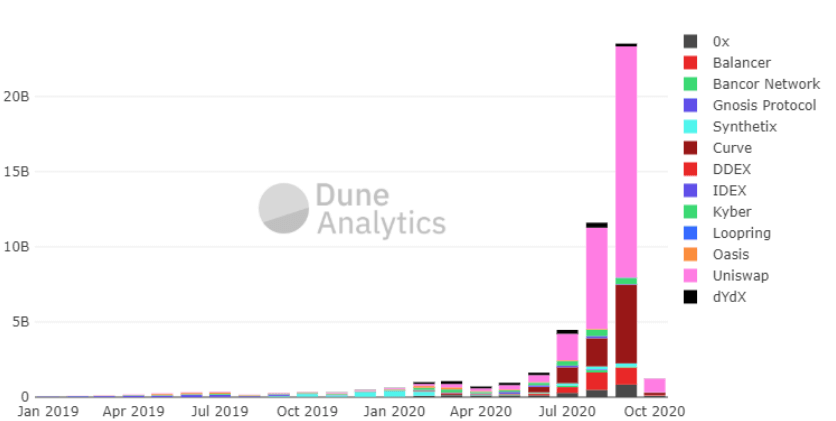

The DeFi industry is still in its infancy stage but has already registered some impressive growth over the years. The industry’s total value is currently locked at $14.92 billion and is expected to grow in the coming year.

There’s no doubt that DeFi brings about some unique solutions that are quite lucrative for investors of all kinds. If you’ve had your eye on the crypto industry for a while, there are chances that you’ve thought of putting your money in this exciting venture. But if you don’t know how to get started, you may feel stuck when choosing the best projects.

If you’re in this position, this article is just what you need. Buckle up, and let’s dive into the five best DeFi projects you should consider investing in the coming year.

Uniswap

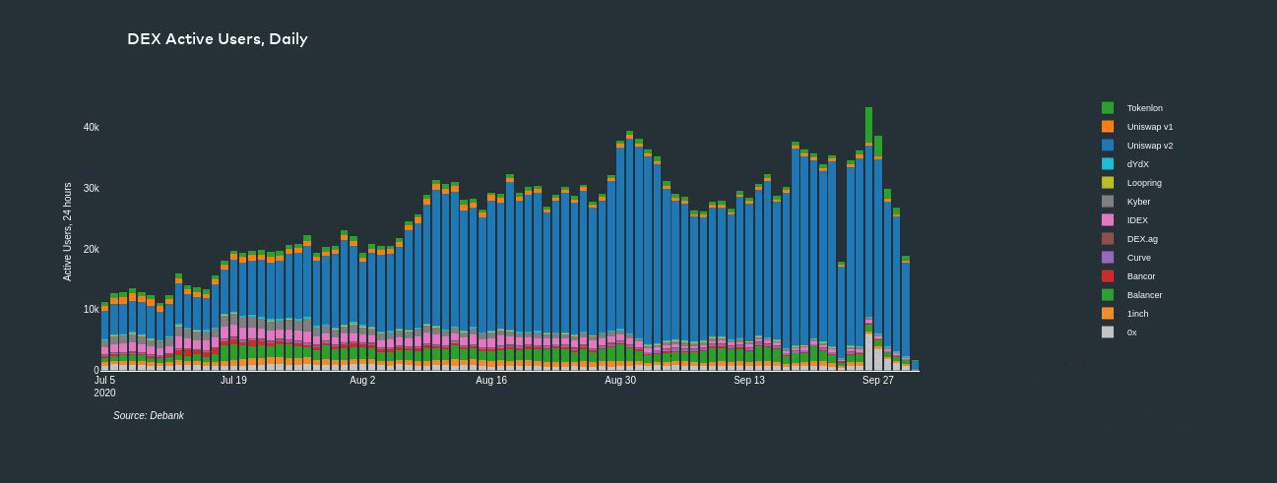

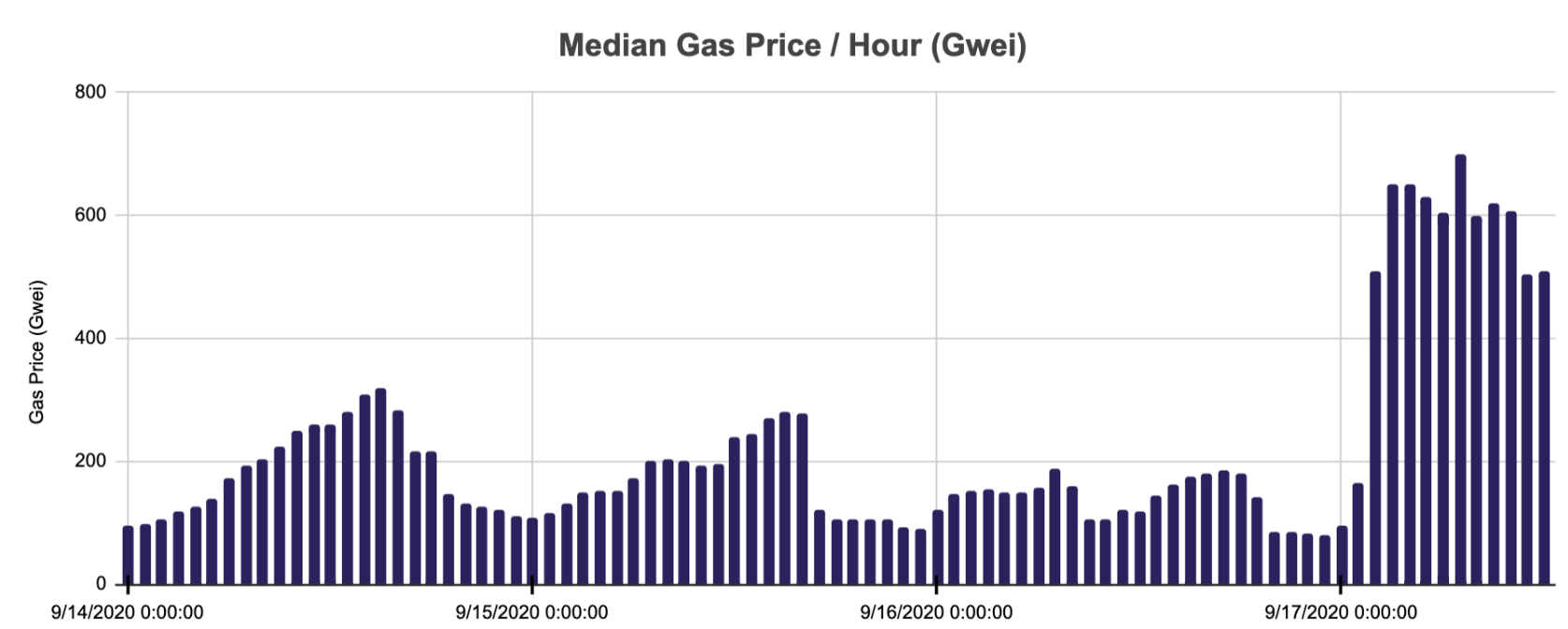

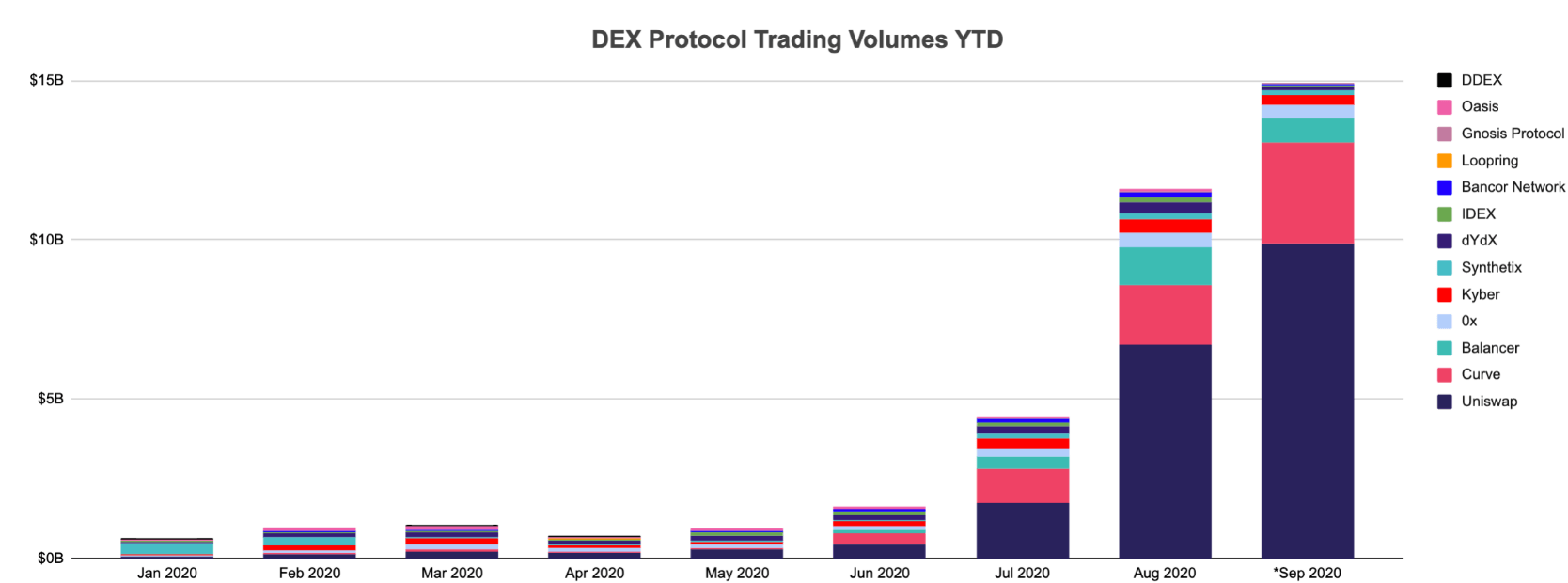

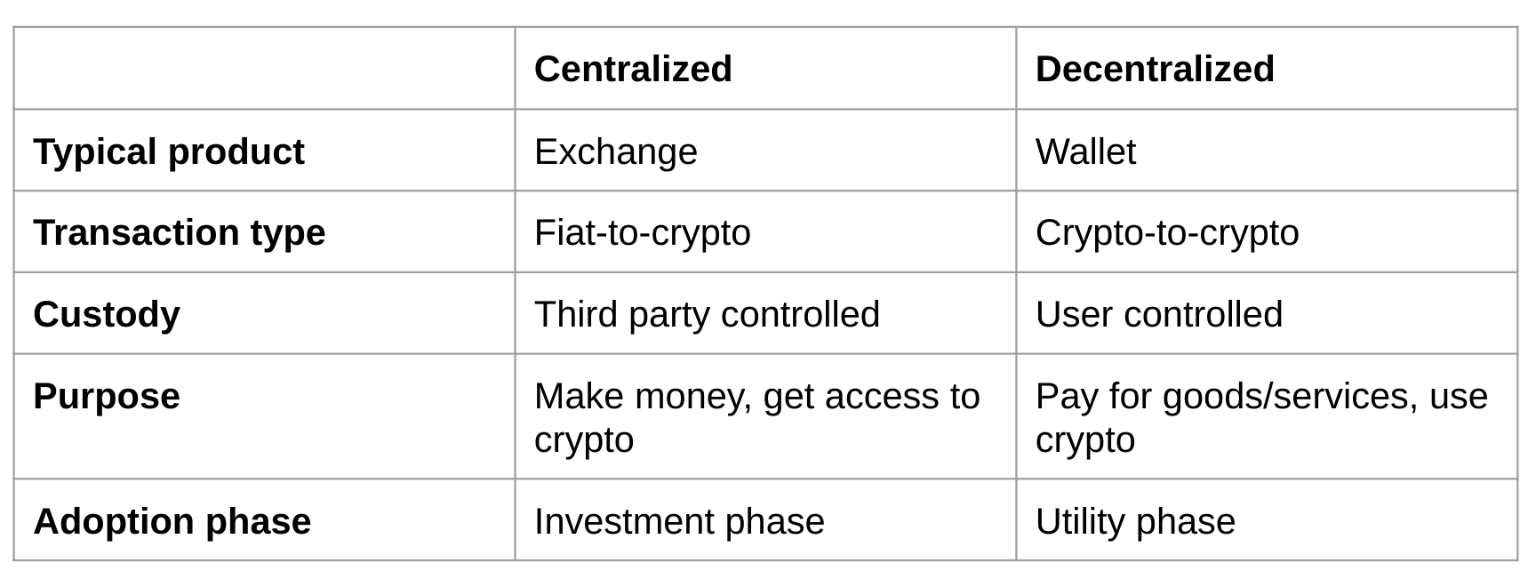

Anyone who has been in the crypto industry for quite a while will agree that decentralized exchanges were primarily associated with thin order books and poor UX. These issues, coupled with exorbitant fees, centralized gateways, and too many transactions was the reason dex enthusiasts demanded a simple yet effective decentralized exchange.

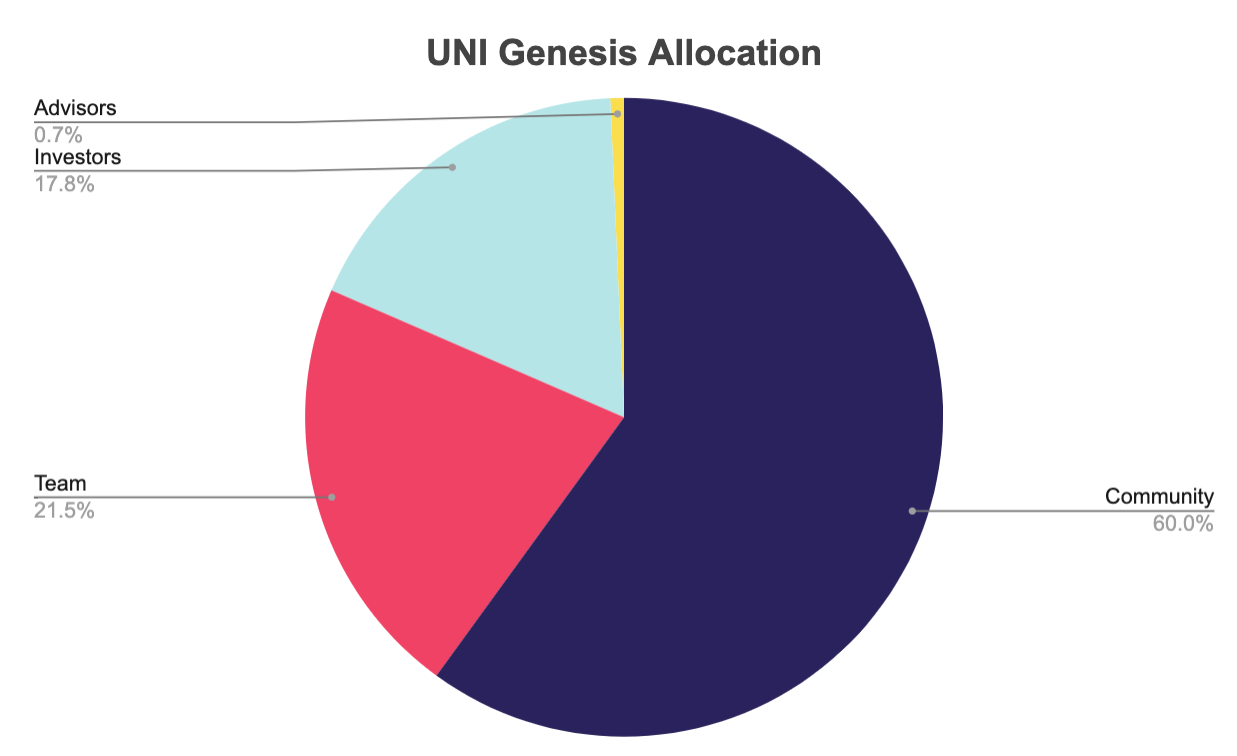

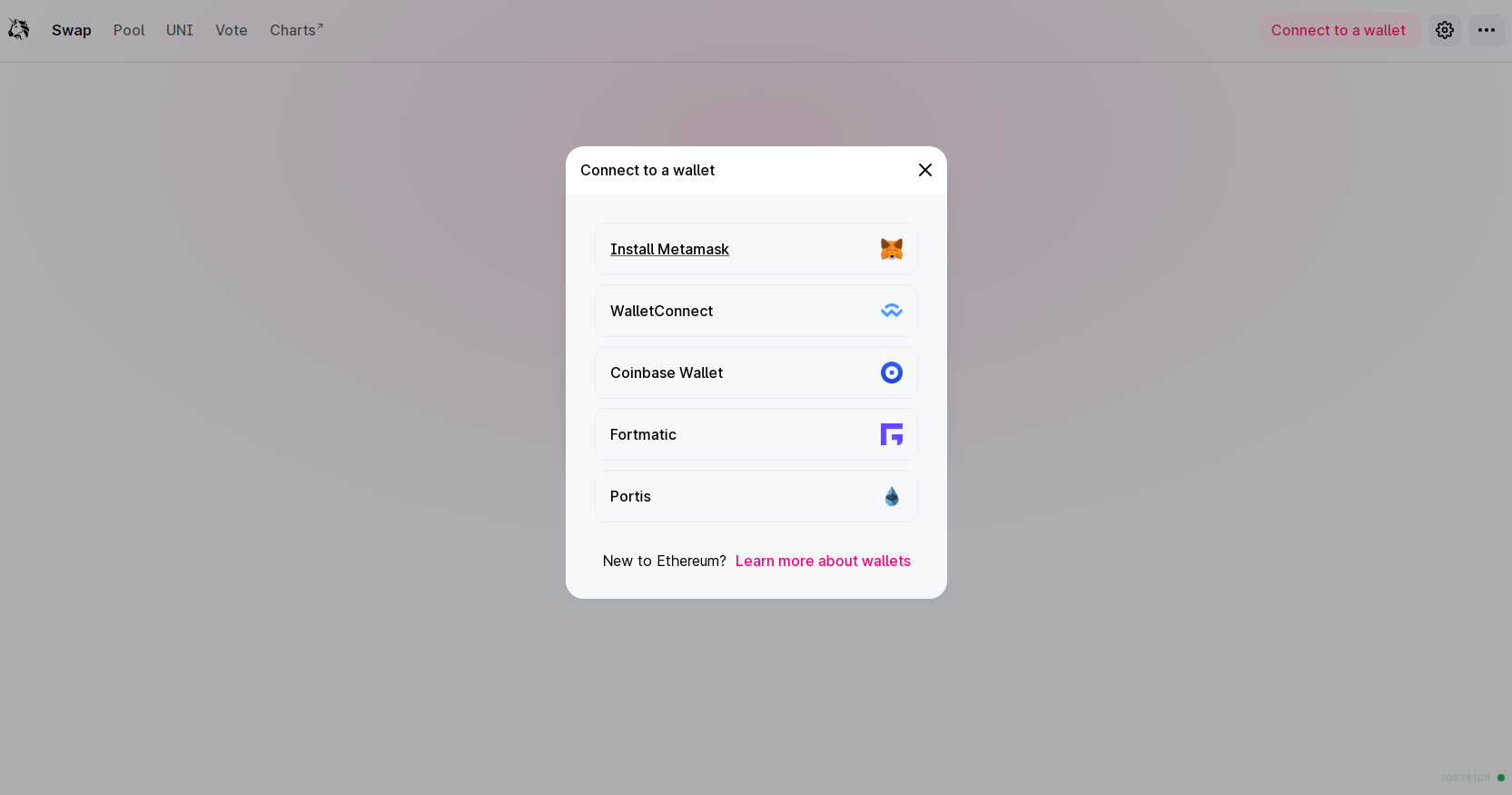

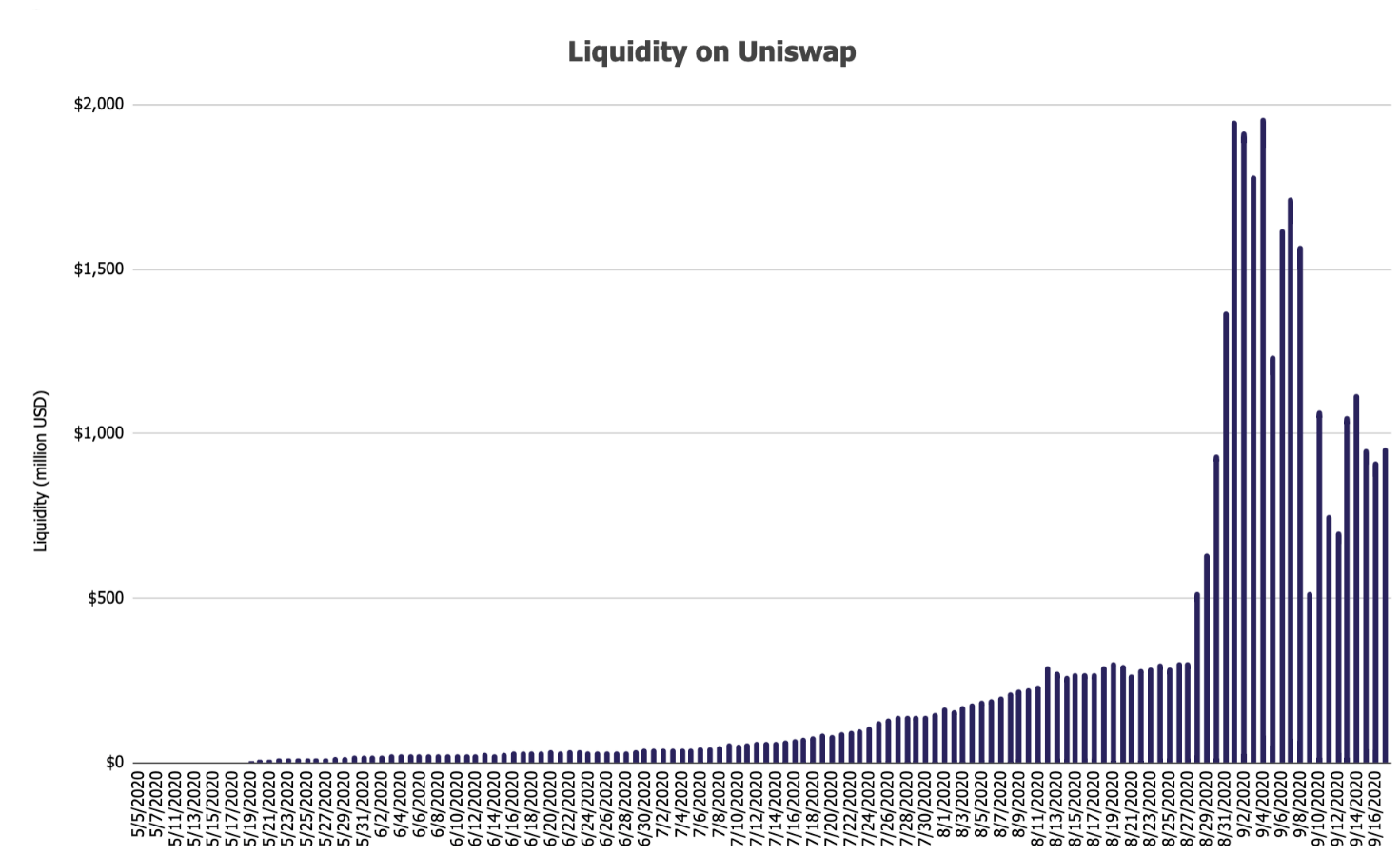

Uniswap was launched in 2018 as an automated liquidity protocol for ETH and ERC-20 tokens. The platform has its own token, UNI, which is instrumental in governing protocol changes.

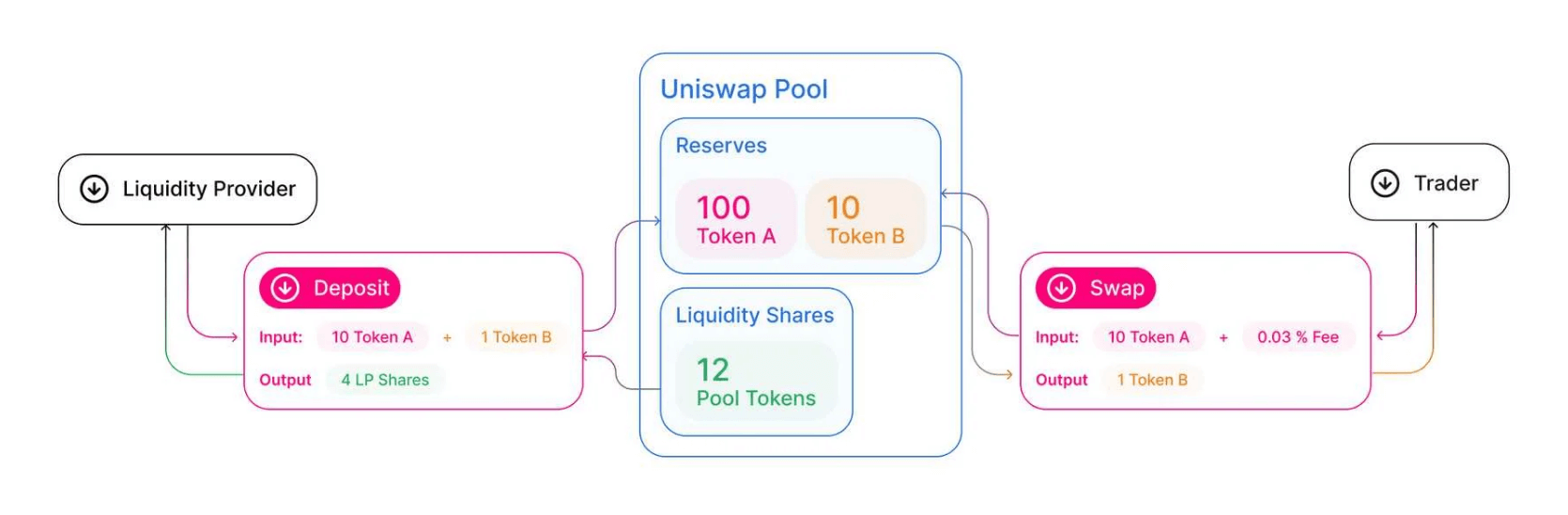

One of the things that make Uniswap unique is that it doesn’t use order books but instead has an automated market maker. Users only need to select the assets they want to trade, and the platform automatically completes the transaction.

Uniswap presents several advantages, which is why you should hop onto it already. It has no listing fees for new tokens, and users don’t have to complete the KYC checks. Besides, you get full custody of your funds and an excellent way to earn some extra tokens through the platform’s liquidity pools.

If you choose to invest in the platform, you could either be a casual user, an arbitrageur, or a liquidity provider, all of whom play essential roles in the ecosystem.

Yearn Finance

Yearn.Finance should be your go-to project if you’re looking to maximize the annual percentage yields on the cryptocurrencies you’ve deposited in DeFi. The unique project is an array of DeFi protocols built on Ethereum and designed for high-yield returns through liquidity pools and community governed lending protocols. Like Uniswap, Yearn Finance uses an automated market marker to allow users to convert tokens and earn from both lending and trading fees.

Yearn Finance is still relatively new in the industry, having been launched in February 2020. The platform had a rapid ascent in August, which saw its value rise to $650 million, accounting for a significant percentage of the entire industry’s value.

According to Jesse Walden, CEO of Variant Fund, “The unifying goal of all Yearn products is to create a simple, intuitive interface to all of DeFi.”

Yearn’s intuitive interface makes trading easier for all users. The platform is a portal for other DeFi products and has the YFI as its governance token. Yearn is considered entirely decentralized because the YFI tokens cannot be pre-mined, and the platform didn’t hold an ICO.

Although YFI was initially designed to be entirely community-governed, it can now be traded on other platforms such as Uniswap.

Curve Finance

You’ve probably heard of stablecoins, and if you know a thing or two about cryptocurrencies, they must have piqued your interest as an investor. Well, Curve Finance is an excellent DeFi platform if you’d like to trade-in stablecoins efficiently. It provides a solution to one of the most considerable problems in the DeFi sector; price slippage.

Like any other ideal marketplace, demand and supply forces determine the lending rates in DeFi. Now, suppose you want to trade between USDC and DAI. If the lending yield for USDC becomes higher than that of DAI, lenders will want to migrate to USDC. Curve Finance allows you to effectively do this and still earn better than you would with a regular DEX.

Switching between stablecoins effectively helps correct any anomalies in the interest rates that may result from mismatches in the demand and supply. Users can keep their profits once the interest rates are back to normal.

Curve Finance provides one of the best ways to earn as a liquidity provider with returns of over 300% per year for BUSD. This is made possible by providing liquidity to other DeFi protocols using the deposited funds. This move generates interest for the other protocols, and Yearn, in turn, assigns the interest to liquidity providers. Additionally, they receive some CRV tokens and a cut of the trading fees from the platform.

DAI

Speaking of stablecoins, DAI is one you should definitely watch out for in the coming year. The coin has its price pegged to the US dollar, which helps maintain its value. Whenever users on MakerDAO, the protocol behind DAI, take out a loan, the stablecoin is created. The decentralized nature of the protocol, together with the lack of volatility, ensures that DAI remains stable and transparent.

Initially, you’d only be able to use ETH as collateral for DAI. However, the stablecoin now supports different cryptocurrencies as collateral for a DAI loan. You can place your cryptos and get them back for the same price, despite changes in the coins’ values.

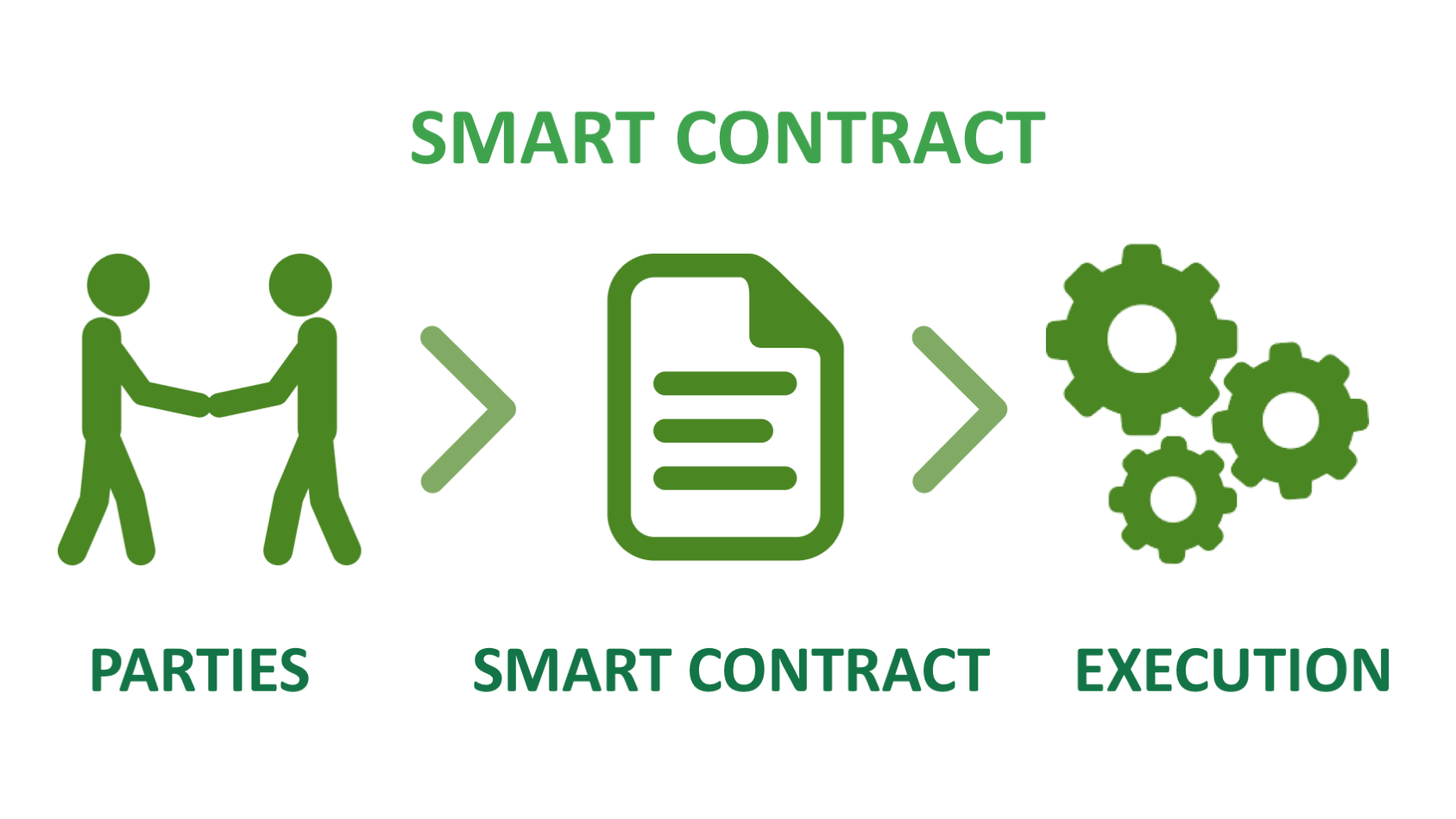

There are plenty of stablecoins available, so what makes DAI any different? Well, if you are really against censorship by governments and other regulatory bodies, you’re going to love using DAI. It is backed by smart contracts, which makes it resistant to censorship. It also provides privacy when transacting since users don’t need to complete KYC checks or create any accounts.

Kava

Kava developers used various technologies to create a system that would allow users of significant crypto assets to access collateralized loans and stablecoins. The network uses USDX as its stablecoin, and users get to collateralize their crypto assets in exchange for the stablecoin.

To help you gain a leveraged position in the market, you could take out several collateralized loans. For each of these loans, you’ll receive an equivalent amount of USDX to create synthetic leverage. You can then earn a passive income from the platform by staking and bonding your USDX coins.

Kava uses a dual token system that ensures usability and flexibility. The native token for the blockchain is Kava tokens, which double up as the governance and voting tokens. Kava tokens help to ensure the platform’s security through staking, which also earns users block rewards.

Kava has already made a name for itself in the business world by gaining some major entities’ attention. For example, Arrington Capital, Ripple, and Cosmos are behind this DeFi project, which provides some assurance in its profitability and sustainability.

Parting Shot

There’s no denying that the DeFi industry has taken giant leaps over recent months and will continue to do so in 2021. Like most investors, you’ll undoubtedly want to add long-term value projects to your portfolio, and DeFi is an excellent way to go about it.

Sure, it’s totally okay to be skeptical about new ventures such as this. However, the DeFi industry has proven to provide solutions to problems poised in centralized finance.

Just as you would with any other investment, it’s best to do your due diligence and learn as much as possible before placing your money in a DeFi project. These five projects should give you an excellent head start for your 2021 investments.