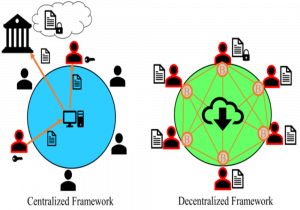

Following Blockchain’s birth, the financial landscape is changing very fast. Now we’re talking of decentralized finance (DeFi), synthetic assets, liquidity pools, and other concepts that simply didn’t exist before. And all these are to the benefit of millions of people across the globe who were previously excluded from the financial system.

PerlinX is a DeFi project that wants to “democratize the trading of real-world assets through decentralized liquidity pools and synthetic asset generation.”

It’s among the many DeFi projects that are recently catching on and providing unparalleled value to users. In the traditional finance system, you can put up your money to generate yield. And sure, it will, but meager yields which take forever to add up to anything substantial.

With PerlinX, you can earn nice rewards for simply staking in the PERL token. Let’s dive into the protocol and see how it works. We’ll also see the platform’s major driver – the PERL token, and how exactly it keeps the ecosystem moving.

Understanding PerlinX

Perlin is a DeFi platform where users can create and trade assets through a synthetic liquidity pool. Perlin will initially be focusing on synthetic assets. Platform users will be able to stake PERL tokens and earn rewards. Rewards will be in the form of PERL, UMA, and BAL tokens. PerlinX will also utilize the UMA protocol for the generation of synthetic assets.

On the PerlinX platform, each asset will have its own real-time price feed, supported by the Data Verification Mechanism (DVM) supported by UMA. The DVM is designed to provide accurate and incorruptible price feeds.

Synthetic assets on PerlinX will begin with the prefix ‘px’, as in pxGold, pxETH, pxCarbon, and so on. Also, for users to create synthetic assets on PerlinX, they must first deposit PerlinX as collateral. For now, the PerlinX protocol will support five assets, namely TUSD, BUSD, USDC, BAL, and ETH.

What Can You Do on PerlinX?

Below is how you can interact with the PerlinX platform:

#1. Deposit crypto and earn rewards

Platform users can stake in PERL and earn incentives as a result. Staking provides liquidity to the platform for borrowers who pay back with interest.

#2. Create synthetic assets

Users can utilize the PerlinX platform to create network assets of any type. To create a synthetic asset, a user must first deposit PERL as collateral.

Roadmap for PerlinX

After enabling users to earn incentives for staking in PERL, the team plans to embark on the following steps immediately:

- Start minting pxTokens.

- Identify potential security loopholes on the platform and fix them immediately.

- Improve user experience to facilitate staking and things like liquidation procedures and settling disputes.

- Come up with a long-term incentivization mechanism for liquidity providers and synthetic asset creators.

Future Roadmap

- Work to narrow the gap between the existing financial system and DeFi, and rally for more support for digital assets and more emerging complex assets like regulated securities

- Work to improve the underlying Automatic Market Maker and synthetic assets mining process to realize better efficiency.

The PERL Token

PERL is the native utility token of the PerlinX platform. It will play a central role in the running of the ecosystem – and the two key roles will include the following:

- As a staking mechanism to earn incentives

- As collateral to be able to create synthetic pxTokens

How PERL Tokens Were Distributed

The PerlinX team distributed PERL in the following fashion:

- Seed sale tokens: 20%

- Strategic sale tokens: 19.49%

- Private sale tokens: 8.36%

- Public sale tokens: 8.38%

- Team tokens: 15%

- Advisors: 9.65%

- Treasury tokens: 19.12%

Key Metrics of PERL

As of September 29, 2020, the PERL token traded for $0.026798, with a market cap of $12,947,152, which placed it at #436. PERL had a circulating supply of 483,139,908 and a total supply of 1, 033,200,000. The token’s all-time high was $0.132243 (Aug 26, 2019) and an all-time low of $0.010643 (March 28, 2020), per Coinmarketcap.

Buying and Storing

Today, you’ll find PERL listed as a market pair of BTC, USDT, BNB, WETH, BUSD, PERL, TUSD, BTC, and BAL in either of these exchanges: Binance, Bilaxy, CoinDXC, HotBit, TOKOK, Balancer and Uniswap (V2).

You can store PERL tokens in Ledger, Trezor, Trust, Atomic, and MyEtherWallet wallets.

Closing Thoughts

PerlinX is one of the bold projects that we’re seeing emerging in the DeFi space. The more these projects are, the more choices for DeFi users.