There’s hardly a facet of our lives left untouched by blockchain technology. From the most ubiquitous to the complex of our engagements, its effects are discernible. But perhaps the one sector where its effects are most discernible is in finance. The shortfalls of the legacy financial systems provide the right environment for innovation to sprout. Fintech firms are outdoing themselves in the production of products and technologies aimed at bettering users’ experiences.

This year has seen the emergence of many disruptive technologies. However, non features as prominently as decentralized finance(DeFi). DeFi is technology’s response to an inadequate financial system.

In this article, we tackle two significant aspects of Defi. First, the significance of Defi projects. We also present the best use cases to give you insight into this revolutionary technology.

Let’s get into it!

What is the Significance of Decentralized Finance Projects?

Defi projects are universally beneficial. The buzz they continue to generate emphasizes this truth. Here’re a few of the benefits associated with them:

- They streamline transactions- smart contracts execute exchanges increasing efficiencies.

- Increase the security of transactions- they draw on the Ethereum blockchain’s Immutability to secure trades.

- They are scalable- Ethereum’s composable software ensures that DeFi protocols and applications are interoperable, giving the developers and product the flexibility to build on top of existing ones.

- Increase transparency of transactions- distributed ledger technology enables one’s peers to access and verify their transactions, curbing fraud.

- It is permissionless- DeFi facilitates anyone with a crypto wallet and the Internet to access its applications regardless of their location.

- Gives the user control over their data- Web3 wallets like MetaMask interact with permissionless dAapps and protocols to provide users custody of their assets data.

What are the Best Use Cases for Decentralized Finance?

From the preceding, it is clear that DeFi projects are beneficial. The question then arises, where can we best use this technology? DeFi technology has wide usage. The following are some of the prominent use cases.

i) Management Of Assets

DeFi protocols give users full custody of their funds. Additionally, Crypto wallets help one easily and securely interact with decentralized applications (dApps) for different transactions. These transactions range from trading and transferring crypto to earning interest on their crypto holdings. Tracking one’s assets becomes easy this way.

ii) Gaming

Defi platforms are interoperable. This feature has opened up opportunities for developers to build cross-platform protocols across a variety of verticals.

Ethereum-based games have gained popularity due to their inbuilt economies and rewards. Take the case of the PoolTogether game. Its users acquire digital tickets using the DAI stable coin. They then pool their tokens for lending on the Compound money market.

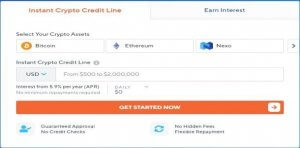

iii) Provision of Credit

DeFi allows the creation of P2P lending pools and borrowing contracts. For instance, Compound -an autonomous interest rate protocol- integrates with most DeFi platforms, enabling users to earn interest in crypto that they’ve lent.

Compound’s smart contract automatically matches creditors to borrowers. Additionally, it determines interest rates by comparing the volume of the borrowed to supplied funds.

iv) Decentralized Exchanges

Decentralized exchanges (DEXs) are crypto trading platforms allowing P2P transactions. They achieve this by eliminating central authorities. As they’re non-custodial, they mitigate price manipulation, hacking, and theft.

DEXs are the mainstay of token projects. They enhance their access to affordable liquidity as they allow projects to list without fees. This way, they differ significantly from centralized exchanges that charge higher prices per listing.

The degree of decentralization varies with the exchange. Whereas exchanges may centrally host order books and other aspects of a users’ account, they don’t hold their private keys. Examples of popular DEXs in the DeFi space currently include AirSwap, Liquality, Mesa, Oasis, and Uniswap.

v) Decentralized Insurance

Investing in cryptos (DeFi included) comes with its fair share of risks. As such, different products that hedge against risks in this space are available. They help protect against market crashes, hackings, failure of smart contacts, among others. Nexus Mutual is one such example.

The players within the Defi space underwrite the risk. That is to say, they pool resources to acquire the premium providing the cover. Utilizing smart contracts makes the products transparent. Anyone can access the payout terms via the Blockchain.

vi) Issuance of Synthetic Assets

Synthetic assets are tokenized representations of derivatives. An Ethereum based smart contract locks them to the Blockchain. These derivatives may represent real-world assets, including fiat currencies, bonds, commodities, or even cryptos.

Synthetic assets are tradeable. Consequently, they allow the disposal and acquisition of assets that are illiquid or difficult to obtain. The Synthetix protocol is essential to their issuance. It employs a 750% collateralization ratio that guards against price shocks.

vii) Liquidity Mining

Liquidity Mining, also known as yield farming, is holding digital assets for rewards. Through smart contracts, owners of crypto assets get incentives for keeping rather than trading them.

Participation in these projects requires stacking liquidity provider (LP) tokens. One obtains these through providing liquidity to a DEX, such as UNISWAP. Users then stake their tokens to mind new ones for exchange.

viii) Identity Management

Traditional financial systems rely on KYC guidelines to comply with AML and CFT regulations. Defi, on the other hand, uses Know- your-transactions (KYT) protocols to deter fraud and other financial crimes. KYT uses the behavior of participating addresses rather than individual IDs to assess and stem the risk for financial crime. The assessment is in real-time.

ix) Enhancing Financial Inclusion

In tandem with Blockchain-based identity systems, DeFi opens up financial opportunities to those previously excluded. It eases collateralization requirements for those seeking credit. Again it delinks creditworthiness from such aspects as income and ownership of property. Instead, it shifts it to attributes like financial reputation and activity.

x) Development of Stablecoins

A stablecoin is a cryptocurrency whose value depends on a stable asset or group of assets. The supporting assets could be fiat commodities or other cryptocurrencies.

Intended to mitigate the volatility of cryptos, they have found a home in the DeFi space. They are essential in remittances, borrowing, and lending. Another area they’re gaining prominence in is the Central Banks Digital Currencies.

xi) Provision of Marketplaces

Many marketplaces have arisen to exploit DeFi functions. These allow P2P exchanges globally. From them, traders and consumers enjoy a wide variety of products and services.

Final Thoughts

The year 2020 could be defined as the year of Defi. During this period, interest in this disruptive technology peaked. The heightened interest attests to its significance. Not only will it increase access to financial services, but also ease transactions besides securing them. The technology has wide useability. For instance, it is essential in credit provision, creating market places, and even combating financial crimes. Even though it is still developing, it has shown the potential to alter our economic landscape for the better. As we expand research and development in the area, we can only look forward to exciting products and solutions in the space.