If you are reading this article, you must be serious about trading. Did you know that curiosity and eagerness to learn are the two crucial components of being a successful trader in the long term? Since this is our part three discussion on the best trading position, we are continuing our journey of discovery, listing proven ways to achieve sustainable success. Now, of course, there can be many different approaches to trading, but here you can learn what actually works. If you happen to be seeing this title for the first time, make sure that you go back and read the story from the beginning, covering parts one and two as well, along with related exercises.

Last time we talked about effective ways to protect your trades, deepening the story about the risk and introducing the topic of stop losses. What we did not talk about in the previous article is that traders often wonder about exiting trades, fearing that they might miss that one opportunity to preserve their assets. However, you will find that with the right system in place, you should always be notified before a particular trend or favorable period ends, so the price should not even hit your stop loss.

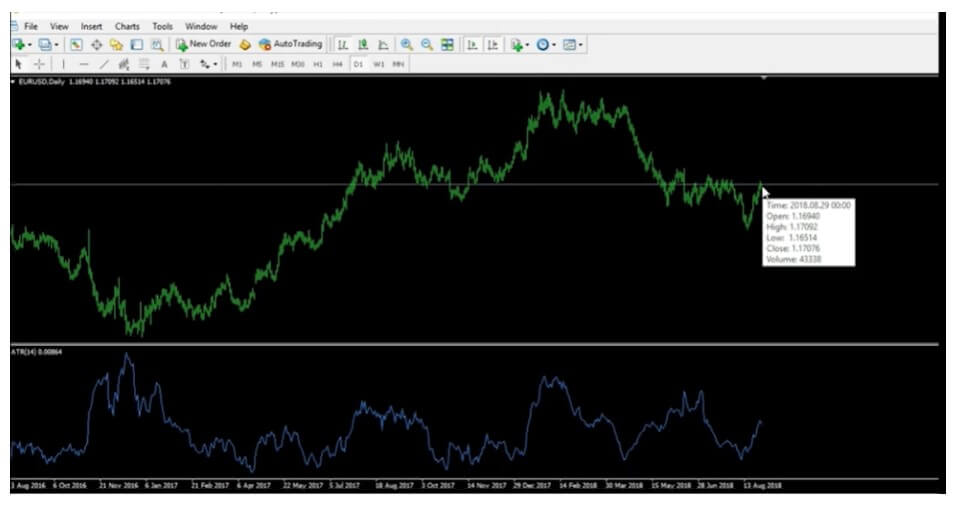

If the price ends up violently moving in a different direction from what you would want to, you still know that you would never lose more than 2% of your account if you set everything up the way we discussed earlier in this series. That is what the ATR indicator we previously talked about is about, helping you manage and adjust to volatile markets regardless of the circumstances. Now, besides general risk and exiting trades, there is another key question to ponder about if you really want to protect your assets.

How many individual trades can I have open at 2%?

When traders read about the 2% instruction, they often fall for the trap of overleveraging, which tends to lead to really bad consequences. To understand where most traders fail, imagine that you entered three trades involving the following currencies: the EUR/AUD long, AUD/USD short, and AUD/CAD short. You assume that by opening three trades at 2% each, you are doing the right thing. Unfortunately, your thinking would be faulty here and you would add more risk instead of controlling it properly. Since there are three trades involving one currency (AUD), you now have a 6% risk in one asset. Therefore, please note down the following rule in your notebook: You can have as many trades running at the same time as you please, but you must never have more than one trade at 2% risk going long or short with the same currency.

What should I do if I am getting several signals for one currency?

There are a few solutions that you can always use in trading if you find yourself in a similar situation. For example, you can choose only one trade to enter. You can either make this choice freely or, if you need reassurance, compare the other two currencies in the pair and measure them against other currencies. So, if you are weighing between the AUD/USD and the AUD/CAD, compare the USD basket and the CAD basket to see which seems to be a better option.

Aside from this approach, you can also opt for entering both trades but at 1% risk each. This is not only a wise way to control the risk when you have multiple trades open at the same time but also a form of a hedge, as you have one currency against two different ones.

What should I do when I almost get another signal involving the same currency?

First of all, you do not have to necessarily ignore all signals of this type. If you happen to get one signal for a particular pair, followed by something that may turn out to be a signal soon, you can always choose to play smart – enter one trade at 1% and wait to see what will happen with the other pair the following day. With such “almost signals,” it is always wise to give yourself space to gather more facts before you make any decisions.

Should I always enter trades at 1% risk only?

No, by no means should you enter all trades at reduced risk. Overleveraging is as detrimental to your account and development as is being timid. This mindset will not get you far, so make sure that you avoid seeing this as a form of protection because it is will hinder your growth, both in terms of your trading skills and your finances.

Regardless of your market of choice, you must always put your risk under control no matter how many trades you decide to enter. Greed can be a funny thing, especially when we don’t know what situations trigger our hunger for more. To have control over your trades, you must consciously choose to follow a specific rule and do so in a disciplined manner. And, on this note, we are going to end today’s lesson, leaving you with the task of trying out these methods with your demo account as soon as possible.

As we promised, we are offering you the right solution to the problem given in the last article of this series:

| RISK = TOTAL ACCOUNT x 2% = 50,263 USD x 2% (0,02) = 1,005.25 ≈ 1,005

ATR = 86 STOP LOSS = ATR x 1.5 = 86 x 1.5 = 129 PIP VALUE = RISK ÷ STOP LOSS = 7.79 ≈ 7.8 |

Upon the completion of this task, we know that one pip should equal the previously calculated amount, so we can estimate that the unit value is going to be 78,000 (usually 0.78 lots) for the EUR/USD currency pair.

P.S. Practice note-taking whenever you test a new method or approach in trading and watch for Part IV to follow.

Good luck!