Last time we started talking about risk management, giving you the exact number of what your risk in trading should be. In case you are eager to learn how to secure the best trading position, go back and read the first article of this series and do the test at the end. If you have already done that, prepare your pen and paper once again because we are covering key concepts that you will need to get the best possible results trading in the forex market.

Why is Stop Loss Important?

Owing to the stop loss, i.e. a specified number of pips away from the point of entry, you will always know that your trades are protected. If there is an unfavorable move and you are not there to oversee your trades or if you are simply tired of being on the watch all the time, stop loss is surely your best friend. Your stop loss will also help you determine the value of each pip and control your risk. Therefore, make sure to set up your stop loss before you enter any new trade because it is one of the most important tools you will learn to use in trading.

How Can I Set up My Stop Loss?

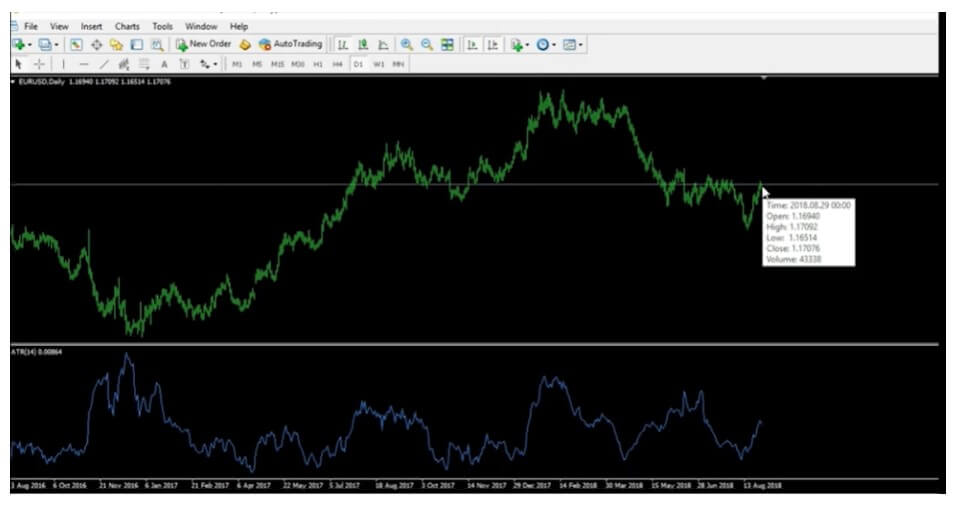

Here is one way to do it. In order to make proper use of stop losses, you will need to meet two conditions: use the ATR (Average True Range) indicator and use the daily chart. Pull up the indicator in the chart for the pair you wish to trade and do not change the default value (14). You will find the ATR on the left side of the indicator window under the white line in the middle. If you see a value of 0.0071, you will know that the ATR for that specific currency pair equals 71 pips. To set up your stop loss, you need to multiply this number by 1.5. Just make sure you remember that any other time frame will not give you correct numbers, so this form of protection would not work in that case.

How do I Calculate My Pip Value?

Use this simple equation to calculate the value of a pip: RISK ÷ STOP LOSS = Pip Value. Now is the time to remember the previous lesson and calculate your risk for a 50,000 USD account and a value of 0.0071 on the left side of your chart. In case you forgot, we will do it together now:

| RISK = TOTAL ACCOUNT x 2% = 50,000 USD x 2% (0,02) = 1,000

ATR = 71 STOP LOSS = ATR x 1.5 = 71 x 1.5 = 106.5 ≈ 106 PIP VALUE = RISK ÷ STOP LOSS = 9.43 |

This is how you determine your risk, set up your stop losses, and protect your trades. Whatever you do, make sure not to deviate from this plan, especially if you are a beginner trader. While this may seem like a lot of trouble to go through, understand that you will know that you have succeeded the moment you see your losses no longer affect your account. Try to use the ATR and set up stop losses for each trade in your demo account for at least six months before you decide to start trading real money.

Part 2 Task

As always, we will give you a task to do on your own and provide you with the results in the next article of this series:

Calculate the pip value for your 50,263 USD account based on the information you can find in the chart for the EUR/USD currency pair.

The correct answers for the last task are provided below. Please, besides the answer key, read the explanations under each answer as well.

- a, b & c

All three answers are correct because we need risk management regardless of our individual stage of development as traders.

- a & c

Do not get misled by a few wins here and there because successful professional trading entails consecutive and sustainable winning.

- a & b

The first task and primary responsibility of every trader is to learn why a certain trade did not go as planned. The worst mistake one can do is just to keep trading regardless of poor results. This is the approach that leads to losses and blown accounts.

- a, b & c

All of the options are correct since forex trading is not only about securing wins but making sure that losses are controlled. We can do that after learning what went wrong in the past and how we can fix those issues.

- b & c

Risk is never about one number alone. Risk entails a series of tasks and strategies that we are still learning about in these articles. Securing the best position will mainly depend on how you manage your risk too, so stay tuned until next time when we will be sharing another set of invaluable tips and tools.

Watch for Part III to be posted tomorrow!