Trading Bitcoin Futures Gaps – part 2/3

While the previous part explained what price gaps in the Bitcoin futures market are, this part will show how to trade them and what to expect when doing so.

Why do price gaps fill?

There are a few explanations as to why most gaps fill. If the spike was too optimistic or too pessimistic, it might lead to a correction afterward. Another possible explanation might be that the price action was too sharp and did not form any support or resistance levels, making the correction more likely to occur.

Gaps and Bitcoin price

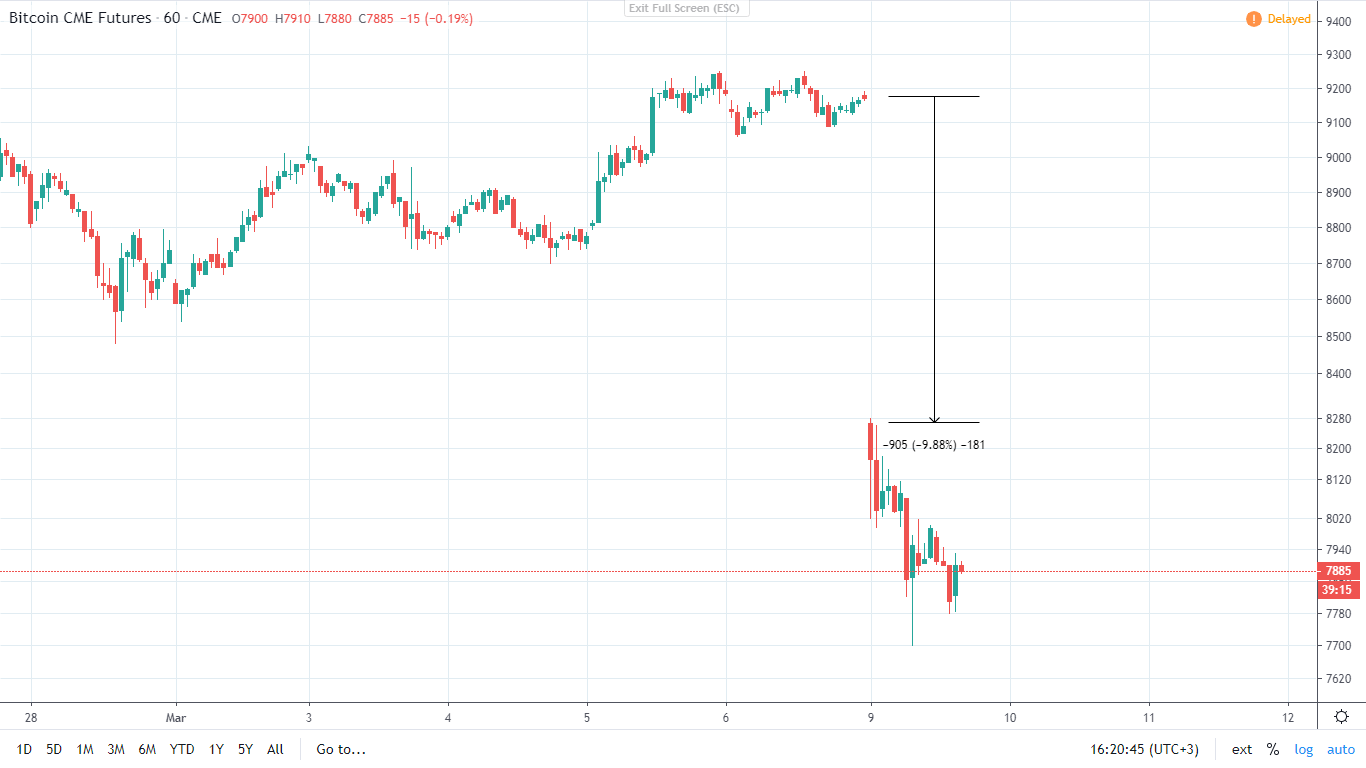

While there is no hard evidence of Bitcoin’s price being directly affected by the price gaps in the futures market, lots of people seem to believe so. In cases where the CME Bitcoin futures price flash crashes in just a few seconds, many people (analysts included) believe that manipulation is occurring.

Traders and Bitcoin price gaps

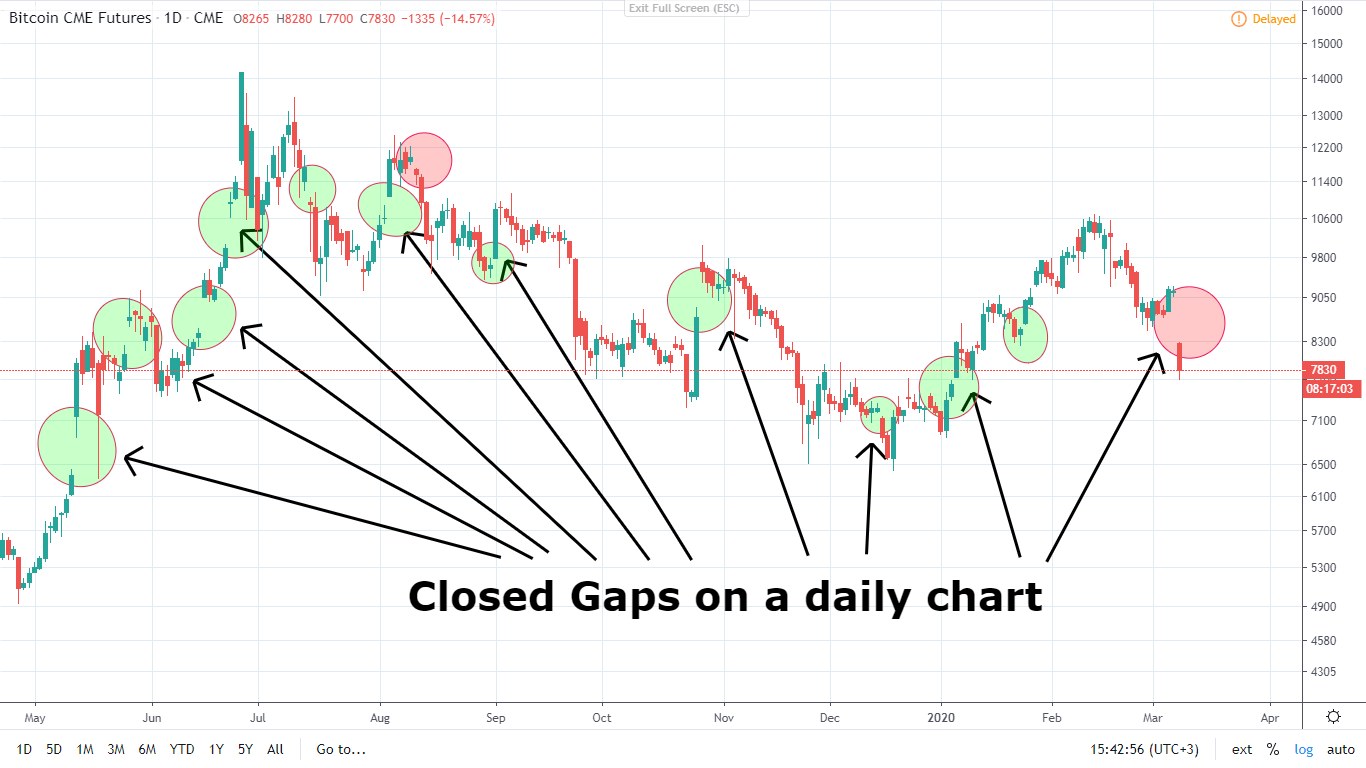

When looking at the price gaps in the Bitcoin futures market, one might conclude that a large majority of them get filled extremely fast. Some traders are even incorporating the futures chart as a necessary tool for their technical analysis. However, doing this could be quite dangerous if not executed properly.

When trading the traditional markets, using gaps as indicators is a lot more transparent. As an example, some traders use strategies such as buying stocks in the after-hours if the company releases an earnings report showing positive results. However, since Bitcoin never stops trading on other exchanges, using this strategy could be trickier than it initially seems.

That’s why we need to know a few rules to trade Bitcoin based on the futures market gaps.

When a significant gap appears, it usually removes the immediate support or resistance levels, meaning that the gap is more likely to get filled. Make sure to trade in the overall direction of the market on a higher timeframe.

The price usually retraces to the original resistance level. The gap will be filled, while the prior resistance will be turned support.

The risk management while trading should be symmetrical (1:1), as almost all gaps eventually close.

Conclusion

Trading Bitcoin while using the CME Bitcoin futures chart gaps as indicators of price direction may be a lucrative strategy. When paired up with good key level analysis, this way of trading might be one of the safer ones. However, one must set its goals (to the upside and downside) correctly to prevent any unnecessary losses.

Check out part 3 of Bitcoin gap trading to learn more about the types of gaps and what they represent.