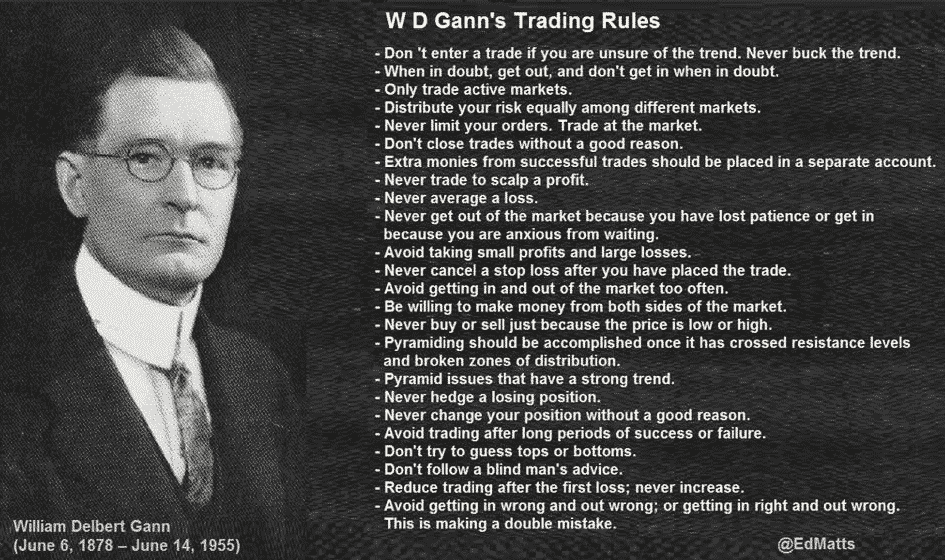

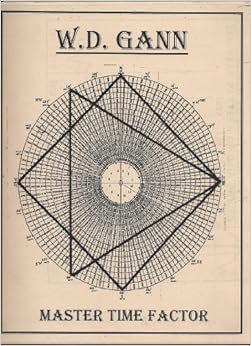

William D. Gann was a financier who developed a technical tool known as Gann’s angles. The trading rules with which it operated are as impressive as this tool. These rules range from basic principles of money management to the important mental game. Anyway, the impressive thing about these rules is that although they were written 100 years ago, they are as true today as they were at the time.

In this article, we will set out some of Gann’s most ambitious rules along with a brief commentary on each. Our purpose is that when you finish this article, you will have an idea that, although the market may change over time, there are many trading rules that remain unchanged.

In this article, we will set out some of Gann’s most ambitious rules along with a brief commentary on each. Our purpose is that when you finish this article, you will have an idea that, although the market may change over time, there are many trading rules that remain unchanged.

1 – Always use stop-loss commands.

This rule goes without much explanation. The use of stop-loss is always mandatory if you want to become a profitable forex trader. By not using it, you open yourself to the potential to operate under emotions, which is never good. Operating without a stop loss is like trying to drive a car without brakes. So, make sure you put it on every time you enter the market.

2 – Never over opers.

We have already talked about not trading. The profit potential increases exponentially as soon as you reduce your trading frequency. What exactly does this mean? This means that when we talk about trade, less is more. The more patience we have becomes, the less operate, and the less you operate, the more you concentrate only on the confluent trading setups.

3 – Do not enter an operation if you are unsure of the trend. Never resist the trend.

This rule is important in 2 respects:

Only active markets operate. If a market is not trending, or you are not sure about the direction of it, stay away.

Don’t run moves against tendencies. It might be tempting to try to trap a roof or floor in some market, but swimming against the current is much more difficult than doing it in favor. Make sure you always operate with the market momentum, never against it.

4 – When in doubt, come out, stay out of it.

If you ever find yourself unsure about an open position, the best thing to do is to get out, especially if the position is at a loss. As a trader, there is no worse option than not having a plan available for the current situation.

Over the years, we’ve discovered that the number one reason why a trader stays in a losing position is because of the fear of taking the loss and then the market moves in the desired direction once it’s out.

The problem is that when you’re in uncharted territory, there’s a 50% chance of earning or losing money. In short, you no longer have a commercial advantage, and therefore you should leave the market.

5 – Only active markets operate.

This rule is extremely important but is often overlooked by many traders. You cannot make money in a market that is not moving. Still, we have seen many traders try to operate side markets. There is nothing wrong with operating price action breakouts inside markets, but trying to operate a side market is one of the fastest ways to lose money in the forex market.

Your most profitable operations will always come from biased markets. This is because it is not only possible to capitalize on the initial position, as a strong trend gives you the good opportunity to multiply your winnings using the technique of pyramiding.

6 – Do not close operations without a reason.

6 – Do not close operations without a reason.

Have you ever gotten out of an operation because of the fear of losing unrealized profits, only to be able to observe the market as continues in the desired direction? We’re sure you do. This is something that every trader must master, the ability to control emotions in a way that allows you to operate based purely on technical analysis.

One way to keep your emotions under control, in case you feel the urge to close a position too soon is to simply ask yourself “why am I closing this position?” If your answer is anything without technical grounds, then you’re probably making a decision based on emotions.

7 – Never promise a loss.

This rule is as old as trading. You should never add to a position that may be a loser. There are many reasons why what we talk about is true, but perhaps the most important thing is that a losing position is a warning that your analysis may have been wrong. By adding this situation, you are making your risk without having first a confirmation from the market that it is not in an unfavourable position.

8 – Never leave the market because you have lost patience and never enter because you are anxious for the wait.

We often speak of patience, which is important for your success. But patience isn’t just waiting for the perfect setup, it also plays a critical role in managing your open operations.

The market has no calendar. It flows according to the news and the feeling that impacts it. This is one of the reasons why as traders we set profitability targets but do not set time limits. A market needs time for the open operation in it to reach its goal, just as it takes time to form the perfect setup. In both cases, patience is required.

9 – Avoid taking small gains and large losses.

We saw an article a while ago that said that making money in forex is hard work. While we agree with this, what we do not agree with is what he said afterward. Whoever wrote the article claimed that it’s all about quick wins, in other words, making small profits every day.

This is totally against our opinion. Becoming consistently profitable is more about letting your winning operations run wild. In essence, you must make enough money on your winners to be able to pay your losers. W.D. Gann had the right approach. He knew that being a trader consistently and profitably means taking big profits and small losses.

10 – Never cancel a stop loss after you have placed the operation.

Why? Because, once you enter the market, your judgments are skewed. Now you have something to lose, which triggers the emotional side of your brain when you make decisions. On the other hand, when you determine a stop loss before entering the market, you have the ability to make an impartial decision about your placement location. This allows you to keep disciplined by operating what the market is doing vs. what you want the market to do.

11 – Avoid entering and leaving the market too often.

Do you find yourself entering a position just to close it within the first 30 minutes in order to pursue a “better” setup? This is very common among Forex traders, the idea that there is always another setup going around that will make them earn more profitability in less time.

The most common reason for this behavior is to risk too much capital in a single operation. In order to let your winning operations run, you must give the market “breathing room”. If you’re risking too much capital on an operation, you’ll be tempted to close the position too soon, losing potential profits.

12 – Be willing to make money from both sides of the market.

For us forex traders, this rule is easy. That said, we still see some traders who prefer only to take long positions or just short positions. While this might seem harmless in principle, it is actually a problem.

If we are price action traders, our main job is to stay patient and wait for the market to show its cards before pulling the trigger. But if we’re only interested in operating long or short but not both, we could miss opportunities. Even you could try to convince yourself that the market is producing a valid signal to go on sale (because you only operate sales) when in fact a setup is being produced to buy, which would leave you on the losing side of the market.

You must there is always a need to be flexible in its approach to financial markets. We must try not to favour one side over the other, as the two are capable of producing profitable trading opportunities.

13 – Never sell or buy for the reason that the price is high or low.

The words “high” and “low” are relative when it comes to markets. What is low for one person could be high for another, and vice versa. For this reason, we are not in favour of using the terms “over-bought” and “over-sold”. Instead of looking to buy a market at a low price or sell a market at a high price, it is much more efficient to be able to use the technical levels, combining them with price action signals. This combination will give you an optimal opportunity to catch a favorable entrance.

14 – Should be pyramided only once the support/resistance levels have been crossed.

14 – Should be pyramided only once the support/resistance levels have been crossed.

The key to a proper pyramid strategy is only to add to a trade when the market has passed a key level of strength or support. This will give you the option to have a degree of confidence in that market will probably continue in the direction intended by adding to your position.

15 – Never change your position without a good reason.

What is a “good” motive? I mean, a good motive is a reasonably valid reason. And therefore a valid reason must be based on technical facts. Entering or leaving a market because you’ve heard someone mention it as a buyer or seller is not a good reason. Similarly, entering or exiting a financial market because it has moved “too low” or “too high” is not a determining reason.

However, if you are in a selling position and the market has reached a support level and forms a bullish bar pin against your position, that is a good reason to at least consider closing the position.

16 – Avoid operating after long periods of success or failure.

One of the reasons why becoming a consistently profitable trader is considered the biggest challenge you will ever face in your life is the word consistently. Placing a winning operation, or even a series of winning operations, is not so difficult after all; we even dare to say that it is easy if market conditions are given. But growing a trading account consistently over the course of several months and years requires much more than a few good trades. A strong mentality is needed, among other things.

Part of that mental strength must include the ability to withdraw from the market after a series of winning operations, or after a series of losing operations. All scenarios can easily lead to emotional decision-making, which can be very negative for your trading account. By stepping away from the market for a while after a streak of winners or losers, you can “reset” your mind.

17 – Don’t try to guess where the roofs or floors are.

Trying to guess where the roofs or floors of a market will be found is purely a form of gambling. If we are traders, our own ability to make money consistently depends largely on our advantage, which is a conjunction of events that help us put the odds in our favor. By trying to guess where the roofs or floors are, you nullify any advantage you might have, and leave your potential winnings to chance.

Many will say that a roof or floor in the market is not clear until the opposite movement has already begun. We do not entirely agree. What is true is that we cannot know for sure whether the market has found a roof or a floor until the opposite movement has begun, what we can do is determine the probability of such movement by using technical patterns and signals. For this reason, learning price action is essential to your success as a trader, regardless of the trading strategy with which you end up trading.

18 – Do not follow the advice of a blind man.

Have you visited a forex blog somewhere? If you have, we are sure that you can relate it to the following rule. The advent of the internet has been a great invention. It not only gives us our ability to trade in forex from the comfort of our homes, but it also provides us with a lot of information about the subject of trading.

But there is the problem… With more information comes confusion, especially when most of this information comes from trading blogs in which everyone is a so-called expert. These traders like to share their convictions, which in principle is harmless, but when other traders operate based on those convictions it can be disastrous.

Information from all forex-related sites, including this one, should be used to generate trading ideas. Nothing more or less. There must be no place to be used to enter blindly operations. In order to be successful as a forex trader, you must learn to run your own technical analysis. Getting ideas from forex websites is fine, but make sure you always follow your own analysis before placing your capital at risk.

19 – Reduce your trading after the first loss, never increase it.

Revenge trading is one of the deadliest sins a trader can commit. It starts with a loser trade and ends with many more losses. One way to avoid revenge trading is either to reduce your trading immediately after a loss or to completely deviate from the market for a while.

20 – Avoid entering incorrectly and exit correctly. Or enter correctly and exit incorrectly.

Becoming a successful trader is about timing. It’s not enough to just get a good entry or a good exit from the market. You must be sure to be right on both fronts to be cost-effective in a consistent manner. Using a combination of entry strategies, correct stop-loss strategy, and key levels to determine profit-making goals, you can learn to enter correctly and exit correctly.

In Summary

What’s amazing is that after 100 years, these rules W.D. Gann has devised are as valid today as yesterday. This shows that some of the simplest forms of technical analysis, such as price evolution, are here to be taken into account always, as happens with the most elementary rules of trading psychology.

We trust that this humble article has helped you to put a little more clarity on how W.D. Gann operates and how these 20 rules can be applied to your own trading to make you a better trader.