Earn Passive Income With Yield Farming – Part 2/2

While the previous part of our yield farming series talked about the definition, threats and opportunities of DeFi yield farming, this part will talk more about specific projects and what they offer, as well as how to choose the right project for you.

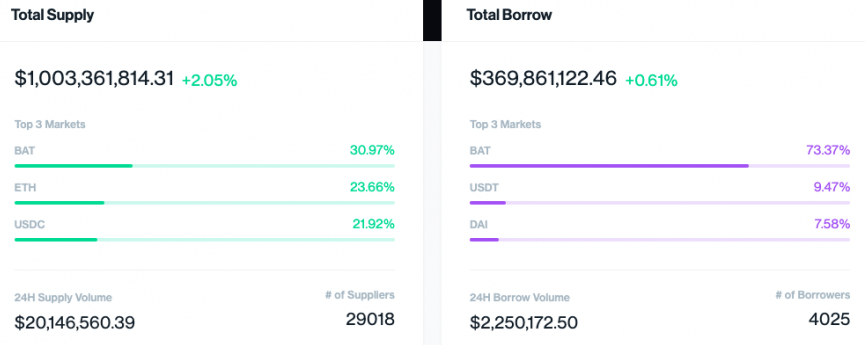

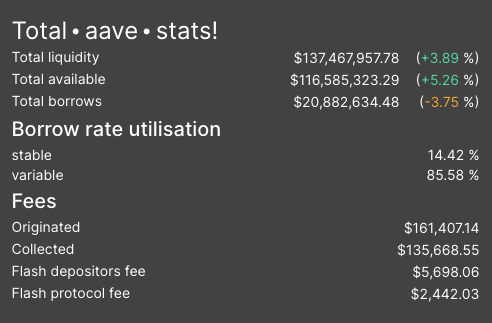

Compound and Aave

Compound and Aave are currently DeFi’s primary lending and borrowing protocols. These two platforms together account for over $1.1 billion of lending and $390 million of borrowing. The easiest and most straightforwards way of earning a return in DeFi is lending capital on the money market.

Aave generally has better rates than Compound, as it offers its borrowers the ability to choose a stable interest rate rather than a variable rate. The stable rate is, in most cases, higher for borrowers than the variable rate, therefore increasing the marginal return to lenders.

On the other hand, Compound introduced a new incentive for its users through the issuance of its COMP native token. Anyone that lends or borrows on the Compound platform earns a certain amount of COMP, translating into more rewards.

Security from Financial Risk

DeFi money markets work by employing over-collateralization, meaning that a borrower must deposit assets that have more value than their loan. When the collateralization ratio (which is the value of collateral divided by the value of the loan) falls below a threshold, the collateral is liquidated and instantly repaid to lenders.

Yield Farming Liquidity Pools

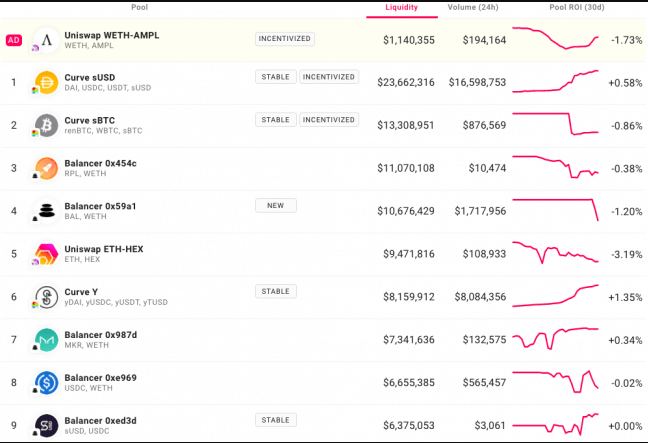

Uniswap and Balancer are the two largest liquidity pools in DeFi. They offer liquidity providers a reward in the form of fees for adding their assets to a pool. Liquidity pools are between two assets that are configured in a 50-50 ratio in Uniswap, while Balancer allows for up to 8 assets in a single liquidity pool.

Whenever someone takes a trade through the liquidity pool, liquidity providers who contribute to that pool earn a small fee to facilitate the transaction. Uniswap pools have offered liquidity providers healthy returns over the past year as decentralized exchange volumes picked up. However, optimizing profits requires investors to also consider impermanent loss, the loss created by providing liquidity for an asset that suddenly appreciates.

Balancer pools are somewhat mitigating impermanent loss, as pools don’t need to be configured as a 50-50 split between two assets. They can be set up in a 90-10 or 80-20 allocation to minimize impermanent loss. However, the risk cannot be completely eliminated.

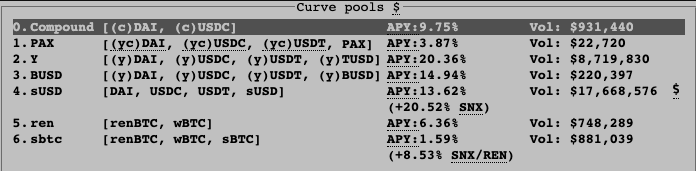

However, there is a liquidity pool that completely eliminates impermanent loss. Curve Finance facilitates trading between assets that are pegged to the same value. As an example, there is a Curve pool with USDC, USDT, DAI, and sUSD: all stablecoins pegged to the USD. There’s also a liquidity pool that consists of sBTC, RenBTC, and wBTC: all pegged to Bitcoin’s price. As all of the assets are worth the same amount, there is no impermanent loss. On the other hand, trading volumes of those pools will almost always be lower than the regular liquidity pools like Uniswap and Balancer.

Incentive Schemes

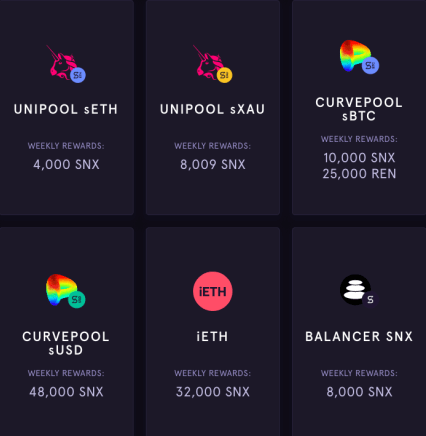

The Synthetix project first introduced an sETH-ETH pool as the original incentives scheme, offering liquidity providers an added incentive of SNX rewards. While this pool has deprecated, this idea expanded to other liquidity pools.

Taking advantage of these incentives can show to be incredibly lucrative. However, investors should ensure that they aren’t earning a dud token, but rather something that holds value. Nobody wants to take part in an incentive scheme that gives rewards in tokens equivalent to BitConnect tokens.

What to Choose

For the slightly risk-averse investors who just want to earn a yield on their stablecoins, there are many options, with money markets or providing liquidity on projects such as Curve Finance being the best option for lower-risk interest. For those with large cryptocurrency holdings and want to use them to earn even more, liquidity pools such as Uniswap or Balancer are certainly a good choice. Added incentives on top of the regular rewards are just icing on the cake.

That being said, the perfect yield farm is different for each individual varies based on their amount of capital, the investment time horizon, as well as how risk-averse they are.