There are a lot of questions you may want to ask about cryptocurrencies and Bitcoin in particular. Interest in the world’s first mainstream cryptocurrency is coming fast and they are relentless now that the price has really started to take off and more and more people are taking notice of it. However, with so many eyes on cryptocurrency, some people may have some pretty basic questions that they feel are a little silly and they simply do not wish to ask them. Yet we are here to tell you that no question is a silly one, we all have different knowledge of Bitcoin and so asking a question is simply our way of gathering more information. So here are some of the questions that you may be afraid to ask about Bitcoin.

Is it a scam?

Let’s get this one out the way right away, the simple answer to this question is no and there are a few reasons why. Firstly it is a completely independent currency, it is not owned or controlled by a single entity, this means that if someone was to suddenly remove their bitcoin from the markets, or to simply state that the price is much higher or lower, then this would make no difference to the ecosystem. Not a single person can control it and so it cannot be a scam. The second point is that the price is controlled by supply and demand, it is an open market that anyone can trade on, anyone can buy or sell, so you are able to sell your bitcoin at any time, you are not forced to hold and you are not stuck with them, a scam would not allow you to sell at any time in order to get your money back. To put it simply again, Bitcoin is certainly not a scam.

Is it a bubble?

This is a slightly harder question to answer, there is evidence that it may be a bubble, but there is also evidence that it is not, but what you really need to ask yourself is whether or not it is actually a bad thing even if it was a bubble. Of course, if it is not then that is great, the price continues to rise and rise. If however it is a bubble and at some point, it bursts, there is nothing to say that the price won’t recover and then continue to rise afterward. Look at the dot-com bubble, that burst, but now the internet and internet-based businesses are bigger than they ever were within that bubble. Yes, bubbles bursting can be pretty bad short term, but they don’t mean that things won’t be successful in the long run.

What is it?

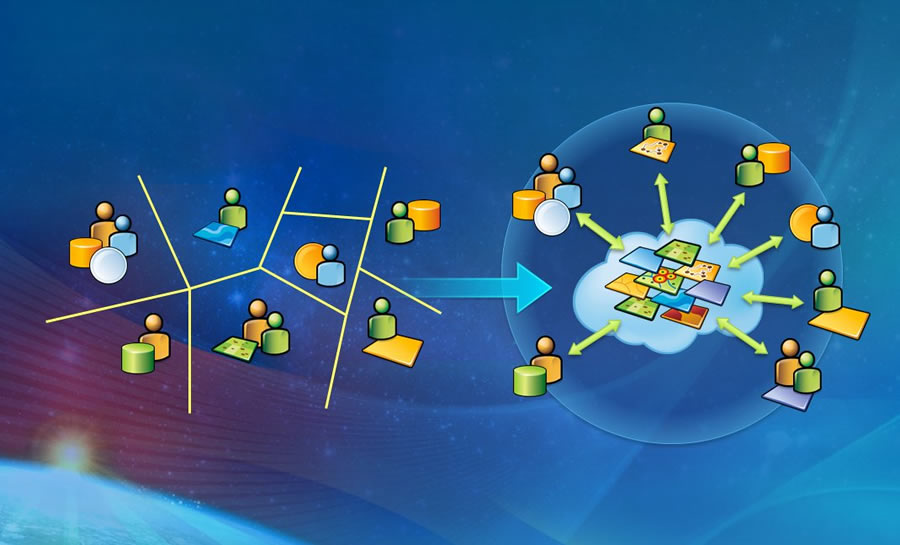

A lot of people may be hearing about Bitcoin for the first time, so while it may seem silly to not know what it is, many people won’t and so this is not a bad question at all. Bitcoin is a cryptocurrency, this means that it is a currency that exists only on the internet and is based on a form of an algorithm, or a blockchain in this case. Bitcoin can be used as a currency, traded and exchanged for goods or other currencies. The way it works is that each person has a wallet with their coins in, you can then send the information, computer algorithms and processing power is used to confirm each transaction and not one person has any control over the network. All transactions can be seen within the blockchain. There is of course more to it, but we would be here for hours trying to explain everything.

How do I store Bitcoin?

Actually, another good question, when we think about storing our money we think about banks or our wallets, the latter is exactly how we store Bitcoin too, in a wallet, only that it is a digital wallet rather than a physical one. This wallet acts as our safety deposit box for our Bitcoin, any bitcoin that is sent to us will go to that wallet and anything that we wish to send will come out of it. No other person will have access to it apart from you and as long as you keep the credentials, the wallet will be around forever, as it is recoverable on other devices with those credentials.

Can you trade it?

Yes, you certainly can and there are a few different ways that you can do it. You can simply buy or sell it, there are many exchanges that allow you to buy bitcoin with your local currency or to sell it in order to get your currency. You can also trade it like you do in the foreign exchange markets, many brokers that offer Forex services are now enabling you to trade cryptocurrencies like Bitcoin too. This makes it extremely accessible and easy to trade on the global markets, there are even Bitcoin or cryptocurrency-specific brokers popping up that have very good trading conditions available on them.

What can you spend it on?

Pretty much anything. Bitcoin is becoming more and more accepted. In fact, no matter which country you live in, there will be services and shops available for you to spend your Bitcoin on. Even places like PayPal, the world’s most popular payment processor, are now accepting Bitcoin and allowing you to purchase through them and to pay through their portal with Bitcoin. There are a lot of shops that now accept it too, if you are looking for pretty much anything on the internet you should be able to find it available for Bitcoin. So while you might not be able to use it in your local shops, you can online, but there is nothing to say that your local shops won’t start accepting it any day now, more and more companies are each and every day.

Those are some of the questions that you may be afraid to ask, but you should’;t be, we all have different knowledge and different understandings of what Bitcoin is, the whale cryptocurrency world is a brand new one, and not one knows everything about it as it is constantly developing. If you have questions you should ask them, no matter how silly it may seem to you, just ask away, you will gain a lot more knowledge doing that than sitting on your question and never finding out the answers.

It can be tempting to simply follow what other people are doing when it comes to trading bitcoin. There are a lot of people out there making a lot of money of fit, so there is no harm in just following them right? Well no, first they will certainly be trading with a strategy, secondly, you do not know what that strategy is and so blindly following trades is never a good idea in that situation. Also, you will not be getting the trades at the exact same time, so by the time you take the trade the optimum time may have already passed. So this is why you need a strategy, a strategy that outlines what you will be trading, when you will be trading and how you will be protecting your account. You should always trade with one and you should only put on trades that are properly in line with the strategy that you are using.

It can be tempting to simply follow what other people are doing when it comes to trading bitcoin. There are a lot of people out there making a lot of money of fit, so there is no harm in just following them right? Well no, first they will certainly be trading with a strategy, secondly, you do not know what that strategy is and so blindly following trades is never a good idea in that situation. Also, you will not be getting the trades at the exact same time, so by the time you take the trade the optimum time may have already passed. So this is why you need a strategy, a strategy that outlines what you will be trading, when you will be trading and how you will be protecting your account. You should always trade with one and you should only put on trades that are properly in line with the strategy that you are using. As mentioned above, you should not be blindly following other people’s trades, as tempting as it may seem. You need to remember that they have been doing this a long time, they have a strategy that they are following, they may even have information from sources that you do not know about, so blindly following their trade will basically mean that you are allowing them to

As mentioned above, you should not be blindly following other people’s trades, as tempting as it may seem. You need to remember that they have been doing this a long time, they have a strategy that they are following, they may even have information from sources that you do not know about, so blindly following their trade will basically mean that you are allowing them to  Risk Management is key when it comes to any form of trading and it is certainly the case for bitcoin too. You need to use it, things like a proper

Risk Management is key when it comes to any form of trading and it is certainly the case for bitcoin too. You need to use it, things like a proper  It can be very tempting to trade more when things are going well, especially when it is bitcoin due to the massive profit potential that it offers, but you need to be wary of this, you do not know what to overtrade. Overtrading is basically when you place more trades than you should. Overtrading can decrease your account’s margin, and when the margin gets too low, it will only take a small movement the wrong way for your account to blow and for your broker to close all of your trades in the negative. Only trade what you need to, do not get greedy, if you are being profitable, accept that, do not try to push too hard for more.

It can be very tempting to trade more when things are going well, especially when it is bitcoin due to the massive profit potential that it offers, but you need to be wary of this, you do not know what to overtrade. Overtrading is basically when you place more trades than you should. Overtrading can decrease your account’s margin, and when the margin gets too low, it will only take a small movement the wrong way for your account to blow and for your broker to close all of your trades in the negative. Only trade what you need to, do not get greedy, if you are being profitable, accept that, do not try to push too hard for more. When you are trading bitcoin, it is very important that you keep an eye on the news that is going on around you. Bitcoin can be heavily influenced by the news, if a country decides to ban its use it can have a very strong and very quick drop, if a major company decides to start accepting it, it can have a huge spike upwards. You do not want to miss out on the opportunities that the news can present, but maybe more importantly, you do not want to get caught out by a huge drop, which even with stop losses in place, can cause an account to blow if the price jumps passed the stop loss. If you are going to trade bitcoin or any other form of cryptocurrency, then it is very important that you keep an eye on the news and know what is going on in the crypto world.

When you are trading bitcoin, it is very important that you keep an eye on the news that is going on around you. Bitcoin can be heavily influenced by the news, if a country decides to ban its use it can have a very strong and very quick drop, if a major company decides to start accepting it, it can have a huge spike upwards. You do not want to miss out on the opportunities that the news can present, but maybe more importantly, you do not want to get caught out by a huge drop, which even with stop losses in place, can cause an account to blow if the price jumps passed the stop loss. If you are going to trade bitcoin or any other form of cryptocurrency, then it is very important that you keep an eye on the news and know what is going on in the crypto world. It is very easy to let emotion take over, especially when there is money involved. This is no different for crypto and bitcoin trading. There is a lot of money to be made, the markets can move up and down a lot which can play havoc with your emotions, in fact, it can cause a lot of stress and anxiety. Things like anxiety can make you not want to trade at all, maybe this has come from a loss or consecutive losses. Then there are things like greed and overconfidence, these can make you start to place more trades, or larger trades, each of which will be putting your account under more and more pressure. If you feel that any form of emotion is starting to build up and that it has the potential to affect the trades that you are making, then you need to take a step back. Take a break, go out for a bit, clear your mind and then come back with a fresh view of the markets. Whatever you do, do not

It is very easy to let emotion take over, especially when there is money involved. This is no different for crypto and bitcoin trading. There is a lot of money to be made, the markets can move up and down a lot which can play havoc with your emotions, in fact, it can cause a lot of stress and anxiety. Things like anxiety can make you not want to trade at all, maybe this has come from a loss or consecutive losses. Then there are things like greed and overconfidence, these can make you start to place more trades, or larger trades, each of which will be putting your account under more and more pressure. If you feel that any form of emotion is starting to build up and that it has the potential to affect the trades that you are making, then you need to take a step back. Take a break, go out for a bit, clear your mind and then come back with a fresh view of the markets. Whatever you do, do not

Buy, buy, buy, advice that is given out a lot, in the past, at any time throughout the life of coins like Bitcoin, if you had bought and helped you would now be in profit, it is as simple as that so the advice would have done pretty well. For other cryptocurrencies though, that advice may not be quite as good, a lot of them have had their all-time highs long ago and have not recovered back to that value. If you simply buy without any real plan or idea of where you will get out, including the historical process of the asset then you could be in for a disaster. Only buying can lead to a lack of funds, it can lead to losses should the markets turn and while it can make you money, it is a risky strategy to simply continue to buy at every opportunity that you can. There have been people doing very silly things, selling their house to put all of the money into Bitcoin, yes it paid off but the risk was far too high, do not put everything into it and do not put money in that you do not have.

Buy, buy, buy, advice that is given out a lot, in the past, at any time throughout the life of coins like Bitcoin, if you had bought and helped you would now be in profit, it is as simple as that so the advice would have done pretty well. For other cryptocurrencies though, that advice may not be quite as good, a lot of them have had their all-time highs long ago and have not recovered back to that value. If you simply buy without any real plan or idea of where you will get out, including the historical process of the asset then you could be in for a disaster. Only buying can lead to a lack of funds, it can lead to losses should the markets turn and while it can make you money, it is a risky strategy to simply continue to buy at every opportunity that you can. There have been people doing very silly things, selling their house to put all of the money into Bitcoin, yes it paid off but the risk was far too high, do not put everything into it and do not put money in that you do not have. Bitcoin is a cam, cryptocurrencies are a scam, you will hear that a lot, and there is absolutely no evidence behind those claims. The majority of people that state this do not have an understanding of what it is that they are calling scams. We have to admit, that yes, there are some scams within the cryptocurrency world, but then again there are within any industry you look at, this does not, however, mean that the entire cryptocurrency scene is a scam, much the same way that not all banks are scams. Those that are telling you it is a scam will also be advising you to avoid buying it and to avoid trading it. That is terrible advice. There is no harm in trading these coins and tokens, as there are a lot that are very safe to trade. Try and avoid the smaller ones but the majority of brokers that offer any sort of trading and purchasing will be monitoring the coins they have listed and will filter out the undesirable or less than legit ones.

Bitcoin is a cam, cryptocurrencies are a scam, you will hear that a lot, and there is absolutely no evidence behind those claims. The majority of people that state this do not have an understanding of what it is that they are calling scams. We have to admit, that yes, there are some scams within the cryptocurrency world, but then again there are within any industry you look at, this does not, however, mean that the entire cryptocurrency scene is a scam, much the same way that not all banks are scams. Those that are telling you it is a scam will also be advising you to avoid buying it and to avoid trading it. That is terrible advice. There is no harm in trading these coins and tokens, as there are a lot that are very safe to trade. Try and avoid the smaller ones but the majority of brokers that offer any sort of trading and purchasing will be monitoring the coins they have listed and will filter out the undesirable or less than legit ones. Something that came up at the start of the whole Bitcoin and cryptocurrency boom was the term HODL, this is basically the idea of holding onto your bitcoin no matter what, with no real aim or goal as to when you will sell or withdraw back into local currencies. While there is certainly some credit to the idea of holding Bitcoin and other cryptocurrencies long term, as there is certainly profit to be had in doing that, the idea of not having any sort of end goal is not. Yes by cashing out you may lose some potential profit, but you are cashing out at a level that is right for you and so you should be happy with that, just aimlessly holding things and hoping that they continue to go up is not a good thing to do as everything that goes up will eventually come back down.

Something that came up at the start of the whole Bitcoin and cryptocurrency boom was the term HODL, this is basically the idea of holding onto your bitcoin no matter what, with no real aim or goal as to when you will sell or withdraw back into local currencies. While there is certainly some credit to the idea of holding Bitcoin and other cryptocurrencies long term, as there is certainly profit to be had in doing that, the idea of not having any sort of end goal is not. Yes by cashing out you may lose some potential profit, but you are cashing out at a level that is right for you and so you should be happy with that, just aimlessly holding things and hoping that they continue to go up is not a good thing to do as everything that goes up will eventually come back down.

The Bitcoin markets are exciting, they are a constant battle between the bulls and bears, and even without trading it, simply watching it can be exciting. In fact, we do that quite a lot, just sit by the charts and various other indicators watching things change and watching the battle between the buys and sells. Of course, it is a little more exciting when your money is on the line. Trading often brings adrenaline and it is no different from crypto trading. When our trade is going the right way, it feels fantastic, when it is going the wrong way it is a panic, but both of those emotions bring our adrenaline levels up. There is nothing better than a big trade dropping to near the stop loss only for it to reverse and end up in profit. You do not get that feeling in many other places in life, so that is one of the major reasons that we love to trade it.

The Bitcoin markets are exciting, they are a constant battle between the bulls and bears, and even without trading it, simply watching it can be exciting. In fact, we do that quite a lot, just sit by the charts and various other indicators watching things change and watching the battle between the buys and sells. Of course, it is a little more exciting when your money is on the line. Trading often brings adrenaline and it is no different from crypto trading. When our trade is going the right way, it feels fantastic, when it is going the wrong way it is a panic, but both of those emotions bring our adrenaline levels up. There is nothing better than a big trade dropping to near the stop loss only for it to reverse and end up in profit. You do not get that feeling in many other places in life, so that is one of the major reasons that we love to trade it.

It used to be hard to get into any form of trading, but that is very accessible with the rise of the retail forex brokers, the same thing has happened with Bitcoin trading. Back when the coin first launched you could not trade it on a broker, you could buy it, or you could sell it at very limited places, that was it. Then brokers began to bring it in, but it was very exclusive, only a few brooks had it and those that did, had horrendous spreads, making it not trading at all. Now though, more and more brokers are picking it up, crypto-specific brokers are out there too. These brokers are now offering much better spreads, ones that make it profitable again, and many broilers are now offering leverage on their crypto markets including bitcoin. These developments have made it far easier to get into the world of bitcoin trading, and this added accessibility has helped to improve things like liquidity in the markets. We can only imagine that it will become even more accessible in the future, how we do not know, just that it most likely will.

It used to be hard to get into any form of trading, but that is very accessible with the rise of the retail forex brokers, the same thing has happened with Bitcoin trading. Back when the coin first launched you could not trade it on a broker, you could buy it, or you could sell it at very limited places, that was it. Then brokers began to bring it in, but it was very exclusive, only a few brooks had it and those that did, had horrendous spreads, making it not trading at all. Now though, more and more brokers are picking it up, crypto-specific brokers are out there too. These brokers are now offering much better spreads, ones that make it profitable again, and many broilers are now offering leverage on their crypto markets including bitcoin. These developments have made it far easier to get into the world of bitcoin trading, and this added accessibility has helped to improve things like liquidity in the markets. We can only imagine that it will become even more accessible in the future, how we do not know, just that it most likely will.