Hedging your cryptocurrency portfolio – part 3/4

Options

Options are a fairly new and limited concept in the cryptocurrency space. The only exchanges that actually offer it are Deribit and Bitmex.

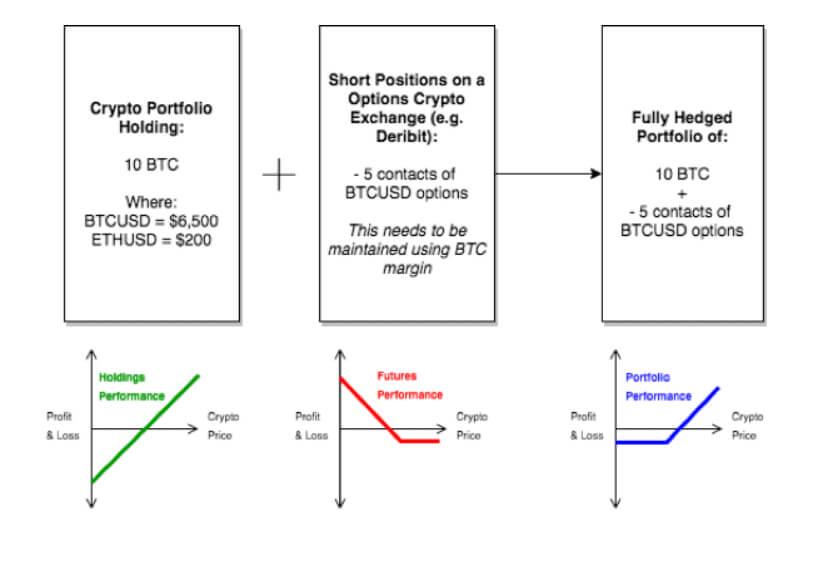

Hedging using options can be pretty complicated. There are multiple ways you can build exactly what you want. We will show one of the most straightforward ways you can hedge out downside risk.

Why You Would Use This Method

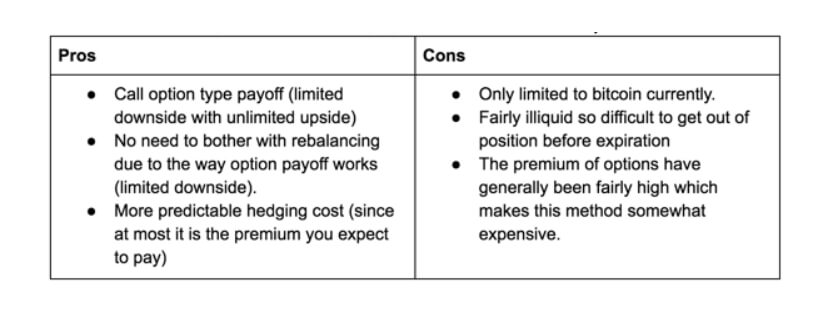

One of the main benefits of hedging by using options is the difference in the payout. Hedging by buying put options can turn your existing options into a call option payout (which have limited downside with unlimited upside). The caveat to the method is that options, especially in the cryptocurrency market, are quite expensive.

Another great thing is that the margin does not need to be monitored as we are purchasing options to construct the hedge. These pros make it a fairly good method for investors that:

Are looking to hedge their positions but cannot, or don’t want to monitor their margin requirements Want the downside protection while still maintaining the potential upside gains.

How to Construct it

You will need:

An account with Deribit (they are the only exchange that offers crypto options)

The steps to constructing this method are similar to using futures:

Based on the current price of Bitcoin and your expected hedging time frame, check for the closest in the money (ITM) put option.

As an example, if BTC is at 6432 and you would like to hold it until the end of the quarter, look for the 6500 put option pricing for the end of the current quarter.

Check the current price of your chosen ITM put option and calculate how much funds you would need to deposit so you could make a 1:1 coverage of your BTC holdings.

Deposit the predetermined funds into the exchange.

Purchase the put option and simply hold it until expiration.

Summary

Hedging with options can be quite a complex task. However, this also means that it can be better tailored to your needs. If you want to use options to hedge and you want to hedge frequently, learning all there is about options is certainly a no-brainer.

Options hedging, as any type of hedging, has its Pros and Cons:

Check out our final part of the Hedging your crypto portfolio, where we will talk about hedging by using Perpetual Swaps.