Surprisingly, many people just buy Bitcoin and fumble with the investment until they make some profit. Investing in Bitcoin is actually a serious venture, and contrary to widespread practice, it needs a strategy! But what is an investment strategy anyway? What constitutes a good strategy? And, does it apply to all forms of Bitcoin investment?

These are the hard questions we seek to answer in this article.

Is There a Right Way to Invest?

When investing in crypto or any other asset, you can gain or lose. The most successful investors are those who combine tactic, experience, and of course, luck. Since we cannot do anything about experience and luck, we are usually left with the tactic in the playground, and that’s where planning comes in. We’re not saying that there is a right or wrong way to invest. But, if you are really keen on maximizing your profits and keeping risks at bay, then planning for that journey is indispensable.

What is an Investment Strategy?

An investment strategy is a calculated approach that helps an investor make decisions to achieve specific goals. The investor could be seeking to multiply wealth. They could be seeking to protect whatever they already have. Regardless of the circumstances, an investment strategy must consider the investor’s goals, risk tolerance, and future capital needs.

What Constitutes a Good Strategy?

Keeping in mind the above picture of what an investment strategy is, it is easy to figure out what a good one should be made of. Generally, you can consult the following checklist if you want to come up with a sound Bitcoin investment strategy.

- It contains your definition of risk tolerance – Risk is a central component of any investment strategy. Defining your risk tolerance helps you apply brakes when the train is accelerating in the wrong direction. It might sound trivial, but desperate decisions are never far from the mind when things get thick.

- It identifies your goals – An investment strategy is nothing without goals. It should be clear from the start what you want to achieve from such an engagement.

- It should be realistic – If it were that easy to make money, everyone would be rich. The excitement one gets when approaching an investment may mislead them to overshoot.

- It should aim at maximizing profits and minimizing risks – well, that’s the whole point of investing.

This is by no means an exhaustive definition of a good investment. However, it is a fair guide on how to approach planning for your Bitcoin investment. With this background in mind, let us look at how you can develop an award-winning Bitcoin investment strategy.

Step #1 Identify the opportunity and the risk

If there is no opportunity, abort the mission. Diving straight into an investment without identifying whether there is a suitable opportunity sounds like gambling. After all, the whole purpose of venturing into investment is taking advantage of some opportunity.

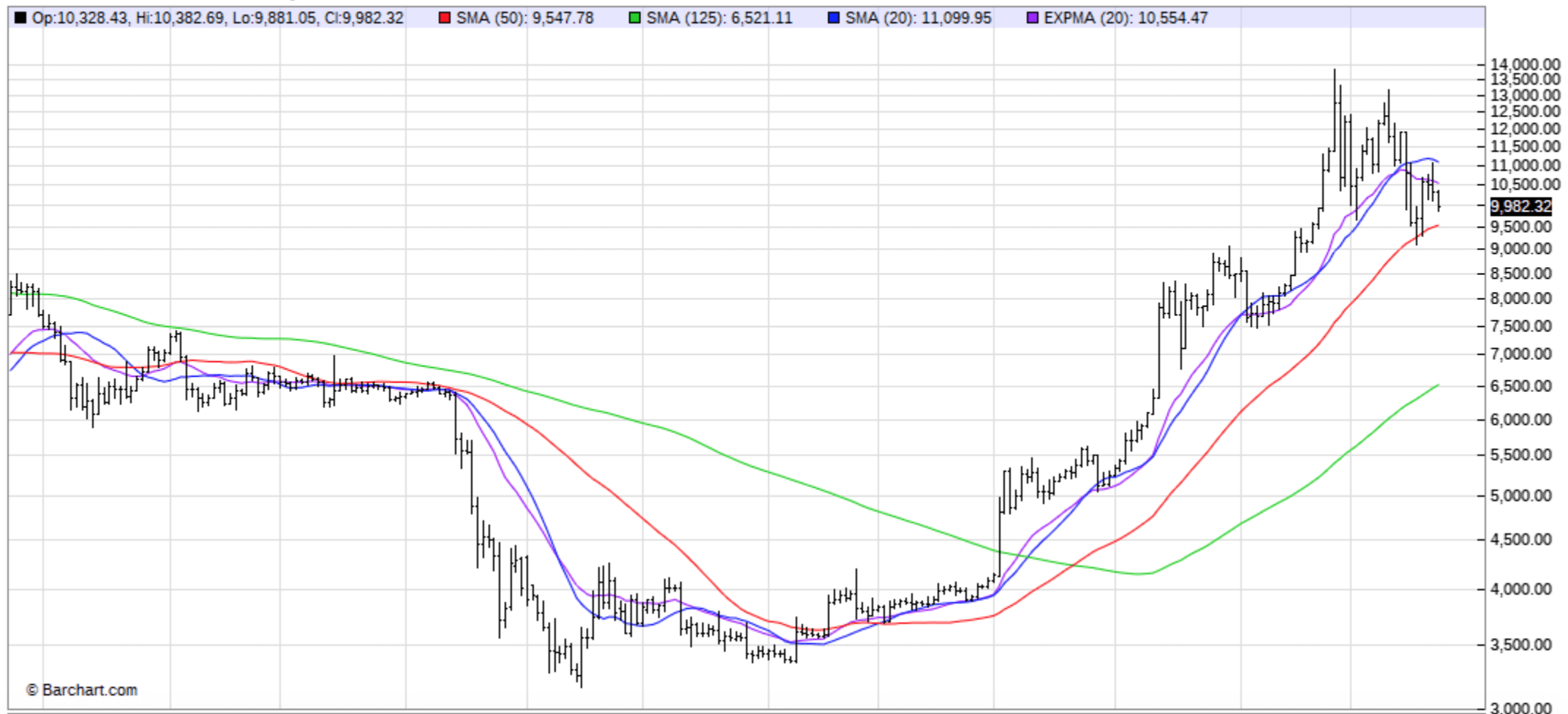

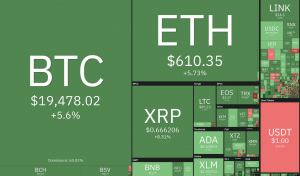

Spotting opportunities is not always easy, but sometimes it is. An example of opportunity in Bitcoin investment is the crypto’s rising value. This could be a short term opportunity or something that will outlive this generation (no one knows how long Bitcoin will sustain the uptrend). However you look at it, we must agree that identifying the opportunity is the basis of everything.

With opportunity comes risks. As mentioned earlier, risk is a core part of any investment strategy. The opportunity might be huge, but so could be the risk. If there is reason to believe that the current Bitcoin boom is a fad, the risk associated with investing all your savings would be catastrophic. The bottom line is, you should identify how much risk the opportunity presents and how much of it are you willing to tolerate.

Step #2 Decide how much and for how long

The amount of money you should invest and for how long are crucial parameters. Of course, you’re not planning to hold Bitcoin until you die. But if that is your intention, it should be clear from the onset. Holding assets indefinitely and without a plan defies the purpose of accumulating wealth.

However, this is not a rule cast in stone. For instance, if you plan to protect your wealth, you might want to convert a huge chunk of your dollar savings to Bitcoin, and short time fluctuations will not be a bother because profits will average out over time.

Step #3 Invest – a plan without action is pointless.

Now that you have a clear goal and an understanding of the opportunities and risks, it is time to invest. Depending on your goals, you may find one investment approach more suitable than others. Typical options for investing in Bitcoin include:

- Trading – With trading, you can either go for spot trading or derivatives trading. With spot trading, you simply buy Bitcoin when you think it is trading at a low price and sell when you believe the price has gone high enough. Without concrete investment goals, it is difficult to remain disciplined when spot trading as periods of explosive uptrends and epic falls might send you into euphoric buying/ panic selling episodes, respectively.

- HODLing – This is where you buy Bitcoin and keep it with no intention of using the asset in the short run. This approach may be more suitable if you plan to protect your wealth or diversify your investment portfolio. Wealth stored in Bitcoin can be readily liquidated and converted to fiat money. You can also use such investments to acquire crypto loans.

Step #4 Monitor your investment

An investment is like a seed – once sowed, the growth journey has only begun. Keeping an eye on your investment helps you to determine whether your strategy needs editing. If you believe you made mistakes in your original plan, there is no shame in revising it until you feel you have gotten it right. It is important to practice emotional control while observing how events unfold during the course of the growth of your wealth. You should also stay updated and keep learning, as that’s the only way to align your strategy with the reality of the market.

Final Thoughts

Investing in Bitcoin is not complicated, but without planning for it, the chances of going nowhere with your investment are high. A good investment strategy, we have seen, needs to define your goals, your risk tolerance, be realistic, and focus on maximizing profits while keeping risks under control. There is no right or wrong way to invest, but that does not mean a planless investment is also acceptable. Similarly, the four-step approach described above is not the only sound methodology. However, it captures most of the crucial elements that will help your Bitcoin strategy stand out. Feel free to play around with it!