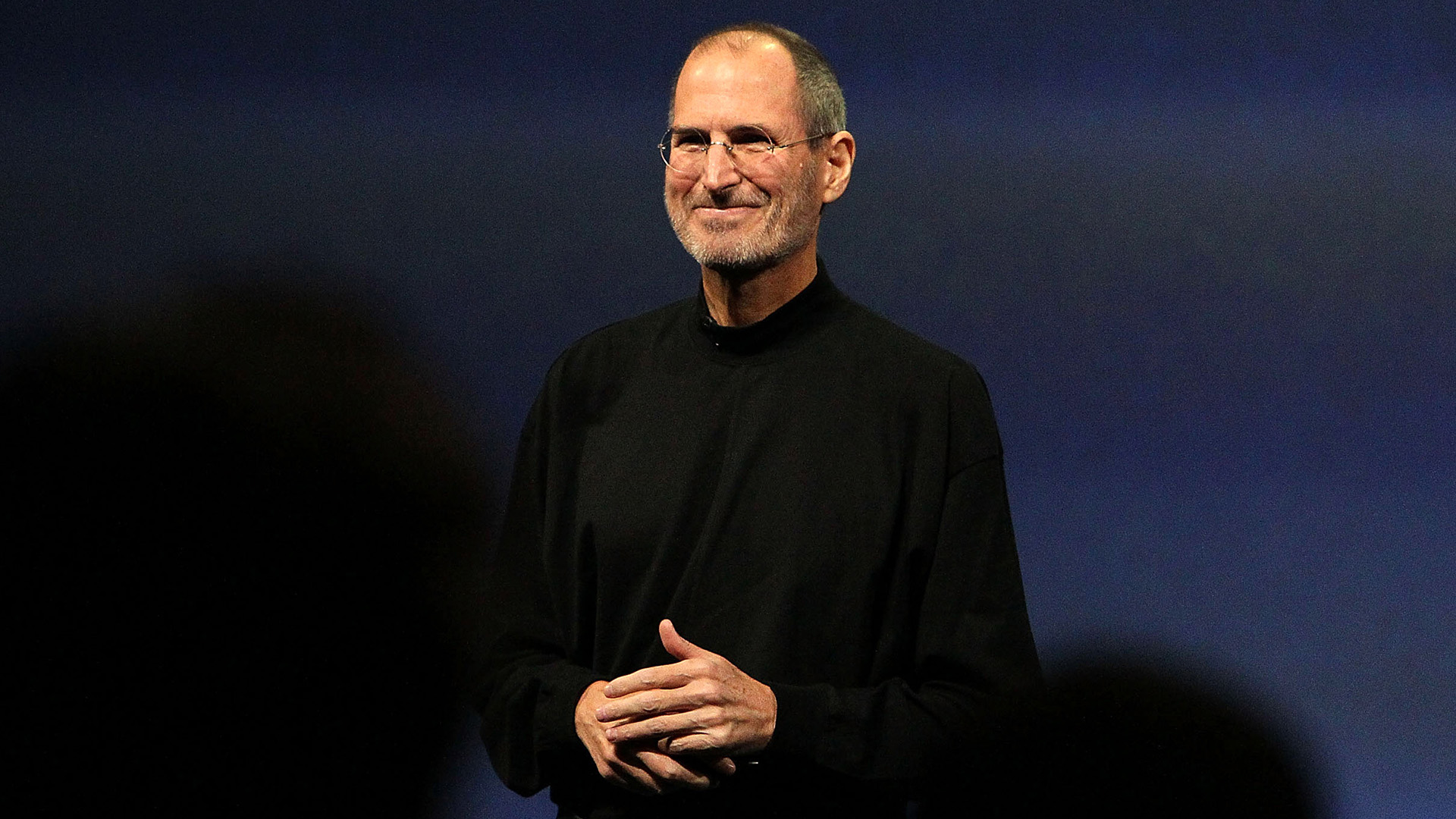

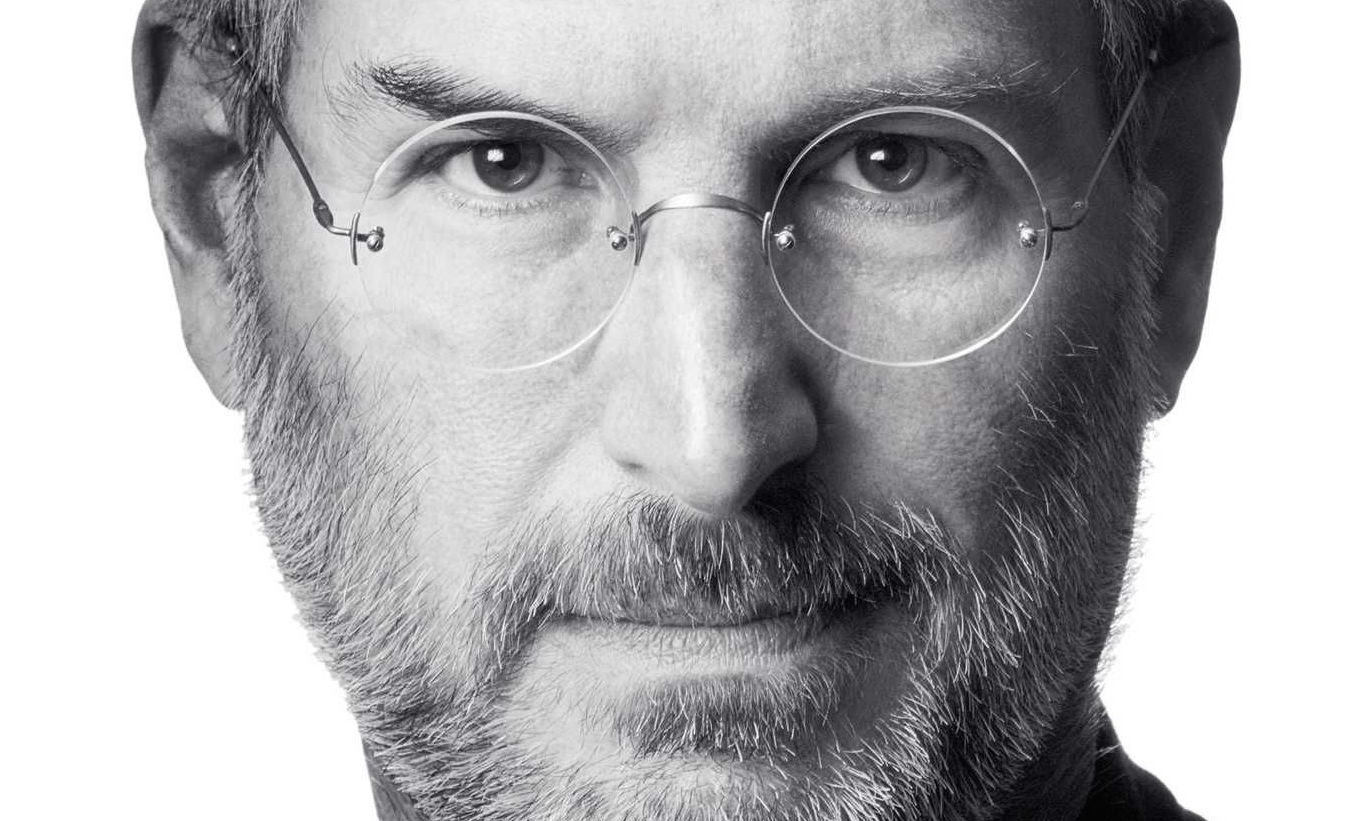

At the onset of the digital awakening, Steve Jobs emerged as a symbol of innovativeness. His legacy precedes him but is no less of a wonder than his own set of traits. He was a true creative, a visionary, and a master salesman who set the grounds for how business was going to be done in years to come. He bestowed the world with not just amazing products but also with lasting lessons that we can and should apply to Forex trading as well.

- Clear Vision & Focus

“Focusing is about saying no.” When Steve Jobs returned to the company in 1997, he immediately stopped all experiments on products he considered futile. He diverted the company’s attention to the things that really mattered. “Focus on a few products because others would drag down the company.” As traders, we can sometimes get torn between our everyday life, developing our trading systems, and our hopes for the future. Steve Jobs made Apple take fewer projects to direct energy to what deserves improvement. More trades won’t make you a good trader but the right focus and prioritization will give you the impetus to become one.

- Results & Reinvention

Steve Jobs didn’t believe that people had to follow a system just because things had always been done that way. He often explained how we have “an opportunity to always question what we do.” This is a necessary approach in trading because we tend to read so much material on how to become successful traders but we may not be as devoted to testing and journaling to make this dream a reality. Each product Apple launched was a more supreme combination of features the market needed, which is a reflection of the effort put into their development.

- Passion

Steve Jobs believed that we should all do what we feel passionate about so that we can make changes around us. As an exceptionally passionate individual, he was able to motivate his company and employees to make history. This special love for his job was transmitted to the products and, hence, to the customers as well. As a trader, you are too making history and changing your (and/or your family’s) everyday life. We cannot become great with a half-hearted attitude. Go all the way now to build confidence and render results gradually.

- Personal & Career Development

The man we know recognize as the face of digital expansion was once a college dropout. He also managed to get fired from his own company. Life wasn’t always easy and Steve Jobs certainly wasn’t an easy person to handle. Besides his genius and the success his attention to detail generated, he was also a human who made mistakes. His products and his mindset revealed how he always believed in innovation and improvement. Still, he didn’t rest his business’s growth solely on intuition; he made changes in the company, in the people he hired, and most importantly in himself.

- Perseverance

Steve Jobs himself said that passion fuels a person’s journey and any ordinary person would certainly quit unless there was any passion. If you see trading as a means to run away from your current boss or a way to finally prove to your ex-wife that you are the man, you won’t last the hurdles that come your way. Persistence needs vision; sustainability requires internal motivation. Don’t rely on the rose-colored glasses to cross the bridge for you. Also, accept your failures as lessons. As Steve Jobs said, “I didn’t see it then, but being fired from Apple was the best thing that could have ever happened to me.” Sometimes, the best lessons are the most painful. Just power through.

- Leadership

Steve Jobs was known for not wanting to delegate. He strived to be interwoven in every business facet. He knew about technology and sales which helped him translate his vision into products that are still sold around the globe. As traders, we need to understand different aspects of trading; while beginners will focus more on the vocabulary and understanding new terms, as they grow they will start to realize that other topics (e.g. news and elections) are of significant importance for trading accomplishments. Traders cannot say that they are only interested in one side of trading because they are owners, the CEO, and the employees all in one. As Steve Jobs put it, “The greatest people are self-managing.”

- Confidence

“You have to trust that the dots will somehow connect in your future. You have to trust something – your gut, destiny, life, karma, whatever – because believing that the dots will connect down the road will give you the confidence to follow your heart even when it leads you off the well-worn path, and that will make all the difference.” If you doubt your every step as a trader, you won’t get far. You need to believe in what you are doing. Learning and improving will additionally help build your stamina because positive self-talk is not what Steve Jobs relied on (at least not solely) to build an empire.

- Facing Challenges

Steve Jobs was always able to pinpoint a problem and present it to others in looking for a way to resolve it. He never wavered thinking that it would go away. Traders too need to address any issues and not procrastinate because of their severity. Great minds charge forwards solving problems on the way. Steve Jobs took the responsibility for growth and so should you.

- Tech-savvy

Mangers may not be that good at understanding the technical side of the business, but Steve Jobs was different. In the years that he wasn’t part of Apple, the company is said to have struggled immensely. Steve Jobs certainly wasn’t the best engineer but he was a man who knew how to get to what he wants. He always found ways to translate his ideas into reality. Traders may not know all instruments there are, but they do need to know how to use what they have properly or where more learning and training is required to reach perfection.

- Talent

As we said above, Steve Jobs wasn’t a top engineer but he knew how to recognize talent. He explained how “it doesn’t make sense to hire smart people and tell them what to do; we hire smart people so they can tell us what to do.” Likewise, traders need to find tools that can assist them in trading as well as tell them what to do at key points in a trade. You don’t want to have to tweak your settings constantly or micromanage your trades all the time because this means your toolbox is flawed.

Steve Jobs never feared failure. When he was fired from Apple, he went on and created NeXT, a computer platform development company. What turned out to be one of his monumental contributions was that he helped drive the development of Pixar, thus boosting the troubled animation industry. Steve Jobs understood his talents and passions and didn’t stop after his failure. Traders often get discouraged because they take losses.

The key ingredient is learning through one’s mistakes and taking the knowledge from one busies to another. We can derive so many lessons from him and his experience. Traders can learn about extremely important topics such as diversification and investment that we often believe is only possible for the wealthy. Steve Jobs never believed in money alone but experience and the message. What is your storyline? What is that great motivating factor that makes you go back to trading? And, finally, how is your routine able to support your vision?

“The doers are the major thinkers. The people that really create the things that change this industry are both the thinker and doer in one person.”