Cryptocurrency and blockchain aim to reduce dependence on regulated financial models and centralized platforms. Unfortunately, the majority of the exchanges are still running as centralized and in fully controlled models.

IDO or the Initial DEX Offering has emerged as a solution to ensure independence and autonomy. The interest in the decentralized token listing is growing, indicating a desire to move towards a no-restriction and higher efficiency model, and that is where IDO comes in.

Initial DEX Offering is only a few months old, and it has already become a preferred method to raise capital in DeFi and distribute tokens. Admittedly, the IDO community is inexperienced, but still, it is making great strides.

Shortcomings of the Initial Coin Offering

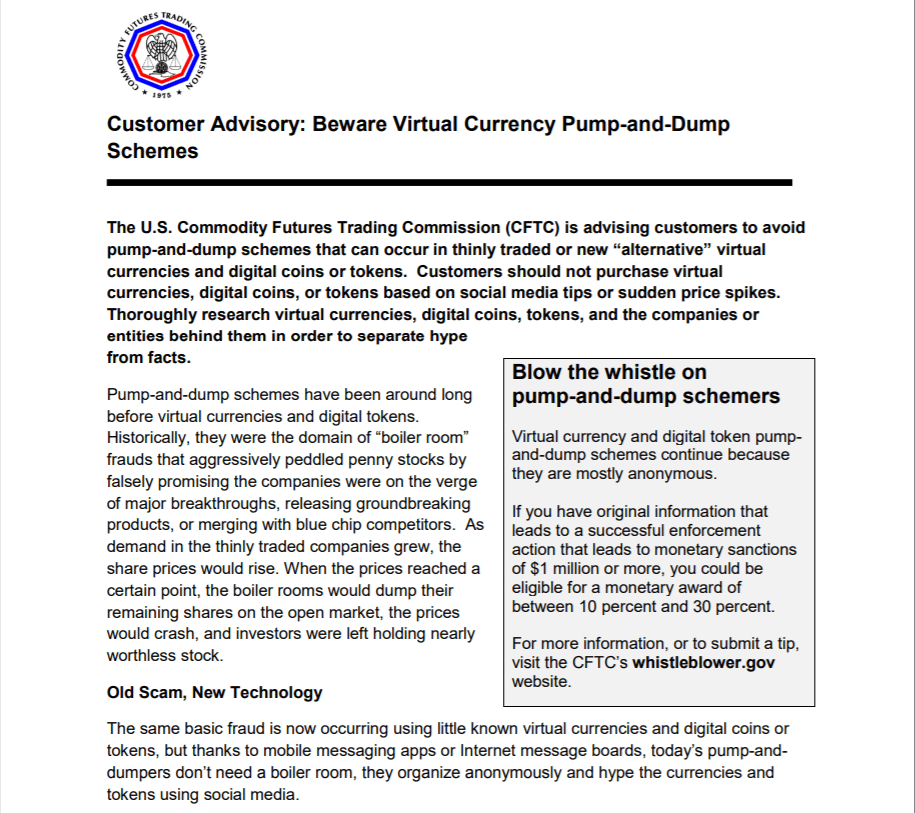

2017 was nothing short of a fantastic year for ICO, and anyone with some white paper on digital currency could raise funds. But as it turned out, most of them were scams, and billions of dollars were lost, highlighting ICOs as scammy.

ICO has its place in the history books as it represents the first method that investors raised funds in the crypto realm, but its weaknesses are quite glaring, and therefore the need to move past it.

Essentially, investors in crypto startups did not have the necessary knowledge background to assess the project’s viability. Some of them invested in rumblings on white papers, and others in ICOs with staggering high valuations. But that is not all.

Initial coin offering had a loophole, and most scammers exploited it gleefully. After ICO fundraising, the project teams were free to collect the funds in one lump sum. Even if the project teams were truly committed to the project, receiving such a sum in one fell swoop was distracting, and the motivation to continue with the project would diminish significantly.

The other shortcoming was the absence of a decent governance mechanism to safeguard the investors’ funds. People who put up their money were left stressing about their investments’ fate, continually sifting through everywhere for news, and there was also the issue of gas wars.

The most common way to contribute or participate in ICOs was through sending money from personal wallets. This created a “gas limit,” which is the maximum amount of funds you are willing to part with as transaction fees to move up the transaction validation system’s queue.

Gas wars occurred when particular investors put up transaction fees too high to push rivals down the queue. Over time, the initially overjoyed investors for winning the gas war would then begin to sulk as regulators and other bodies started to examine some of the fundraisings’ legitimacy. For example, the SEC is beginning the process of filing cases against some of the concluded ICOs.

Considering all these factors, legitimate projects can fail to get sufficient funding through ICOs. This is mostly because of the diminishing reputation and the need for a better alternative.

What is IDO?

The IDO fundraising method has striking similarities to ICO and IEO. However, it is decentralized and based on DeFi, a robust, innovative, and scalable open finance technology.

An excellent example of Initial DEX Offerings is the Raven Protocol-built IDO, the first of its kind, hosted on Binance DEX. The others in operation include UMA (a Synthetic asset) and BZX, a margin trading and lending protocol. Many other platforms already have IDO dashboards and are looking to throw their hat into the ring.

Not too long ago, UMA, BZRX, and COMP used Uniswap, popular for its fair and smooth way to deliver tokens to the market. This method of distribution has become standard and is open to public access. IDO empowers users from different countries to participate in the trade. That means people from all over the globe can purchase tokens from Raven Protocol and other token vendors.

The Difference between IDO, IEO, and ICO

The main difference between IDO and IEO is the fundraising platform hosting them. On the part of the ICO, the operations and transactions are managed on an inner platform.

On the other hand, the centralized exchange IEO (initial exchange offerings) hosts “ICO” in-house and is, therefore, the ICO’s mutated version. Unlike ICO, IEOs offer an additional layer of intermediation, only allowing legitimate projects. Unfortunately, a large number of IEO’s are selling similar tokens to ICO, which may complicate the whole issue.

No doubt, the regulatory landscape governing crypto exchanges such as EIO is complicated, but that does not shield it in any way. The U.S. regulator has made it clear that ICO token sales are the same as securities issuances, posing a significant risk to IEO issuers and contributors. It is not an exciting prospect to invest in a promising project only to enter the SEC’s bad books.

Typically, IDO (Initial Dex Offering) is IEO and ICO rolled into one decentralized platform. IDOs emerged with the DeFi rally as a new form of raising capital on a decentralized platform. In the case of IDOs, it is the active community members that vet and approve projects and tokens. This mechanism is somewhat favorable as it incorporates diverse opinions.

Also, DEXes and IDOs are part of the push to decentralization as regulators begin to shift their attention to cryptos. Furthermore, the synergy between DeFi and DEXes reinforces their value in the crypto world.

The exchange fee for IEO is spiraling out of control as the market develops, and together with increased scrutiny by the regulators put it at a disadvantage. The advantage of IDO over IEO is in its decentralized nature and scalability. You don’t need permission from any authority to trade in the exchanges.

Is IDO Replacing IEO and ICO?

The birth of new technology is most often similar to a human child that goes through various stages before it matures. IDO is still in its infancy and is quickly moving to puberty, with various noticeable characteristics such as instability. The concept of IDO is no doubt exciting and may replace IEO and ICO sometime in the future. However, it has to mature first before it can take over from IEO and ICO.

UMA, the synthetic assets platform which placed $500k into a liquidity pool, best illustrates the above point. The total supply put up was 2% under a starting price of $0.26, similar to what the seed investors paid a couple of years ago. Investors scrambled to purchase the tokens, and the bonding curve effect occurred, raising the price in the process.

Competing traders set up higher gas costs, resulting in a higher $2 price of UMA within minutes. Some buyers were dissatisfied as they purchased the tokens at a higher price than the initial investors.

This is the same problem that BZX’s buyers face on Uniswap, with BZRX token prices rising to 12 times within a minute. There is still no IDO model that balances fairness and the need to maximize the capital. In the future, this goal may become a reality, but there’s some distance to cover.

Conclusion

No doubt IDO is the next big thing in DeFi and blockchain finance. However, it is still in the development stage, with instability and slight uncertainties, and it may be some time before it becomes mainstream and replaces IEO and ICO. In the meantime, IDO is in a wait-and-see situation.

But that does not mean you should stay away from IDO, at least for the time being. It means that you should be prepared to deal with the price instability until the platform matures and stabilizes in a not so distant future.

Setting yourself up for success

Setting yourself up for success