Unless you’ve been blind to the crypto industry in 2020, you’ve undoubtedly caught wind of the DeFi craze. On the one hand, some investors are minting lucrative yields from the industry. On the other, some are losing their life savings.

If you’ve been following the trend, you’ve probably heard loads of things about investing in the new industry. Influential Bitcoin advocate, Anthony Pampliano, tweeted that all it took to shut down most DeFi dapps was for Jeff Bezos to shut down AWS. The tweet sparked quite a debate on the decentralization aspect, which is the core of DeFi projects.

Truthfully, investing in DeFi is quite similar to any other worthy project. It comes with risks, and investors need to do their own research before getting on board.

Well, DeFi is mostly uncharted territory for most investors, including crypto enthusiasts- which is why this article will come in handy. Here are some crucial principles you need to have in mind before deep diving.

Check the Number of Active Users

The value of a blockchain is dependent on the number of users, seeing as the technology solely relies on networks. Just like other network companies like Facebook, the more people who join the platform, the more valuable it becomes.

When determining whether to invest in a Defi project, check the number of active users on the platform. Luckily, unlike other network companies, DeFi projects built on Ethereum allow you to view real-time data on the users. With other platforms such as Twitter and Facebook, you have to wait for the quarterly reports to get this insight.

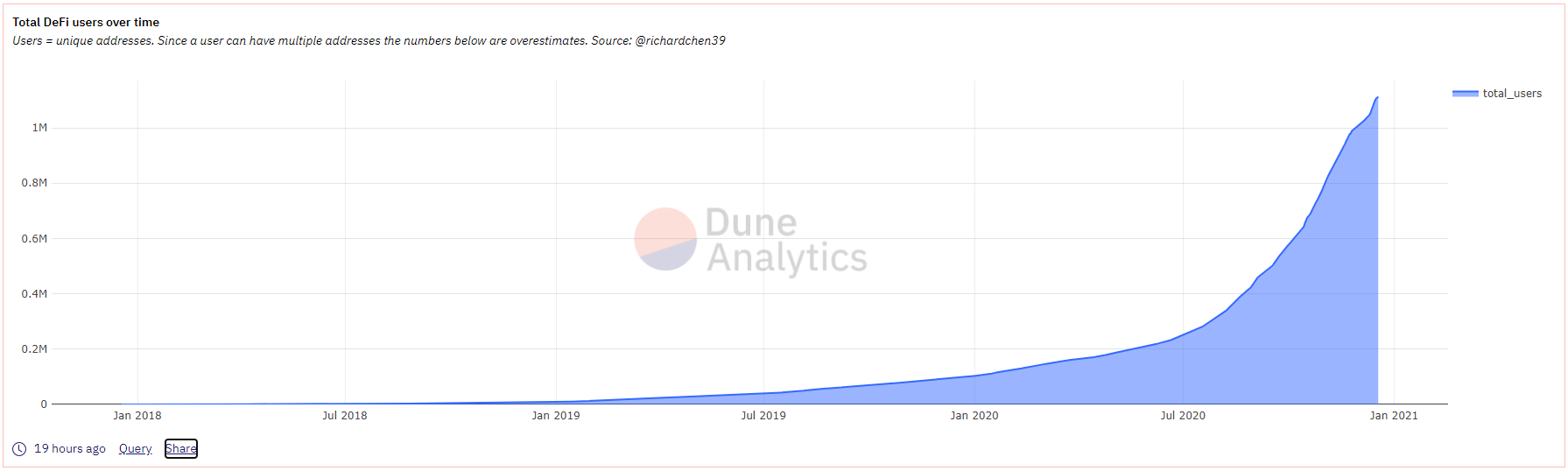

Additionally, you should also check the growth in the number of users. You want to invest in a project that registers sustained growth that keeps accelerating over time. The network effects of blockchain mean that the number of users won’t grow linearly as you’d expect, but rather quadratically, as shown below.

Source: Dune Analytics

Put Your Money in What You Understand

“Never invest in a business you cannot understand.” – Warren Buffet.

If you cannot take it from me, then take it from the investment mogul. Buffet has built his empire by investing in multiple businesses over the years, but he always keeps it simple. You should apply the same principle when investing in DeFi projects.

The DeFi world is complex, and before placing your money anywhere, you should ensure you understand as much as you can. Scam projects take advantage of the industry’s complexity to dupe investors into getting on projects that will not yield much, or worse yet, lead to significant losses.

It sure is boring, but go through a project’s documents, including the whitepaper, beforehand and understand the basic tokenometrics. What is the project’s native token, if any? How exactly will you make profits? What is the project’s primary aim?

Similarly, you don’t have to leap for every DeFi project that seems promising. Implement the 20-slot rule to help you separate the wheat from the chaff.

Watch Out for Gas Fees!

Most DeFi projects will quote gas fees for transactions, which are simply service charges. You’ll probably not bat an eyelid on the gas fees, but here’s why you should.

For starters, these platforms won’t display the gas fees in fiat currency. Instead, they’ll have it in ETH, which makes it easier for you to ignore it. However, the fees are absolutely real, and when gas fees are high, you’ll probably end up making a loss.

Say, for example, you want to invest $1000 in tokens, but the service fees are $50 worth in cryptocurrencies. With just one transaction, you’ll already have lost 5% of your investment.

Usually, gas fees will skyrocket when there are too many people using the network. Therefore, you end up paying more for the same transaction. Higher gas fees also indicate you’re following the crowd, in the case of FOMO.

As a rule of thumb, stay away from investing in DeFi when fees are high to avoid FOMO and FUD.

Don’t Invest in the Platform, Buy DeFi Tokens Instead

If you’ve read up a bit on investing in DeFi, this principle is probably contrary to what you’ve heard from the industry. Yield farming is the most common strategy in DeFi platforms and involves moving your tokens between protocols and platforms to wherever they’ll earn the most interest. This approach is time-consuming since you have to keep checking what platforms are gaining interest so you can move your assets there.

Although this is a popular way to invest in DeFi, stay away from it. Instead, invest in the protocol, which is quite similar to buying the company’s stock.

I know what you’re thinking; most of these projects are decentralized, and there are no companies. So, how exactly do you go about that?

Most DeFi projects will offer governance tokens that allow holders to vote on proposed changes. In this way, you gain something similar to a shareholder’s vote, which is like buying the company’s stock.

Therefore, instead of locking up your crypto assets on the platform or chasing after yield farming, consider investing in the platform’s native token. If the project is viable, your tokens’ value will keep increasing with an increased number of users, which is just what your investment portfolio needs.

DeFi is only a Portion of Your Blockchain Investment

Investing in blockchain projects is a fraction of your entire portfolio, and your DeFi investments should be a fraction of that. In other words, your investment basket is an entire pie, blockchain is a slice of it, and DeFi is only a portion of the blockchain investments.

The majority of your investments should be in stocks and bonds. A smaller portion should then go to the blockchain projects you’re interested in, and an even smaller portion of this in DeFi. This way, if the DeFi markets were to crash suddenly, you’d only make a small loss.

Similarly, with most of your investments are in stocks and bonds, a crash of the entire blockchain market will only slightly affect your portfolio.

Endnote

Investing in a new industry requires caution, but when it comes to DeFi, you have to be particularly careful. There are two sides to the coin, and you could either make some good money or incur losses. Whatever the case, be sure it’s what you want to do and that you aren’t only following the ongoing DeFi craze.

Every investment bears some risk, and you just need to decide which one’s worth your money. So go ahead and identify an investment you’d like and implement the above strategies for an enhanced fighting chance.