In this article, I will present a practical guide with the 3 key points to achieve financial freedom. This means that someone who does not follow these premises will not be able to reach it, but the odds of becoming financially independent are much higher considering everything I am going to tell you next.

What is Financial Freedom?

Financial freedom is to be able to spend your time in the way you prefer, whenever he receives a regular income that allows you to live well by bearing all your expenses without having to work to get a salary. That is, to invest money in certain assets until they generate a higher income than our expenses. That’s what we call financial freedom. This sounds very nice, and it’s also very easy to say, but we know it’s hard to get. Although not impossible…

Normally, people have a job, to which we dedicate about 40 hours a week or so, and for which we receive a salary that allows us to live. In this situation, it seems a utopia to be able to generate revenue on a regular basis without the need to exchange our time for money, but believe me, it is possible.

Why Should Financial Freedom Be Achieved?

It’s not an obligation. If you are completely happy working 8 hours a day and you would not like to do anything else during those 8 hours more than your tasks at work, and you think you will be able to continue working in the same until 65 years (minimum), you’re probably not interested in financial freedom.

Now, imagine that every month you were given an amount of money that allowed you to live well without the need to go to work. In that case, we can say that we are free financially, so if really what we want at that time is to work… Great!

The Fundamental Requirement for Financial Freedom

Most importantly, bearing in mind that if we do not meet this requirement we will not be able to achieve financial independence:

Have a powerful reason.

That is, to have a motivation that allows us to be constant until achieving our goal. It is very difficult to make a habit of any new behavior that we want to implement. On many occasions, if you have not yet reached financial freedom with your current habits, it will be necessary to develop new habits that allow you to reach them.

And if it is sometimes difficult to establish simple habits such as going to the gym one day a week to leave a good tipín for the summer, achieving financial independence is not something that is usually achieved within a few months of establishing some habits. This process takes years, but in my opinion, the reward gained and the duration of the subsequent gratification far outweigh the effort.

The question is…

And you, what are you willing to do to achieve financial freedom? In the end, the goal is not to achieve financial independence, the goal is to be very clear why we want to have free time to decide what to do with it. Spend more time with family? Children? Travel the world? There are thousands of reasons, but you must have a very powerful one that allows you not to give up on the road until you get it. Therefore, the first essential step if we want to achieve financial freedom is to find the main motivation that makes us wake up every morning convinced that we will work to achieve our goal.

Step 1: Calculate how much money you need.

It is very important to keep track of our income and expenses. In this way, we can know if we need 600€, 1500€ or 4000€ monthly to live well with all our needs met (not only the basic ones, we also have to go out with friends, go to dinner, travel, etc.). And not only that but surely a person with 25 years can live and save money with 1000€ per month but someone with 40 years, a mortgage and 3 children will obviously need more income to live well. That is why we need to consider not only how much money we need to live well today, but also in the future, and to do so we need to see what our expenditure might be in the future.

Step 2: Start generating profitability for your money

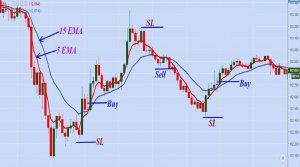

IMPORTANT: It is impossible to achieve financial freedom without investing our money. This needs to be clear. If we don’t want to invest our capital in any assets, we will never achieve financial freedom. The alternative to exchanging our time for money is to exchange our money for more money, if we are not condemned to work 40 hours a week until we retire.

It is true that sometimes this investment can start out small, and that there are thousands of assets in which to invest (open a business, invest in real estate, invest in vending machines, invest in the stock exchange, do trading…). I will assume that throughout my career as an investor I get an average of 12% annual return. This means that if I invest 1,000,000€ I would get an annual income of 120,000€. Or if I invest 400,000€ I would get an income of 48,000€ per year (on average), or what is the same, 4,000€ per month.

And how can I get that kind of money?

Imagine that my goal is to achieve financial freedom 20 years from now. If I start with an initial capital of €20,000, and I am able to save and invest €500 per month at 12%, within 20 years I will have achieved €496,543 (with inflation of 2.5% per year).

Step 3: Don’t start It’s already costing you too much

In the example we saw above, we can see that after investing 20,000€ + 500€ monthly would be able to reach almost 500,000€ in 20 years. Do you know what would happen if I waited a year to start? If instead of starting to invest today I waited 365 days more, in 20 years would no longer have 496.543€, but 445.657€. I mean, I lost 50,000€ just to start a year later. Doing exactly the same thing, let’s be clear. And what if with my current saving capacity I am unable to achieve Financial Freedom? In that case, a number of things need to be considered.

The first, although it may sound redundant, is that we need to be able to maximize our savings capacity, and for that, there are two options: either we reduce spending, or we increase revenue (or both).

Before you tell me that it is not possible to further reduce expenses, if you really have a strong motivation to achieve financial freedom, you must be in control of what you spend your money on. Only then will you be able to rethink and see clearly whether all your expenses are justified or there is some way you think you can save more at some point. Know what you spend on clothing, food, gasoline, vehicle maintenance, insurance, loans, leisure…

And on the other hand… how do you increase income?

In the first case, if our main source of income is work, we have to think if we can materialize some task on our part that we can take to benefit the company in which we work so that a salary increase can be justified. Are you certainly being as productive as you can? Could you increase your productivity by making some changes to your work routine? Do you lose something by proposing a raise to your boss?