PaxForex is an online foreign exchange broker based in Saint Vincent and the Grenadines and is registered with the Financial Services Authority (FSA). They ere founded by a team of professional traders who have extensive knowledge in trading forex, stocks, options, and CFDs. They aim to offer high-quality customer services, trading conditions and overall conditions for their clients. We will be looking into the services of an offer to see how they compare to the competition in this very saturated and competitive market.

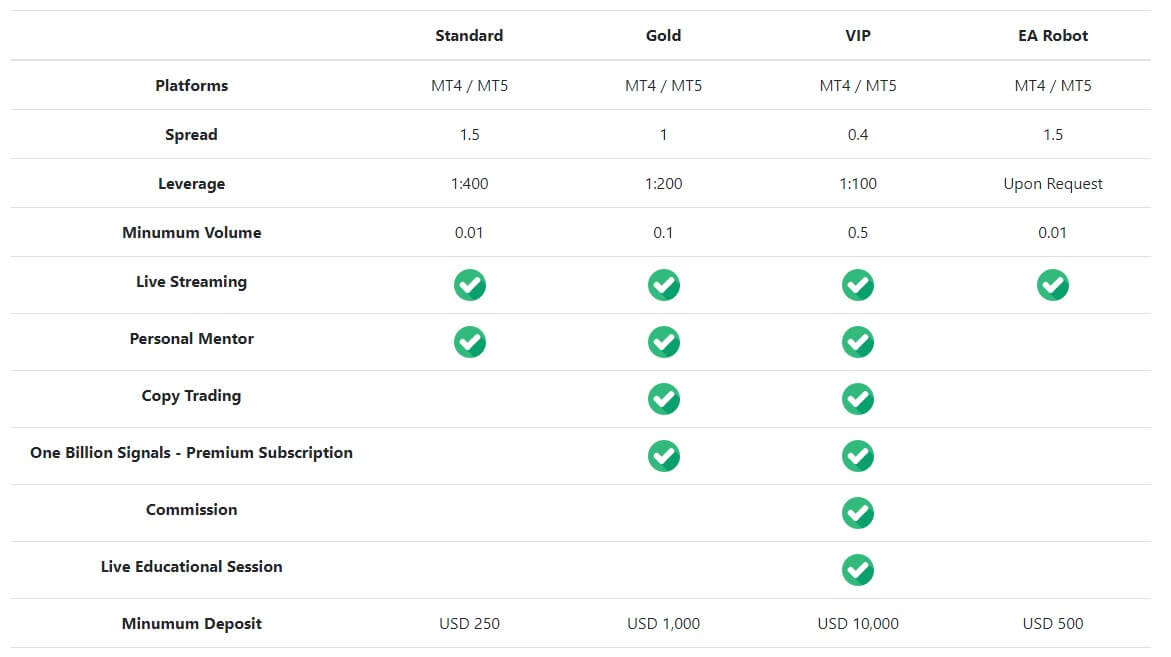

Account Types

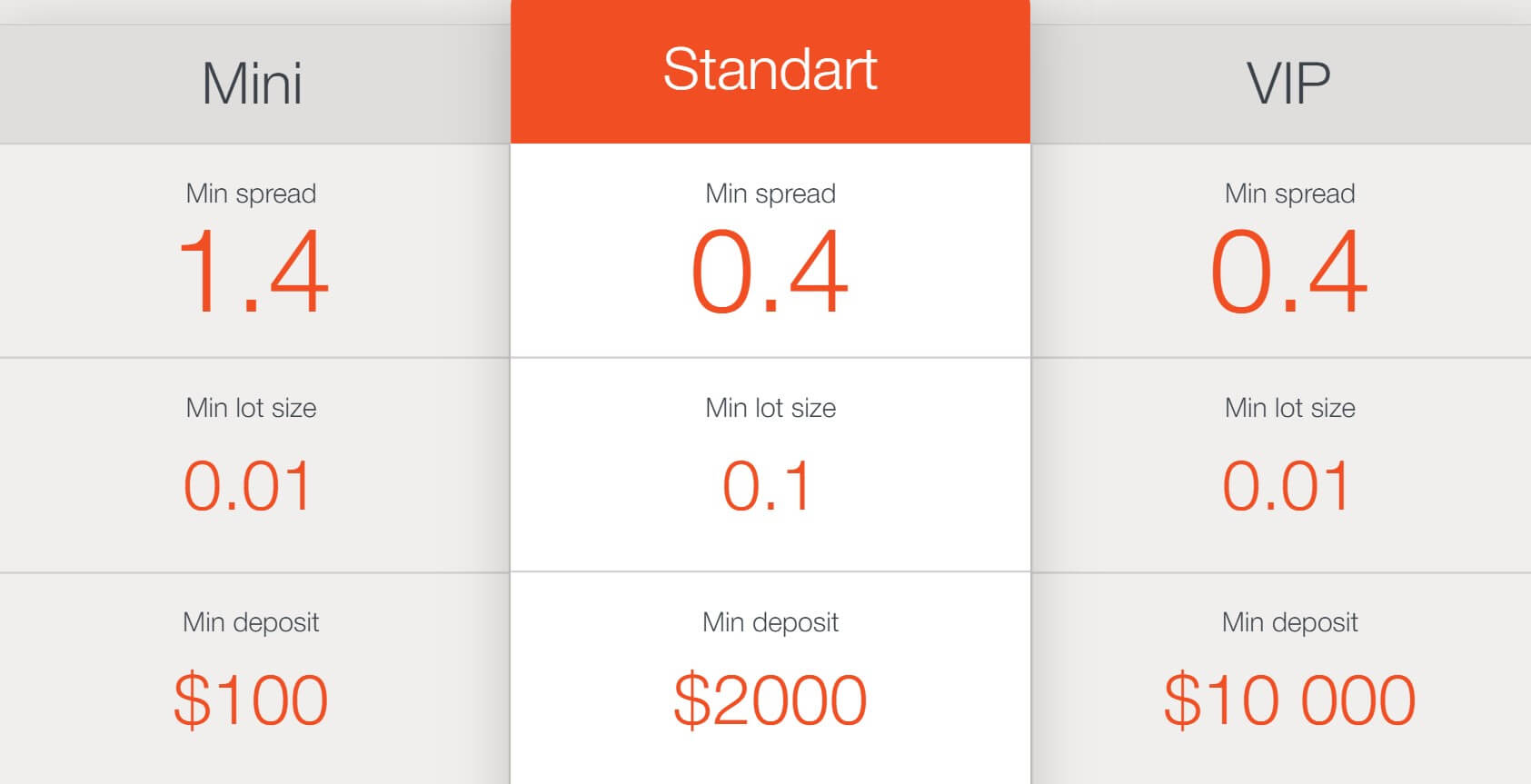

There are four different account types available, each based on the deposit value that you need to deposit with. They each come with their own conditions and features that we have outlined for you below.

Cent Account:

This account requires a minimum deposit of $10 but a recommended amount of $100. The base currency can be in USD and can be leveraged up to 1:500. The account comes with spreads starting from 2.4 pips, the lot size is 1,000 units and the minimum trade size is 0.0001 lots. The account has access to forex pairs, Gold and silver. There is no maximum trade size, the margin call level is set at 55% and the stop out level is set at 20%. You can get a VPS for $25 per month when using this account.

Mini Account:

This account requires a minimum deposit of $100 but a recommended amount of $500. The base currency can be in USD, EUR or GBP and can be leveraged up to 1:500. The account comes with spreads starting from 2.4 pips, the lot size is 100,000 units and the minimum trade size is 0.01 lots. The account has access to forex pairs, Gold, Silver, and shares. There is no maximum trade size, the margin call level is set at 10% and the stop out level is set at 5%. You can get a VPS for $25 per month when using this account. A swap-free version of this account is also available.

Standard Account:

This account requires a minimum deposit of $2,000 but a recommended amount of $5,000. The base currency can be in USD, EUR or GBP and can be leveraged up to 1:500. The account comes with spreads starting from 2.4 pips, the lot size is 100,000 units and the minimum trade size is 0.01 lots. The account has access to forex pairs, Gold, Silver, and shares. There is no maximum trade size, the margin call level is set at 10% and the stop out level is set at 5%. You can get a Free VPS when using this account. A swap-free version of this account is available. it comes with a personal manager and priority trade execution.

VIP Account:

This account requires a minimum deposit of $10,000 but a recommended amount of $50,000. The base currency can be in USD, EUR or GBP and can be leveraged up to 1:500. The account comes with spreads starting from 2.4 pips, the lot size is 100,000 units and the minimum trade size is 0.01 lots. The account has access to forex pairs, Gold and silver. There is no maximum trade size, the margin call level is set at 10% and the stop out level is set at 5%. You can get a VPS for $25 per month when using this account. A swap-free version of this account is available and it comes with a personal manager.

Platforms

MetaTrader 4 is the only platform offered by PaxForex, and it is a good platform to have. It is one of the most well known and use platforms offering a whole host of features that can help with your trading and analysis. It is also accessible as a desktop download, mobile application or web trader. Some of its other features include a simple and user-friendly interface, a customizable view.

You can put any group of colors for every forex chart, three major types of forex charts: Bars, Candlesticks and Line Chart, nine timeframes, more than 50 built-in indicators that help traders during the analyzing process, ability to use as many indicators on one chart, multiple chart setups, automated trading through expert advisors, and real-time data export via DDE protocol.

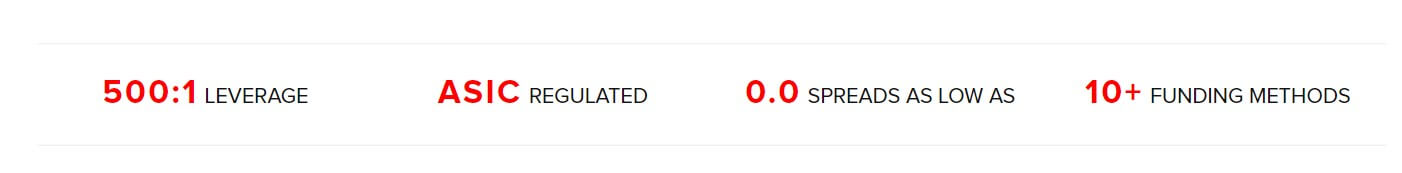

Leverage

The maximum leverage available to all four accounts is 1:500. The leverage that you want can be selected when opening up an account. You can get the leverage changed on an already open account by contacting the customer service team with the change request.

The maximum leverage available to all four accounts is 1:500. The leverage that you want can be selected when opening up an account. You can get the leverage changed on an already open account by contacting the customer service team with the change request.

Trade Sizes

The Cent account is a smaller account, 1 lot is equal to 1,000 base units, so the smallest size in the platform being 0.01 lots equates to 0.0001 lots. The Mini, Standard, and VIP accounts have full 100,000 unit lot sizes. The minimum trade sizes on the accounts are 0.01 lots and they go up in increments of 0.01 lots. There is no maximum trade size but we would recommend not trading over 50 lots in a single trade due to execution and slippage issues. We do not know what the maximum number of trades you can have at any one time is.

Trading Costs

All four accounts use a spread based system so there is no added commissions on the accounts when trading. There are, however, swap charges which are fees charged for holding trades overnight. These can be viewed within the trading platform you are using. They are also available on the website under the contract specifications. The Mini, Standard and VIP accounts can also be used as an Islamic swap-free account where these swap charges are not present.

Assets

The assets on PaxForex have been broken down into a number of categories, we have outlined these below along with the instruments within them.

Forex:

EURUSD, GBPUSD, USDCHF, USDJPY, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, NZDJPY NZDUSD, USDCAD, USDSEK, EURSEK, USDNOK, USDDKK, EURDKK, USDMXN, EURMXN, USDZAR, UERZAR, EURNOK, USDPLN, EURPLN, USDSGD, EURSGD, USDHUF, EURHUF, AUDDKK, AUDPLN, AUDSGD, CHFSGD, EURHKD, GBPDKK, GBPNOK, GBPPLN, GBPNZD, GBPSEK, GBPSGD, GBPZAR, NZDCAD, NZDCHF, NZDSGD, SGDJPY, USDHKD, USDTRY, EURTRY.

Metals:

Just Gold and Silver are available to trade.

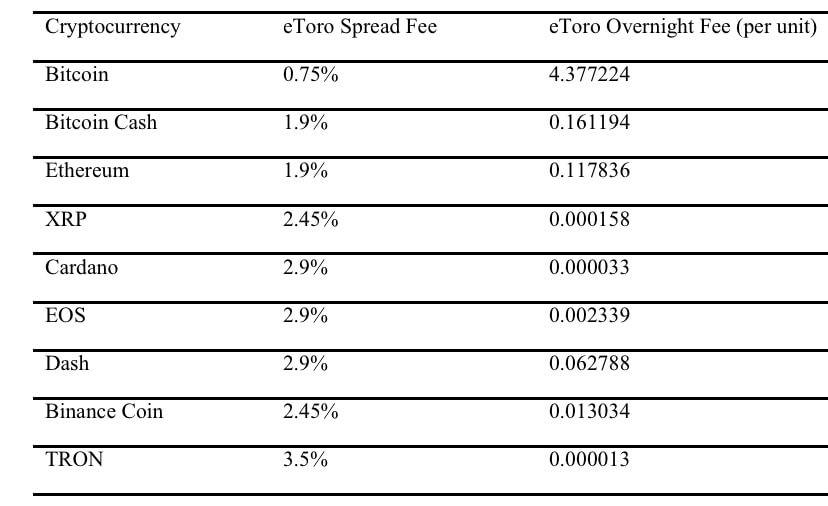

Cryptocurrencies:

Bitcoin, Ethereum, Ripple, and Litecoin are available for trading.

Shares:

There are plenty of shares available to trade, some of these include Apple, Cisco, Facebook, Google, Intel, Microsoft, and Alcoa.

Spreads

The spreads that you get depends on the account you are using, the Cent account has spreads starting from 2.4 pips, the Mini account from 1.4 pips, the Standard account 0.4 pips and the VIP account also start from 0.4 pips. The spreads are variable which means they move with the markets, the more volatility or lower liquidity will cause the spreads to grow larger. Different instruments will also have different spreads, so while the typical spread for EURUSD maybe 0.8 pips, it will be 2.5 pips for AUDJPY.

The spreads that you get depends on the account you are using, the Cent account has spreads starting from 2.4 pips, the Mini account from 1.4 pips, the Standard account 0.4 pips and the VIP account also start from 0.4 pips. The spreads are variable which means they move with the markets, the more volatility or lower liquidity will cause the spreads to grow larger. Different instruments will also have different spreads, so while the typical spread for EURUSD maybe 0.8 pips, it will be 2.5 pips for AUDJPY.

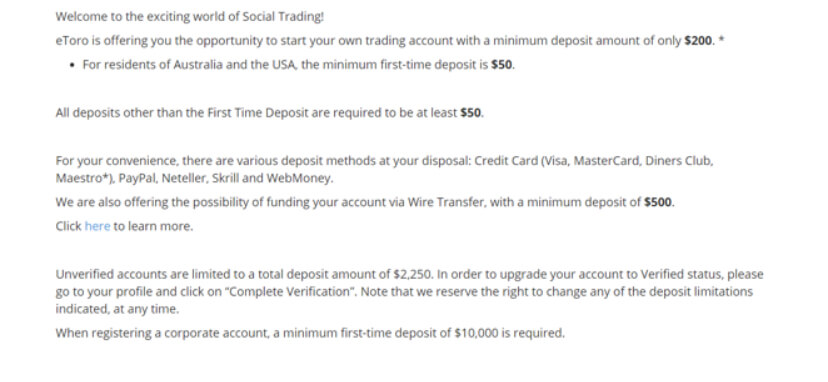

Minimum Deposit

The minimum amount required to open up an account is $10 which allows you to use the Micro account, the Mini account requires $100, the Standard $2,000 and the VIP requires a deposit of $10,000. Once an account has been opened the minimum amount required reduces down to $10 for all top-up deposits.

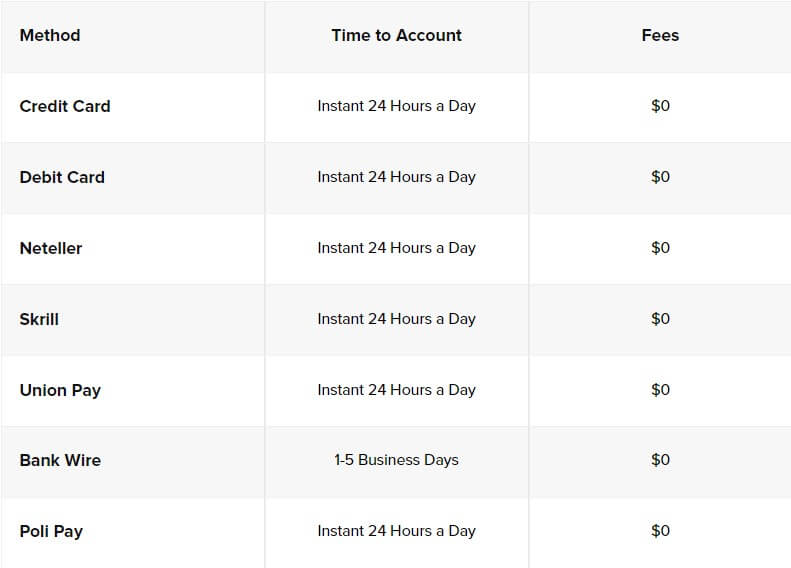

Deposit Methods & Costs

There is a wide range of methods available to deposit with. Some have fees attached to them while others do not. We have outlined the methods below along with any potential fees.

- Neteller – 3.2% -3.7% + $0.29 min 1$

- Bank Transfer – Bank commission

- Credit/Debit Cards – up to $299 3.75%-8.5% +$0.5, above $300 – 0% fee

- Skrill – 2.9% – 3.9% + 0.38 USD

- Perfect Money – No fee

- WebMoney – 0.8% fee

- QIWI Wallet – 4% fee

- FasaPay – 0.5% fee

- Bitcoin – No fee

- Ethereum – No fee

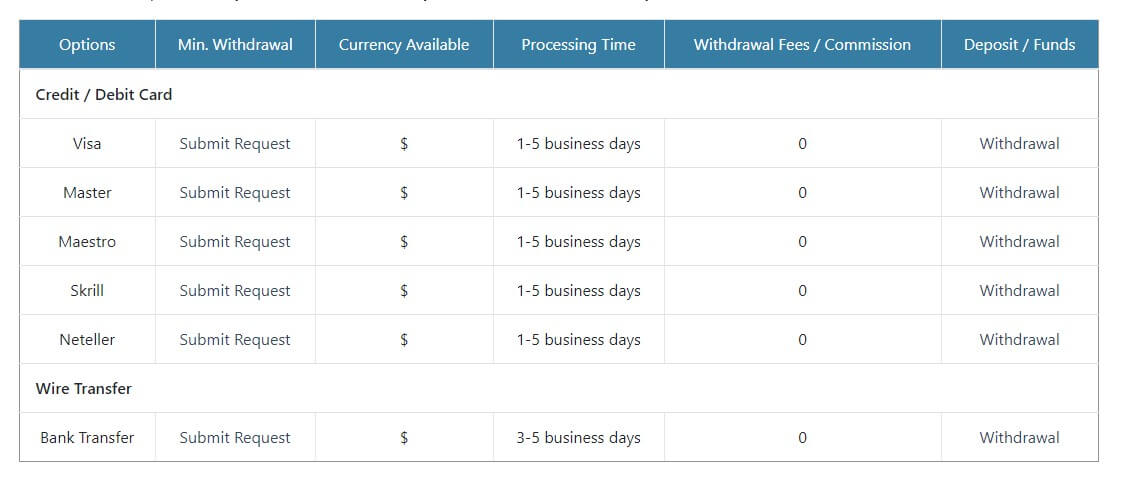

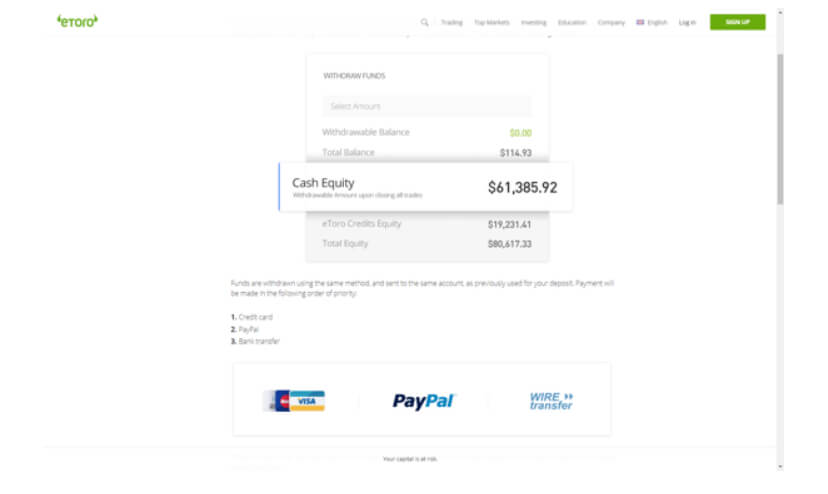

Withdrawal Methods & Costs

The same methods are available to withdraw. We have outlined them again with any fees that apply to them.

- Neteller – No fee

- Bank Transfer – Bank commission

- Credit/Debit Cards – 5,5% (Min 10 USD)

- Skrill – from 1% up to 3,9% + 0,35 USD

- Perfect Money – 2.5% fee

- WebMoney – 0.8% fee

- QIWI Wallet – 1% fee

- FasaPay – 0.5% fee

- Bitcoin – 7% + 0.0006 BTC fee

- Ethereum – 7% fee

Some of the fees are extremely high which could make it quite expensive to get your money out of PaxForex.

Withdrawal Processing & Wait Time

PaxForex will process withdrawal requests within 1 working day of the request being made. It will then take between 1 to 5 working days for the withdrawal to fully process, this will depend on the method used and the processing speed of the method such as your bank’s own processing times.

Bonuses & Promotions

There is only one promotion displayed on the promotion page but unfortunately, it has now ended. We will still outline if just so you can get an idea of the sort of promotions that may be offered. If you are after bonuses, then you could always contact the customer service team to see if there are any new ones coming up that you could take part in.

Labour Day 2019 Promotion:

Based on the amount that you deposit, you will receive the spread back on a selection of trades of your choosing.

- deposit 500 $ – we will recover the spread of 4 trades of your choice

- deposit 1000 $ – we will recover the spread of 10 trades of your choice

- deposit 1500 $ – we will recover the spread of 15 trades of your choice

- deposit 3000 $ – we will recover the spread of 30 trades of your choice

Educational & Trading Tools

There are a lot of options when it comes to education and tools, the first being a set of trading courses. These go over the basics of trading and can give you a good starting platform. There are infographics that give a little bit of information about trading, and there is also a glossary detailing different terms used when trading if you come across anything you do not understand you can refer to this page to learn what it means.

There is some fundamental analysis which seems to be updated regularly throughout the week. It can give you ideas on what to trade. Along with the fundamental analysis is some technical analysis, this is once again updated daily to help with your own analysis. There is a forex related blog and an economic calendar that details upcoming news events and any potential effect the news could have. The final section is a calculator that can help you work out costs, profits and other areas of your trades.

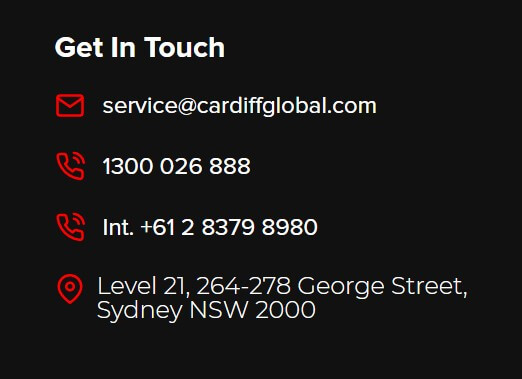

Customer Service

PaxForex is offering a few ways to get in touch with them. You can use the online form, fill it in and you should then expect a reply via email. They also provide you with a postal address, a phone number, and an email. You could always use a host of social media sites like Twitter to get in touch too.

Address: 1825, Cedar Hill Crest, Villa, Kingstown, St. Vincent and Grenadines

Phone: +44 2035040387

Email: [email protected]

Demo Account

You can open up a demo account using the form on the home page of the site. We, unfortunately, we do not have information about it such as the trading conditions or expiration times. The demo account allows you to test out the markets and strategies completely risk-free.

Countries Accepted

This information is not provided on the site so if you are thinking of signing up with PAXForex, you should contact the customer service team to ensure you are eligible for an account prior to opening one up.

Conclusion

PaxForex offers a range of accounts each with its own trading conditions. They all use a spread based system and so there are no commissions to worry about. The spreads on the Cent account are a little high while they are much more competitive on the top tier accounts. There are lots of ways to deposit and withdraw is good, but the fees are pretty high for both depositing and withdrawing. So while the trading is cheap, the funding is not. There are plenty of assets to trade which is good. You should always be able to find something available and there is some decent educational material for those just starting out. Our main concern is the high fees for funding, if you don’t mind them and can deposit enough to get a higher tier account then PaxForex could be a decent broke to use. If not, then we would suggest looking elsewhere for a slightly cheaper option.

Leverage

Leverage Minimum Deposit

Minimum Deposit

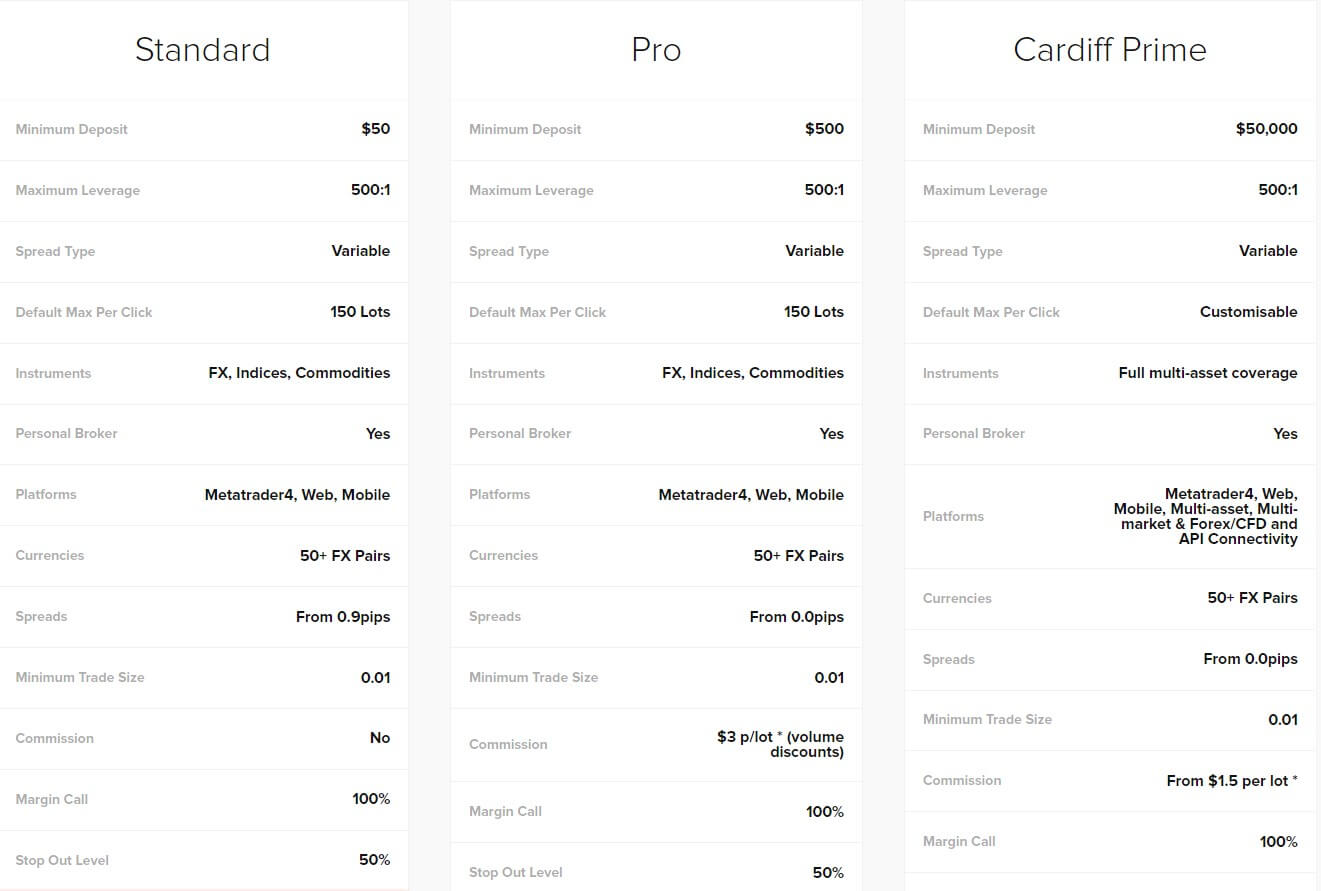

Aronex uses the Metatrated 4 platform only, highlighting its great ability for analysis, indicators, automation, etc. No web or mobile versions are up. An interesting quote is a relationship Aronex has with the developers of the MT4 platform to provide the best experience and trading conditions to clients. We are unsure as to how the developers can influence the trading conditions a broker provides unless some plugins are used, like the notorious Virtual Dealer plugin.

Aronex uses the Metatrated 4 platform only, highlighting its great ability for analysis, indicators, automation, etc. No web or mobile versions are up. An interesting quote is a relationship Aronex has with the developers of the MT4 platform to provide the best experience and trading conditions to clients. We are unsure as to how the developers can influence the trading conditions a broker provides unless some plugins are used, like the notorious Virtual Dealer plugin.

Trading Costs

Trading Costs Spreads

Spreads Bonuses & Promotions

Bonuses & Promotions