Introduction

The forex market offers a lot of trading opportunities, but still, many traders find it difficult to make profits consistently. Emotions combined with undue risk and money management are often the main obstacles that new traders face.

In this article, we will discuss the hourly volatility in the forex market and the trading risks involved during these hours. Some traders trade the market based on its volatility. Few traders enjoy volatile markets, while others prefer trading in non-volatile conditions. So let’s get right into the topic.

The volatility of a major currency pair

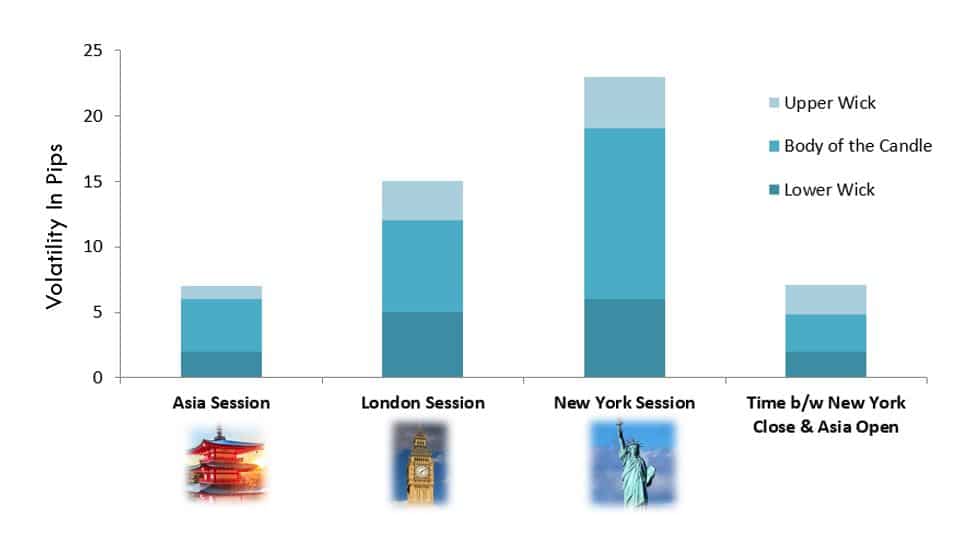

Hourly volatility is relevant to short term forex traders but is not a significant factor for long term investors. The global trading sessions affect volatility within the 24 hours. A forex pair is typically most volatile when a major trading session opens, or two market sessions overlap with one another. For example, EUR/USD is the most volatile and active when London or New York is open because these markets are associated with the Euro and USD, respectively. The below figure depicts the volatility of EUR/USD in a day.

The average volatility of EUR/USD currency pair on a single day

The bar chart shown above represents the volatility of EUR/USD in a day. It depicts nothing but a candle with lower wick, body, and upper wick. One can see that during the Asia session, the price is not volatile. Whereas during the New York session, the price makes large movements shown by larger wick and body of the bar chart. Even without looking at candlestick charts on the trading platform, these bar charts are sufficient to decide at what time to trade during the day, which is much easier than analyzing candlestick charts.

Low volatile hours – Asia Session and Time b/w NY close & Asia Open

Traders have a misperception that “More risk equals more return.” There is no doubt that highly volatile pairs deliver impressive returns, but research and data have found that lower-volatility sessions generate risk-adjusted returns over time. This is the reason why traders include the ‘Low volatility factor’ in their portfolio.

Risk of trading in low volatile hours

In times of low volatility, there is increased slippage, which means a trader will hardly get the price they desire for. This would mean eating up of their profits, or even sometimes a complete drain of profits (when trading on a lower time frame). In this way, a trader will not be trading according to the rules of money management. Hence, to manage risk, there is a right way to trade during such times. Some of them are discussed below.

Why is it important?

There are several reasons why trading in lower volatility conditions has the potential to create a lot of money over the long term.

Leverage aversion– In money management theory, we had mentioned earlier that the more leverage a trader use, the more is the risk. In times of lower volatility, traders are restricted from using the leverage from their trading account. As a result, they buy and sell currency pairs that are less risky with good profit potential.

The lottery ticket– Many traders treat the forex market as a “lottery” where they buy and sell currency pairs like they are purchasing lottery tickets. This, in turn, raises the bid of high-risk pairs, which leads to the type of lottery effect and increases volatility. Here, we need to find pairs that are under no one’s attention and buy them (which will be least volatile).

High volatile hours – London & New York Sessions

Many traders live on volatility in the forex market, as volatility is what creates profitable trading opportunities.

Risk of trading in high volatile hours

High volatility hours also has its own disadvantages. During such times, one can see their stop-losses getting triggered frequently. This happens due to the tricks played by more significant players like stop-loss hunting. Another risk is the high leverage provided by forex brokers. So to manage these risks, high volatile hours should be traded in a certain way. Some of them are listed below.

Trend trading– One key opportunity in a volatile market is that trending currency pairs may see the rate of their trend increase. When we are trading with the trend, our risk drastically reduces, which is good for money management.

Short-term strategies– In volatile markets, strategies work the best by booking profits automatically than manually. In this way, we will be eliminating emotions in trading as everything will be done by the system, which is crucial for risk management. Strategies also make use of indicators like RSI and Bollinger bands, which help in identifying overbought and oversold zones.

Bottom line

Every trading session and hour has its own advantages and risks, which a trader needs to evaluate, based on his/her risk appetite. The right time to trade depends on the personality of the trader and style of trading. Volatility on an hourly basis is more complex than how much a forex pair moves each day on an average basis. We see volatility varies drastically across different hours of the day and days of the week. We need to monitor and adapt to these changes. Cheers!