The key to Bitcoin’s allure as an investment is its price fluctuations. The fluctuations give investors the choice to buy when the price is bearish and sell when the price is bullish.

But after the 2017 incredible bull run, Bitcoin seems to have adopted a more predictable price action. While the coin experiences volatility, it’s not up to the level where many investors would consider “exciting.”

For this reason, speculators looking for, well, more exciting trades are flocking to Bitcoin derivatives. Global trading of these products already even surpassed Bitcoin.

So what are derivatives exactly? Read on.

What are Derivatives?

A derivative is a tradable security whose value is derived from or relies on an underlying asset. Derivatives are not a modern phenomenon. Indeed, they go as far back as medieval times when merchants all over Europe would use them to facilitate trades and take part in periodical fairs.

Today, derivatives have become an integral part of everyday trading. Generally, they belong to the more sophisticated and high-risk realm of trading. Examples of derivatives include swaps, futures, options, swaps, and warrants.

With that,

Let’s explore Bitcoin derivatives

#1. Bitcoin Futures

Bitcoin futures are an agreement or contract to sell or buy Bitcoin at a predetermined price at a predetermined date in the future. Bitcoin futures give investors the opportunity to participate in the Bitcoin market without having to purchase the underlying currency.

By trading in Bitcoin futures, investors get certain benefits as opposed to if they were trading in Bitcoin directly. First, trades take place on an exchange regulated by the Commodities Futures Trading Commission, which would give investors who are risk-averse more confidence to participate. Second, futures are settled in Fiat, which means investors do not need to sign up for or invest in a Bitcoin wallet.

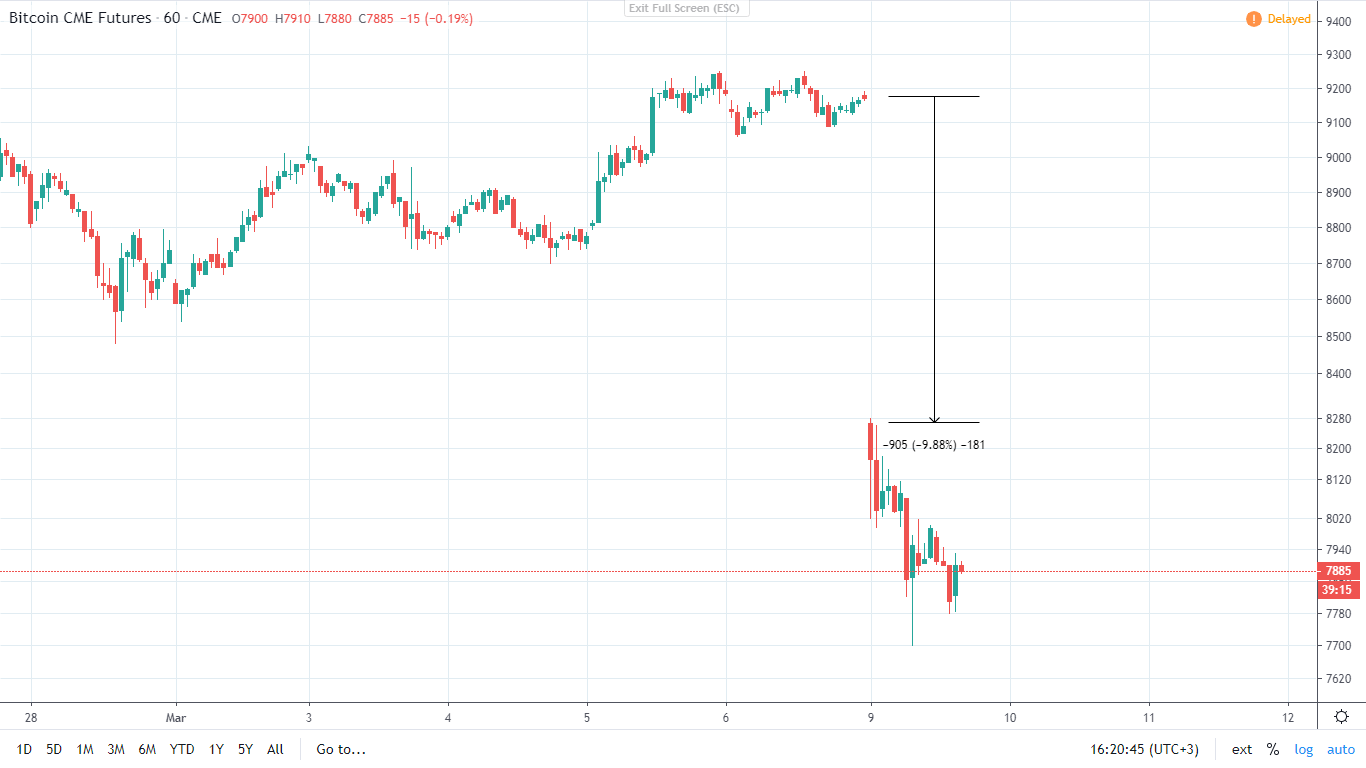

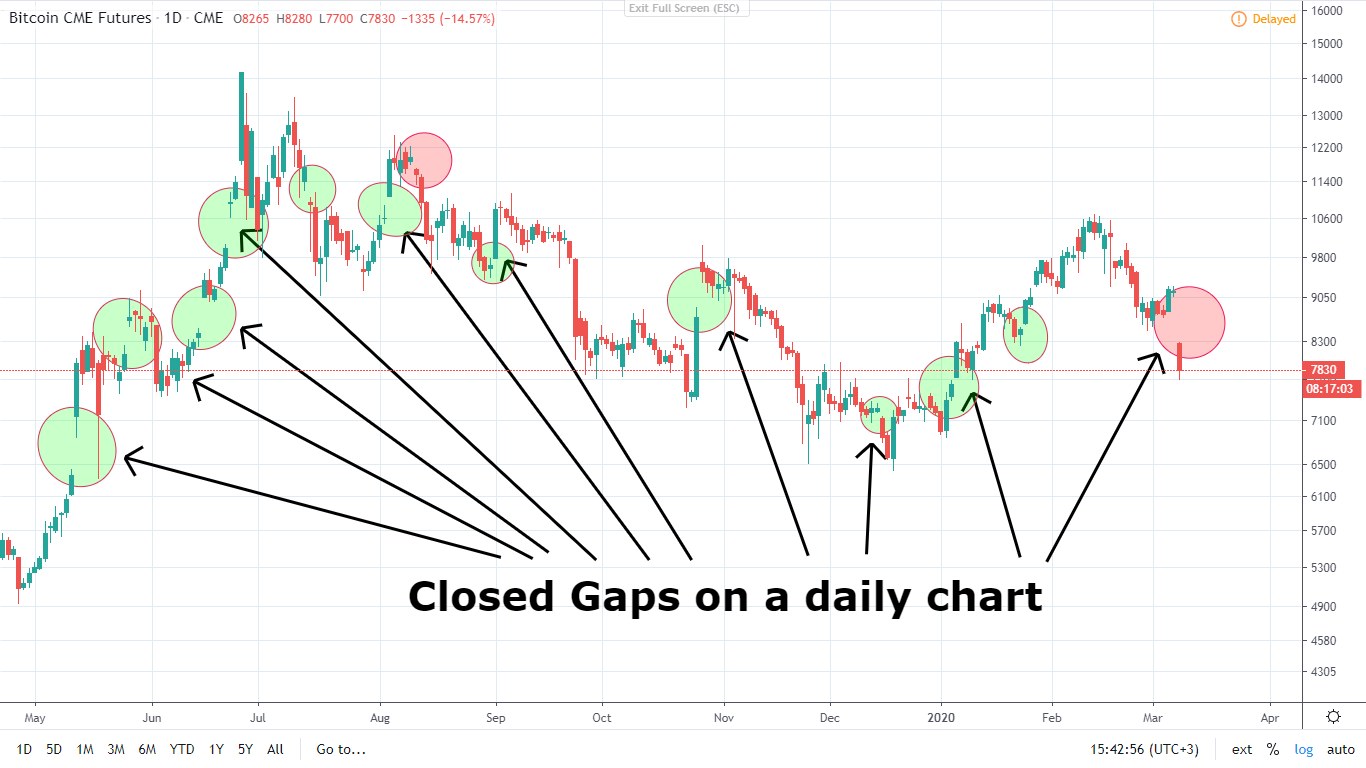

Of all Bitcoin derivatives, futures were the first to really explode into the market, and they remain the most actively traded today. Before they caught on, BTC futures were trading in lesser-known platforms. It’s only in 2014 when increased demand prompted major exchanges such as CME Group Inc and Cboe Global Markets to start offering the service. Bitcoin futures today lead other Bitcoin derivatives in terms of adoption and market activity.

#2. Bitcoin Perpetual Futures (Swaps)

The Bitcoin market also supports derivatives known as perpetual futures or swaps, which are a lot like the standard futures discussed above, except they do not have an expiry date, a predetermined date on which they are to be settled.

Since the contract will never expire, both the parties can hold the position indefinitely, as long as their BTC count holds enough funds to cover them.

Perpetual futures use a mechanism called funding rate, which is a small fee that keeps the price of a contract near the underlying spot price index to cushion against major deviations. Funding rates usually correlate with market sentiment. When the market is bullish, funding rates will be positive, and when the market is bearish, funding rates will tend to be negative.

The funding rates are exchanged between the two participants in a contract (long and short parties) – it’s not a fee collected by the exchange.

Note: Both perpetual features and the funding rate phenomenons were invented by crypto exchange Bitmex.

#3. Bitcoin Options

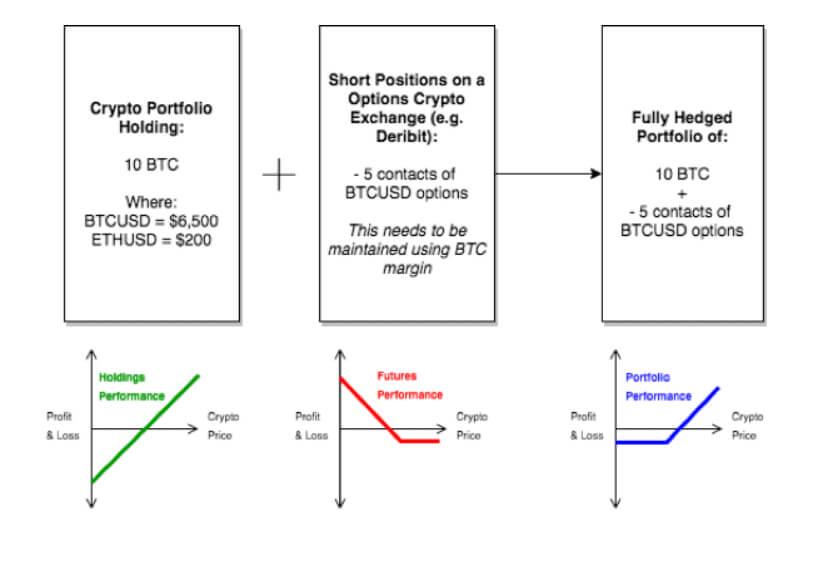

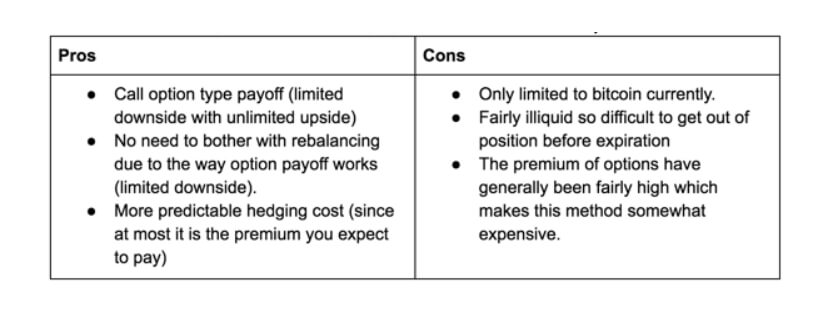

Bitcoin options are derivatives that track the Bitcoin market over time. A trader invests in an option by buying the “option” or right (but not obligation) to sell or buy the asset at a set price (known as the strike price) in the future.

Options contracts can either be of two types: call and put. Call options give you the right to purchase underlying assets before or on a specific date. Put options give you the right to sell it.

Options contracts can also be either European or American. An American option allows you to exercise options rights at any time during the life of a contract (before and on the date of expiration), while the European option can only be executed on the day of expiration.

Owning the rights to an option means that you reserve the right to buy or sell on the expiry date. If you don’t, the contract simply lapses. However, you lose the money you paid for the contract.

Just like futures, options are settled in cash but bear very little risk compared to futures. With futures, both parties (buyer and seller) have unlimited risk and reward (since the price of Bitcoin can go any direction before the settlement). For options, however, only buyers have an unlimited reward for a limited risk, while sellers have unlimited risk and very limited reward.