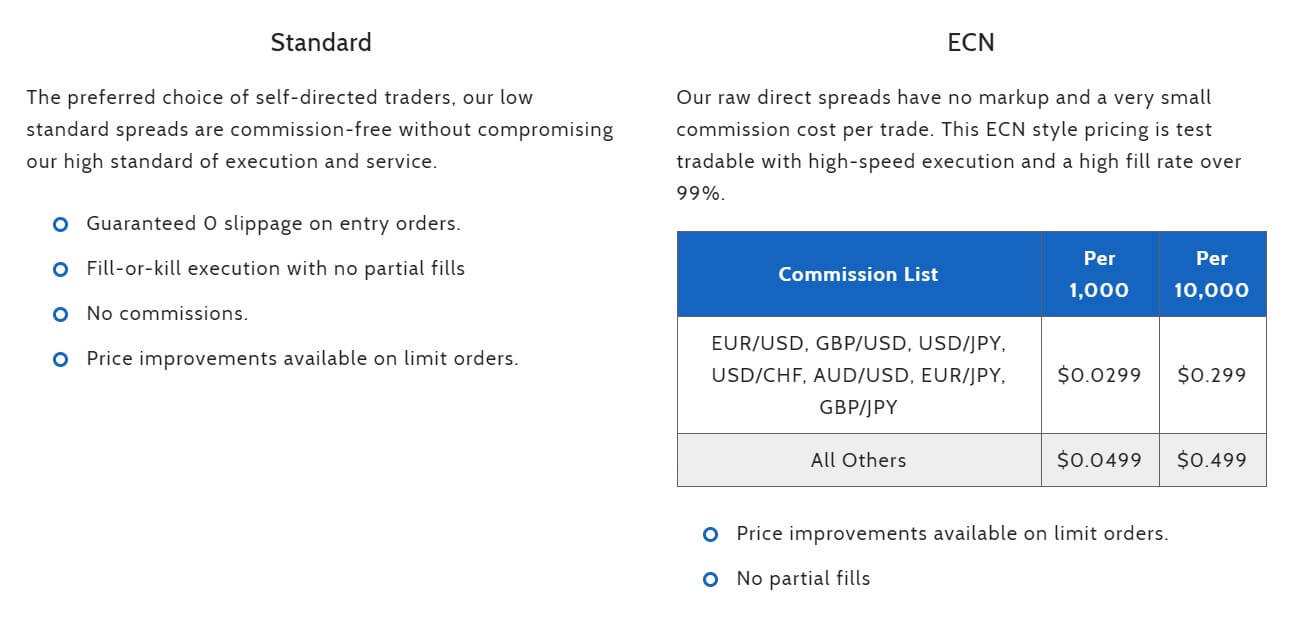

This broker offers us variable spreads on all the assets we can trade. For example, in the Standard account (STP), the average spread of the currency pair EUR / USD is 1.7 pips, while in the ECN account, the average spread is lower, 1.3 pips.

MINIMUM DEPOSIT

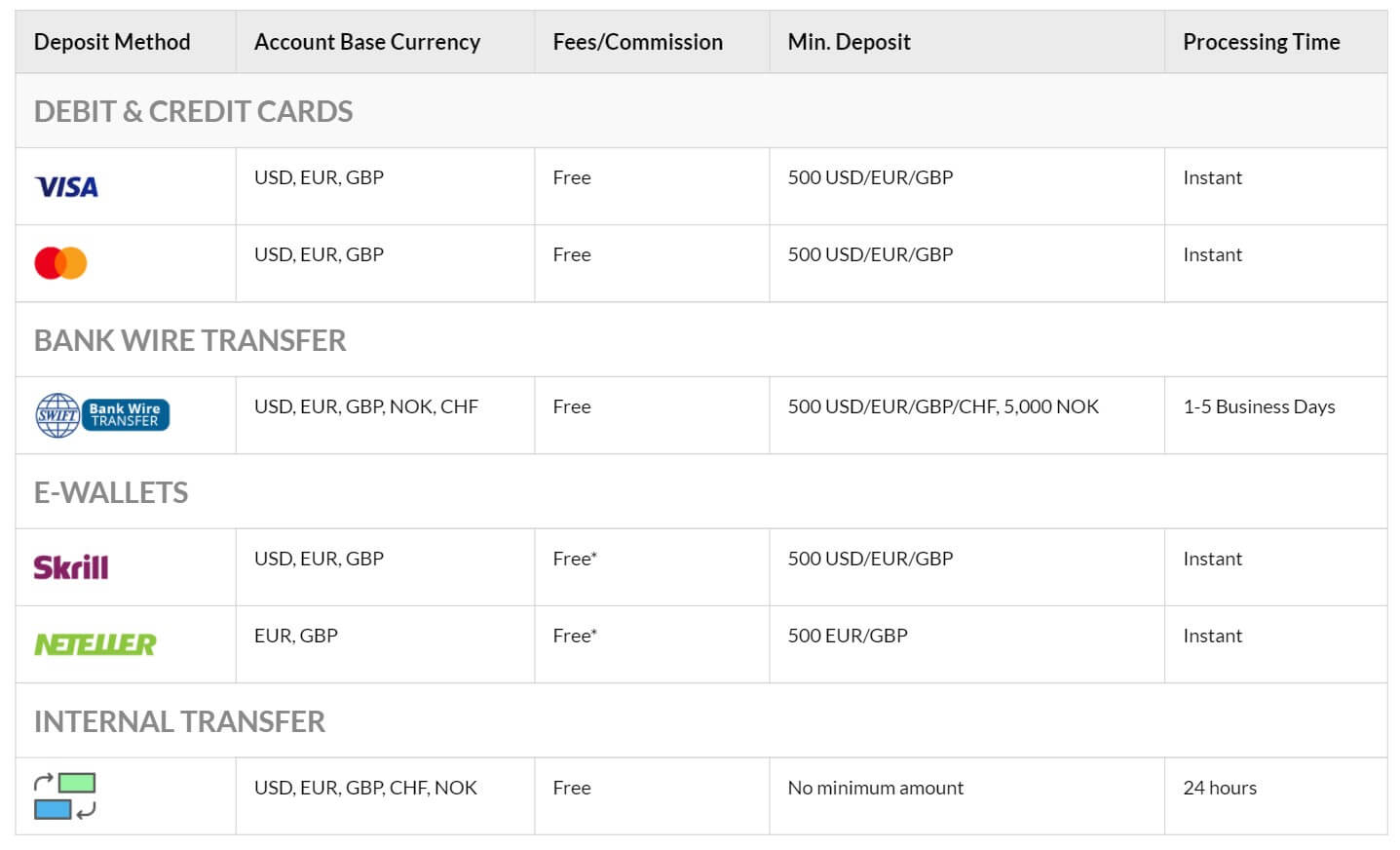

With this broker, we can open an account with a reasonable amount, and according to the industry average. For starters, you can open a standard account (STP) with 200 USD. If we have enough capital, the ECN account requires a minimum capital of USD 4,000 to be able to trade with it. It is highly capital but is rewarded for its lower commercial costs (a more economic spread).

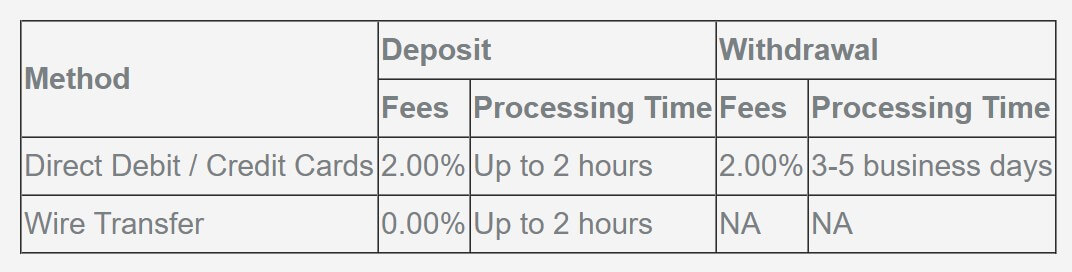

DEPOSIT METHODS & COSTS

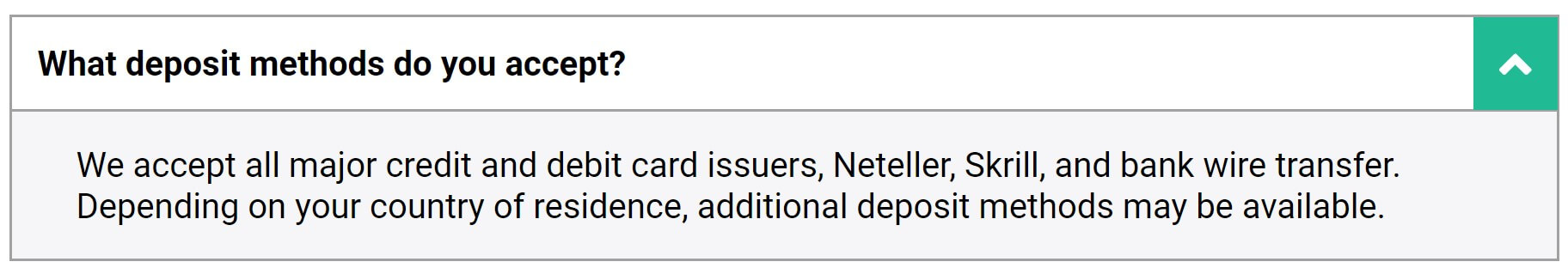

Grinta Invest has a good variety of payment methods, these are bank transfer, credit or debit cards, and electronic payments such as Skrill, Neteller, Qiwi, or Web Money. There are no broker fees for deposits in your account.

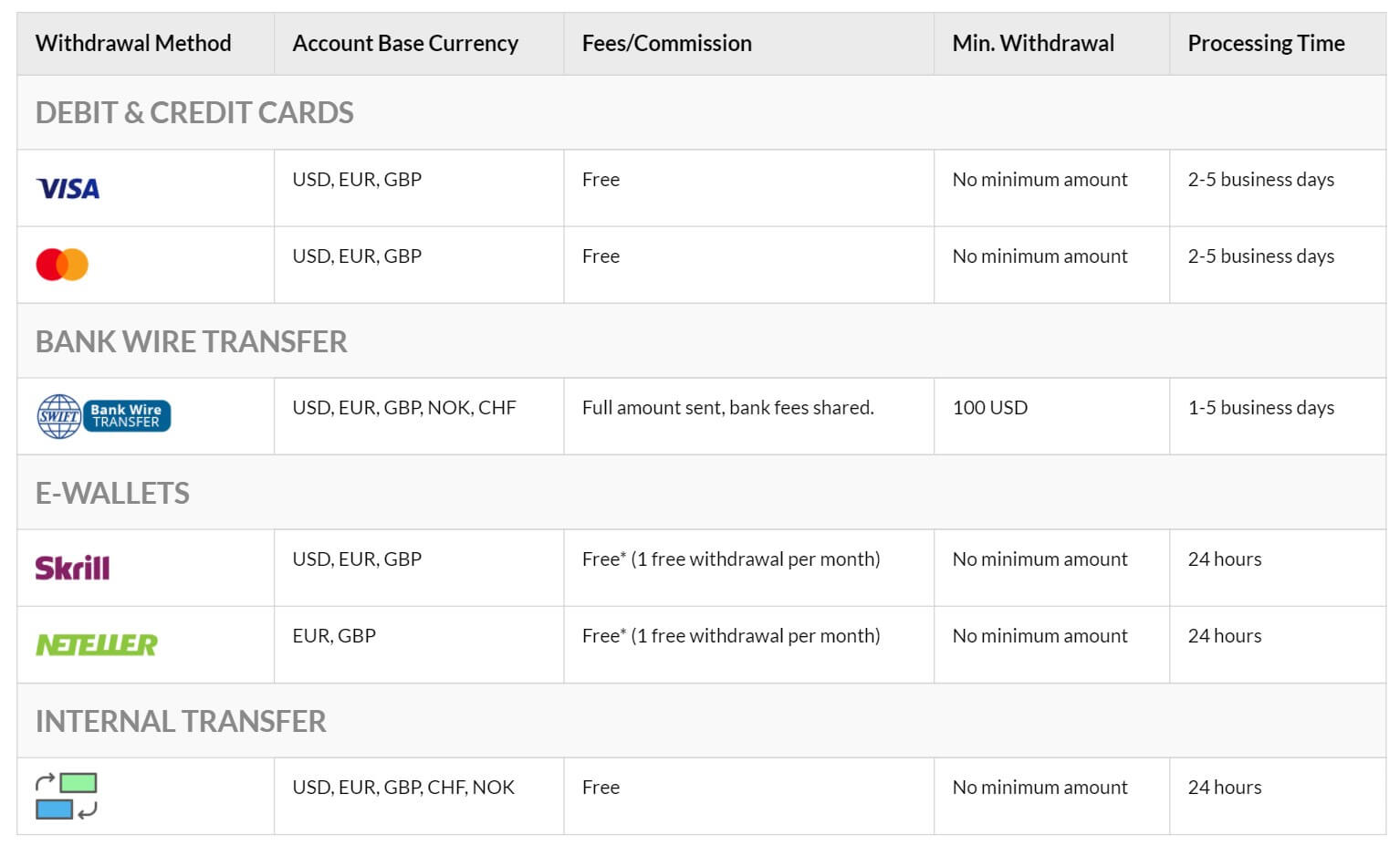

WITHDRAWAL METHODS & COSTS

The broker, on its website, does not report the withdrawal methods or the costs associated with them. But most often, you have at your disposal for withdrawals, the same methods that can be used for deposits. The costs vary from broker to broker, but generally, bank transfer withdrawals are more expensive than, for example, electronic retreats. Customer service should be consulted for further details on this issue.

WITHDRAWAL PROCESSING & WAIT TIME

Nor have we found information about processing and waiting time at the retreats. The most common thing in most brokers is that they process the withdrawal 24 hours after receiving your request. At that time, several methods of payment must be added. For example, a transfer can take a long time to reach your bank account between 1 and 5 days, depending on whether it is an international transfer or not, whether the shipping currency matches the destination currency… etc. Other methods such as ePayments are usually instantaneous receipt of money or at most take one day.

BONUSES & PROMOTIONS

Grinta Invest offers a promotion called “ recommendation to a friend. ” This promotion is designed so that you can earn money with friends whom you recommend Grinta Inves and open an account. The benefit you can expect varies according to the number of trades your friends make and the size of the initial deposit. An example with deposits could be this:

- From 500 USD to 1500 USD. You get 150 USD.

- From 1501 USD to 4000 USD. You get 300 USD.

- Starting at 4001 USD. You get 700 USD.

EDUCATIONAL & TRADING TOOLS

Grinta Invest has an educational section, but once you enter it, you realize it is very scarce. In this case, the entire educational area consists of 3 articles, are: What is Arbitrage Trading?, High-Frequency Trading (HFT), and the Importance of low Latency.

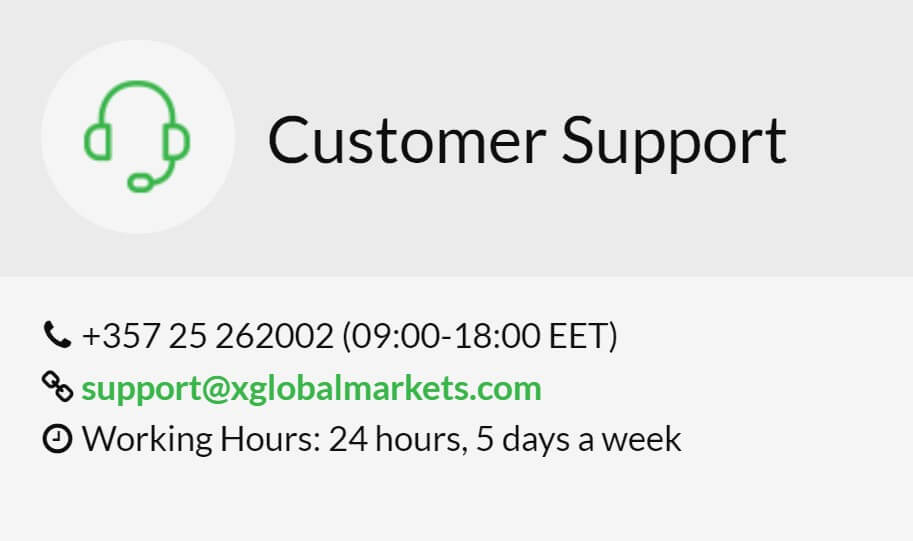

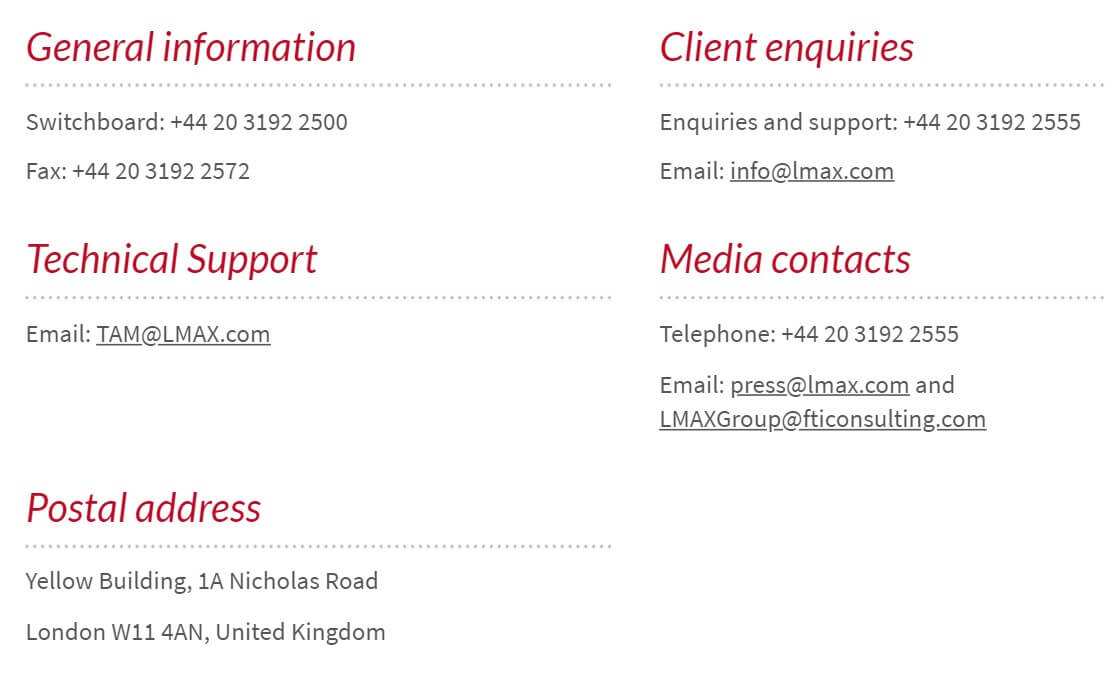

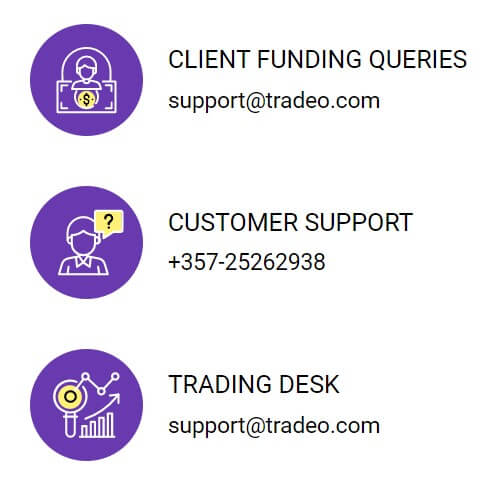

CUSTOMER SERVICE

If you want to get in touch with customer service, you can do so via a contact form or by phone. The broker does not provide either an email address or a physical address where he or she may have offices. The data that Grinta Invest provides are:

- UAE:+971-45-740828

- Mexico:+52-55-81177230

- Russia:+7-495-1452725

- Africa:+27-832-145035

DEMO ACCOUNT

Grinta Invest does not have a demo account for its clients. We consider this a negative aspect. Having a demo account is essential, especially for all those novice traders who need to simulate a real operation without taking risks and gain experience in different markets.

COUNTRIES ACCEPTED

This bróker does not provide services for citizens of certain regions, such as The United States, France, North Korea, Iran, Myanmar, Cuba, Sudan, and Syria.

CONCLUSION

Grinta Invest is an offshore broker using the popular MT4 platform. Its commercial offers are quite reasonable. The fact that Grinta Invest has an STP / ECN environment is quite positive. In our view, the main disadvantage of this broker is that any serious authority does not regulate it. Let’s summarize the advantages and disadvantages we see in this broker.

In general, Grinta Invest is a broker with reasonable terms. The initial deposit they require is typical to other brokers, and the levels of leverage offered are high, a common feature of foreign-registered brokers. As for spreads, in the Standard account, they are above the industry average, whose range is usually 1.0 – 1.5 pips for the currency pair EUR / USD.

Advantages: STP execution / ECN. Operation without commissions. MT4 platform availability. They reward you for recommending other traders to open accounts with them.

Disadvantages: Unregulated broker. Spreads are slightly above the market average. Lack of information on the processes, costs, and waiting times of the withdrawals.

Demo accounts serve as simulation experiences for those that are considering opening an account with a forex broker, and these account types allow one to test out the broker’s conditions and practice trading on the offered platform, all while using virtual currency. Fortunately, BML provides access to these risk-free accounts, along with the majority of others. The broker’s demo account mimics all of the conditions offered on their live accounts and can be opened through the MT4 trading platform.

Demo accounts serve as simulation experiences for those that are considering opening an account with a forex broker, and these account types allow one to test out the broker’s conditions and practice trading on the offered platform, all while using virtual currency. Fortunately, BML provides access to these risk-free accounts, along with the majority of others. The broker’s demo account mimics all of the conditions offered on their live accounts and can be opened through the MT4 trading platform.

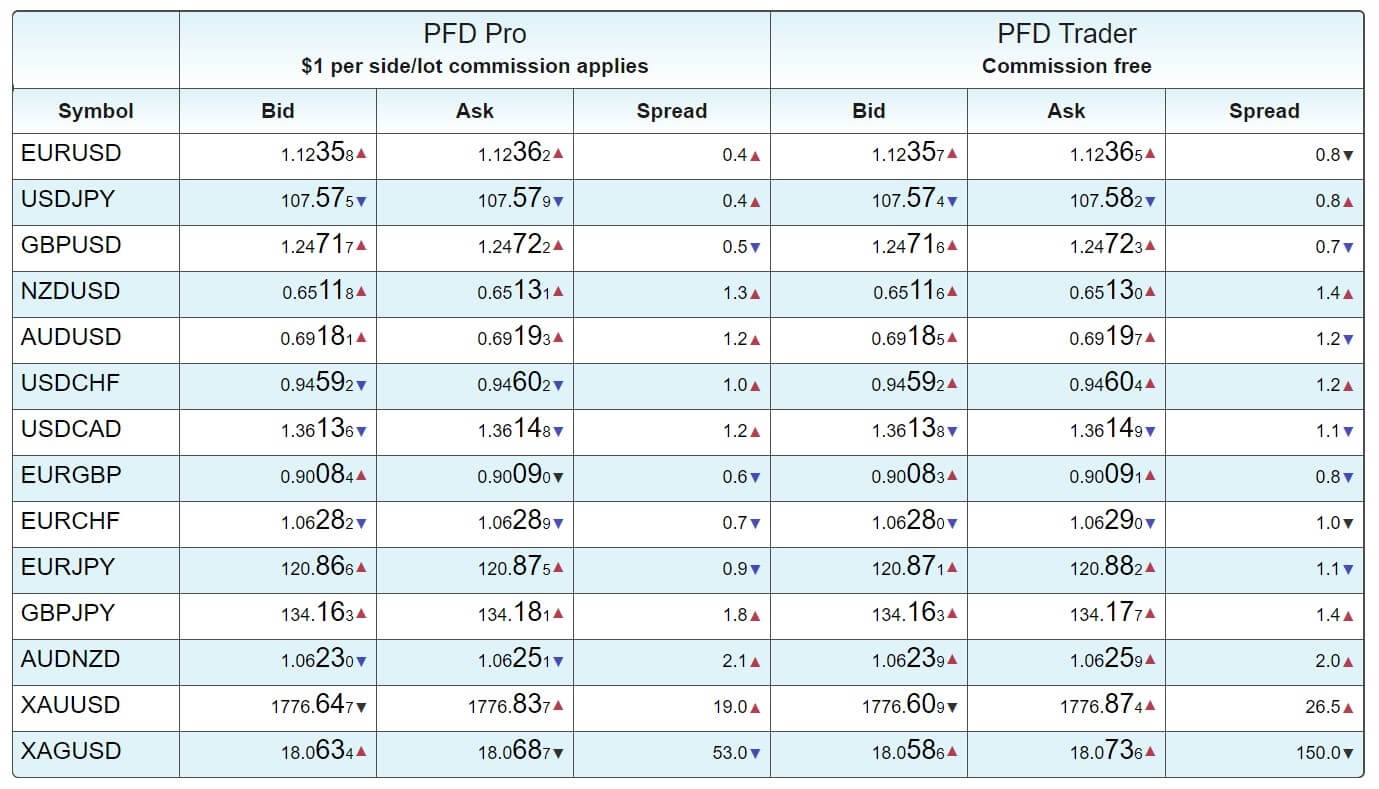

According to the account types page, spreads start from 1 pip on the Pro Royal account and from 1.8 pips on the AED Gold and Prime Royal accounts. The higher spreads are more reasonable due to the lack of commission fees that are charged by the broker. Bear in mind that certain conditions may affect the spreads that one would see. For example, during the first few hours that the market is open, thinner liquidity may result in wider spreads than those advertised. Rollover can also widen spreads, or generally any time of high market volatility. The website does provide us with a list of typical spreads based on each instrument, but the list is a little confusing, considering that the chart only lists one option per instrument when there are three account types and two different spread. The listed options seem to fall into the lower category that would apply to Pro Royal accounts. We’ve provided a few examples below.

According to the account types page, spreads start from 1 pip on the Pro Royal account and from 1.8 pips on the AED Gold and Prime Royal accounts. The higher spreads are more reasonable due to the lack of commission fees that are charged by the broker. Bear in mind that certain conditions may affect the spreads that one would see. For example, during the first few hours that the market is open, thinner liquidity may result in wider spreads than those advertised. Rollover can also widen spreads, or generally any time of high market volatility. The website does provide us with a list of typical spreads based on each instrument, but the list is a little confusing, considering that the chart only lists one option per instrument when there are three account types and two different spread. The listed options seem to fall into the lower category that would apply to Pro Royal accounts. We’ve provided a few examples below.

The highlight of Kirik Market’s educational material comes as a free training course, which aims to provide traders with insight into the market, a detailed overview of the MT5 platform, steps to building a professional trading system, and how to understand risk management while avoiding mistakes. Upon completion of the free course, traders are provided direct support with a trainer and Skype consultant that help to tailor one’s strategy. Yet another plus is the ability to participate in this program online, at an office location, or even in person in your own home. The personal approach to the program is unlike many other offers we’ve seen before, so beginners should certainly consider taking advantage of the offer. We’ve also provided an overview of various other resources below.

The highlight of Kirik Market’s educational material comes as a free training course, which aims to provide traders with insight into the market, a detailed overview of the MT5 platform, steps to building a professional trading system, and how to understand risk management while avoiding mistakes. Upon completion of the free course, traders are provided direct support with a trainer and Skype consultant that help to tailor one’s strategy. Yet another plus is the ability to participate in this program online, at an office location, or even in person in your own home. The personal approach to the program is unlike many other offers we’ve seen before, so beginners should certainly consider taking advantage of the offer. We’ve also provided an overview of various other resources below. Along with the majority of other forex brokers, Kirik Markers recognizes the benefits that demo accounts can offer their clients and have therefore made these accounts available to any trader free of charge. The non-expiring demo accounts can be opened by clicking on the “+” sign at the top right corner of the website and filling in the short form. The form allows traders to choose leverage from 1:100 up to 1:500 and an amount of virtual funds from $1,000 to $1,000,000 can also be chosen. The customization options are a bit more detailed than some of the demo accounts we’ve seen before, where leverages are pre-set and funds are often set at unrealistic amounts. Fortunately, the broker does make it possible for the account to be more personalized.

Along with the majority of other forex brokers, Kirik Markers recognizes the benefits that demo accounts can offer their clients and have therefore made these accounts available to any trader free of charge. The non-expiring demo accounts can be opened by clicking on the “+” sign at the top right corner of the website and filling in the short form. The form allows traders to choose leverage from 1:100 up to 1:500 and an amount of virtual funds from $1,000 to $1,000,000 can also be chosen. The customization options are a bit more detailed than some of the demo accounts we’ve seen before, where leverages are pre-set and funds are often set at unrealistic amounts. Fortunately, the broker does make it possible for the account to be more personalized.

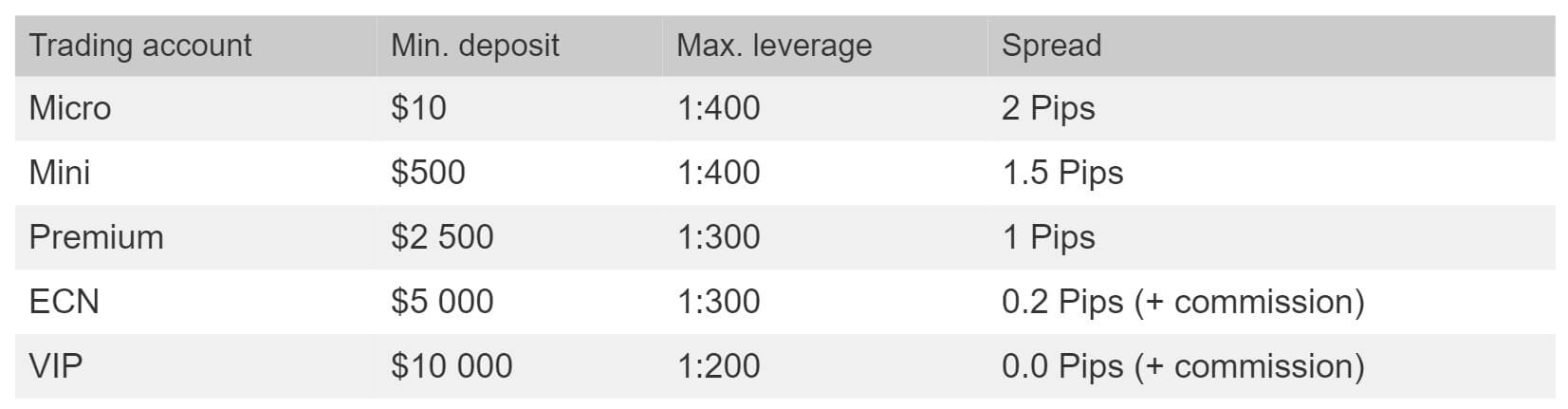

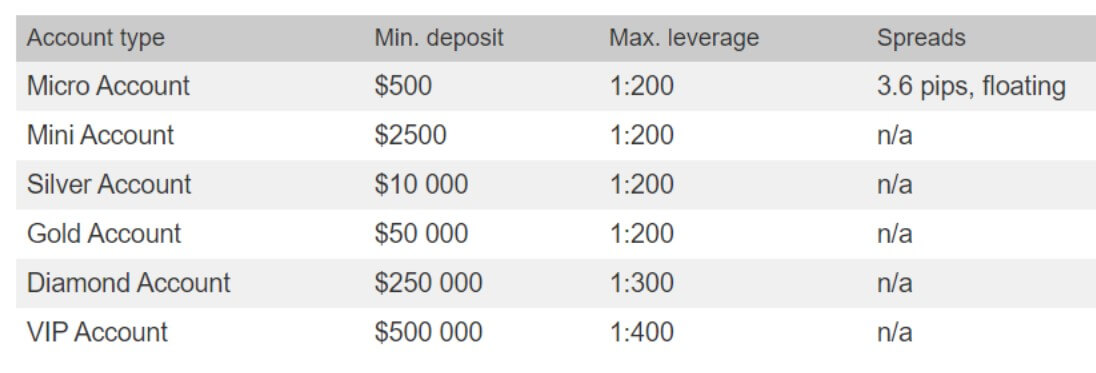

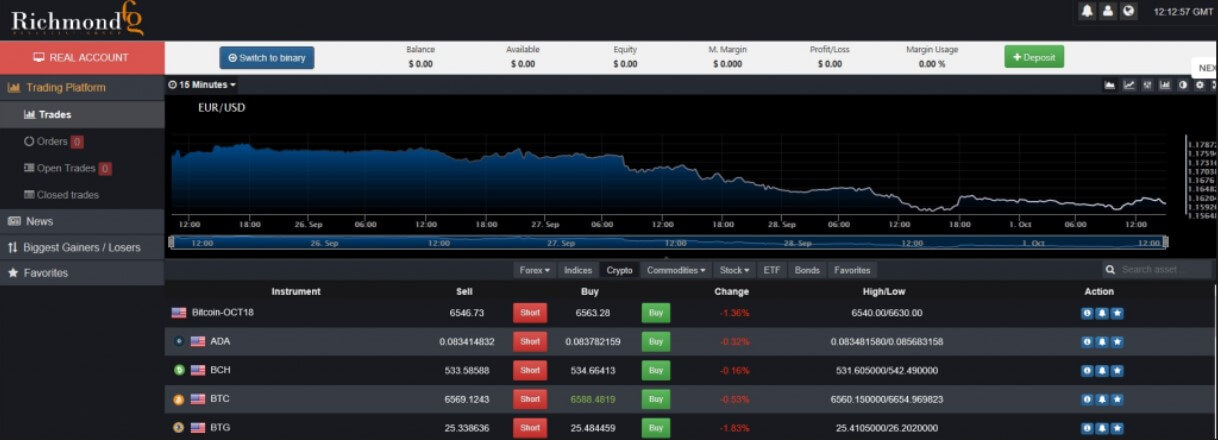

Different types of trading are supported, including high-low, touch-no-touch, AboveBelow, and many more. The broker features margin loans at a percentage rate that varies by account. The smallest loan starts at 10% on the Micro account, increases to 25% on the Mini account, and so forth, until topping out at a 100% loan on the VIP account. Not surprisingly, the website doesn’t actually mention which levels stop-out would occur, and it isn’t clear as to whether those levels are shared by each account, or differ based on one’s status.

Different types of trading are supported, including high-low, touch-no-touch, AboveBelow, and many more. The broker features margin loans at a percentage rate that varies by account. The smallest loan starts at 10% on the Micro account, increases to 25% on the Mini account, and so forth, until topping out at a 100% loan on the VIP account. Not surprisingly, the website doesn’t actually mention which levels stop-out would occur, and it isn’t clear as to whether those levels are shared by each account, or differ based on one’s status.

Richmond Financial Group features more than 60 animated videos on its website, along with some educational articles. Further resources are offered based on one’s account type. Traders that open an account of the Mini level or above can access a weekly live stream trading seminar. Gold level accounts and above can enjoy the benefit of a personal account manager. Gold account members are also given weekly one-on-one

Richmond Financial Group features more than 60 animated videos on its website, along with some educational articles. Further resources are offered based on one’s account type. Traders that open an account of the Mini level or above can access a weekly live stream trading seminar. Gold level accounts and above can enjoy the benefit of a personal account manager. Gold account members are also given weekly one-on-one

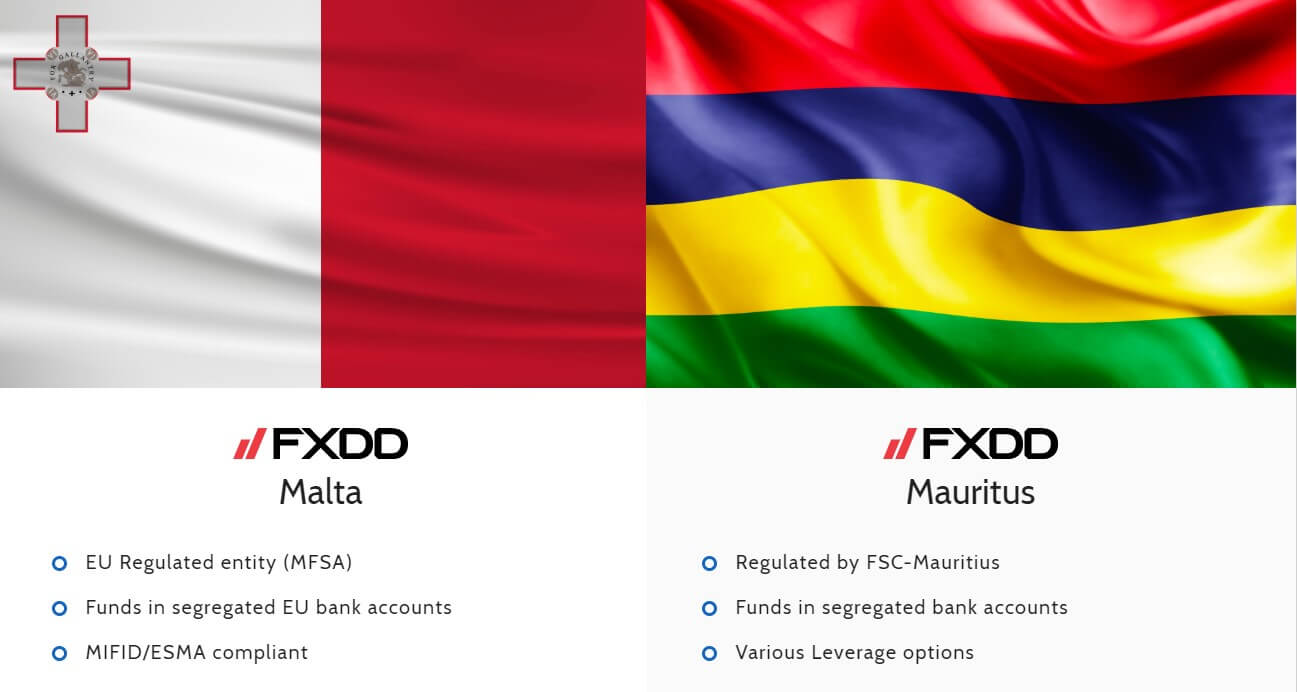

You can contact FXDD anytime between 5 pm on Sunday and 4:55 pm on Friday (Eastern Standard Time). They can be reached via phone, email, and regular mail. You also have the option of communicating with them by filling out a contact form on the website.

You can contact FXDD anytime between 5 pm on Sunday and 4:55 pm on Friday (Eastern Standard Time). They can be reached via phone, email, and regular mail. You also have the option of communicating with them by filling out a contact form on the website.

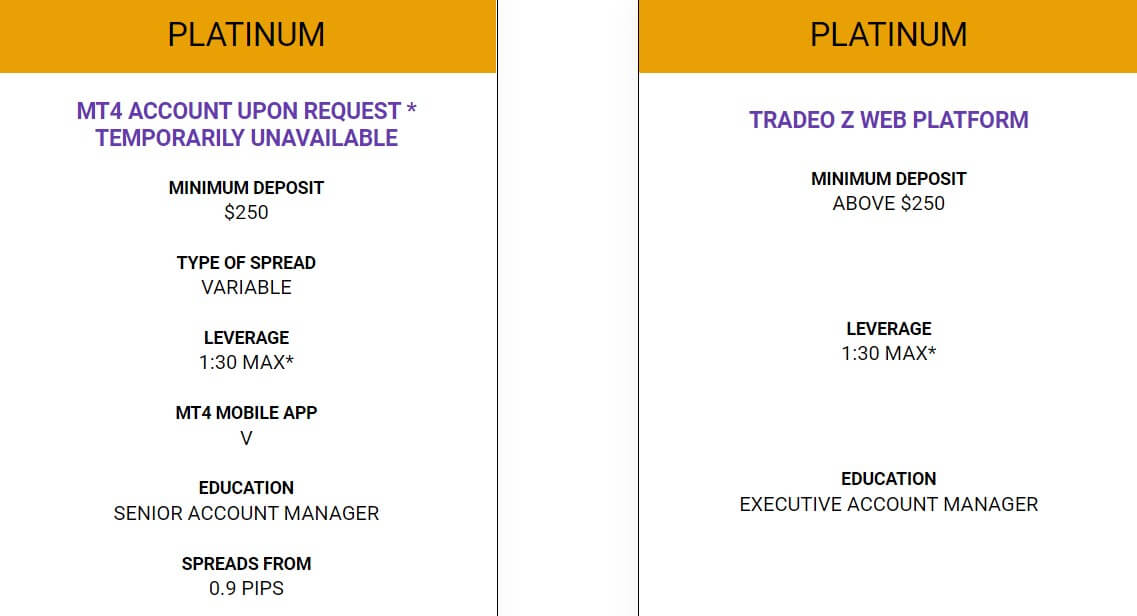

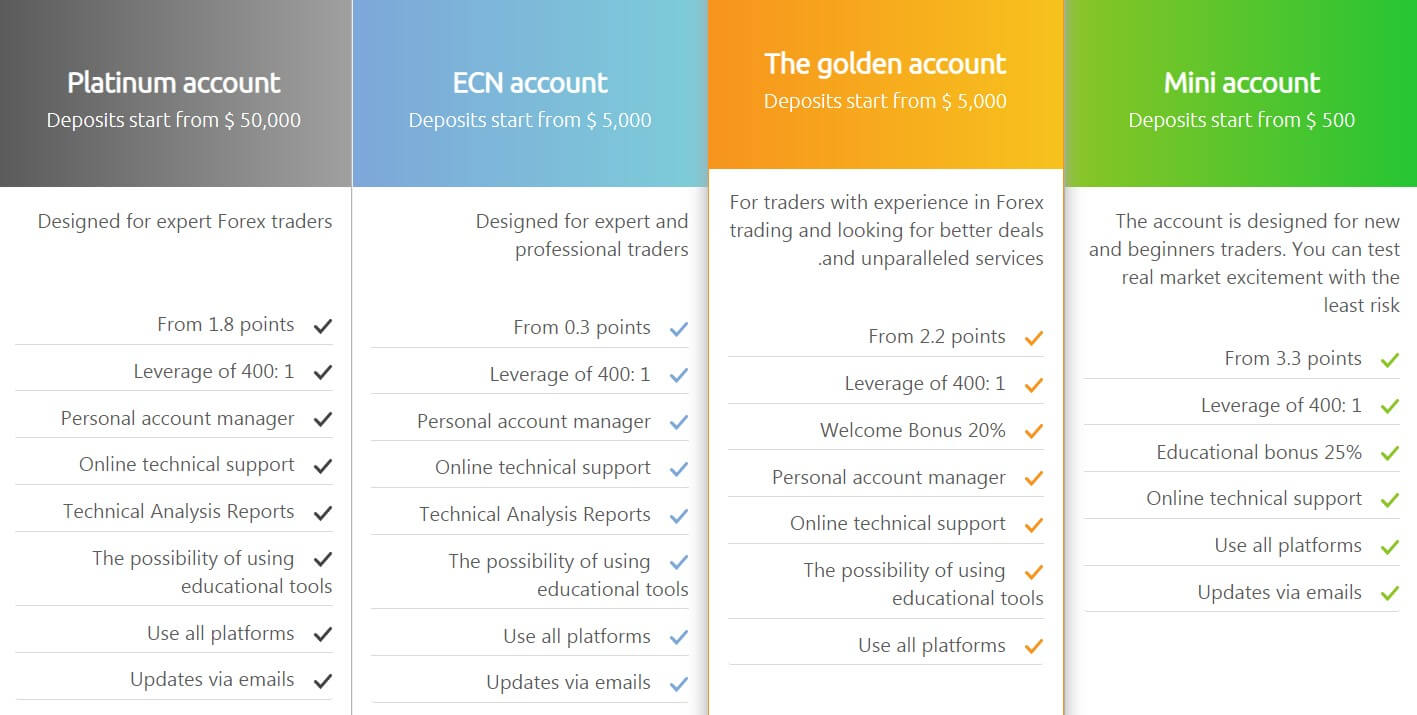

The broker’s website features an education section that includes a forex glossary, articles, demo accounts, and a FAQ. When listing each account’s features, NetoTrade mentions the possibility to use educational tools on the Golden, ECN, and Platinum accounts, which means that Mini account holders are excluded. It’s extremely disappointing when traders try to withhold resources from certain account holders, especially considering that Mini account holders are more likely to be beginner-level status and would need the tools more than other traders. Educating clients is in the broker’s best interest, so it makes no sense to not offer those resources to everyone. It also isn’t clear as to whether traders would actually have access to additional resources since there are accessible options on the website.

The broker’s website features an education section that includes a forex glossary, articles, demo accounts, and a FAQ. When listing each account’s features, NetoTrade mentions the possibility to use educational tools on the Golden, ECN, and Platinum accounts, which means that Mini account holders are excluded. It’s extremely disappointing when traders try to withhold resources from certain account holders, especially considering that Mini account holders are more likely to be beginner-level status and would need the tools more than other traders. Educating clients is in the broker’s best interest, so it makes no sense to not offer those resources to everyone. It also isn’t clear as to whether traders would actually have access to additional resources since there are accessible options on the website.