What Is Uniswap: In-Depth Analysis (part 1/4)

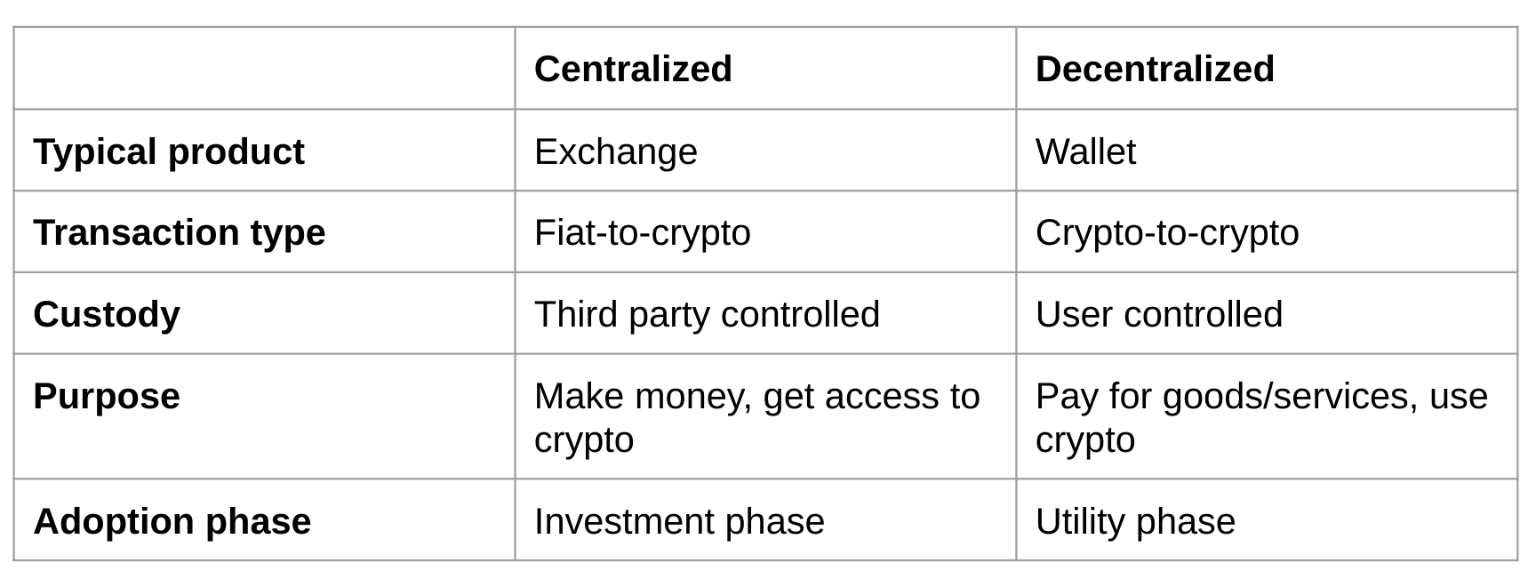

Centralized exchanges have been the foundation of the crypto market for years. They offer extremely fast settlement times, high trading volume, as well as continually improving liquidity. However, it is clear that they defeat cryptocurrencies’ purpose, as they are centralized and hold your keys. Over time, developers have come up with a solution in terms of decentralized exchanges. These exchanges require no custodians or middlemen to facilitate trading.

Due to blockchain technology’s current limitations, building DEXes that can actually compete with their centralized counterparts is extremely difficult. One of the pioneers in the decentralized exchange sector is Uniswap. As a result of the innovation they brought to the sector, Uniswap has become one of the most successful DEX projects.

Uniswap – Explained

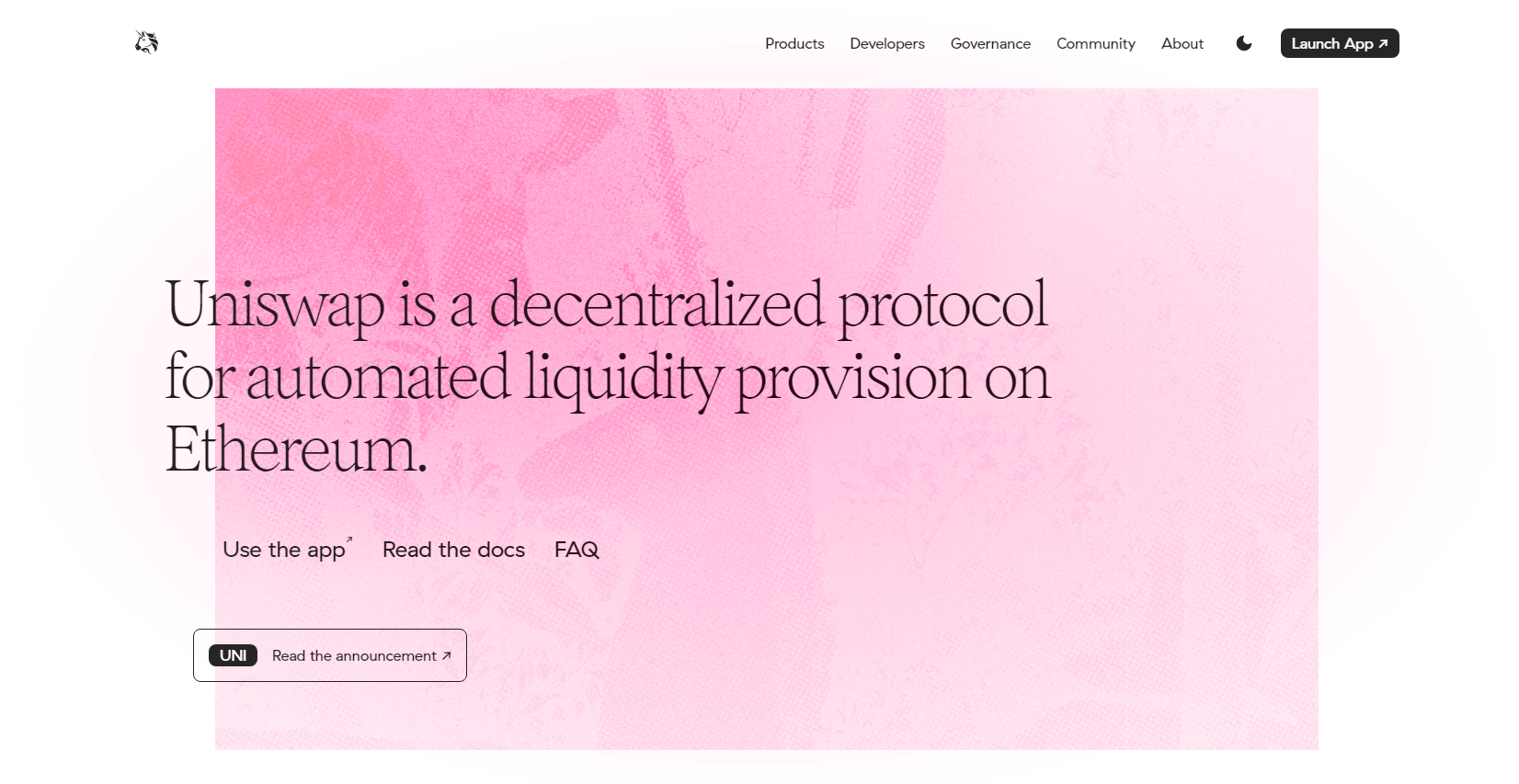

Uniswap is a decentralized exchange built on the Ethereum blockchain. To be even more precise, Uniswap is an automated liquidity protocol. What’s important to know is that no order book or centralized party is required to make trades. Uniswap allows its users to trade without intermediaries and provides a high degree of decentralization as well as censorship-resistance. It is also open-source, which is one of the pillars of the decentralized finance space.

Uniswap users can seamlessly swap between many ERC-20 tokens without any need for an order book.

Unlike centralized exchanges, Uniswap protocol doesn’t list certain tokens on the exchange, while denying it for others. Any ERC-20 token can be listed on it as long as there is a liquidity pool available. As a result, Uniswap doesn’t charge listing fees.

So how does it all work?

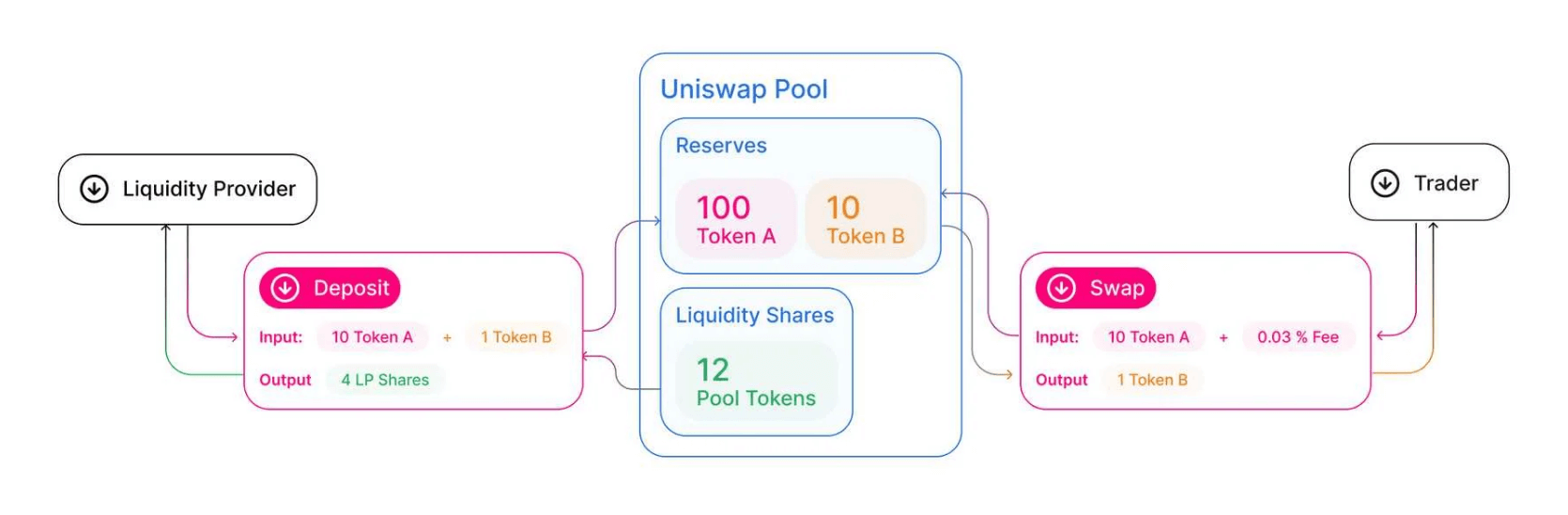

Uniswap completely leaves behind the traditional architecture of digital exchanges in that it has no order book. Instead, it implemented a Constant Product Market Maker design, an iteration of an Automated Market Maker model.

An automated market maker is a smart contract that holds liquidity reserves that traders can trade against. They are being funded by liquidity providers. Liquidity providers are users who deposit an equivalent value of two tokens in the pool. When trading, traders pay a fee to the pool distributed to liquidity providers, all according to their share of the pool.

If you want to learn more about Uniswap and its token, how it all works, and how the platform makes money, check out the next part of our guide.