What’s the best trading book? This answer will depend on where you are and where you want to go deeper, whether you are starting, whether you have experience, whether you are looking for a more long-term or short-term approach.

If you are reading this article you will surely be looking for a book that can help you as a trader. There are good books about trading, some focus on the technical part, and others do it more in experiences.

I have made a list of the trading books that have brought me the most and that I think they can bring to you the most. Something like the trader’s library. Surely some of these books you didn’t know, how is this possible? If you do a quick search, most of the books you’re going to find are loaded with aspirational messages and smoke. I tell you that, as you know, my approach is quantitative and this can be seen only by looking at the books I have chosen, but I recommend to you what has served me and helped me on my way.

The ranking is divided by levels so you can choose the one that best suits your level. Although it may seem that they all deal with the same topics, what makes the difference is the focus of each of them. There really are a lot of pearls and gold nuggets. Some of these books are only available in English but are usually fairly easy to read with terms similar to Spanish in some cases.

When you start, what you read can mark you for better or worse. That’s why you won’t see any titles in all these books that are kind of “how to get your first million in 30 days”. These books are the ones I think can really bring you value and a good basis to start with realism:

Quantitative Trading Initiation Guide – Martí Castany

This book has been published recently and as its name suggests it is a very complete and basic guide if you are starting in quantitative or algorithmic trading. I have recently recommended it when you ask me because it makes a good review of all the basic concepts and explains the day-to-day of a quantitative trader (necessary equipment, programs, etc.).

Martí Castany is the author and has been able to condense the information very well and make its reading very enjoyable. It’s not a long book and you can read it in no time. I especially like the realistic approach it gives to trading as a business.

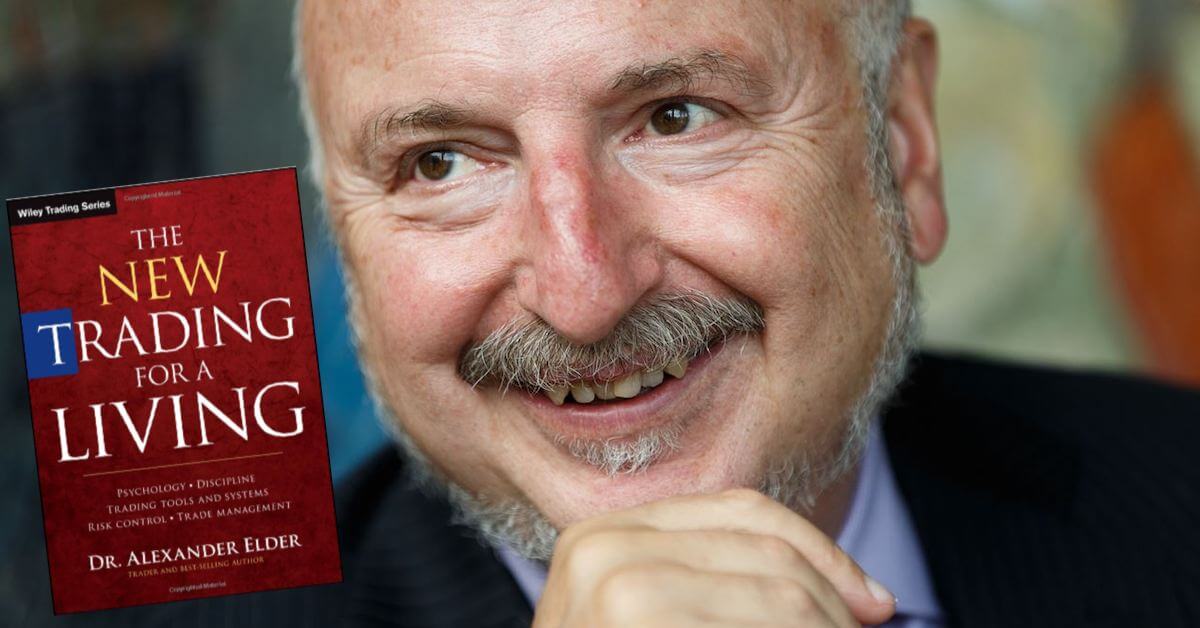

The New Life of Trading – Alexander Elder

The New Life of Trading – Alexander Elder

This is one of the best-known and recommended books, especially the previous version. This is a new one that has recently come out. There is a lot of interest in psychological factors and emotions within trading and relates it to technical analysis and risk management. It deals with issues as important as they are basic.

In this book, you won’t find backtest or operational statistics, as Alexander Elder is constantly relying on technical analysis for trading and manual trading. Recommended if you’re starting out.

Be Successful in Trading (Trade Your Way to Financial Freedom) – Van K Tharp

This book focuses on the aspects that the author considers to be important to create a good trading system. He constantly points out that input is only a small part of the strategy and explains how outputs and stop-loss affect their results.

The strengths it deals with are money management (position size) and the psychology to succeed in trading. There are two versions: “Trade your way to financial freedom” (in English) and “Being successful in trading” (in Spanish).

Now yes, we get into trouble. If you master the basics of trading and want more chicha, these books can help you a lot:

Quantitative Trading Strategies – Lars Kestner

This is one of the books I liked the most in my day. Although I might have qualified it as uninitiated, I think it can also contribute to people with experience. Lars Kestner talks about basics yes, but also about the types of trading strategies in detail and following order according to their behavior (trends, reversion to the average, and with price patterns).

In this book, you will also find system evaluations, their optimization, and risk management (a classic, as you will see in most). I read it in English and I did not find it in Spanish, but if you find this or any other translated, write it to me in the comments and I can add it.

Quantitative Trading Systems- Howard Bandy

Quantitative Trading Systems- Howard Bandy

Howard Bandy is one of the best authors on quantitative trading today. He writes in a very simple and enjoyable way. In this book, he explains what quantitative analysis is, how to treat data, interpret different ratios, create detailed strategies, analyze or test systems.

The book is quite complete and every concept is explained in detail. Of course, the strategies are done by the author on the Amibroker platform. Even so, the concepts and explanations do not change and are general.

Cybernetic Trading Strategies – Murray Ruggiero

Murray Ruggiero is for me a reference in the creation and development of trading systems. In this book, he touches on classic topics such as technical analysis and more advanced ones (neural networks, fuzzy logic, genetic algorithms) to demonstrate the power of trading systems based on computation. It is the common idea of the book, to make us see that with a computer we have many tools and power to do incredible things.

It is a book that is worth it for the range of topics it deals with and how it treats them, as they are accompanied by examples and practical cases that will make you understand everything better.

Building Reliable Trading Systems – Keith Fitschen

Keith Fitschen is another author I quite admire. He gives a different perspective and a twist to the creation of systems in a traditional way. In this book what he does is that he proposes a method to build and test systems in an alternative way to avoid our worst enemy: over-optimization. This method is called BRAC (“Build, Rebuild, and Compare”).

In addition, to do all this in a practical and visual way, he constantly compares two totally different trading systems that he is modifying throughout the chapters.

Technical Analysis Based on Statistics (Evidence-Based Technical Analysis) – David Aronson

Technical Analysis Based on Statistics (Evidence-Based Technical Analysis) – David Aronson

The main objective of this book will be able to demonstrate the effectiveness of technical analysis with numbers. What really works and what doesn’t objectively. It has a first theoretical part and a second part where it makes the demonstrations (I warn you that it can become denser).

Although it was written in 2007, it develops very well how to statistically measure the reliability of a trading system. It deals with concepts like statistical analysis, data mining, and techniques for analyzing information, but it’s nothing basic. Its author is David Aronson.

Quantitative Trading – Ernest Chan

This is one of the first books that read about quantitative trading. It brings interesting ideas about statistical arbitration. It develops the concept of seasonality and generates a quite original mental framework.

The systems that Ernest Chan usually proposes are quite theoretical and are not easy to implement. Still, you can get a lot of ideas from everything you transmit. It also talks about risk, backtesting, cointegration, correlation, and many concepts that are important.

[Extra]: Books that can help you in your trading

Now we’re going with books that, although not trading, can help you improve it. How is this possible? Because they deal with topics that are perfectly transferable to the world of investment and trading.

Principles – Ray Dalio

Principles – Ray Dalio

Ray Dalio is one of the people who has inspired me the most. I found this book brutal, as the title indicates, it reflects principles not only at the working level but as a philosophy of life. Open-mindedness, transparency, and the ability to stand up are some of the messages it transmits and teaches. He also defends the union algorithms and people to work with and explains how he performs it.

In the book, Ray Dalio constantly shares experiences and situations that make his reading quite enjoyable, especially in the early part of life. If you didn’t know him, he’s the founder of Bridgewater, the world’s largest hedge fund.

Antifragile – Nassin Taleb

Nassin Taleb has become quite popular in recent years and you probably know him because he has other very good books like, “The Black Swan” which develops the idea that it is positive or preferable to stress something constantly to not do and when an unlikely event happens it will take everything ahead. The concept of robustness is important in trading.

It basically tells us that anything that is not exposed to that fragility will not thrive and will end up incurring greater risk. It gives many examples of the day-to-day that will make you reflect.

I know there are very good stock market books that can be more general or focus on other areas such as fundamentals, value, or finance that you may have missed, but I have selected only those that I find interesting in trading.