For some, getting a crypto loan may sound stranger than fiction. But times are changing and fiat money is no longer the king of the financial jungle. Crypto loans are slowly gaining ground. And while the majority of crypto users, let alone the general public, have yet to fully understand what this fuss is all about, there is a small class of users who are already turning around their financial outlook for the better, all thanks to crypto loans.

Understandably, when it comes to crypto loans, many questions need to be answered – what is a crypto loan? Why would one need it? How does it work? And for the mischievous, can you default and get away with it? These are some of the questions we address in this article. The idea is to get you comfortable with the concept of crypto loans and how you can easily get one.

What is a Crypto Loan?

Crypto loans are a relatively new concept in finance. As such, the understanding on what exactly constitutes a crypto loan may vary depending on the provider. For the sake of this article, let us use the following definitions:

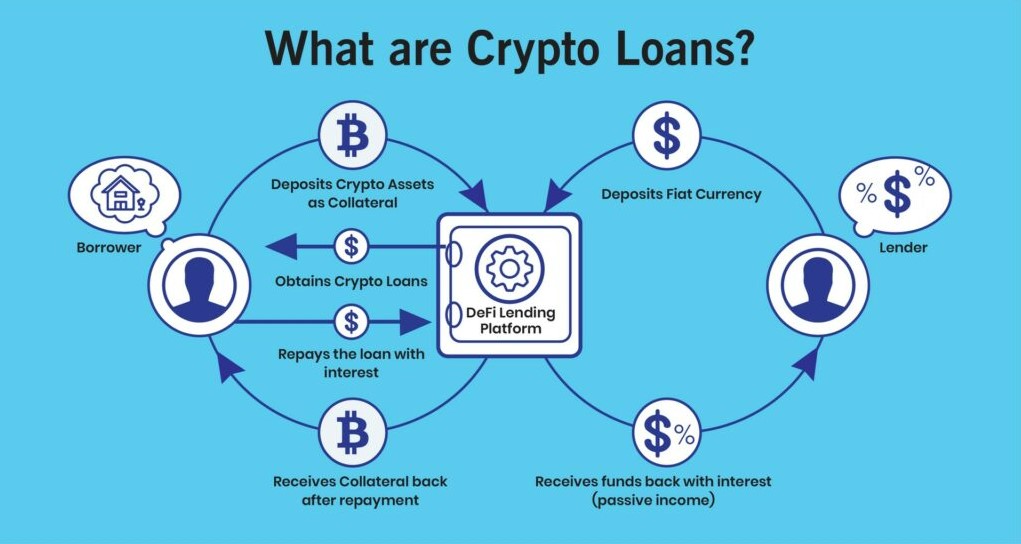

- A loan backed by crypto assets – This is perhaps the most common form of crypto loans. In this form, you borrow money and deposit digital assets as collateral. Crypto loans cannot be easily recovered by repossessing physical assets as is the case with traditional finance. Therefore, the idea of holding your digital assets as collateral comes in handy.

- A loan issued in crypto – In this scenario, you apply for and receive cryptocurrency as credit. Of course, you must provide collateral, which is usually in the form of other digital tokens.

Why Take Crypto Loan Anyway?

There are different circumstances under which you may find a crypto loan useful. For instance:

- You have large Bitcoin deposits and you want to buy a house that is in high demand – it won’t be in the market for long. You also don’t want to lose your crypto, especially after seeing how BTC is booming. Taking a loan with your BTC deposits as collateral will smoothly get you out of this dilemma.

- You have crypto lying idle in your wallet but no fiat money and you want to go for a vacation. You’re sure to have trouble paying for expenses with your crypto. Instead of exchanging crypto to fiat for this purpose (maybe because the rates are not favorable), you may choose to borrow fiat to cover your expenses.

- You have a high-cost debt that is threatening to ruin your finances. It could be a huge credit card loan that is accruing interest at a high compounded rate. In such a case, you can take a crypto loan at a lower interest and clear off your credit card loan (which is more expensive). This is called debt refinancing.

- You have digital assets (say, Dao) which you cannot use for a certain purpose. You may collateralize these assets, and take a loan issued in a suitable format to address your needs at that moment.

These are just some of the creative ways you can use crypto loans. Expectedly, many more applications will emerge as events in the crypto space continue to evolve. For now, let us look at some of the best platforms where you can get a crypto loan (not arranged in any order).

Best Platforms for Crypto Loans

#1 Nexo

Nexo is perhaps best known for issuing interest for staking crypto assets. The less advertised side of the institution is the crypto credit lines it advances to its customers. Getting a crypto loan on Nexo requires you to set up an account and supply some know-your-customer (KYC) information. This is done only during the first registration.

Once your account is ready, you can get an instant crypto loan with interests from 5.9% annual percentage rate (APR). When applying for a loan, Nexo’s live calculator shows you how much collateral you will need for that amount of loan.

One of the features that make Nexo a world leader in crypto loans is the fact that you can stake any of the 18 currently supported digital assets. The idea that loans are disbursed instantly is also quite refreshing.

#2 BlockFi

BlockFi issues loans in USD in exchange for BTC, ETC, or LTC as collateral. Getting a crypto loan with BlockFi means entrusting them with either of the above digital assets while you spend their dollars. The platform is among the easiest to use. Getting a loan on BlockFi is as easy as signing up for an account, specifying the amount USD you need, and which crypto you will be staking for the loan.

Like most other reputable digital financial organizations, a few KYC checks will be performed. It takes one business day for your loan application to be processed and receive a loan offer, which will indicate how much of your selected digital asset you will need to send as collateral for the amount of loan you specify. Also in the offer, there will be other information regarding your loan parameters such as interest, APR, and other financials that will help you evaluate the offer. On BlockFi, you can get a loan for as low as 4.5% APR. Overall, the loan experience on BlockFi is pleasant except for a long time it takes for the deal to reach closure.

#3 CoinLoan

Like Nexo, CoinLoan offers both crypto lending and interest-earning from deposits. The platform promises no paperwork and no credit history check to delay your loan processing. As such, CoinLoan loans are approved as soon as you submit collateral. However, when registering on the platform, KYC is mandatory – these are just the rules of the financial market.

The platform accepts collateral in crypto, stablecoins, or fiat. Interest rates start at 4.5% APR, which are some of the lowest in this market. CoinLoan will allow you to deposit any one of the 17 currently supported cryptocurrencies.

#4 Salt

Salt is one of the friendliest crypto lending platforms. Without moving from the home page, you can instantly see how much collateral you need for your loan, monthly installments, APR, and all. Salt loans are also highly customizable in terms of payback period, loan-to-value ratio, and whether you hold any Salt coins or not. Sadly, you can’t borrow less than $5,000, just in case you wanted to try it out. Interest rates on the platform start at 5.95% and increase depending on your loan parameters.

Final Thoughts

Getting a crypto loan is one of the best ways of using your crypto assets to ease personal financial pressures. These loans allow you to get fiat currency without letting go of your crypto gems. Then, when you are much more financially stable, you can pay back your loan and have your digital assets back. You can also use crypto loans to access services where crypto is not accepted or refinance another loan. Some of the leading crypto lending platforms include Nexo, BlockFi, CoinLoan, and Salt. As to whether you can get a loan and default, the answer is yes, but you will have to forfeit your collateral!