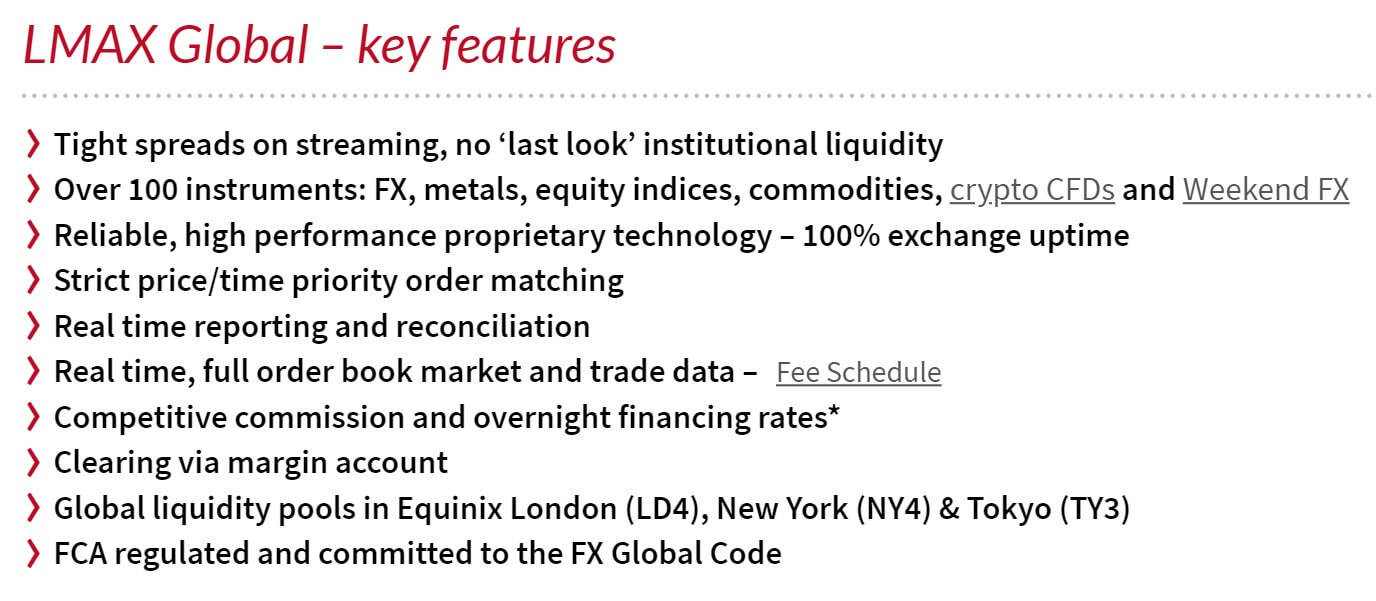

LMAX Global is an FCA regulated broker based in the United Kingdom. They have been around a long time and claim that many of their key features are their tight spreads, they offer plenty of tradable assets, reliable, high-performance platforms, and the fact that they are FXA regulated. We will be using this review to delve deeper into the services on offer so you can decide if they are the right broker for you.

Account Types

The accounts that you use will depend on the trading platform that you are going to use, we have outlined some of their main features below.

MetaTrader 4 Account This account requires a minimum deposit of at least $1000, it has trade sizes starting from 0.01 lots with a full lot being equal to 100,000 base units. Spread starts from 0 pips and the account has access to Spot FX, Spot Commodities, Equity Indices, and Crypto CFDs. The margin level is set at 100% with the stop out level being set at 70%. You are allowed to hedge on this account and there is an added commission of $5.2 per lot traded.

MultiChart Account: This account requires a minimum deposit of at least $1000, it has trade sizes starting from 1 lot with a full lot being equal to 1,000 base units. Spread starts from 0 pips and the account has access to Spot FX, Spot Commodities, Equity Indices, crypto CFDs. The margin level is set at 100% with the stop out level being set at 70%. The account has a commission for metals, energies, and CFDs of 0.0020% of the notional traded in the second named currency.

LMAX Client This account requires a minimum deposit of at least $1000, it has trade sizes starting from 0.1 lots with a full lot being equal to 10,000 base units. Spread starts from 0 pips and the account has access to Spot FX, Spot Commodities, Equity Indices, crypto CFDs. The margin level is set at 100% with the stop out level being set at 70%. The account has a commission for metals, energies, and CFDs of 0.0020% of the notional traded in the second named currency.

Quantower: This account has the exact same features and conditions as the LMAX Client account.

API Trading: This account has the exact same features and conditions as the LMAX Client account.

Platforms

There are a few different platforms available. We have outlined them below along with some of their main features.

MetaTrader 4 (MT4): MetaTrader 4 is a hugely popular trading platform and comes in the form of a desktop download, WebTrader, and mobile application. The platform has thousands of compatible indicators and EAs that allow you to analyze and automatically trade with the platform. There are a variety of timeframes available for each asset that provide a detailed analysis of price dynamics. MT4 further provides a large number of built-in indicators and tools to help simplify the process of analysis.

LMAX Global Platform: Not a whole lot of information is given away about this platform, but some of its features include direct access to all LMAX Global markets, low latency, anonymous trading, a streamlined efficient, and superior execution, and an easy to use and feature-rich professional user interface.

Quantower: This is a platform from the Quantower company and comes with a number of features including that fact that it has easy access to the platform’s features through the control center, charting, analytics, trading interface, multiple simultaneous connections to different brokers, one-click trading, basic and smart order types, and more.

MultiCharts: This is yet another trading platform that offers features such as direct access to all markets on LMAX Global, the ability to trade in Micro lots, native stop orders and contingent orders, high-definition charting and direct chart trading, multiple DOM windows, backtesting, and optimization, EasyLanguage® compatibility, entry, and exit automated trading, and 64-bit format to enable unlimited computer memory usage.

Leverage

The retail account follows the recommendations of the ESMA which are as follows:

Leverage limits on the opening of a position by a retail client from 30:1 to 2:1, which vary according to the volatility of the underlying:

- 30:1 for major currency pairs;

- 20:1 for non-major currency pairs, gold, and major indices;

- 10:1 for commodities other than gold and non-major equity indices;

- 5:1 for individual equities and other reference values;

- 2:1 for cryptocurrencies;

Should you be considered a professional trader then you will be able to get increased leverage up to 1:200.

Trade Sizes

There are a lot of differences between the accounts, we have outlined them below, we have the minimum trade sizes and also the contract sizes.

- MetaTrader 4: 100.000 contracts – Forex 0.01 lot min, CFDs 1 lot min

- MultiChart: 1.000 contracts – Forex 1 lot min, CFDs 1 lot min

- LMAX client: 10.000 contracts – Forex 0.1 lot min, CFDs 1 lot min

- Quantower: 10.000 contracts – Forex 0.1 lot min, CFDs 1 lot min

- API: 10.000 contracts – Forex 0.1 lot min, CFDs 1 lot min

We do not know what the maximum trade sizes are or how many open trades and orders you can have at any one time.

Trading Costs

When trading on the MetaTrader 4 account you have an added commission of:

- USD: FX $ 5.20, CFD $6.40 per standard lot Round-Trip.

- EUR: FX € 4.00, CFD € 4.80 per standard lot Round-Trip.

- GBP: FX £ 3.25, CFD £ 4.00 per standard lot Round-Trip.

When trading on any other account there is an added commission on FX, BULLION, ENERGY, CFDs: 0.0020% of the notional traded in the second named currency.

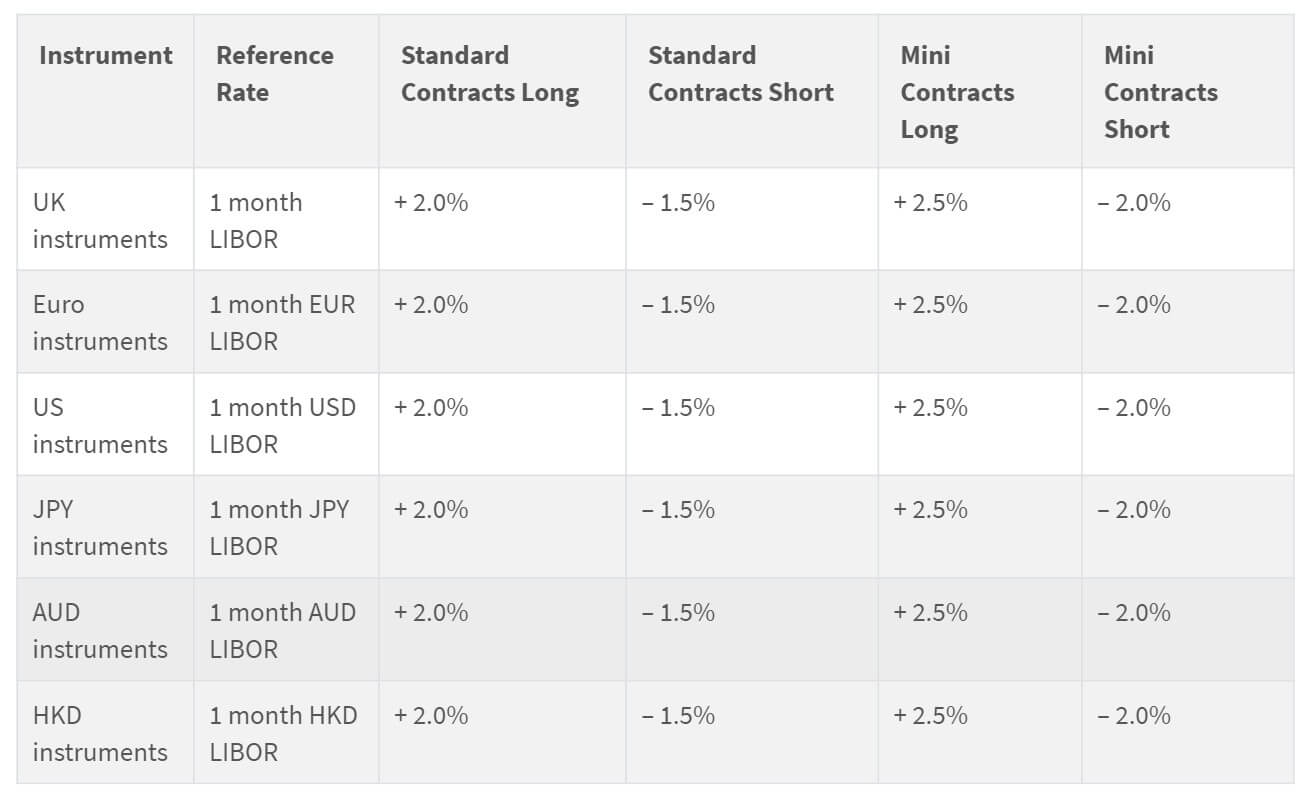

There are also swap charges when holding trades overnight, they can be viewed within the trading platform, there is also an inactivity fee of $50 per month after 6 months of inactivity.

Assets

Sadly there does not appear to be a full breakdown or product specification available, all that we do know is that there are Spot FX, Spot Commodities, Equity Indices, and Crypto CFDs available to trade. It is often good for brokers to display their available assets as certain potential clients will look to see what assets are available, so not knowing will mean that they may well look elsewhere.

Spreads

Spreads on all accounts are stated to start from 0 pips, however, the spreads are variable which means that they will be influenced by the markets, they will often move higher when there is more volatility or less liquidity in the markets. While some spreads may be as low as 0 pips, others will naturally be higher.

Minimum Deposit

The minimum amount required to open up an account is $1,000, this is the amount needed for all of the accounts and also the minimum for further top-up deposits on an already open account.

Deposit Methods & Costs

Just Bank Wire and Credit/Debit Cards are available to deposit with, it would be good to see some additional methods being available. The good news is that there are no added fees from LMAX, however, you should always check with your own bank or card issuer to see if they add any fees of their own.

Withdrawal Methods & Costs

The same two methods of Credit/Debit Card or Bank Wire are available to withdraw with, just like with the deposits there are no added commissions or fees from LMAX but you should check with your own card issuer or bank to see if they charge any incoming transaction processing fees.

Withdrawal Processing & Wait Time

Withdrawal processes should be processed within one working day from the date that the request was made, it should then take a further 1 to 5 working days for the withdrawal to fully process.

Bonuses & Promotions

There does not seem to be any promotions or bonuses active at the time of writing this review, there are also no signs that there have been promotions in the past. Should you wish to check, you could contact the customer service team to see if there are any promotions coming up that you could take part in.

Educational & Trading Tools

There are a few little tools available to use, there is an economic calendar which details different news events that are coming up, it will also give you an indication of the impact that those news events could have. There is a volume-weighted average price chart, global insights, and a VPS is on offer, however, we think you will be required to pay for this from a dedicated forex VPS company.

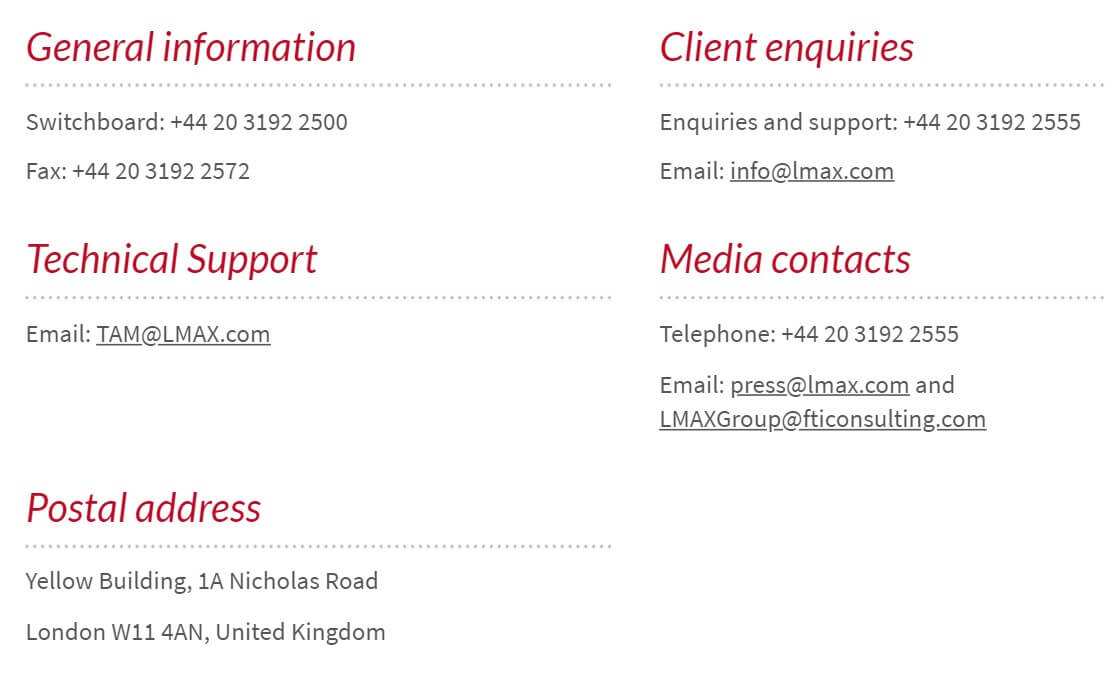

Customer Service

LMAX is offering a number of different ways to get in touch with them which is great, you can use the usual online submission form, fill it in and you should then get a reply via email. You can also use the provided postal address, email address, or phone number. The customer service team is available 24 hours a day between Sunday 22:00 and Friday 22:00 UK time.

Address: 220 C Blythe Rd, London W14 0HH, United Kingdom

Email: [email protected]

Phone: +44 203 192 2555

Demo Account

A demo account is available and they allow you to test out the markets and strategies without any real risks to your own capital. The only options that you get are the platform that you wish to use and the base currency of USD or EUR, the other trading conditions will be matched to those that the platform you chose offers.

Countries Accepted

The following statement is present on the website:

“PLEASE NOTE WE ARE UNABLE TO ACCEPT APPLICATIONS FROM AFGHANISTAN, ALBANIA, AUSTRALIA, BELARUS, BOSNIA-HERZEGOVINA, CONGO DR, COTE D’IVOIRE, CANADA, GUINEA, GUINEA BISSAU, KOSOVO, LEBANON, LIBERIA, MACEDONIA, MONTENEGRO, TUNISIA, ERITREA, GAZA STRIP, HAITI, IRAN, IRAQ, LIBYA, MYANMAR, NORTH KOREA, PAKISTAN, SIERRA LEONE, SERBIA, SINGAPORE, SUDAN, SOMALIA, SYRIA, UNITED STATES, WEST BANK, ZIMBABWE RESIDENTS.”

Conclusion

There are a lot of accounts on offer which are based around the trading platforms, which there are a lot of, so you should be able to find the platform that suits your style. All accounts require a minimum deposit of $1,000, but the leverage on them is restricted down at 1:30 which is far lower than what a lot of retail brokers are now looking for. The spreads are starting low but there is an added commission of $5.2 per lot read, just slightly below the industry average of $6 per lot traded. There is a limited number of ways to deposit and withdraw and while the site states over 100 tradable assets, there is not a breakdown of them. You now hopefully have the information that you need to decide if they are the right broker for you.