Hedging your cryptocurrency portfolio – part 1/4

If you are looking for ways to hedge out your crypto investment exposure, this guide will cover four different methods that you can use:

Short Selling

Futures

Perpetual Swaps

Options

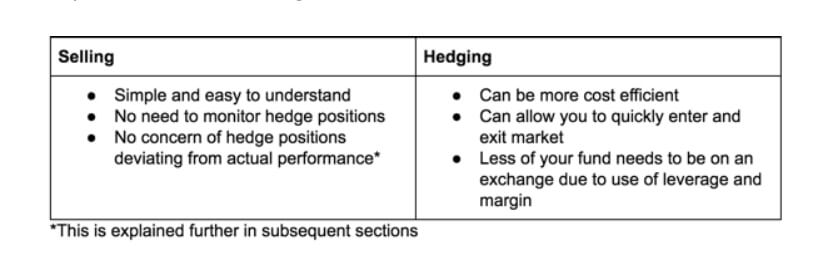

Selling vs. Hedging

The first question that should be asked is, why is there a need to hedge when you can just sell. This point will be covered in each hedge method section individually to avoid any misunderstandings.

Short Selling

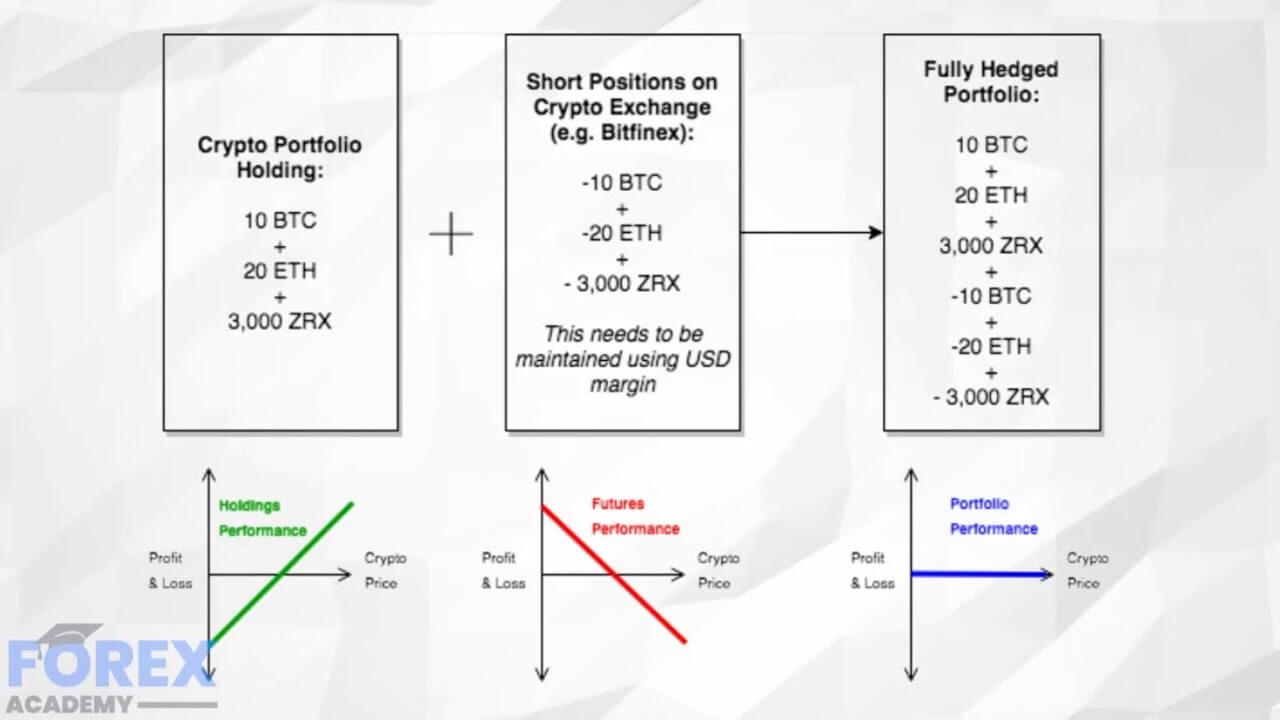

This is the most straightforward method of hedging out your investments. All you need to do is to short sell the cryptocurrencies so that your portfolio will look like shown on the picture (assuming you want to hedge your exposure fully).

Why Would You Use This?

Long-term investors say that you are better off just selling your cryptos as the cost of short selling is higher for the amount of margin funding cost. However, hedging is good for reducing risk in the short-term.

There are several reasons why hedging crypto in the short term is better than selling:

Once you sell your cryptocurrencies on the exchange, the proceeds of the sale remain on the exchange until withdrawal (which isn’t always that easy). This makes your funds subject to default risk. Short selling requires you to have fewer funds on the exchange (which is not the best to store your cryptos on). If your hedge period is short, the process of selling, withdrawing, and then depositing and buying back could be too slow.

How To Construct This

For this method, you are required to have:

An account with any exchange that provides the option to short sell (Optional) USD for maintaining margin in your account

We will be using BTC as an example of constructing a short-sell hedge:

1. Deposit your USD into the exchange that provides the option to short sell. If you do not have any USD available, you can deposit some cryptocurrency and sell a fraction of it

2. The amount of USD that should be on the account will depend on the margin requirements of the exchange

3. Put on a short position on the cryptocurrency that you want to hedge against at a 1:1 ratio. As an example, hedging 10 BTC at a 1:1 ratio will require a short position of 10 BTC

4. Monitor your short positions to avoid reaching the margin call.

6. Close out your short position when you decide to close out your hedge.

Summary

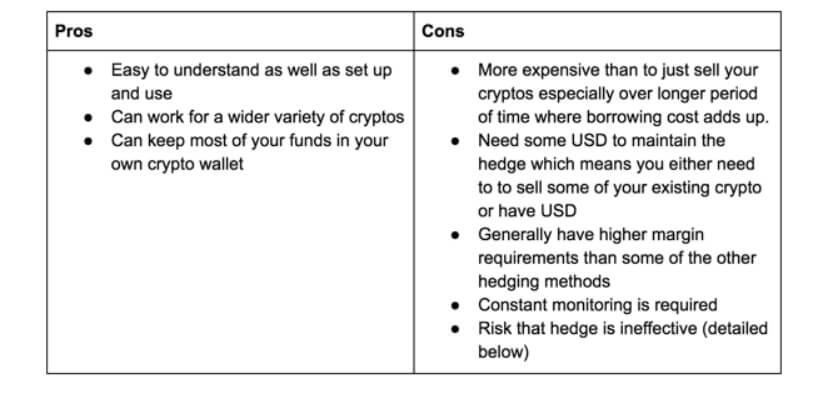

Short selling as a hedge method is best suited for investors that are already diversified, and that want to hedge as selling parts of their portfolio would take too long.

There are quite a few pros as well as cons to using short selling for hedging. This table shows some of them:

Check out the next part of the Hedging your cryptocurrency portfolio, where we will talk about using futures as a hedge.