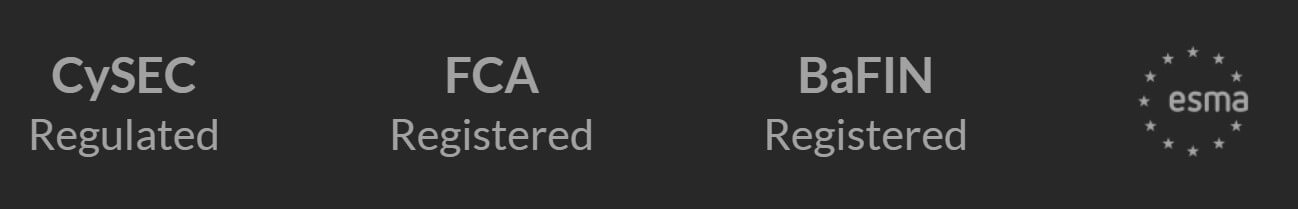

XGlobal Markets is a Forex broker, founded in 2012, offering more than 50 currency pairs, precious metals, and some CFDs on commodities and energy indices. XGlobal Markets is the trademark of X GLOBAL Markets Ltd. This Cypriot investment firm (CIF) is registered in the European Union and authorized by the Cyprus Securities and Exchange Commission (Cysec) under license CIF 171/12.

The Cysec regulation imposes certain standards and requirements on investment firms in Cyprus. An example of these requirements is, they must maintain at least € 1.000.000 to demonstrate a good economic situation. The Commission also requires Forex brokers to keep client funds in segregated accounts separate from the company’s operating funds.

As an additional guarantee to customer funds, all companies regulated by Cysec are members of the Investor Compensation Fund, which can guarantee the compensation of up to 20.000 EUR, if the company becomes insolvent. Also, all companies regulated by Cysec also comply with Mifid and therefore have the right to offer services within the EU under Mifid’s passport regime. As an additional safety measure, Xglobal Markets states that regular internal, Ernst & Young, and external audits of Deloitte are carried out.

ACCOUNT TYPES

XGlobal Markets has 4 accounts, denominated, Trading Account, Corporate Account, Demo Account and in addition, this broker offers non-cash accounts (Islamic) that comply with Sharia (for Muslim traders who do not want to earn interest for religious reasons).

The common account specifications offered by Xglobal Market are:

- Execution Model: Market and Limit (internally matched or externally covered)

- Order Requotes: None

- Minimum Spreads: 0.4 pip / 4 pts

- Spread Type: Variable

- Commission Per Lot Traded: 7.50 USD

- Swap Free / Islamic Conditions Available upon request

- 77 Tradable Currencies, Metals & CFDs

- Leverage Offered 30:1 for retail clients / up to 200:1 for professional clients (ESMA restrictions apply)

- Minimum Deposit: 500 USD/EUR/GBP, 5,000 NOK or 50,000 JPY

- Account Currencies Available: USD, EUR, GBP, NOK, JPY

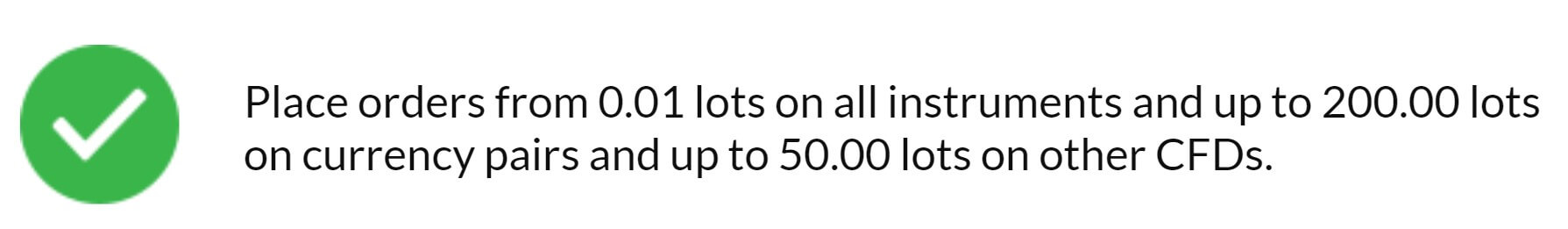

- Minimum Trade Size: 0.01 lots

- Maximum Trade Size: 200.00 lots

- Contract Size of 1.00 Lot (FX), 100,000 units of the base currency

- Maximum Number of Open Positions: Unlimited

- Margin Call Level: 100%

- Stop-Out Level: 50%

- Segregated Bank Accounts Yes, deposits held in Clients’ denominated bank accounts

- Negative Balance Protection Yes (for retail clients)

PLATFORMS

With this broker, we will have the technology of the Metatrader4 platform (MT4). This is the platform most used by most Forex and CFDs operators. Certainly, MT4 has many advantages: experienced operators are accustomed to it, there are a large number of users of the platform, along with the programming language, very easy to learn, has determined the development of many custom tools. Some of these tools are paid and others are free.

LEVERAGE

There is a 30:1 limit for retail clients in place, and up to 200:1 for professional clients (ESMA restrictions apply).

TRADE SIZES

Trade sizes start from 0.01 lot (micro lot), and increments are 0.01 for all instruments. XGlobal Markets offers a maximum trade size of up to 200 lots per click in Forex.

TRADING COSTS

The trading costs with XGlobal Markets, are the spread and a commission of 7.5 USD for each lot traded.

ASSETS

77 tradable Currencies, Metals & CFDs on indexes and commodities.

SPREADS

A few examples of spreads applied by this broker are:

Forex: EURUSD 1.0, GBPUSD 1.5, USDJPY 1.0, AUDUSD 1.3, USDCHF 1.9, EURGBP 1.6

Gold and Silver: XAUUSD 0.300 and XAGUSD 0.030.

Indexes: FDAX (DAX30) 1.5, FTSE100 1.5, Nikkei225 15, Dow Jones 3, SP500 0.75, and Nasdaq 1,25

Commodities: Light Sweet Crude Oil (WTI) 0.03, Brent Crude Oil 0.03, Natural Gas 0.022, and Coffee Future 0.25

MINIMUM DEPOSIT

The minimum deposit required is 500 USD / EUR / GBP or 50,000 JPY.

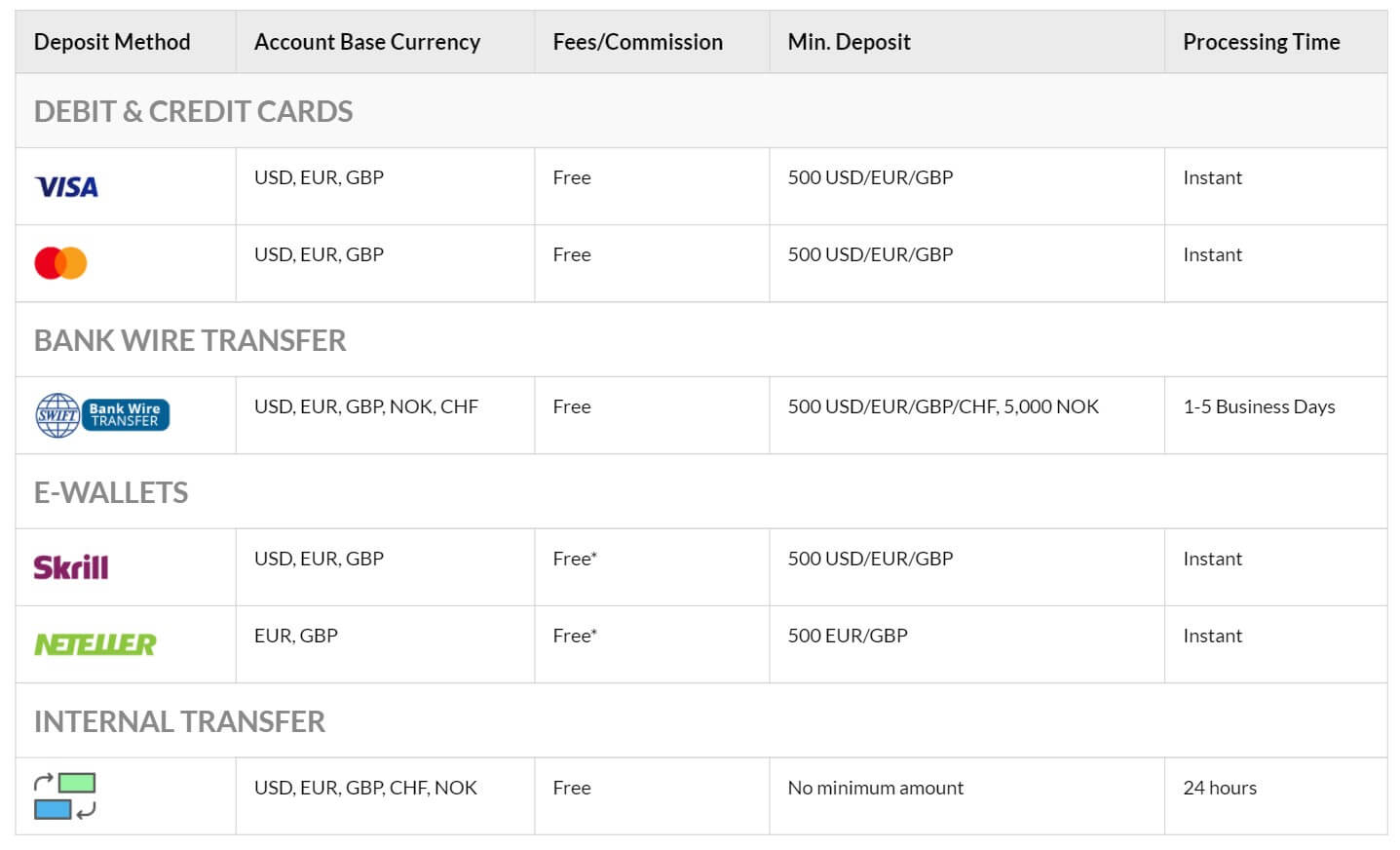

DEPOSIT METHODS & COSTS

The methods available for depositing are 3, bank transfer, Skrill, or Neteller:

Bank Transfer: Supports the following currencies, USD, EUR, GBP, or JPY. No deposit fees. Minimum amount to deposit, 500 USD / EUR / GBP, 50,000 JPY.

Skrill: Supports the following currencies, USD, EUR, GBP, or JPY. No deposit fees. Minimum amount to deposit, 500 USD / EUR / GBP, 50,000 JPY.

Neteller: Available for the following currencies, EUR, GBP, JPY. No deposit fees. Minimum amount to deposit, 500 EUR / GBP, 50,000 JPY.

The time taken for deposits with these methods is, bank transfer, between 2 and 5 working days. With Skrill or Neteller the deposit is instant.

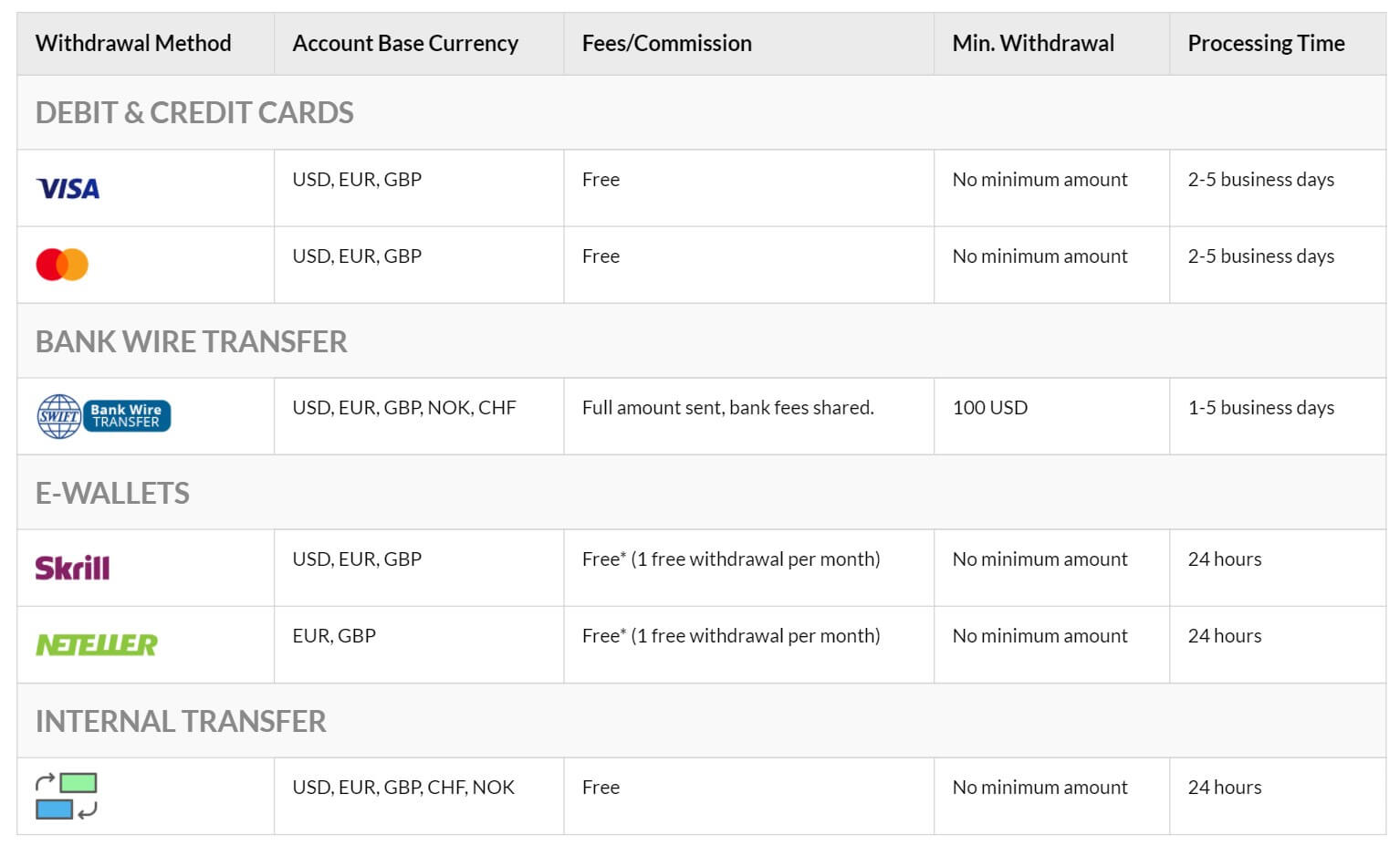

WITHDRAWAL METHODS & COSTS

The withdrawal methods are the same as for the deposits, and all withdrawals will be made to the same source from which the deposits were made. These are the characteristics of the retreats:

Bank Transfer: Currency available, USD, EUR, GBP, or JPY. It does not specify the cost of these and informs that the Eurobank rates will be applied. The minimum withdrawal amount is USD 100 or the equivalent currency.

Skrill: Currencies available, USD, EUR, GBP, or JPY. Withdrawal fees are free with a limit of 1 monthly withdrawal, subsequent withdrawals will have a commission of 1%. There is no minimum amount for withdrawal.

Neteller: Available currencies, EUR, GBP, and JPY. Withdrawal fees are free with a limit of 1 monthly withdrawal, subsequent withdrawals will have a commission of 2%. There is no minimum amount for withdrawal.

WITHDRAWAL PROCESSING & WAIT TIME

XGlobal Markets processes withdrawals on the same business day you receive the request.

The waiting times according to the chosen withdrawal method are:

- Bank transfer: 1 business day

- Skrill: 1 business day

- Neteller: 1 business day

BONUSES & PROMOTIONS

We haven’t found any promotions or bonuses currently.

EDUCATIONAL & TRADING TOOLS

XGlobal Markets has 4 fairly complete courses in its educational area.

A summary of the contents you can find are:

Beginner Course: What is Forex Trading All About. The concept of Fundamental Analysis. Introduction to Technical Analysis. How to successfully choose a bróker. The principles behind lots trading and pips calculation.

Japanese Candlesticks: Japanese Candlestick Basics. Double Candlestick Patterns. Interpreting Candlestick Patterns.

Technical Indicators: Support and Resistance Lines. Trendlines. Channel Line. Bollinger Bands. The Relative Strength Index (RSI). Moving Averages.

Money Management: Intro to Money Management. Money Management Main Guidelines. Trade Diversification and Risk Management Strategies. Trade Timing Tactics. Summary of Money Management and Trading Guidelines.

CUSTOMER SERVICE

There are several ways to contact customer service, mainly by phone and e-mail. We need a live chat to speed up consultations.

The phones and emails to contact are:

Customer Support: +357 25 262002 [email protected] Working Hours: 24 hours, 5 days a week

Sales: +357 25 262002 [email protected] Working Hours: 09:00-18:00 EET.

Back Office: [email protected] Working Hours: 06:00-24:00 EET.

Marketing: +357 25 262002 [email protected] Working Hours: 09:00-18:00 EET

Partnerships: +357 25 262002 [email protected] Working Hours: 09:00-18:00 EET

Accounting Department: +357 25 262002 [email protected] Working Hours: 09:00-18:00 EET.

Their offices are in XGLOBAL Markets Ltd. 162 Fragklinou Rousvelt, 1st Floor. 3045, Limassol, Cyprus

Tel: +357 25 262002

Fax: +357 25 560202

Email: [email protected]

DEMO ACCOUNT

XGlobal Markets offers a free DEMO account with which you can trade in fictional money emulating a real-money operation.

A Demo account can benefit the trader in 2 ways:

– Practicing commercial techniques

– Learning the different tools of the platform.

It is very common for traders to open a Demo account before depositing money into a real account.

It is also important to know that the Demo account retains the same live prices and market conditions, simulating the exposure in a real account.

COUNTRIES ACCEPTED

XGlobal Markets reports that according to the Dodd-Frank Act approved by the United States Congress. UU, The CFTC (Commodity Futures Trading Commission) no longer allows US residents to open commercial accounts outside the U.S.

CONCLUSION

XGlobal Markets is a well-regulated broker that offers us to trade more than 50 currency pairs, precious metals, commodities, and stock indices. We have the popular MT4 trading platform, which is highly appreciated by traders.

To summarize the above, here are the advantages and disadvantages with respect to Xglobal Markets:

Advantages:

- Well regulated broker

- MT4 available

- STP model

Disadvantages:

- Commission of 7.5 USD per lot operated

- Spread for retail customers is scarce