Are you here because your forex broker hasn’t been meeting your expectations lately? If so, then you don’t have to settle. New brokers open their doors every single day and hundreds of options have probably popped up since you first signed up for that old trading account. Finding a new broker can offer multiple benefits, from reduced fees to a wider selection of trading instruments, the chance to make extra money through bonuses, and more. If you’re seriously considering switching, then take a look at our list of tell-tale signs that you need to find a new forex broker.

Sign #1: You’re Paying Too Much in Fees

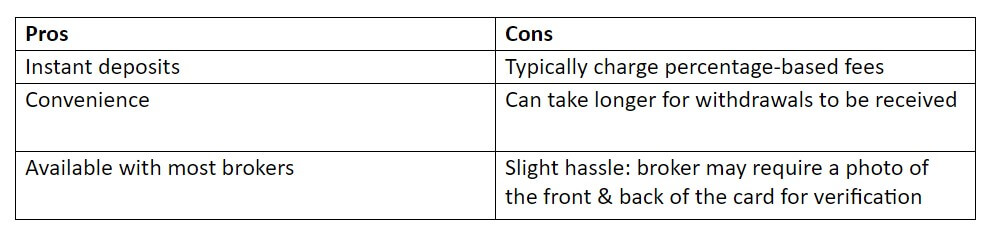

You’re likely paying commissions, spreads, and possibly withdrawal fees for trading through your broker. In some cases, you might not be paying commissions but you’re dealing with a higher spread to make up for it. If you’ve been trading with the same company for some time, you may not have been paying much attention to these fees, but have you compared them to any other brokers lately? If your broker is charging you a spread that is above 1.5 pips on EURUSD, we can almost guarantee that their other prices are too high, which means that you could be walking away with more of your own money in your pocket at the end of the day if you simply switch to a broker with cheaper fees. There’s also a good chance you could find a broker with no withdrawal fees for debit cards versus the 7% fees we’ve seen listed through several brokerages.

Another thing to watch out for are extra charges, like inactivity fees or account maintenance charges. Some brokers do charge small inactivity fees to clear out balances that are left behind forever, but others charge high fees after about a month of zero trading activity. Account maintenance charges are basically like made-up charges that your cell phone provider would come up with to make a few extra dollars. Now is a good time to check your broker’s terms & conditions to see if any of these fees apply. If so, you might want to switch, especially if you’ve been hit with inactivity fees before.

Sign #2:LacklusterCustomer Service

When it comes to customer service, a good broker offers flexible hours, quick and convenient contact methods, and polite service representatives. Sadly, you won’t find this available with every broker and you’d have an easier time pulling teeth than getting in touch with an agent through some shadier brokerages. Imagine having an issue where you never received a withdrawal you desperately needed, but you couldn’t get in touch with anyone to find out what happened. Or perhaps you simply get locked out of your account and can’t reset your password, so you’re stuck missing out on trading opportunities for days while you wait for an agent to respond to you. If you haven’t been there before, there’s always a chance that this will affect you in the future. Rudeness is another thing that you shouldn’t have to tolerate and is a sure sign that you’ll do better with another company.

Sign #3: Limited Trading Opportunities

If you’re a trader that is only interested in currency pairs, then this one might not matter to you as much, as long as your broker offers a good selection of majors, minors, and exotics. However, many traders do look to diversify their trading portfolio over time, even if they started out focusing only on currency pairs. If this is the case for you, then you’ve probably outgrown your forex broker if they don’t offer much in the way of commodities, stocks, or cryptocurrencies. If you’re in this situation, you might want to switch to gain access to a wider diversity of investment options – or you could open a secondary account through another broker and continue to trade currencies on your current account if your broker offers competitive prices.

Sign #4: An Unsatisfactory Trading Platform

Some brokers offer access to award-winning platforms like MetaTrader 4 and/or 5, or they have their own trading platform for users to trade on. If you’re dealing with a broker that lets you trade on MT4 or MT5, then you already have access to one of the best platforms out there, but don’t hesitate to switch if you don’t personally like those options. If your broker offers their own platform, you’ll need to think about how satisfied you are with the features and tools within it. Does it seem basic? If your trading platform is missing out on all the tech you’re looking for, consider switching. Also, know that more popular brokers are more likely to offer outstanding platforms, while smaller shadier brokers are likely offering up more basic trading platforms.

Sign #5: Your Broker Is Too Basic

Some brokers have a lot to offer in the way of extra perks, like bonuses and promotional opportunities, a wide selection of assets to choose from, a wide array of educational resources, trading tools like calculators, amazing trading platforms, and etc. Others only offer a basic trading platform with zero resources or extra perks on their site. Obviously, the latter is rather boring when there are so many companies offering so much more out there. If your broker only offers the bare minimum, we highly recommend looking at other options so that you can benefit more from the trading experience.