Bittrex has time and again been ranked among leading crypto exchange platforms across the world. And some of the factors that keep it ahead of competition include the fact that it embraces advanced technologies in guaranteeing system security as well as the wide range of cryptocurrencies one can trade on this platform. We attribute these to the fact that Bittrex is one of the few exchanges that haven’t lost its client assets to crypto hackers.

They offer three different types of accounts with the highest level (Enhanced account), giving total freedom to the trader. Several other perks come with trading in Bittrex exchange. But how safe are your crypto transactions on this platform? Is the platform even reliable?

With so many options available and stringent regulations that vary from state to state, it is essential to understand the exchange before investing your money. Below is a brief overview of the Bittrex crypto exchange platform, including its features, signup, accounts, pros, fees, and customer support, among others.

What is Bittrex?

Bittrex is one of the oldest exchange platforms founded back in 2014 by former Microsoft employees Richie Lai, Bill Shihara, and Rami Kawach. The exchange is headquartered in Seattle, Washington, but its reach extends well beyond the United States. Ideally, virtually anyone across the world can create a free trader or investor account with Bitmex exchange.

Both traders and investors on the platform are, however, advised to check their local regulations before they begin trading with any crypto exchange platform. Bittrex offers a familiar proposition for experienced traders. They provide various cryptocurrencies you can trade and also supports fiat currencies.

Their custom trading engine seamlessly combines various automated trading features such as GTC (good till canceled), stop loss, and instant sell or buy, among others. The interface also loads very first and is more beginner-friendly than most platforms. You will never experience any lags with this platform.

It, however, does not support margin trading. As such, Bittrex suits the traditional crypto trader looking for a wide variety of cryptos and standard spot trading orders. And you will like it here because the exchange supports over 234 different cryptocoins and doesn’t charge deposit fees.

How does Bittrex work?

Bittrex works like a classic cryptocurrency exchange, so those who have experience trading cryptos will find it quite familiar. The platform presents the trader with both standard technical and charting tools traders needed to manage their accounts. Once you have an account, you can deposit funds and begin trading. Keeping in mind that the platform supports three types of accounts: unverified, basic, and enhanced.

Unverified accounts

These have various limitations, including a lower cap on the maximum withdrawal you can make (1 Bitcoin per day). When you sign up for Bittrex, you automatically create an unverified account. You will require the 2-factor verification to upgrade to the basic account. However, there are various tools you can use to help you learn more about the platform. Unverified accounts are most appealing to beginners looking to expand their crypto trading skills

Basic accounts

This option offers more tools and access with the possibility to withdraw up to 3 Bitcoin per day. You can upgrade to the basic account once you complete the 2FA verification process. The platform uses a strict verification process and collects more information about their clients. However, this ensures they provide trustworthy coins and keep the exchange secure.

Enhanced account

This is the premium option for prolific crypto exchange traders looking for total freedom. With enhanced accounts, you can withdraw up to 100 Bitcoin per day. In addition to the two-factor verification, enhanced accounts require you to provide a photo of your government-issued ID and a selfie portrait.

Once you have an account, trading is effortless with Bittrex. The platform is known for its sleek user-friendly features and fast-loading interfaces. You can easily access your dashboard, make trades, track your orders, and contact customer support.

Bittrex account registration

Registering for an account with Bittrex is an effortless and straightforward process. All you need is a valid email address and proof that you are 18 years or older. As aforementioned, you can sign up for any of the three account options available depending on your unique requirements. If you seek a robust platform with all the necessary trading tools and features, the enhanced account is more suitable. Conditions are also different for each account.

Unverified accounts are entry-level with minimum requirements. They also have limitations, since the platform has not verified user identity. You will need to complete the two-factor verification and provide your ID and portrait, among other necessary info to get full access to the exchange. As a global service headquartered in Washington, Bittrex allows registrations from anywhere in the world, provided you meet the minimum requirements.

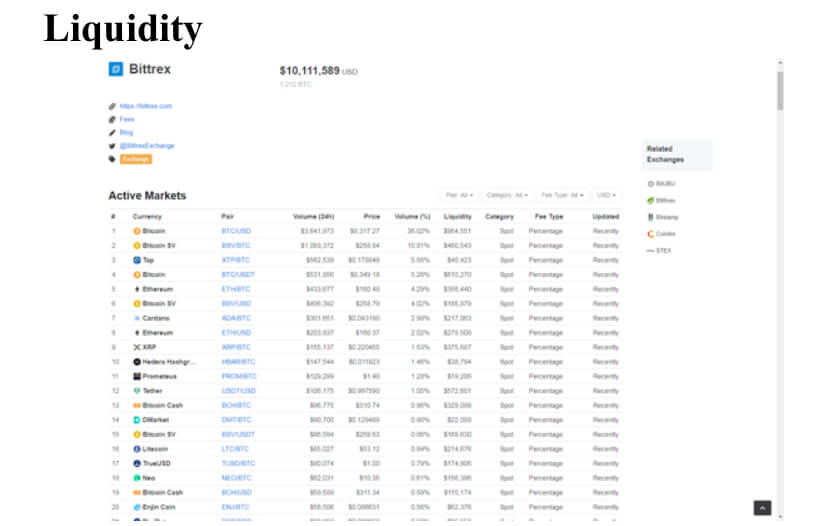

Number of cryptocurrencies supported on Bittrex

As one of the older exchange platforms, Bittrex was initially designed to support Bitcoin. However, the exchange has since expanded to accommodate over 400 altcoins you can trade against Bitcoin, Ethereum, US dollar, and Tether (USDT). The platform also supports FIAT, although deposits are made using the cryptocurrency wire transfers.

Bittrex is known for its transparency when it comes to listing up and coming altcoins thanks to its strict source code vetting process. Plus, they also remove inactive coins from their listing to improve the overall quality of their offers. Currently, the only FIAT supported is the USD.

How to trade on Bittrex?

Bittrex offers an effortless way to trade cryptocurrency and manage your digital assets. Once you have signed up for an account and made a wire transfer deposit, you can start analyzing cryptos and making trades. There are various tools and features available from your dashboard to help you pick an option. Bittrex allows investors to buy, sell, or trade cryptos against other coins. You can also use automation features to stop you from generating losses past a preset limit. The platform also has charting tools you can use to track and analyze your trade.

Bittrex trading fees and charges

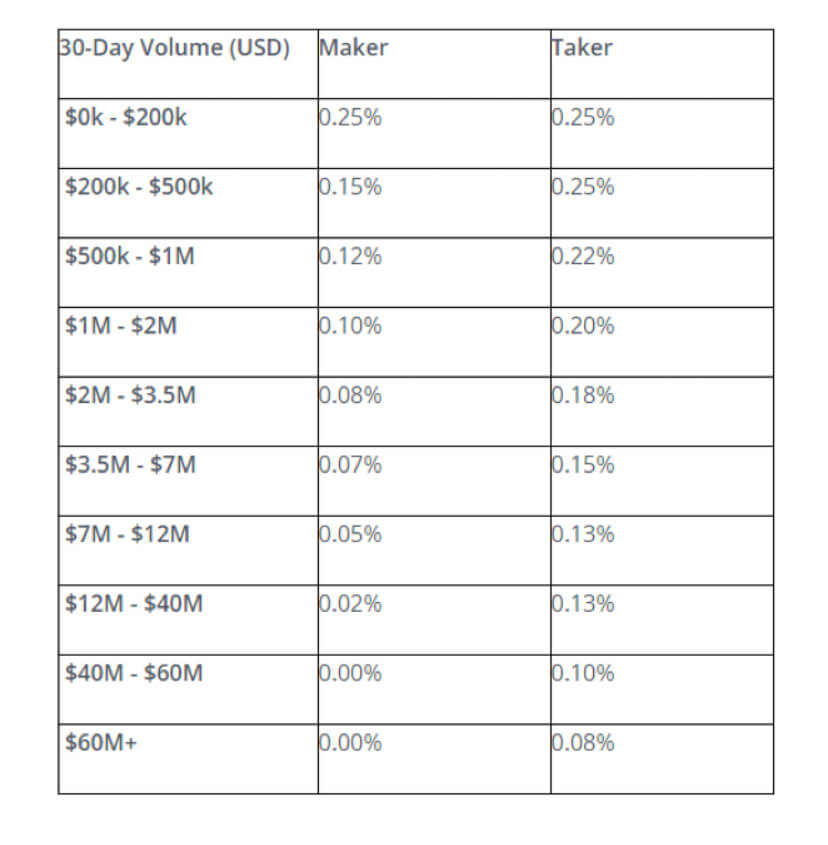

When it comes to trading fees, Bittrex commissions are slightly higher than the industry average. The platform charges a flat commission of 0.25% on all trades, which can translate into a lot, especially if you are making larger transactions. They do not have any high-volume trades, rebates, or incentives for markers and traders.

There are no fees charged for deposits and withdrawals. However, each coin has its unique transfer fee built into the trade. There are no hidden fees in the system, and the high margins are justified by the platform’s sleekness and premium status. Bittrex offers a decent opportunity to trade numerous cryptos and make a profit.

Deposit and withdrawal

Bittrex does not charge anything for deposits and withdrawals. There, however, is a cap on how much you can withdraw, depending on your type of account. The platform also has no support for direct purchases of crypto using credit, debit, or ACH bank accounts. Nonetheless, identity-verified customers operating outside the US are eligible for USD currency deposits and withdrawals.

About 40 US states, including Alaska, Alabama, California, Indiana, Georgia, Florida, Ohio, Texas, Washington, Michigan, and New Jersey, among others, also have access to this feature. However, you must first add Bitcoin to your e-wallet before you can start purchasing other coins.

Security and digital asset protection

Bittrex is known for its emphasis on all matters of safety. Their platform is one of the safest you will come across in the crypto world, and they use a strict verification process to ensure users are real and safe. The platform also scrutinizes all coin listings and has various security measures to fix all vulnerabilities. The founders of the platform are former security experts with over 40 years of combined experience.

This platform has never been hacked, and there are no cases of any insecurity, which is very impressive considering Bittrex has been around since 2013. Their elastic multi-stage wallet strategy also keeps 80%-90% of user funds in offline cold wallets. Withdrawals require 2-factor verification and API calls, making the platform impossible to breach.

Registration and regulation

Bittrex is a legitimate cryptocurrency exchange company headquartered in Seattle, Washington. While the service is not regulated under the US Securities laws, it abides by all compliance requirements in the places it is available. The company is also not FDIC insured, which presents a significant level of concern should the company go down. Nonetheless, it has been around for a while and boasts a large community of users.

Bittrex customer support

Bittrex offers 24/7 customer support with multiple communication channels. However, as a large platform with numerous users, their customer support is relatively weak compared to most alternatives. Several reviewers have also reported cases of unwarranted suspension pf trader accounts as well as Bittrex taking too long to reply to customer issues. This can be frustrating, but you eventually get a response from the team.

Bittrex maintains that only 0.1% of its user accounts suffer suspensions and outright bans. Their low-tier requirements also make it appealing for the un-banked global population. But you are advised to first check your local laws on Crypto transactions before investing your money here.

Everything else you need to know about Bittrex

Bittrex is among the leading crypto exchange platforms with low minimum requirements and a sleek feature-rich platform. You can easily create an account, load your wallet, and make trade orders. Managing and monitoring the account is also not as daunting as with other platforms.

However, trading crypto involves a considerable amount of risk. The main benefit of Bittrex compared to alternatives like Binance is verified account owners can access USD deposits and withdrawals. Other than that, Bittrex offers the conventional exchange experience for anyone seeking robust platforms with all popular options.

Verdict: Is it safe to trade on Bittrex?

Other than the reported issues with customer service, Bittrex offers everything necessary to begin trading cryptocurrency. Registration is effortless, and there are several technologically advanced tools and features to help you complete trades. They have also invested in security and as evidenced by their exhaustive verification process. While the site is designed to be beginner-friendly, it has various elements that make it attractive for all kinds of crypto traders. It is also a legal business that boasts of close to five years of experience in the crypto exchange industry.