Waves (WAVES)

Market Cap: $647.89M

Circulating Supply: 100M WAVES

Max Supply: 0 WAVES

Volume (24h) $29.10M

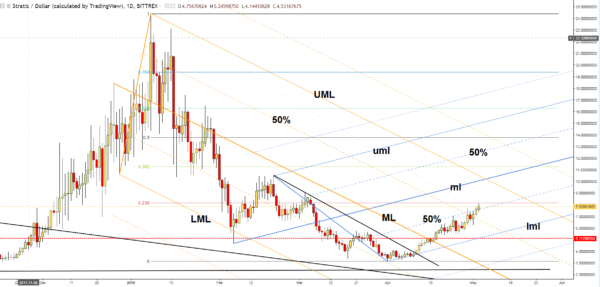

The WAVES drops like a rock on the short term after another false breakout above a very strong dynamic resistance. Price approaches a strong support right now. It remains to see how it will react when it touches and retests the near-term support levels.

It is premature to talk about a larger drop in the short term as long as the rate is located above some crucial support levels. I said in last weeks report that the crypto marker rebound could be only temporary and it could come back down trying to capture more bullish energy.

We have important corrective movements on all major cryptocurrencies. This retreat is natural and it was expected after the impressive rally. I’ve told you in one of my editorials (Is the crypto market sell-off natural?) that the cryptocurrencies have reached important upside targets and could turn to the downside on the short term.

The WAVES/USD dropped sharply in the last days and now is pressuring the 6.28330036 static support. It should reach and retest the lower median line (LML) as well. A further increase on the Daily chart will be invalidated by a valid breakdown below the outside sliding line (SL) of the ascending pitchfork.

Conclusion

We could go long on this after a false breakdown below the mentioned support levels and after a retest. The first upside target will be at the 50% Fibonacci line. Only a valid breakout above the 50% line will signal a further increase towards the median line (ML).

©Forex.Academy