One of the driving forces behind forex traders is being able to escape their monotonous daily routines. We all fantasize about quitting our conventional jobs and experiencing freedom while making money off our computers.

But does this mean that you can sit on the couch and occasionally press the buy or sell button while watching “Game of Thrones”? Probably not. The reality is that you are leaving a world in which you have been raised to survive and are entering another world for which nothing has prepared you. In the forex currency market, there is a different set of rules.

As traders we know, deep down in our minds, how important capital management is, not only for the health of our trading account but also for our mental health. The average trader’s approach makes it very difficult for him or her to ever make a profit or sustain real growth in forex.

We’ve talked to many traders, and there seem to be a few common mistakes that continue to occur. In this article, we fully intend to expose about capital management and highlight some bases on which you might be building your money management mentality, and which may be harmful to your chances of getting where you want.

Don’t orient your goals toward money.

Some of the most common questions say something like:

- Can I do 10% a month?

- How many signals a week can I expect?

- How long will it take me to double my account with $1,000?

All these questions have a strong focus: the urge to make money really fast. The big problem we have with these kinds of “goal-oriented” questions is that they cannot be answered the way the trader wants to be answered.

The foreign exchange market is a dynamic environment. A month could be very productive, with many “easy prey” and lucrative trading signals. The next month could be a dead zone, where the price is consolidated and compressed with low volatility, preventing you from making money from price movements.

Don’t try to force rigid money management goals in a fluctuating environment. Pretend you are in the last week of the month; What are you going to do if you are not even close to completing your “monthly fee”? In what way you will give an answer to the pressure you put on yourself to achieve your monetary goal?

Don’t try to force rigid money management goals in a fluctuating environment. Pretend you are in the last week of the month; What are you going to do if you are not even close to completing your “monthly fee”? In what way you will give an answer to the pressure you put on yourself to achieve your monetary goal?

With a sense of urgency, you might need to be more aggressive and start forcing operations; operations in which you wouldn’t normally pull the trigger, but now under this pressure, you feel you need to take immediate action.

The best way to fix this is to not set any goals, but instead, concentrate on becoming an excellent trader who is a master at reading graphics and managing risks. Learn to take what the market has to offer. Take action only when the market offers you a valid signal for your trading system, which you know gives you an advantage with the odds in your favor.

We don’t like to admit that we can’t predict or control what’s going to happen every time we look at the graphics. Sometimes the market is too noisy and hostile to operate, it’s that simple. In these cases, it becomes a black hole, in which you throw money and it is consumed by consolidations.

Some months you will do well, in others you will not see profit or even suffer a loss. What you never want to do is define your possible success with absolute numbers, which will lead to self-inflicted emotional pressures, and a negative self-assessment if these are not met. If you try to make money fast, you’ll be taking an incredibly high risk.

Measure Success in Pips

If you’ve seen a forex blog, you’ll notice that traders measure the outcome of their pip operations, or “how many pips are up or down this day. This has become the social standard for forex traders, we are all used to talking to each other in this way, using pips as a benchmark for performance. But the truth is, it’s not the right way for a serious trader to assess how well an operation has gone or its risk.

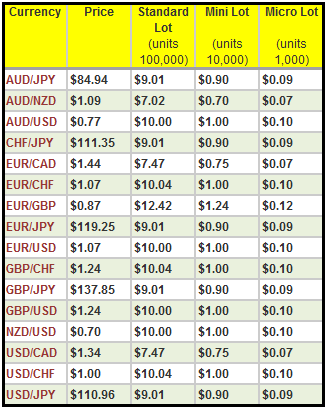

Pips are only a measure of distance on a price chart. Catching a move is great, but the most important thing is how the setup has allowed us to catch that move. You see, 1 pip for us could mean something different than what it means for you, and at the same moment totally different from what it means for someone else. Pips are very relative measures and therefore have relative values. If you “win 100 pips“, but your stop loss was placed at a distance of 500 pips, it is a negative-oriented operation, which gives you no right to brag about winning those 100 pips.

You should also note that a movement of 100 pips will look very different in EUR/USD compared to the EUR/AUD pair, and in turn will be different in GOLD. If you see a movement of 100 pips in EUR/USD, it would not be uncommon to see the EUR/GBP move 250 pips on the same day. The GOLD can easily move 2,000 pips in a session, and when you compare the graphics side by side, they all look quite similar despite the drastic differences in the movements of pips.

100 pips in EUR/USD is not the same as 100 pips in GOLD, and to further expand the differences, we can say that pips also contain an “intrinsic value” that is unique for each operation.

The value of each pip is defined by the following factors:

The value of each pip is defined by the following factors:

- Size of the position (lotion).

- The quoted currency of the currency pair you are trading (it is the currency that appears 2º in the pair).

- The currency in which you have your trading account.

If your trading account is in USD, then any pair whose quoted currency is USD (XXX/USD) will always have a pip value of $10 per lot. If you were using AUD in your trading account, and you operated these same pairs (XXX/USD), then the value of each pip would be determined by the AUD/USD pair exchange rate and the batch size in the pair you are operating.

Let’s say we open a transaction in GBP/USD with 5 standard lots, and the trading account is in USD. In this case, each pip would be worth $50. The operation would increase or decrease our account by $50 for each pip earned or lost. A movement of 100 pips in our favor would put us ahead by $5,000.

Compare the same situation with that of another person who takes the exact same operation but uses AUD on his account. The “pip value” will be different in this case, and this person should fix this difference by adjusting the position size to compensate. We won’t get into mathematical calculations here, the important thing is that you understand the idea.

So, when someone tells you they’ve won 200 pips on their operation, it doesn’t really mean much. If it was in EUR/USD, the movement has been pretty decent, probably a good operation, but if it was in GOLD, it’s not even an accomplishment.

Remember, the real measure of the success of an operation is how much return on investment you were able to get with it. The bottom line for trading is money, we are not exchanging magic beans, here we are looking to earn $$$$.

If you’ve had to risk $1,000 to win $100, then you’re playing to destroy your account. If instead, you risk $100 and earn $1,000, you’ve done very well! , getting a 900% return on investment. We all know that to fit into society you must speak in the classic terms of pip movements here and there, but when it comes to recording your own data, don’t be a pip counter when measuring your success.

Capital Management: Under-Capitalisation

How many accounts have you ruined or seriously compromised because you weren’t happy with the profits you were making and decided to expand your risk to compensate? A serious forex trader knows that trading should be treated as a business. One of the most common failures for small businesses is under-capitalisation, that is, not having enough money.

The ironic thing about forex is that you can start and operate with small amounts of money. Technically you can operate with initial investments as small as $100! That being said, if you want forex to generate $500 a week with a $100 investment, then you’re very undercapitalized!

The ironic thing about forex is that you can start and operate with small amounts of money. Technically you can operate with initial investments as small as $100! That being said, if you want forex to generate $500 a week with a $100 investment, then you’re very undercapitalized!

The undercapitalisation affects the trader deeply at a psychological level. Undercapitalized traders want the big income they want, but they don’t have the power to make it happen in their account, so they are prone to risk more and overexposure to the market. This can lead them to clear their account quickly, and then become frustrated and angry traders.

Do not be the one who overexposes your account to a massive risk by the desperation of getting “the big win”. This is a betting mentality that provides an incorrect framework for developing the trader mentality.

Cutting Operations Too Soon

One of the fastest ways you can do harm yourself is to become a “micro forex manager“, the trader who sits down to make lots of fine micro-adjustments to their open positions. Sometimes you may feel like you should babysit your open operations until they reach a profit. When a trader makes adjustments to his stops, or does anything outside the original trading plan, this will usually result in an unfavorable outcome.

Don’t sit back and look at your floating gains and losses, because each pip of movement will generate more and more emotions. If you do this, you will therefore have a better chance than close an operation based on emotions even when there are no clear exit signs.

Think of all those times you’ve interfered with your open operations and all you’ve achieved is to deprive yourself of the potential earnings that you would otherwise have achieved.

The price will not move in the straight line you would like, but will move in “waves” or zig-zag patterns. It is logical to expect a transaction to come in and out of profits several times as the financial market gradually moves in the direction it wants to go. This is a basic principle of swing trading.

Do yourself a favor: put your operation in a logical way that you have confidence in and then just walk away from it. Close your trading terminal and don’t even look at it until the next day. This type of “prepare, forget, and collect” system will do wonders for you, financially, mentally, and emotionally.