Which are the best DeFi tokens of 2020? DeFi tokens have had a great year. It’s not an exaggeration to say they could very well eclipse ‘normal’ cryptocurrencies in the future. As DeFi continues to explode and the year nears a close, it helps look at the tokens that have defined 2020 and will probably continue to do so in the coming year.

This list doesn’t just follow the tokens that are the highest in market cap. It also looks at the most promising and exciting tokens.

#1. Chainlink

Chainlink is a decentralized oracle for connecting blockchains to external data and information. The Chainlink protocol, which includes the LINK token, allows smart contracts to operate without relying on permissioned or centralized information. For instance, a developer can run a sports betting contract that relies on an external oracle for sports scores. Chainlink has proved especially popular, with countless DeFi protocols including Aave, Ampleforth, Celcius, Arbol, yearn.finance, Nexus Mutual, and Synthetix all utilizing its smart oracles function. This popularity has catapulted it to the top ten in market cap, sitting at #5 at the time of writing. The LINK token, which began the year going for $2, already hit $12.

#2. Maker (MKR)

Maker is one of the earliest stablecoins in the DeFi space and one of the most resilient. Despite (and probably because) of its low total supply of slightly more than a million, the token is a huge hit in DeFi, judging by its current per-token value of $513. And this is a climbdown from the highs of $1,700 in 2018 before the token plummeted during the 2018/2019 crypto winter. In 2020, it got a reprieve after reaching $600 this year. With its MKR token, the protocol makes up what is probably the best example of a stablecoin system: a collateralized debt position powered by its stablecoin – DAI, which maintains stability for the protocol by using various economic incentives. MKR will be one of the tokens driving the DeFi space in the near future and beyond.

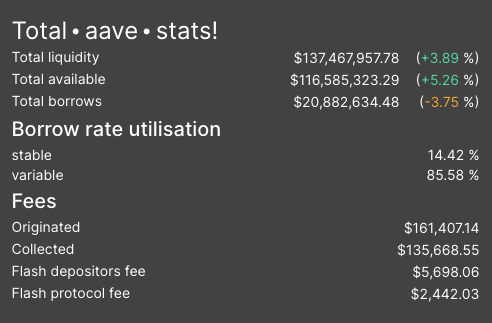

#3. Aave (LEND)

Aave is an open-source, decentralized protocol that allows users to create money markets, earn interest on their deposits, and borrow funds through the LEND token. With a market cap of $859 million, Aave is currently the 4th biggest DeFi token. Aave has had an incredible year. It started off at a mere $0.009 in January but has now clocked $73 per token, which is remarkable even in crypto.

#4. Synthetix Network Token (SNX)

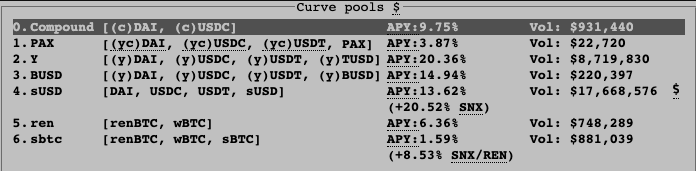

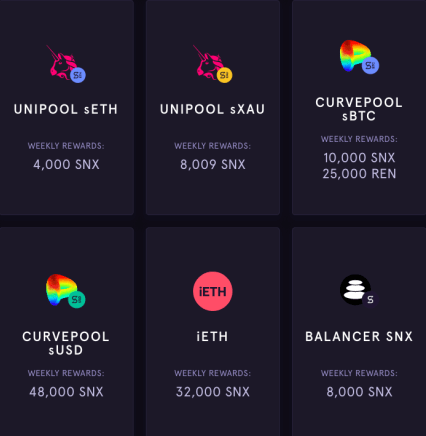

Synthetix is a blockchain protocol that lets anyone gain exposure to a wide array of assets. The platform is credited for introducing yield farming in DeFi, though it’s now been overrun by platforms like Compound and Aave. Still, the token continues to ‘hold the line,’ as manifested by its current position of #9 among DeFi tokens and #40 among all cryptocurrencies. With a market cap of nearly $500 million, SNX demonstrates its resiliency. Synthetix supports a smart contract infrastructure and incentivization system that will continue to propel it upwards.

#5. Dai (DAI)

Part of the Maker ecosystem, DAI isn’t a token that you buy to HODL. Still, it’s an excellent idea to buy the token and hedge your portfolio against volatility. Dai is probably the most elegantly designed stablecoin in the world today, with an ingenious incentivization and collateralization system that securely puts its value at a 1:1 ratio against the US dollar. While other stablecoins achieve stability by using clumsy ways like holding US dollars in the bank, Dai uses a more accurate and flexible tech-based system. Anyone can also create their own Dai if they put up collateral.

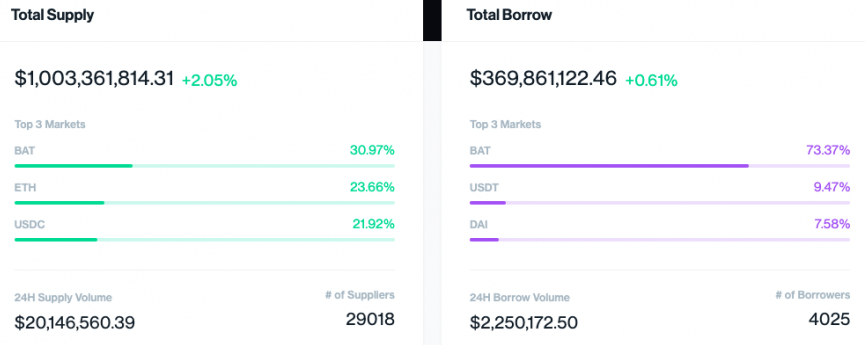

#6 Compound (COMP)

Compound is a DeFi protocol that allows anyone to lend, borrow, and provide liquidity and earn returns. Comp exploded after it started distributing its native token, COMP, in June this year. It’s definitely one of the hottest tokens in DeFi right now, featuring a market cap of $526 million and a per-token value of $124 at the time of writing. COMP is an Ethereum-based mechanism used as a governance mechanism of the Compound ecosystem. As the Compound platform continues to expand, we’re sure to see the value of COMP following the lead.

#7. 0x (ZRX)

0x is a decentralized exchange protocol that allows developers to create their own exchanges. The project’s founder calls it the “Craigslist for cryptocurrencies” in that anyone can build an exchange and post it online. Despite its promising value proposition, the 0x token, ZRX, has had the slowest growth this year. In January, you could buy the token for around $0.20, and it’s now sitting at $0.36 at the time of writing, with a market cap of $273,926,375. But the dismal growth of the token does not discount its potential to break through in the future. The 0x token is one to keep sights on.

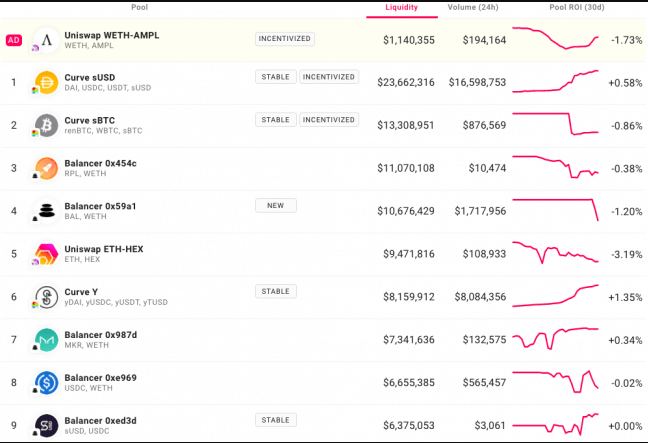

#8. Ampleforth (AMPL)

Ampleforth kicked off the year trading at around $1, went to rise to $4 in July, before sharply clamping down to around $1 again. Ampleforth calls itself a cryptocurrency “like Bitcoin,” but with a daily change in supply, insuring against market shocks. Ampleforth wishes to solve what it calls the “dangerously correlated” crypto market by adding diversity to the ecosystem. While most cryptocurrencies follow the Bitcoin price pattern, the AMPL token matches to its own beat. This could prove an excellent hedge for your crypto portfolio.

#9. Augur (REP)

Augur started the year sitting at around $9, and if now trades at $14 in November, a dip from around $20 in August. Based on Ethereum, Augur, via its native token – REP, aims to power a prediction market where users can earn money if they predict winning outcomes. Augur also acts as a decentralized oracle for verifying real-world events. These events could be anything – from natural events to election results to football matches’ outcomes. At the time of writing, Augur is at position #75 in the market and continues to be one of the DeFi’s best.

#10. Terra (LUNA)

Terra is a DeFi protocol that wants to expand everyone’s financial inclusivity through its native token, LUNA. The Tetra team wants to “set money free” by building an open, global financial infrastructure. This infrastructure constitutes a family of stablecoins that allow users to earn mining rewards, giving people an incentive to participate in the network. Terra launched its mainnet in April 2019. It currently offers stablecoins pegged to the US dollar, South Korean Won, the Mongolian tugrik, and the IMF’s Special Drawing Rights basket of currencies. Users can trade LUNA as well as stake it and earn interest. LUNA token holders can also participate in the platform’s governance. After kicking off the year at $0.24, LUNA’s price nearly doubled around July before cooling down to around $0.33 in November. With its value proposition, Terra is set to be one of the most important DeFi presences in the future.

Closing Thoughts

Ten years ago, the crypto space was talking about Bitcoin and decentralized currencies. Now, we’re talking of decentralizing the entire finance space. The above tokens represent some of the most exciting decentralized finance projects and their tokens in 2020. With a rapidly evolving DeFi space, you can expect anything in the coming year, but for now, these are among its biggest stars.