We just adore revealing things that are not talked about in the mainstream media. In our articles series, a trader could notice most of our trading methods are not ordinary. There is a reason for all that. Some could say it is a conspiracy but consider crisp and public proofs on the internet, reporting, news, forums, and other sources, some of which we present here. Dirty little secrets about forex are everywhere, in many forms, from fundamental manipulation to technical trading quirks that turn out to be manipulations too. Here is what we want to tell you.

Forex Gods

We will start from the forex rulers, the world’s largest banks are moving the currencies, not you or me, however big your pocket is. Never try this, and never get vengeful at them, forex has specifics because of the big bank interventions otherwise forex would look like the stock market as some professionals would say. Their dirty little secret is of course manipulating the forex market and the hunt for cluster groups of traders’ positions. It is not just about the Stop Loss positions or any pending orders, but about orders already triggered. Just a hint for those thinking about using a script to hide pending orders away from broker servers. As one familiar pro trader explained, the banks notice where orders are triggered, then they let a small movement that favors the traders, however, what follows is a sharp correction that cuts through most of the traders. Professionals that follow the big banks’ psychology call this accumulation (of traders) and manipulation phase, it looks like this:

Notice the far left side of the picture where the downtrend is reversing. This is the area where traders start open buying positions. The banks like these clusters and leave some movement up to keep them building on. What follows is a sharp move to the downside below the initial reversal level (middle of the picture). This is done to eliminate buyers’ Stop Loss. Only then the real trend starts which is much larger (right side of the picture) than the initial fake one.

Now, another easier way to see this is by looking at the traders’ sentiment indicator. As mentioned in our previous articles, the IG group has a Client Sentiment Report daily on most forex pairs and other assets. Notice that the most liquid pars, also the most popular ones, are not moving according to the supply and demand logic. It is almost perfectly reversed. When buyers come in, the price falls, and vice versa.

Hey, this does not happen on crypto! If you wonder why, cryptocurrencies’ core idea is Defi, decentralization, or no bank involvement. Even precious metals are not that manipulated despite the recent fine:

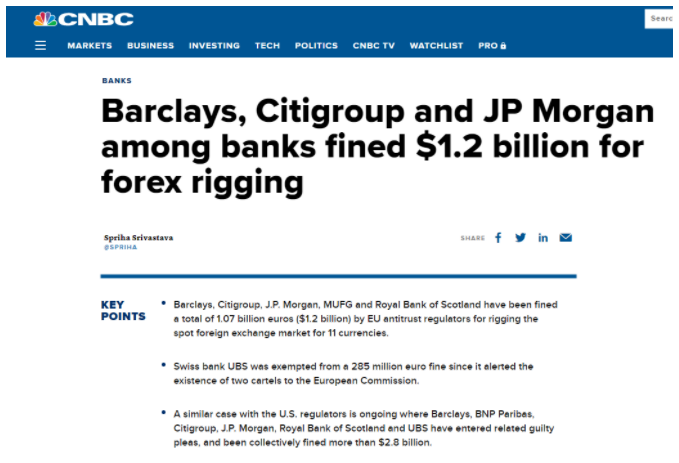

Commodities have real supply and demand, not much room to manipulate there, however, money or currencies can be printed whenever. Printing can be digital with a press of a button too. Here is some more news about this recurring event (CBNC):

Ok, we have some raising eyebrows now, this dirty secret is repeating however there is not much “ordinary” people can do. Interestingly, according to pros, this behavior is what gives forex movements and sets it apart from the stock market, for example. Indexes by the way, also have sentiment anomalies, but be aware there is a very strong link between equities and the forex gods.

The Brokers

Ok, these guys are not really forex gods but they still play a role to retail traders and they too, of course, have dirty little secrets. They are one part of the forex industry and are playing a similar game, even though forex unethical games come in many flavors, this one is the most popular. It is the Stop Loss hunting.

Now, this is done on a smaller scale, it is not in plain sight and justice is rarely served. If you wonder why it is because they are the same team. Transparency is always the issue, you do not know what is done and if there is a conflict of interest caused by the well-known fact some brokers earn money from their clients’ losses. Stop-Loss hunting is hard to prove and the excuse is always the same, brokers are connected to different liquidity pools or banks so not every broker has the same price action. This explanation is overused. If we look up at the clients’ opinions, some brokers are labeled as stop hunters while some are not even though they are companies of the same size. Transparency is not strong with brokers so the only truth meters are the forums that reflect customer satisfaction.

Review Misleads

Portals that reportedly host broker reviews is another dirty little secret that is present in the forex industry, however not uncommon in many other businesses. Just typing some broker name with the word “review” will overwhelm you with results. There are a few obvious ads first but then what looks like a sound review website. Sometimes the review has a great, 5-star rating, while the same broker is criticized on other portals. This is one easy clue that somebody paid for good reviews. More often than not, the same portals are owned by companies that hold broker brands, making you think they are separate entities. Of course, their brands are top-rated while the competitors are destroyed. There are also affiliate websites that just put a good word for anyone that wants it (pays), provided the affiliate website has a good number of visitors.

We have put a lot of work writing independent broker reviews, however, if you are looking for client opinions forget about the first search results pages. Real, unbiased opinions come after, where the money noise is dimmed down. Only here there is no special interest by the brokers to mess with the truth. Alternatively to forex-academy.com, the Forex Peace Army portal is a very good source for reviews and client opinion, but there are more out there under the served plate.

Reading fake reviews does not end with brokers, you will also find reviews for Expert Advisors for MetaTrader platform or automated trading solutions companies. The same marketing scheme is applied, yet the source might be a company that developed the script, not only a broker. It is often mixed since you need a broker and probably a VPN service too.

Marketing

Similar to other industries, marketing borders with the ethics on one side and the law on the other. Brokerage is a heavily regulated industry yet it still has enough freedom to legally scam beginners. Even though certain regulatory measures are now more restrictive, such as leverage limit, amateurs looking for gamble trade are easy pickings for brokers. If you heard about the high percentage of losing trades in the forex industry then you get the picture of why. Of course, education is also tainted by this scheme so it is not easy to blame the client. Even those who do not want to gamble do not easily have access to good resources and learn to trade. Similar to the review search, good educational websites are rare and show only after all the junk in the first pages.

Forex is a Scam?

Foul play is present in forex and people do not believe in the trader dream, the dream is vividly presented in marketing to lure uneducated clients. This is easy money for brokers and banks only. As it was not already plagued by the industry, forex is also a good playground for outright scammers. It is especially present today with untraceable cryptocurrencies. Scams are just another reason and alarm for beginners to dig deep when it comes to forex trading that, interestingly, elevates their research skills essential for successful forex trading. Forex has many ways to scam you, however, meticulous, patient, and curious will find their way to the trader’s dream eventually, just keep up the work.