Hedging your cryptocurrency portfolio – part 2/4

Futures

Futures represent financial contracts that obligate the buyer to purchase a certain asset (or the seller to sell a certain asset) at a predetermined future date and a predetermined price.

Just like in traditional finance, cryptocurrencies have futures contracts that you can use to hedge out your position. Crypto market comes with two types of futures:

Futures that trade in USD and settle in USD, such as CME Bitcoin Futures and CBOE Bitcoin

Futures

Inverse Futures that trade in USD pricing, but settle in BTC, such as Bitmex Quarterly Contract Futures

The profit and loss calculations work slightly differently for these two methods. However, they can both come to the same result.

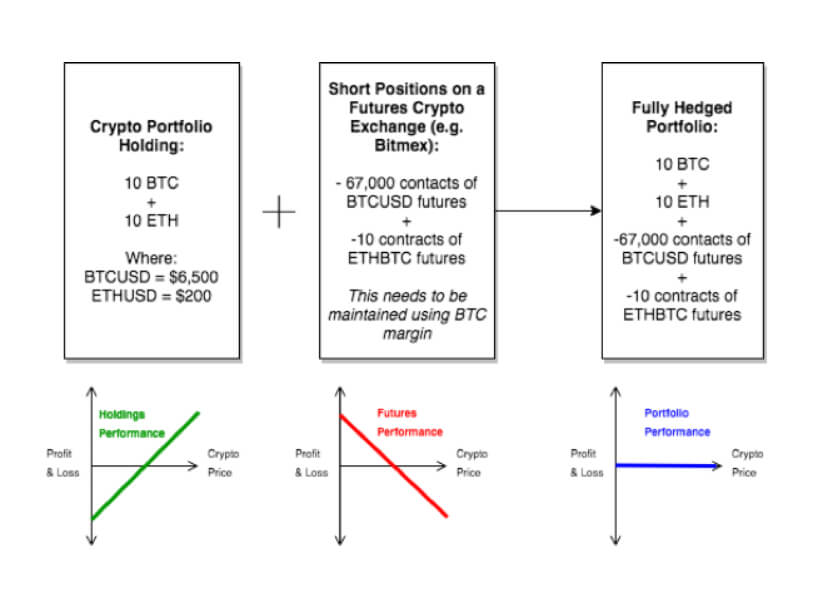

An example of the investment is (if you wish to hedge your position fully):

Calculation explained:

As Bitmex offers only BTCUSD and ETHBTC futures, we need to convert ETH to BTC first. As the contracts are denominated in ETH, we will:

Short 10 ETHBTC futures

Factor this into our BTCUSD hedge. The total short of the BTCUSD position = $6,500 x 10 + $200 x 10 = $6,700

By using this method, your portfolio will be fully hedged (as long as you make sure to maintain your hedge).

Why Would You Use This?

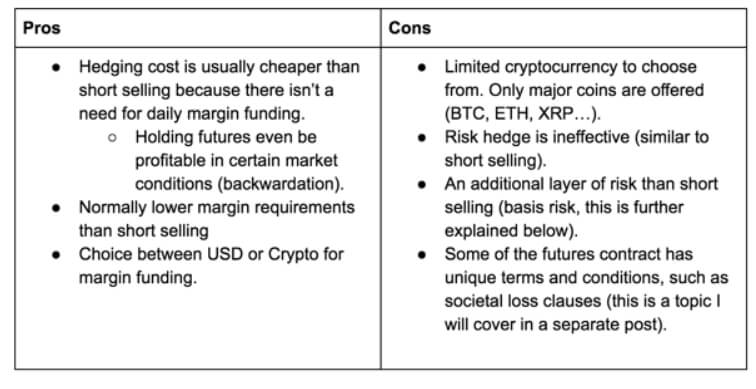

Futures contracts are a fairly cost-efficient way of hedging out your risk. This is because:

You have a lower capital requirement due to the leverage you can use.

You can profit from the hedge over time if the market goes in your favor.

You know the full cost of your hedge the moment you place the hedge on, unlike some other methods of hedging.

How You Construct The Hedge

In order to start hedging by utilizing futures, you will need:

An account with a crypto futures exchange.

To construct this hedged portfolio:

Choose which future contract you will use. Your decision should depend on which currency you wish to settle in and fund the exchange.

If you are settling in USD, you can sell some crypto to fund the account. However, keep in mind that withdrawals and deposits could take some time to process.

Based upon your holdings and what is available on the exchange, you need to calculate which combination of futures contracts you need as well as how many contracts.

Monitor your short positions profit and loss so that if you are getting close to your margin call, you will need to deposit more USD or cryptocurrency into the exchange to maintain your short position.

Depositing into the exchanges can take some time, and since crypto markets are very volatile, make sure to do everything in time.

Close out the short position when you think there is no reason to hedge anymore.

Summary

Hedging by using futures is best suited for cryptocurrency investors that carry the standard coins and are not overly diversified into altcoins. Hedging by using futures is very efficient but requires knowledge of the market as well as futures themselves.