Introduction

The Forex market is open 24 hours daily and is traded from Monday to Friday. This feature makes it feasible for traders all around the world to trade it. However, it is not quite ideal to trade anytime in Forex. There are specific times of the day and week that offer greater liquidity. These are the times when the professional traders step into the market as well. So, let’s dive right into the topic.

The preferable time to enter the forex market

Liquidity and volatility are the two vital factors a trader must consider before choosing the best time to trade. Because, with the absence of liquidity and volatility, it is not possible to grab big moves in the market. Hence, one must look out for the times when there is a high volume of trading happening in Forex.

As far as liquidity is concerned, liquidity is excellent (as well as volatility) when two sessions overlap. During these times, the volume of orders double, making significant movements on major pairs. Hence, getting in-depth knowledge about how pairs behave during session overlaps is very important.

The overlapping sessions

The Tokyo-London Overlap

During the Asian session, there is not much movement in the market. But, when the London market opens, the Tokyo markets are still running. Hence the volume during the overlap time segment increases as both the markets are actively traded. Having said that, most of the volume comes from London, which ends up suppressing the Tokyo market. Hence, trading this overlap session is highly recommended.

The London-New York session

The London market and the New York market alone bring in considerable volatility. And when both these markets combine, the liquidity rises significantly. Hence, this becomes the ideal time to trade the forex market. Moreover, due to the high liquidity, the spreads during this time are incredibly tight.

Now that we’re clear with the preferable time to trade the markets let us discuss the preferred weekdays to engage in trading.

What are the days of the week best to trade?

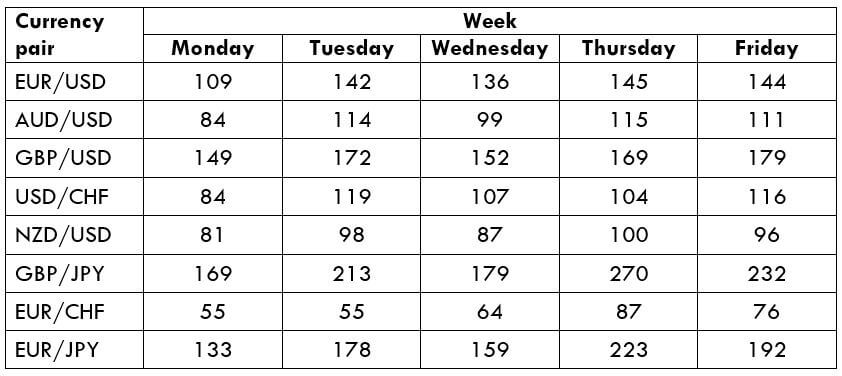

Let us answer this question by considering the average pip movement of currencies pairs on all trading days of the week.

From the above table, we can ascertain that the pip movement on Monday is lesser when compared from Tuesday – Friday. Also, on Friday, once the afternoon sets off, the liquidity reduces considerably. Hence, to get the best from the Forex pairs, it is best to work during the middle of the week and near the time of the market openings.

This brings us to the end of this lesson. To get a recap of the above lesson, you can take up the quiz given below. [wp_quiz id=”47251″]