There are a lot of advantages to trading forex over some of the other methods of trading such as stocks, some of these advantages are the leverage that you can use, the liquidity in the markets, and the volatility that the markets can give. Each of these gives you a huge advantage as a trader and can help boost your potential earnings. Of course, they can also add a bit of risk to your trading too. We are going to be looking at some of the advantages of trading forex today.

Leverage

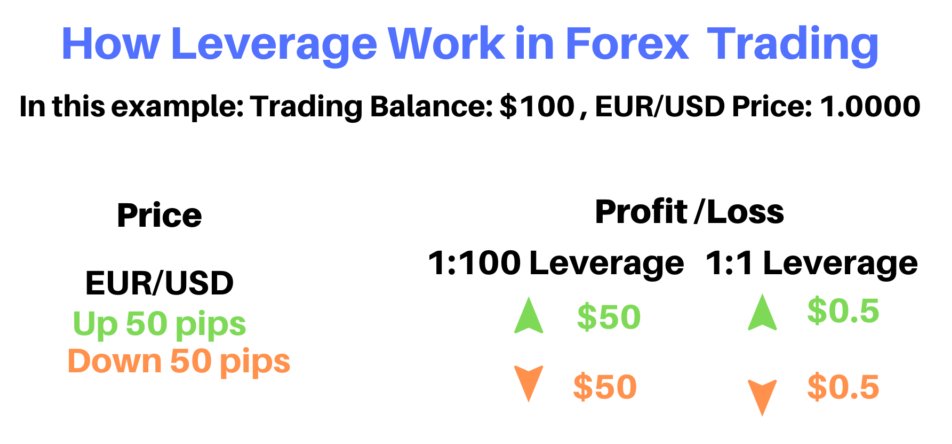

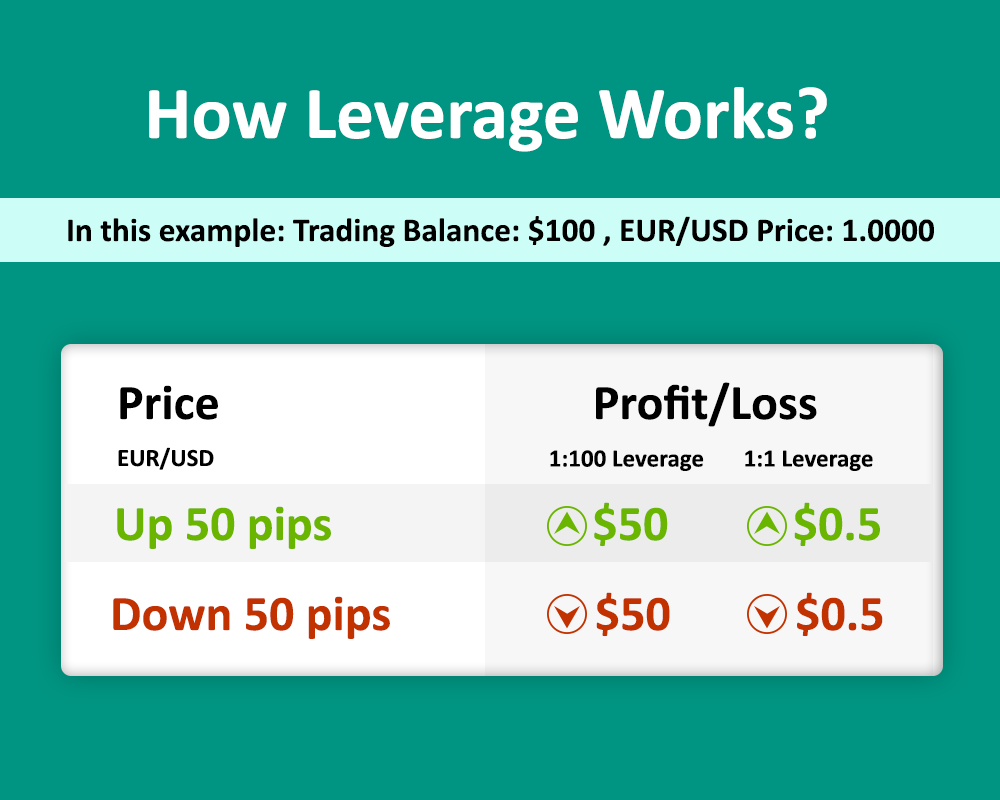

The first advantage that we are going to be looking at is leverage, but before we work out why it is good, let’s get a little understanding of what it actually is. Leverage basically allows you to borrow the money that is needed to make a trade from your brokers. It allows you to place trades that are far larger than your balance would otherwise allow you to make, this is one of the reasons why it is so sought after. So if we take a simple example, let’s imagine that you have a balance of just $100, you would not be able to place much with a 1:1 leverage on the account, so we go for a 100:1 account. This means that for every $1 that we have in our account, the broker will top it up to $100, so will add $99 themselves. So that $100 account is now acting like a $10,000 account, allowing you to make far more trades. Of course, some brokers go higher, at 500:1, 1000:1, or even 2000:1, the latter two are a little too high and the 500:1 seems to be the sweet spot.

So that is what leverage is, but how is it helpful to us as traders and why is it one of the major advantages of forex trading? To put things simply, leverage allows us to trade a lot more and thus make a lot more profits. After all, why would you trade with an account with just $100 in it when you could be trading the equivalent of a $10,000 account. You should bear in mind, that while the brokers are giving you this money to trade with, it is not yours to keep, you will have to return it, and should you lose, you may have to pay it back, although most brokers now offer negative balance protection to help this. The main advantage is that it lets you trade with more and so they can earn more in profits. Larger trades mean larger profits and that is the main advantage to it. It does come with risks, but with proper risk management it is very manageable, so do not be afraid of taking larger leverage, just bear in mind that it does come with some risks.

Liquidity

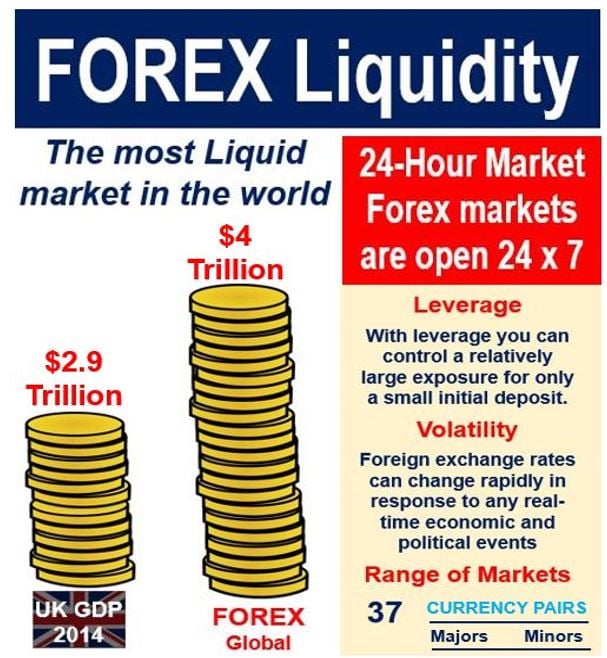

The forex markets are one of the most liquid markets in the world, this simply means that there is a lot of money available to be traded at any one time. Liquidity is basically defined as the ability for a currency or asset to be traded on demand. As the forex markets are so liquid, this basically means that you are able to trade at any given time whenever you want, and the more liquid that a currency pair is, the lower the spread cost that comes with it. With high levels of liquidity also comes a certain level of calm, the markets will not jump up and down as violently when there is a lot of liquidity in the markets, making it a slightly safer investment opportunity. While the forex markets as a whole are incredibly liquid, there are some pairs that are a little less liquid and so the spreads may be higher and there may be larger jumps in those currency pairs.

The forex markets are one of the most liquid markets in the world, this simply means that there is a lot of money available to be traded at any one time. Liquidity is basically defined as the ability for a currency or asset to be traded on demand. As the forex markets are so liquid, this basically means that you are able to trade at any given time whenever you want, and the more liquid that a currency pair is, the lower the spread cost that comes with it. With high levels of liquidity also comes a certain level of calm, the markets will not jump up and down as violently when there is a lot of liquidity in the markets, making it a slightly safer investment opportunity. While the forex markets as a whole are incredibly liquid, there are some pairs that are a little less liquid and so the spreads may be higher and there may be larger jumps in those currency pairs.

Some of the higher liquidity pairs include EURUSD, GBPUSD, USDJPY, EURGBP, AUDUSD, USDCAD, USDCHF, and NZDUSD. Some of the lower liquidity pairs include the exotic pairs such as PLNJPPY, these sorts of currency pairs cannot be purchased in huge lot sizes due to the lack of liquidity, however, with smaller trade sizes they can offer large jumps and large potential profits and losses.

Volatility

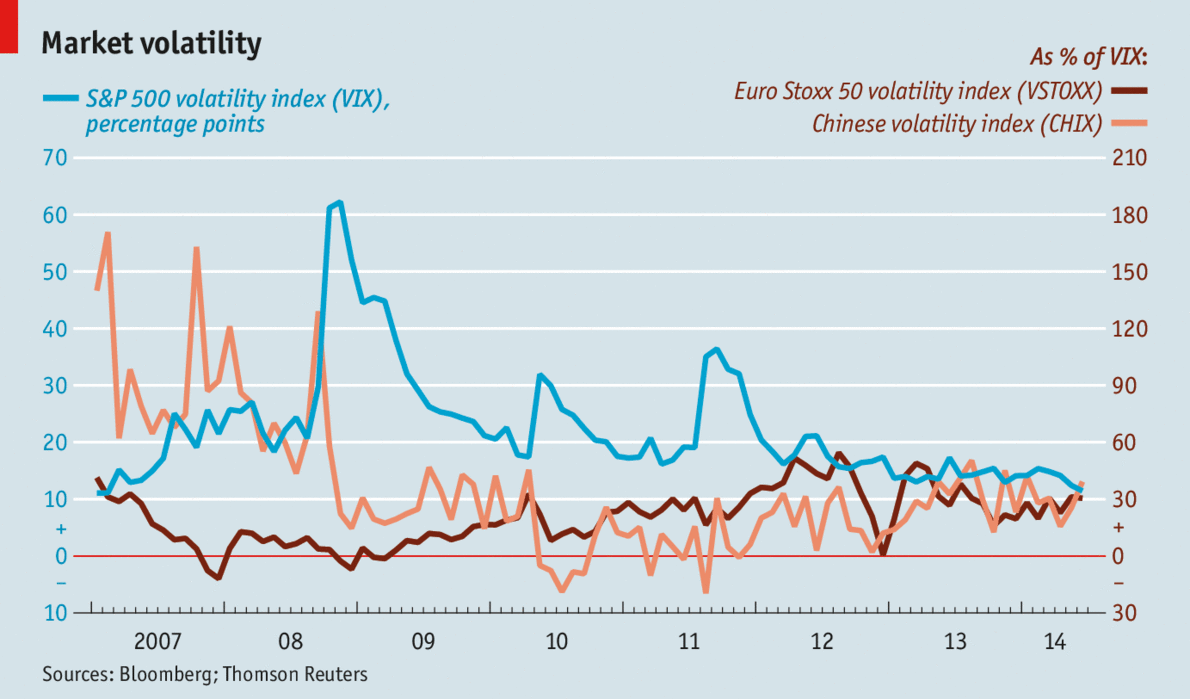

Volatility within the forex markets is basically a measure of the frequency and the size of changes to a currency’s value. If something is described as having high volatility, this simply means that that currency or currency pair has frequent movements within its market price and those movements can be sharp and large, whereas a currency that is considered to have lower volatility will simply move up and down at a more controlled pace and those movements will not be as sudden and the price is far less likely to simply jump up and down.

Both high and low volatility pairs can offer us some advantages as a trader, if we take high volatility, the profit potential of these pairs is far higher than low volatility pairs. Imply due to the fact that the markets will be moving a lot more and when they do move, they move a much larger distance. So a single trade on a highly volatile pair has a lot higher profit potential in a shorter period of time than one on a low volatile pair. Having said that, there are advantages to a low volatility pair too, they are much safer to trade, you do not need to worry about any sudden jumps in the wrong direction and they are often considered as being a lot easier to predict. The slow movements allow you to constantly analyze the markets and changing conditions, allowing you to get in and out at a much more comfortable level. Which one works for you the best will simply come down to your own preferences and your own trading style.

So that is Leverage, Liquidity, and Volatility, all three offer you very different advantages to trading forex, and combined they are the reason why forex trading is becoming so popular for both professionals and retail traders. Ensure that you get an understanding of how each one works, this will enable you to much better maintain your account and to understand the risks and advantages that you are getting from your account and the markets that you are trading. Do not be afraid to experiment with different pairs that offer different volatility and liquidity, part of being a good trader is trying out new ways to make a profit.

You often hear margin being mentioned, it is also mentioned quite a lot within trading platforms such as MetaTrader 4 or 5. But do we actually understand what it is and how it works? The easiest way of looking at it is to think of it as a loan from the broker which has been given to help cover the position that you are entering the market with. Without having margin, you would not be able to use the leverage that is being offered, the broker uses this margin in order to keep our position open and to cover the potential losses as it goes into drawdown.

You often hear margin being mentioned, it is also mentioned quite a lot within trading platforms such as MetaTrader 4 or 5. But do we actually understand what it is and how it works? The easiest way of looking at it is to think of it as a loan from the broker which has been given to help cover the position that you are entering the market with. Without having margin, you would not be able to use the leverage that is being offered, the broker uses this margin in order to keep our position open and to cover the potential losses as it goes into drawdown.