The concept of tokenization has grown in popularity in the age of blockchain technology and online commerce, but it is not entirely a new concept. The 17th to 19th century British empire used tokens when fiat was in short supply.

Contemporary online payments contain advanced security protocols to protect users’ critical data according to the latest international standards. In a nutshell, this is tokenization. Payments are made without necessarily revealing the user’s data.

But what are tokens?

Typically, tokens are unique digital identifiers that replace information about the user’s card and transfer it in encrypted random alphanumeric form. They do not carry any practical value that can be used by cybercriminals. Only the bank servers can interpret the tokens to confirm the transaction.

Tokenization improves the transaction process’s security, and this has been the driving force behind its growing implementation. But is it the engine of future economies?

The Chicken-and-Egg Concept

Online platforms such as Airbnb and Amazon have grown in popularity and importance in the global economy. These platforms are intermediaries or matchmakers, bringing sellers and buyers together. They create value by reducing transaction costs and search costs.

The value created by these popular platforms depends on several factors, such as the platform’s size. Inarguably, the utility derived from using the platform depends on how many users are on the platform, and only experiences accelerated growth after reaching a critical mass of users.

In the past few years, business models have focused on developing platforms that can propel business growth. Unfortunately, low platform utility experienced by first users acts as a barrier to accelerated growth. There is no incentive for potential buyers to join it if they cannot find any sellers in it and vice versa.

This is what is referred to as the chicken-and-egg problem. Every company that wishes to establish a platform must overcome this challenge, which is a gradual and expensive endeavor to create a suitable incentive. This is where tokenization comes in.

Thanks to Satoshi Nakamoto, the introduction of blockchain technology can change the incentives for platform participation to skirt around the chicken and egg problem.

Usually, the platform founders issue their blockchain-enabled token for different applications. The utility token is one type of token that represents the privilege of access to products and services on the platform. In the blockchain context, the utility token is simply tokenization.

The Incentive in Tokenization

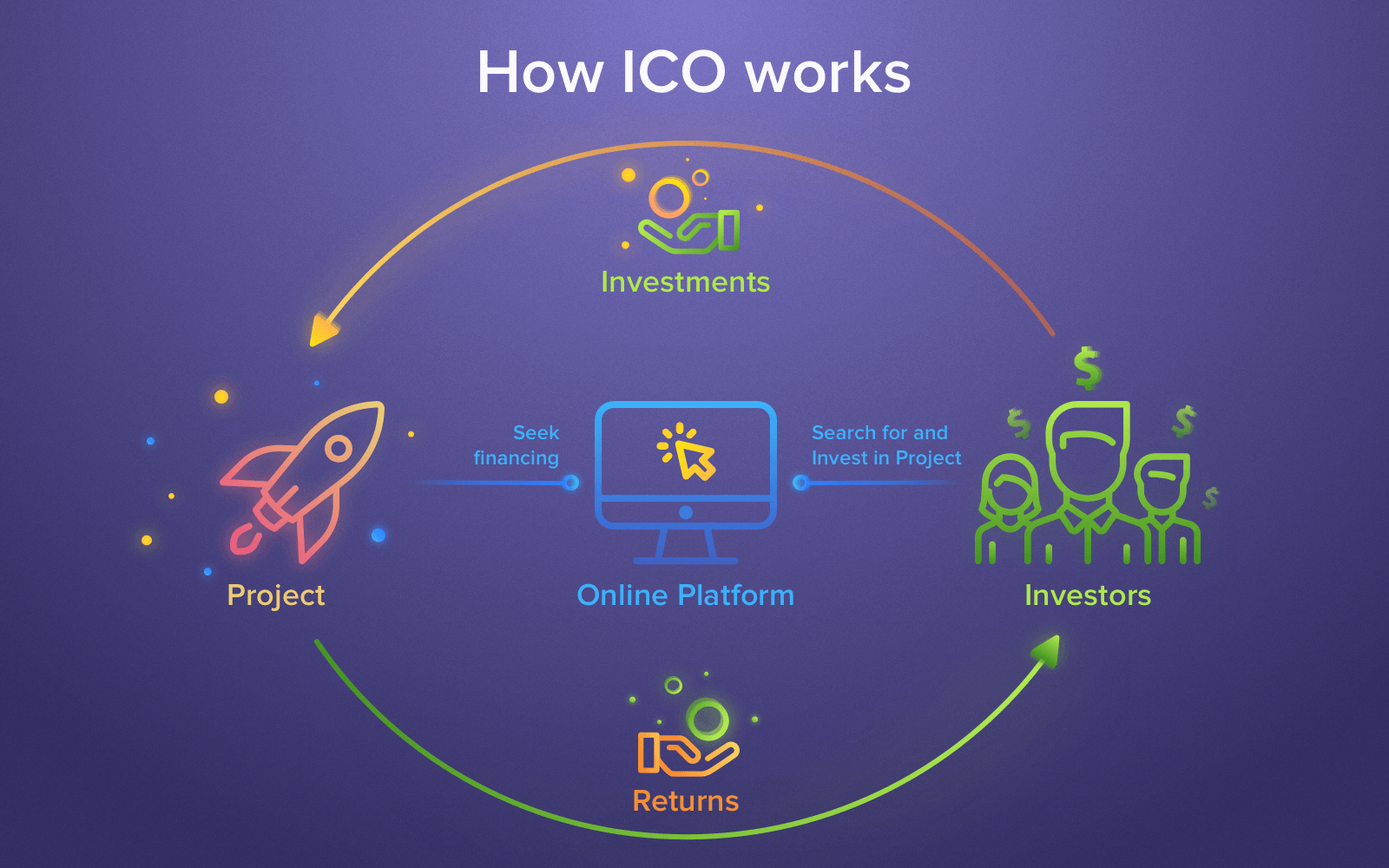

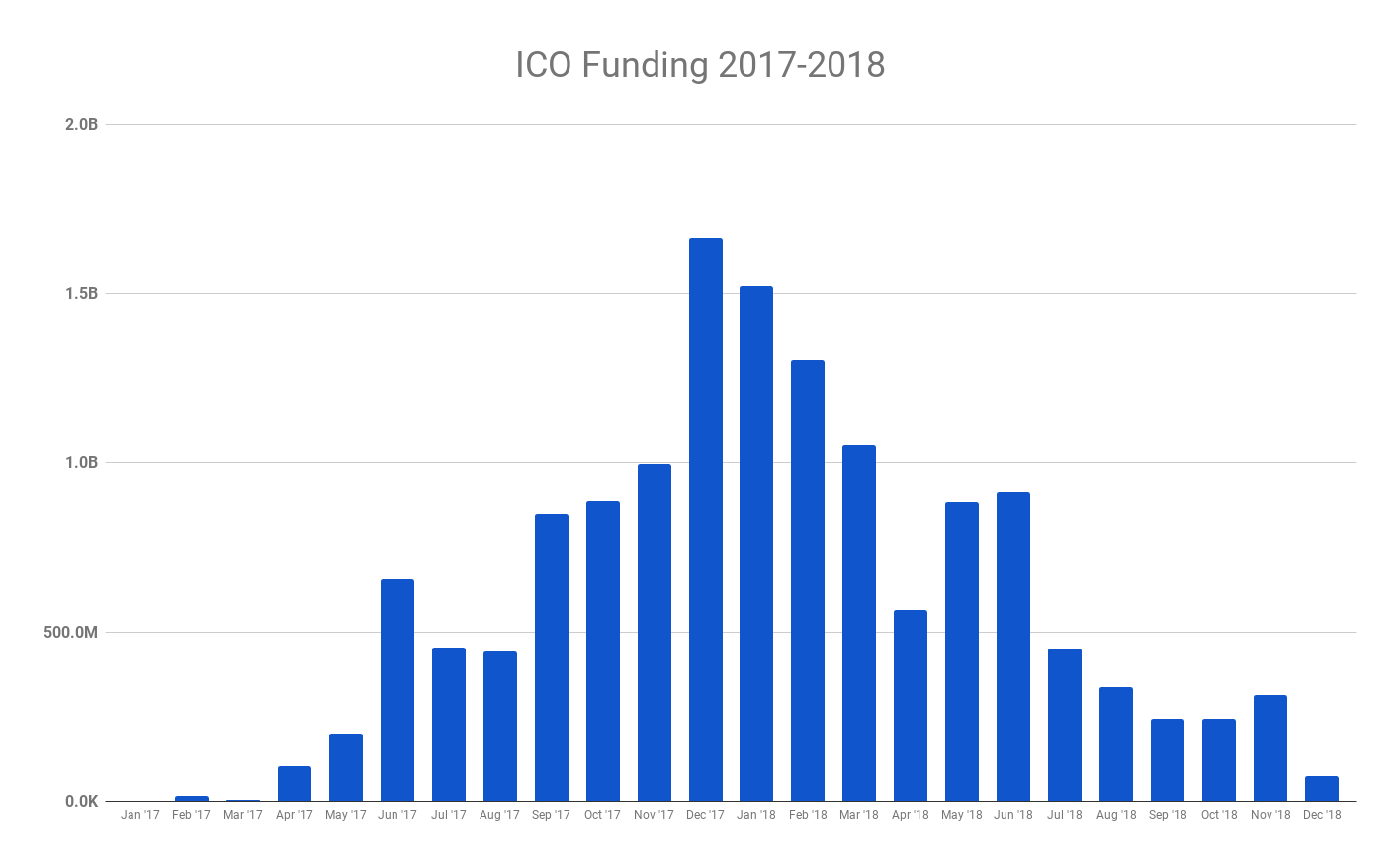

The blockchain community views utility tokens as a medium of exchange on the platform. Before the platform launch, the entity undertakes a token issue at a particular price and uses the proceeds to fund platform development. The process is much like the stock exchange, where a company issues shares to the public to obtain funding.

The issuer promotes the sale of the token in the hope of increasing its value. As the number of platform participants rises, the demand for the tokens also goes up. Eventually, the entity limits the token supply in the face of an increasing demand to raise the token’s value.

There is a financial incentive for buying tokens earlier because the value presumably goes up. Therefore, tokens are not only a medium of exchange but an investment vehicle as well. The early adopters get compensation as the platform grows.

A suitable financial incentive overcomes the chicken and egg problem as potential users want to benefit from the growing platform, or simply, the ever-increasing token value. There is a direct relationship between the growing token value and the platform’s growth, and every participant wants to contribute to the growth.

Asset Tokenization

Blockchain and decentralization are synonymous. Decentralization is one of the main wheels that have kept blockchain growing, and unlike centralized systems, it is not prone to manipulation, bureaucracy and cumbersome systems among other shortcomings.

The advent of blockchain has transformed the process of asset and business valuation as well as their funding. Not long ago, the market for serious funding through securities was only accessible to fairly big organizations. But thanks to tokenization of assets, businesses of any size can access this borrowing.

But what is the tokenization of assets?

From the blockchain perspective, asset tokenization is the secure transfer of rights to a financial asset or property to a digital asset. The primary characteristic of the process is encrypted transactions in blocks of information that can be monitored in the blockchain network.

Tokenization is a transparent, secure and progressive method of evaluating and managing any asset of value. Indeed, it is the future of the digital market.

The true potential of tokenization is unfolding right before our eyes, thanks to blockchain technology. Through blockchain, you can efficiently and safely tokenize businesses and a wide range of assets.

The Growth of Tokenization and Its Benefits

Since the 2017 cryptocurrency boom, there have been various revisions of the concept of tokens as security. There is wide use of the term security token offering or STO to denote tokenized assets – rights or partial rights to other assets such as real estate or precious metals.

- The apparent benefit of tokenization is dividing up an asset into tokens to open up new investment opportunities. This allows small investors to participate without the associated bureaucracy. The process of tokenization simplifies the registration process for investors and lowers the financial requirement.

- More importantly, tokenization improves the security of data. The token does not contain any personal data, so your information is safe from hackers. Tokenization also increases the speed of transactions as there is no need for intermediaries when transacting.

- Various transaction aspects, such as ownership registration become simpler. For example, a token can be created for a piece of the prime property somewhere around the world. It is also possible to apply tokenization to time, ability and an idea. There is also no need for a lot of paperwork that currently inhibits trading. That means you don’t need asset management companies to support transactions.

- The management of physical assets is also transforming with tokenization. Token holders can manage the assets without necessarily going through the procedure of physical transfer. Clearly, tokenization is gaining new supporters with increased democratization of the market.

Anyone can become indirect shareholders without infrastructure costs and barriers. As a result, it is now possible to enter the market with zero costs.

Expectedly, there are some legal challenges to overcome, such as applying the new technology to illiquid assets, but it is only a matter of time and patience. Everything is moving in the right direction.

Shortcomings of Tokenization

Tokenization is an exciting new way of trading in the digital space. However, some shortcomings currently stand in the path towards the transition to full universal application.

- For starters, global tokenization will not be realized anytime soon since there are not many software solutions to digitize assets. Most of them are prototypes, and which is not sufficient.

A clear tokenization concept is necessary to provide all participants with interaction algorithms, token management, withdrawing, registering and exchanging assets. Furthermore, the simplicity of registration and unrestricted access to assets is a recipe for chaos.

- Tokenization is not standardized, affecting integration with traditional payment processors, security, and asset management. Of course, blockchain technology was built upon decentralization, but it appears that tokenization will need government regulation to achieve standardization.

- There is also the issue of trust. The creator of the token is not regulated, and the model only operates on authority and trust. There may not be any documentary evidence to prove the asset’s security, and you only have to rely on the honesty of the token developers. It is not legally binding.

In every aspect, tokenization has the same characteristics as a bubble in the absence of a regulator to minimize frauds. Typically, the traders of secured tokens are anonymous on the network, and this poses serious challenges.

- Also, the concept of smart contracts is not adapted to the traditional financial markets and the current IT infrastructure, which is a challenge. Other obstacles to tokenization include distrust among participants and the existing legal framework.

Final Word

Tokenization is finally here, and it is going to disrupt the asset investment market and the financial industry at large. If you are not ready, you risk being left behind, and that is not ideal for anyone.

But what benefits does tokenization have to create such an excitement?

Well, the main benefits of tokenization are similar to those of blockchain technology, and they include decentralization, security and transparency.

No doubt, the current digital market is embracing tokenization with real assets, and this is the best thing that could happen to the financial industry, and of course, investors. And similar to wildfire, tokenization is spreading fast to various industries as its advantages become apparent. The market is ripe for tokenization.

But as with any other technology, there are some hurdles to jump before going mainstream. For example, there is a need to implement algorithms to support participant interactions in a decentralized system, and a mechanism for the distribution and issuing of tokens is imperative. Also, there are legal and legislative mechanisms, issues and interactions with tax systems that need to be solved.

Slowly but surely, we are heading in the right direction, but admittedly, it will be some time, maybe decades, before tokenization can become globally accepted.